Some recent articles and blogs explain a strategy consisting in selling short a pair of opposed leveraged ETFs on the same underlying asset. Here is a non-exhaustive list of the pairs that people doing this usually use: FAS/FAZ, ERX/ERY, DRN/DRV, EDC/EDZ, TNA/TZA, AGQ/ZSL. The idea is to profit by the inherent decay of leveraged ETFs while keeping two market-neutral positions. This article demonstrates that it is a very bad idea.

First, if you want to profit by the decay of leveraged ETFs, you have to understand the main reason for this decay. This is called beta-slippage (contango and intrinsic volatility are secondary reasons for ETFs embedding futures and options).

To understand what is beta-slippage, imagine a very volatile asset that goes up 25% one day and down 20% the day after. A perfect double leveraged ETF goes up 50% the first day and down 40% the second day. On the close of the second day, the underlying asset is back to its initial price:

(1 + 0.25) x (1 - 0.2) = 1

And the perfect leveraged ETF ?

(1 + 0.5) x (1 - 0.4) = 0.9

Nothing has changed for the underlying asset, and 10% of your money has disappeared if you are long. If you are short, your gain is 10%. Beta-slippage is not magical: it is just the normal behavior of a leveraged and rebalanced portfolio. The previous example is simple, but beta-slippage is not a simple mathematical object. It cannot be calculated from statistical and probabilistic parameters. It depends on a specific sequence of gains and losses. It means that any strategy based on beta-slippage is questionable because its results are unpredictable, even with a statistical and probabilistic model of the game. This is a theoretical and sufficient reason to avoid doing that.

The second argument has to do with the market neutral balance. In fact, you cannot keep it market neutral. If you want to profit by the phenomenon of beta-slippage, the pair rebalancing must be significantly longer than the ETFs rebalancing, which is daily. So there will always be a discrepancy in the pair from the first day after every rebalancing. With so volatile instruments, it makes the strategy very sensitive to the rebalancing dates.

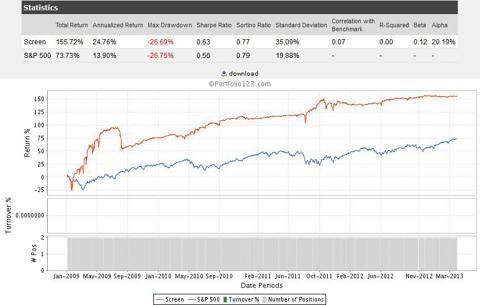

The following charts show simulations of holding equal-weight short positions on FAZ and FAS since January 2009, rebalancing them every four weeks.

The first chart is calculated with a starting date on 1/02/2009.

The second chart is calculated with a starting date on 1/16/2009.

Starting two weeks later not only transforms an apparently winning strategy in a loser, it also transforms a decent drawdown in a horror story.

The results above don't take into account the borrowing rate of such instruments, which are typically between 3% and 9% a year. This is an additional drag. Moreover, the rates are not constant, which makes the concept of "expected return" quite fuzzy.

Last but not least, the continued availability of the borrowed ETFs is not guaranteed. Your broker can ask you -at any time and without justification- to buy back a short position in the current trading day. If you cannot do it, the order is automatically forced. The only guarantee is to get a price between the low and the high of the day, and the "market neutral" balance falls apart (possibly at the worst time).

Conclusion:

People making money with this technique can consider themselves as lucky up to now. It is much wiser to bet on proven and documented biases. For example, I have described paired switching and seasonal strategies, with references to academic articles. People wanting to verify, backtest themselves, and maybe improve these strategies can follow this link.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Charts courtesy of Portfolio123.

=================

1) Two option commissions instead of one ETF commission2) MUCH larger bid-ask spreads on options compared with the ETF, especially on these 3x leveraged ETFs it's horrible.

3) When one option goes into the money by a lot, the bid-ask spread is huge.

4) Some of these leveraged ETFs don't even have options!

5) Options expire, so you have to put on a new position every couple months because the longer-dated options have NO volume at all on these 3x ETFs.

6) When you get assigned, it's even more commissions.

Really guy, try full disclosure for once!1) One option commission, free when you cover @nickel or less.

2) 2 cent B/A spreads on weekly's on UVXY is the norm

3) OI dictates spread, not "how far ITM it is.

4)I only trade UVXY and it does have high liquidity, tight B/A spreads and plenty of option chains.

5) I never had to wait more than a week or two after getting assigned before I could cover at full profit or more due to contango, beta slippage, rebalancing and mean reversion.

6) No commissions when assigned, only when you cover which is chump change 3.95. If you can't afford that, you shouldn't be trading.

I sure hope you don't invest in these things lest I take all your $$$!

It might not be related to your topic but, have you thought about ZIV 40% and TLT 60% balanced monthly?

Looking at the figures mentioned by A.L "with scottrade I can short SDS, QID, DXD, but no other inverse leveraged. Scottrade charges for them $1 for 1000 shares borrowed, no interest. The situation is probably broker-specific.", I think I'm paying way too much or Am I interpreting the information incorrectly?

Responses are much appreciated in advance.

The reason became obvious to me once I thought about it - this would be to easy for regular people to actually make money with. So "they" have made it so that if you want to "short" these ETFs you have to do it with PUTs, vastly increasing the likelyhood that you will lose your money, which is of course what "they" want.The amusing thing Friday is that I had expiring short puts on both FAS and FAZ. I had the FAS set to close at .10, and didn't bother with FAZ (because I didn't mind assignment). I was away all day (golf) and assumed that I would be the proud new owner of 2,000 shares of FAS-given the news. So, I suppose the FAS got filled at market open. The FAZ had almost no value left-so that won't get assigned either. Sometimes if you just leave things alone (assuming a good structure), you get pleasantly surprised.

Again, I recall that the author was discussing shorting the actual shares. I rarely short shares-it's too easy to use options.

It's not a gold mine, it's a coal mine.- on the short side you can quickly reach the margin call with that stuff.

- my experience is with borrowing fees from 3 to 9%. Heavy drag.

As for margin calls, sanity is the best remedy.

being short SDS for a while, relying on gravity. works fine for me.Also, I had three dimensions based on time, and there were times when I rolled out.

One other dimension was that I also had a series of ratio backspreads (both put and call).

Since I retired more than a year ago, I closed out the strategy as I didn't have time to spend on the project. One thing I'll mention is that one can encounter a situation where the lagging inverse creates a very low-priced ETF. Mutuality of option premium and bid/ask spreads have to be considered. Normally a reverse split is needed to get the 'parity' back. Also, note that my objective was to 'run out the clock' on option premium-not necessarily game inherent contango issues. In other words, it seemed to me that one simply pair traded a set of twins-one 'angelic', the other 'evil.'

I guesss I'll need to fire up SQL server, or Quantshare if i want to look into it more closely.Regards

Fred

When I tested this using that Investopedia simulator, it assumed a single 100k portfolio with $20 per trade transaction costs (which is pretty steep).

If you were rebalancing a large portfolio daily with small transaction costs, that may explain the difference.

I've run into forced buyback problems with several different brokers, if the shares were even available in the first place.