2006 (191)

2007 (288)

2017 (1)

2020 (1)

2021 (1)

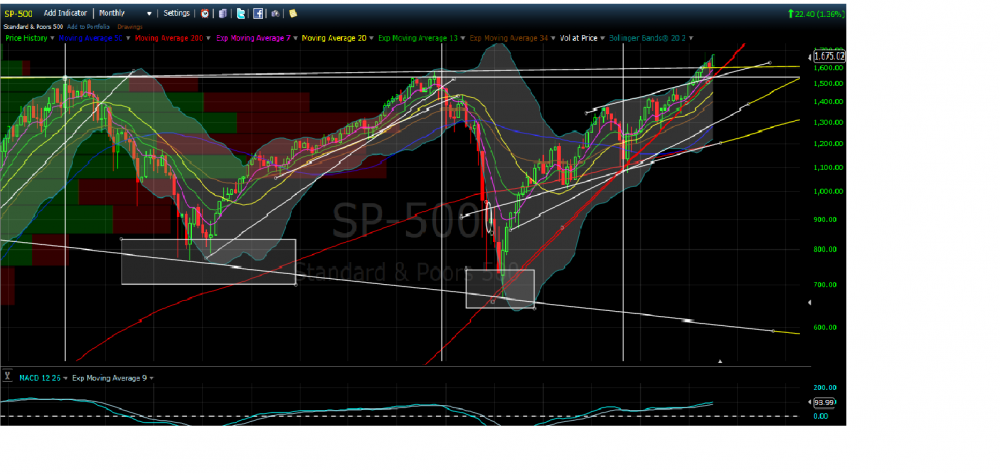

“We’re out of the trading range we’ve been in since 2000,” Bartels notes, suggesting that the investing climate for stocks nowadays has elements of the early stages of the stunning bull run that began in 1982 and lasted through 2000.

The initial leadership of this new bull phase will be cyclical areas of the market, Bartels says. The best sector currently in terms of positive earnings revisions is financials, she adds, which benefit from a steepening yield curve, or the spread between short- and long-term rates.

“With banks breaking out and estimate revisions rising, how can that be bad?” Bartels says. “Bank stocks leading is a good early indication for the behavior of the market.”

The strategist also likes the energy sector as way to latch on to growing U.S. efforts to achieve greater energy independence, and technology as a way to tap increased U.S. corporate innovation.

U.S. stocks can do well even when interest rates are rising, Bartels says, because both the economy and corporate earnings are improving. The firm expects the Federal Reserve to scale back, or “taper,” its bond purchases by December – a departure from the September consensus.

“Tapering is not tightening,” Bartels says. “We need to be aware that we might have finally reached the point where we can normalize interest rates. This is a good thing.”

Bartels’s view dovetails with BofA Merrill strategists’ upbeat outlook, noted in Thursday’s report, for U.S. housing, bank stocks, value shares, developed-markets equities and the U.S. market overall, common proxies for which, of course, include the S&P 500 and the Dow Jones Industrial Average DJIA .

Pessimism, meanwhile, clouds BofA Merrill’s outlook for bonds, commodities, China and emerging markets stocks, and growth stocks.

That said, the firm is advising investors to own some “humiliated” assets from acontrarian standpoint, including gold GCQ3 +0.21%, which bounced almost 3% higher on Thursday.

– Jonathan Burton