Author: 0xjs@Jinse Finance

The "national-level" technological breakthrough of Deepseek is continuing to ferment, and the entire Chinese asset may need to be revalued.

On February 5, 2025, Deutsche Bank released a research report "China eats the World", which went viral among investors. Deutsche Bank stated that 2025 will be the year when China surpasses other countries. In 2025, China launched the world's first sixth-generation fighter jet and the low-cost artificial intelligence system "DeepSeek" within a week. Marc Andreessen called the launch of "DeepSeek" the "Sputnik moment" of AI, but it is more like China's "Sputnik moment", marking the recognition of China's intellectual property rights. China's performance in high-value-added fields and its dominance of the supply chain are expanding at an unprecedented pace. China has companies that are leaders in almost every industry, and as Chinese companies expand in the global market, China's valuation discount should turn into a premium at some point in the future. Investors must significantly shift towards investing in Chinese stocks in the medium term, and Hong Kong/Chinese stocks will see a major bull market in the medium term.

It is worth noting that the title of the research report borrows the famous quote from a16z founder Marc Andreessen: "Software is eating the world", and the first part of the report "This is China's, not AI's, 'Sputnik moment'" also borrows Marc Andreessen's recent comment on DeepSeek: "DeepSeek is AI's Sputnik moment".

The full text of the Deutsche Bank research report is as follows:

Original Title: China eats the World

Author: Peter Milliken, CFA, Research Analyst

This is China's, not AI's, "Sputnik moment"

We believe 2025 will be the year when the investment community realizes that China is surpassing the rest of the world. Increasingly, it is hard to ignore the fact that Chinese companies are offering better value for money, and often higher quality, in multiple manufacturing sectors, and even in an increasing number of service areas.

Investors will have to pay the price to be in the driver's seat, and we expect the "China discount" to disappear. Furthermore, as policies tilt towards consumption rather than production, and possibly due to financial liberalization, we believe profitability is likely to exceed expectations throughout the cycle. We believe the bull market in Hong Kong/Chinese stocks will start in 2024 and will exceed previous highs in the medium term.

China first emerged as a dominant force in global apparel, textiles, and toys. It then took the lead in basic electronics, steel, and shipbuilding, and more recently in white goods, solar, and other less glamorous areas.

China has also unexpectedly taken the lead in complex telecommunications equipment, nuclear power, defense, and high-speed rail - technological achievements that have not previously been on investors' radar.

But by the end of 2024, China will be in the spotlight for becoming the global leader in car exports, with a flood of advanced, attractive and lower-priced electric vehicles entering global markets.

In 2025, China launched the world's first sixth-generation fighter jet and the low-cost artificial intelligence system "DeepSeek" within a week.

Marc Andreessen called the launch of "DeepSeek" the "Sputnik moment" of AI, but it is more like China's "Sputnik moment", marking the recognition of China's intellectual property rights. China's performance in high-value-added fields and its dominance of the supply chain are expanding at an unprecedented pace.

We believe global investors have been significantly underweight Chinese assets, just as they avoided fossil fuels a few years ago, until the market punished those who made non-market-driven decisions. We see fund exposure to China is currently extremely low. Investors who like to own companies with moats cannot ignore the fact that: the moats now belong to Chinese companies, not the supposedly more economically superior Western companies.

China's manufacturing prowess is evident, with its merchandise exports twice the size of the US. China accounts for 30% of global manufacturing value-added, and its share in services is also rising rapidly. People have avoided China as an investment destination due to concerns about economic weakness, but despite cyclical slowdowns, China's growth rate is still more than double that of most developed markets.

With companies that are leaders in almost every industry, China's share of global market capitalization is unlikely to remain in single digits for long. We believe people are gradually realizing that today's China is akin to Japan in the early 1980s, when Japanese companies were climbing the value chain, producing higher-quality products, and constantly innovating. Many Western companies and industries may face potential existential threats and need to adjust their investment portfolios accordingly.

To survive, Western companies will need to: 1) Automate on a massive scale; and/or 2) Erect trade barriers. The latter path has historically been a downward one for economies, and while this is happening, it may not necessarily help the West. For example, in the auto sector, China's main export markets are often the 7 billion people outside the G10 countries.

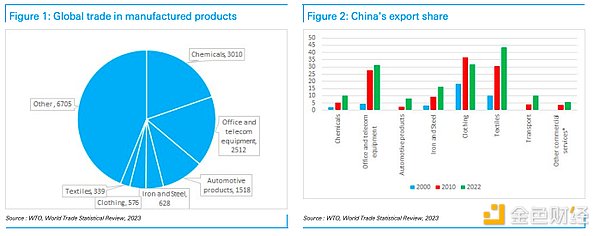

Figure 1: Global Manufactured Trade Figure 2: China's Export Share

Looking at the main categories of international trade, China is present in all categories except apparel (where it dominated before expanding overseas). In key commodity categories, China's scale is larger than the US, and often much larger. The only exception is autos (by value, not volume), but China is likely to have caught up here too - the Ford CEO driving a Xiaomi car makes it hard to see this trend reversing. Even in services, China is catching up, for example gaining around 0.5 percentage points of market share per year in transportation services.

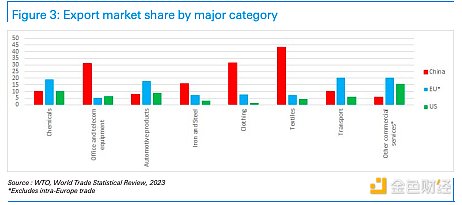

Figure 3: Market Share in Major Export Categories

Using Patents as a Proxy for Intellectual Property

China has complete value chains and local industrial clusters in key industries, with multiple Silicon Valley-like specialist domains, and close collaboration with domestic universities on research.

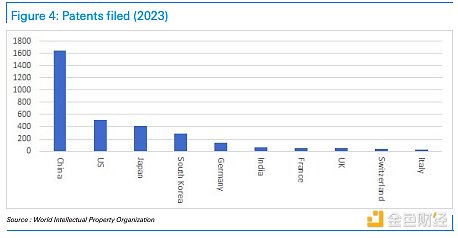

In electric vehicles, China holds around 70% of the patents, and a similar position in 5G and 6G telecom equipment.

In 2023, China accounted for nearly half of global patent applications. Given that the number of Chinese STEM graduates exceeds the total of the rest of the world excluding India, this trend is likely to continue. Furthermore, many of the graduates in other countries are also Chinese. So, barring exceptional circumstances, the rise of Chinese corporate dominance is unlikely to be halted in the near term.

China does face trade barriers, with the US and EU imposing tariffs on electric vehicles being a prominent example, but the West is constrained in its actions by the potentially severe consequences (e.g., inflation, competitiveness decline, and retaliation). In the 1980s, the US tried to curb Japan's rise and had some success, but we believe China's situation today is not like Japan in 1989, but more akin to Japan in the preceding years.

Figure 4: Patent Applications in 2023

China vs. Japan in the 1980s

Throughout the 1970s, Japan's Gross National Product (GNP) was the second-largest in the world, after the US. Surprisingly, after consulting Wikipedia, we found that Japan's actual GDP growth rate in the 1980s was only around 4% per annum, yet this was still seen as a crucial component of its economic "miracle". In contrast, people today are anxious about whether China's economic growth rate is 4% or 5%, and consider this "slow", but in hindsight, this view may evolve into seeing it as a "miracle".

Here is the English translation of the text, with the specified terms translated as requested:

The Plaza Accord required a 40% appreciation of the yen, which slowed Japan's industrial lead. This led to an economic slowdown, and the Japanese government responded with an accommodative monetary policy. From 1987 to 1989, economic growth recovered to 5%, a period in which the stock market saw a strong rally and a bubble emerged. The recovery in economic growth drove the revival of the steel and construction industries, raising wage levels and increasing employment. In the late 1980s, domestic demand rather than exports became the driver of economic growth. This situation may also occur in China.

Japan in the 1980s

According to the explanation on Wikipedia, Japan's economic growth was achieved through the input of a large amount of cheap labor, the intensive use of capital, and the improvement of productivity. Domestic investment accounted for more than 30% of GDP, and financial repression kept interest rates at a relatively low level, which had a promoting effect on investment. Japan acquired new technologies through joint ventures. In the early 1970s, Japan's savings rate reached 40% of GDP, and by the early 1980s it had dropped to around 30%. In the 1970s, Japan began to set up factories overseas to avoid trade frictions. China has only recently begun to take similar measures.

The question is: what stage is China at on this development path? Like Japan, China has also experienced a real estate bubble, but to a much lesser extent. Furthermore, it has been six years since the credit tightening and the real estate industry began to decline. Housing prices have fallen by a third, mortgage rates have halved, and nominal GDP growth has been about a third, so the affordability of housing has returned to a level not seen in many years. Due to low profit margins and low price-earnings multiples, the stock market valuation is also at a low level. So this is not Japan in 1989 (when the Japanese stock market had grown 50-fold in the previous 20 years).

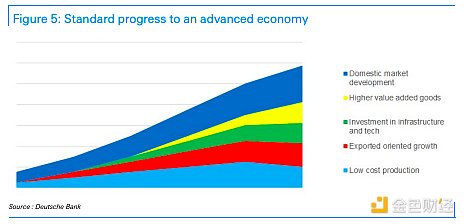

It is generally believed that China will not follow the consumption-led economic development path of Japan and will only fall into economic stagnation like Japan. In fact, China is on a path that the United States, Japan, Singapore, Hong Kong, Taiwan, South Korea, Spain, and many countries and regions in Eastern Europe have all taken. While some countries and regions are struggling with the middle-income trap, unlike them, China has become the global leader in manufacturing as well as an increasing number of service industries.

Figure 5: The standard process of moving towards a developed economy

Japan achieved financial system liberalization around this time

The 12th chapter of the IMF's 2013 report "China's Economic Transformation" mentions that Japan in the 1980s has similarities with China's future development path. Before the Plaza Accord, Japan's financial system was highly regulated, with interest rates controlled and capital controls strict, and due to the abundance of corporate funds, the demand for bank credit was limited. Japanese investors held a large amount of US assets, and the depreciation of the yen also led to calls from abroad for Japan to open up its financial markets and increase the attractiveness of yen-denominated assets. This in turn led to capital inflows into Japan, increasing the money supply and driving economic growth and asset bubbles.

China may also be heading in a similar direction. President Trump may emulate President Reagan's approach and push for China's financial liberalization in trade agreements, and China may also be preparing to accelerate the internationalization of the renminbi. We believe this is good news for the stock market, as the renminbi may depreciate, which from a foreign exchange perspective will boost corporate profitability and the attractiveness of Chinese assets. Why does the US want to push for this? The reasons may include: 1) political considerations in reaching an agreement; 2) believing that renminbi depreciation can offset the impact of tariffs, allowing trade to continue and tariffs to be collected, rather than being crowded out; 3) believing that financial liberalization will lead to renminbi appreciation, thereby weakening China's competitiveness.

Regardless of external pressure, if China wants to promote consumption, financial system liberalization will be helpful, by normalizing interest rates and ending the transfer of wealth from savers to enterprises. This will reduce over-investment and vicious competition, as capital will be allocated more rationally, which will be conducive to improving corporate profitability, easing fiscal pressure, as the returns of state-owned enterprises will increase. We expect large enterprises, investment companies and households to increasingly pressure the government to ease vicious competition to boost stock market value. Just as the government previously slowed down excessive investment in infrastructure and real estate, curbing industrial over-investment will obviously be the next step, and it may come faster than expected. We expect this to become a key issue in 2025, both to appease the US and as a necessity of the situation, and we expect this to drive a major bull market.

But what is the impact of China's population decline?

The decline in China's population is a drag on economic growth, but many countries are facing this problem. We believe this completely ignores an important fact: China has two advantages: 1) leading in automation, with about 70% of the world's industrial robots installed in China, bringing productivity advantages and thus increasing per capita wealth; 2) a huge potential market, with the "Belt and Road" initiative incorporating Central Asia, West Asia, the Middle East and North Africa into its development trajectory, expanding market potential.

Although Central Asia has a population of only 80 million, it is rich in resources; West Asia has a population of 310 million and is generally prosperous. South Asia has a population of 2.1 billion (although two-thirds of it is in India, which has largely restricted trade and investment with China, but this situation may change in the medium term). There is also Africa, with a population of 1.4 billion. In other words, the potential consumer population of Africa is comparable to that of China, and the potential consumer population of Central Asia, West Asia and South Asia (excluding India) is comparable to that of ASEAN plus Latin America. If China-India relations improve, India's potential consumer population will also become a huge market. Therefore, focusing only on China's domestic population situation may lead to erroneous conclusions about China's future.

In 2024, China's exports grew by 7%, with exports to Brazil, the UAE and Saudi Arabia growing by 23%, 19% and 18% respectively, and exports to ASEAN countries along the "Belt and Road" growing by 13%. Currently, China's exports to ASEAN plus the BRICS countries are on par with its exports to the US plus the EU, and its market share in these destinations has increased by nearly two percentage points per year over the past five years. Even in Latin America, China is rapidly expanding its market. Therefore, although US tariffs will hurt China, Deutsche Bank's economic team believes that if the US imposes 10% tariffs in the first half and second half of the year respectively, given that US exports account for 3% of China's GDP, this will put 0.5% downward pressure on China's GDP, which is a manageable shock.

The downside of China's export dominance is that many major countries, even within the BRICS+ group, have adopted protectionist measures, so China's export growth is to some extent constrained. However, due to its advantages in intellectual property and manufacturing value-added, Chinese companies are likely to expand their influence in the international market by setting up factories in other markets or exporting components for assembly. The weaponization of the US dollar makes investing in overseas infrastructure and factories more attractive than investing in US Treasuries, so the future direction of development is quite clear.

Figure 6: China's expansion into new economic markets (unit: million people)

Figure 6: China's expansion into new economic markets (unit: million people)

The China-US trade issue may see an unexpected positive turn

The market generally expects the US tariff level on China to be higher than Deutsche Bank's expectation (we expect 20% tariffs to be implemented in two steps by 2025, one of which has already been announced). But the actual situation may be much more optimistic than this pessimistic expectation.

Here is the English translation:The Trump administration appears to be keen on using tariffs as a source of fiscal revenue, and for economic and strategic reasons, views China as the main source of tariff revenue. However, President Trump seems to value tactical victories more than clinging to ideological positions that are difficult to gain support for. In our industry, there are investors as well as traders. In recent years, the influence of traders has been growing. Perhaps President Trump is more like a political "trader" than an "investor" who adheres to an ideological stance. If so, he is likely to set strict stop-loss points.

"DeepSeek" has shattered the West's illusion of being able to contain China. The best approach for the US would be to stimulate business development through deregulation, providing cheap energy, and reducing import barriers for intermediate products that cannot be competitively produced domestically. The last point may take longer to achieve, but we expect that members of the US House, Senate, and business leaders will generate internal demands that will push the US to return to the traditional Republican stance on trade issues. This may require some back-and-forth negotiations, but this analyst expects that a more trade-friendly stance will ultimately become part of the "America First" agenda before the midterm elections.

We believe that a political "trader" will seek to lock in results as soon as possible, and therefore may reach a US-China trade agreement in the first half of 2025, then shift focus to Western Hemisphere affairs. A quickly reached agreement may include limited tariffs (as expected by Deutsche Bank), the removal of some existing restrictions, and some major contracts between Chinese and US companies. If this occurs (which this analyst believes it will), the Chinese stock market is expected to see an upswing.

Trade and Market Performance Are Not Closely Correlated

Historically, trade and economic strength have been mutually reinforcing. Therefore, we were surprised to find that there is little research linking exports to stock market performance. However, China's exports are closely related to the growth in global money supply, which has been rising but is now slowing down. When we prompted Deutsche Bank's AI platform to search for relevant research, it told us: "Some studies suggest that export growth can increase corporate earnings and thus boost stock valuations... (but) some research also indicates that a sole focus on export growth may sometimes come at the expense of domestic demand, which could hinder overall economic growth and thus negatively impact the stock market."

Paradoxically, a decline in exports may actually drive stock market gains in the short term. China's rise across various industries has been accompanied by over-investment in many areas. In the solar energy sector, there are currently efforts to reduce supply, and if other industries follow suit, this could be positive news for the stock market, as it may also release some capital for domestic consumption.

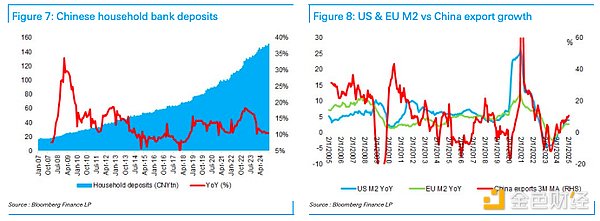

The growth rate of Chinese household deposits has slowed to twice the nominal GDP growth rate, but since 2020, Chinese household savings have increased by $10 trillion, and we expect these savings to be largely used for consumption and investment in the stock market in the medium term. Therefore, Hong Kong/Chinese stocks have significant upside potential in terms of accelerating earnings growth and P/E revaluation.

Figure 7: Chinese Household Bank Deposits Figure 8: Comparison of US and EU M2 with China's Export Growth

Valuing Market Leaders

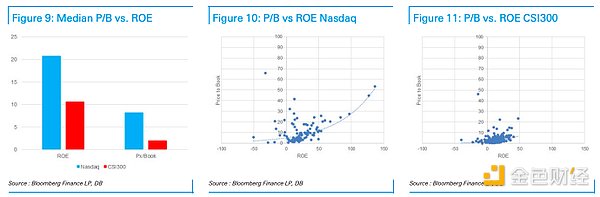

Figure 9: Median P/B Ratio vs. ROE Comparison Figure 10: Nasdaq P/B Ratio vs. ROE Comparison Figure 11: SSE 300 P/B Ratio vs. ROE Comparison

The problem with investing in the technology sector is that profits are often concentrated in the hands of market leaders, leading to fierce competition to capture this position. Chinese investors are fully aware of this issue, but leading tech stocks like Amazon have faced similar situations. When comparing the SSE 300 index and the Nasdaq index, both of which contain the global leaders in their respective domains, we find that the ROE of US companies is twice that of Chinese companies, but investors pay a P/B ratio for US companies that is four times higher (8.2x vs. 2.0x). Most large-cap Chinese stocks are also listed in Hong Kong, where their share prices are typically around 40% cheaper, close to a 1x P/B ratio. Looking at the MSCI China index, it trades at a record 10 percentage point discount to the world index in terms of P/E, and is also near the bottom of its valuation range.

As Chinese companies expand globally, this valuation discount should eventually turn into a premium at some point. We believe that investors must significantly shift towards investing in Chinese stocks in the medium term, and may have difficulty obtaining these stocks if they do not push up their prices. We have been bullish on the Chinese stock market, but have previously been constrained in finding the factor that would awaken the world and lead to buying Chinese stocks, and we believe that China's "Sputnik moment" (or its dominance in the electric vehicle sector, for example) is that factor. We expect the Hong Kong/Chinese stock market to continue outperforming in the medium term, just as it did in 2024.

Figure 12: Comparison of MSCI China Index and MSCI World Index Forward P/E

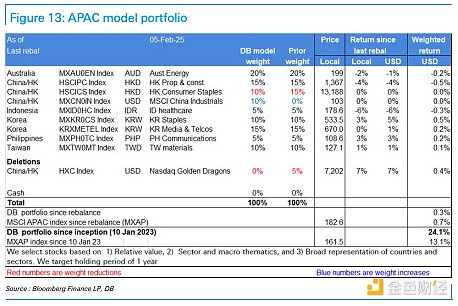

Figure 13: Asia-Pacific Portfolio Model