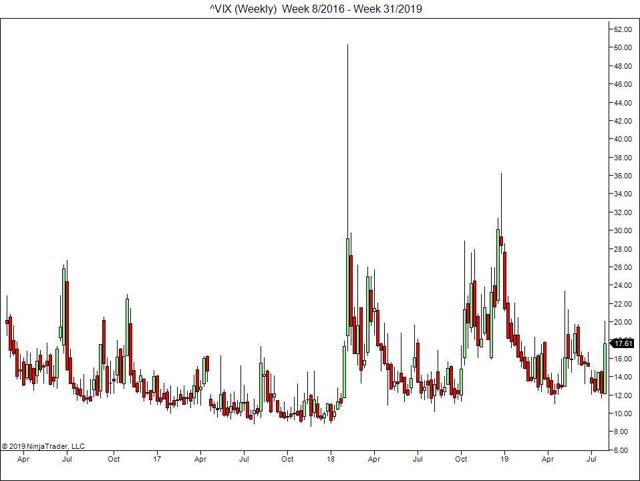

While the iPath S&P 500 VIX Short-Term Futures ETN (VXX) has seen declines of around 20% over the last month, this week has witnessed a marked uptick in price as rising equity volatility has led shares higher.

In this article, I will explain the rally in VXX as well as give an argument for the short side of this trade. I believe that equity volatility is overdone at the time and buying an at-the-money put on VXX with a target of 1-2 months into the future represents an excellent trade on the instrument.

The Instrument

There is a large variety of volatility ETNs which follow different methodologies in their approach of the volatility markets. In the case of VXX, it is a relatively straightforward note which seeks to give exposure to a hypothetical rolled position across the front two months of VIX futures. Despite the fact that this fund is relatively straight forward, quite a bit of nuance influences the daily price movements of VXX.

To understand VXX, we need to break down the definition to get an idea of the different drivers of price return for shareholders. First off, we need to define the VIX. The VIX is an index which is calculated by taking the implied volatility of a basket of options on the S&P 500. It is not a tradable instrument in that it is simply a calculation based off of traded options; however, the CBOE has created futures which settle off of the value of the VIX in a certain window. VXX follows a strategy which continuously rolls long exposure across the front two months of the CBOE VIX futures curve. This process results in something called roll yield.

Roll yield is the gain or loss associated with holding a position in later months of a futures curve. There is a general tendency in futures markets for prices in later months to trade towards prices in the front months as time progresses. This slow approach of back contract towards front contracts results in a steady stream of gains or losses for investors depending on market structure.

When the market is in backwardation (front contract above the back contracts), investors who are long the roll (as is VXX) will experience gains from roll yield. When the market is in contango (front contract under back contracts), roll yield from a long position will be negative because long positions established at the higher back-month prices will decline in value in relation to the front of the curve as time progresses.

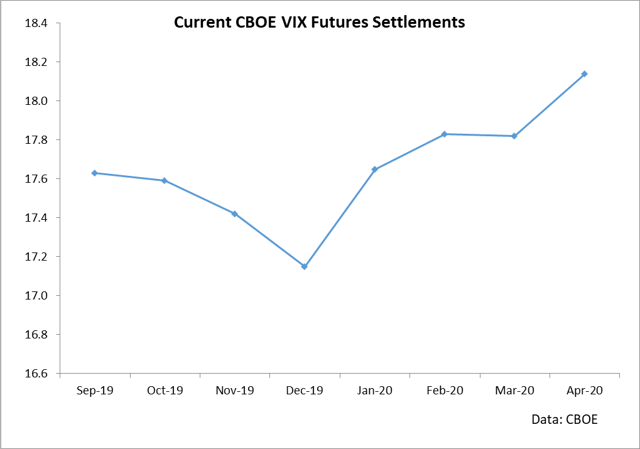

Here is the current VIX futures curve from the CBOE.

Over the last week, we have seen a shift in the front month structure in which the market has pushed into backwardation in the front contracts. This shift has attributed to the price gains seen in the ETN and comes in conjunction with a rise in the underlying VIX index.

As per the specific reason for the price rise, we can point a finger directly at the Federal Reserve's language following the rate cut in which the Fed seemed reluctant to give the market exactly what it wanted, which would be more aggressive cuts. One day later, Trump tweeted about further tariffs on Chinese goods, resulting in substantial volatility (particularly in the commodity markets). This is the backdrop for the data we'll discuss below - macro events have pushed the VIX higher and moved the curve into backwardation in the front, which means that VXX long traders from last week are currently in the money.

Volatility

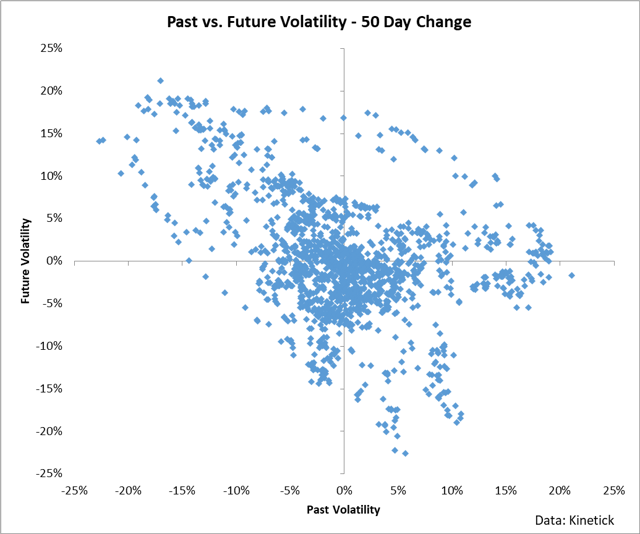

When we discuss volatility, the first thought that comes to mind should be something along the lines of "mean reversion". When you study volatility from a data-based approach, you'll largely find that volatility meanders between points through time and largely doesn't trend for long. Rallies are followed by declines and declines are followed by rallies. This can be seen in the below study which shows past 50-day changes in volatility by future 50-day changes in annualized volatility of the S&P 500. As you can see, it mean reverts.

Right off the bat, this should immediately be informing our thoughts as per how we approach the surge in VXX shares last week. The basic approach regarding volatility instruments should generally be "what goes up, must come down." You can quantify it many different ways, but the recent rally in VXX represents a statistically-sound trading opportunity to the downside. For example, over the last week, we saw the VIX rise by 5.45 points. In the past five years, we've only seen the VIX rise by this amount or more in a week 16 times. Of those 16 times, only 3 occasions saw the VIX higher next week and zero occasions saw the VIX higher 3 weeks into the future. In other words, VIX strongly mean reverts.

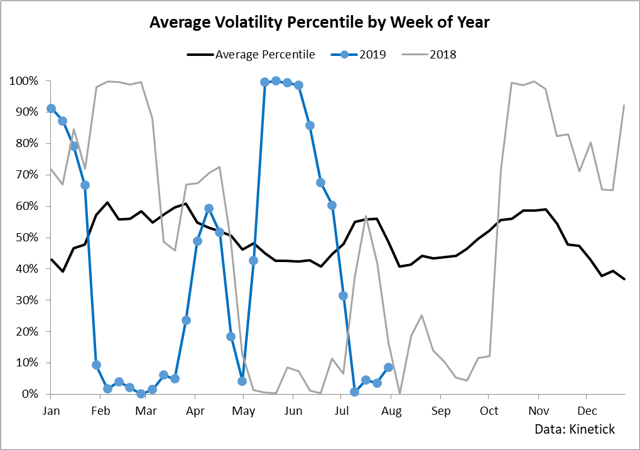

Another factor to consider is the seasonality of volatility. In the following chart, I have stripped out the outright level of volatility and taken the average one-month percentile of annualized S&P 500 volatility to show the general trends in seasonality and where we currently stand in relation to these trends.

Historically speaking, volatility has been low this year; however, we are approaching a period of unusually low volatility as seen by the average weekly percentile since 1992. Specifically, the months of August through September tend to be some of the least volatile months of the year (as measured by percentile) while October and November tend to see strength. To frame this into a trading idea, this means that we can likely expect subdued volatility until October giving a degree of protection to the short trade.

The reason why VXX is rising is that VIX futures in the front month have tracked the run-up in the underlying VIX index which has resulted in gains for the ETN from both price movement and a backwardated long roll. This situation is likely to fade in the immediate future, which suggests that shorting VXX makes for a great trade at this time. I'd specifically recommend buying an at-the-money put with a tenure of 1-2 months into the future to capture the reversion to the mean in volatility.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

================