笨狼发牢骚

发发牢骚,解解闷,消消愁

正文

惨,就是大家都去抢购,去囤积,结果美国如此富庶的国家形成物资短缺的状况。

为什么去抢购?当然是因为大家对国家的运作产生了怀疑。当人民遇到大型传染病的时候,抢购囤积的心态是可以理解的,但这种现象不应当到如此程度付,这种程度不应当发生在美国。两天前美国股市对政府宣布紧急状态感到振奋,我觉得不可思议( 国家介入,股市大振,美国是不是逃过劫难?),这几天老百姓的反映体现了整个社会的真实心态:恐慌。你要是自由民主体制的绝对信奉者,此刻越来越多的人谈“中国社会主义优越性”而怀疑美国政府的能力,才是你最大的恐惧。

美国侨民回国在机场的处境(中国侨民返京人也很多,也排队,但分开的,有次序)

为什么会出现这一局面?

(《纽时》)Among the advisers who share the president’s more jaundiced view is his son-in-law, Jared Kushner, who considers the problem more about public psychology than a health reality, according to people who have spoken with him.

说习近平身边都是马屁精,除了忠还是忠,(美国总统)淳朴(美国总统Donald Trump,人称特朗普或川普)身边也是如此。

Reading the stories today and it really blows the mind that the President’s 30something son in law, real estate heir, appears to be the WH official running coronavirus response.

— Susan Glasser (@sbg1) March 15, 2020

《纽时》的专栏作家David Brooks叹到:“淳朴是美国历任总统在危机中最无能最束手无策之人。”有此想法的人多得是。

国家变得如此,淳朴不是唯一使坏的,美国两党的领导阶层也许没有中共那么恐怖,但也是够腐败到头了,尤其是共和党老大精英们,绝对是只顾自谋私利的一群人,美国的体制遇到淳朴这么一个山大王,算是给自己找到克星了,哈,咱华裔也有一份功劳。美国政府的无能,是总统私利成了国策,而两党腐败让权贵操纵整个国家极其,进而导致体制失灵,最终让百姓遭殃。

Since his first bankruptcies at end of 1980s, Trump's life has been dominated by one idea: what scheme/scam will keep his creditors at bay for the next 24 hours? That's the approach he's brought to coronavirus too.

— David Frum (@davidfrum) March 16, 2020

(此人是个狠心川黑)

中国政府处理疫情的有效性确实不能反映一个制度的优越性,一百年前世界经济萧条之后,纳粹德国是第一个全面恢复的国家,人民自豪,全球羡慕,二战开打后德军俘虏的英军脸色苍白销瘦,而德军个个脸色红利透白,然而结果如何,大家都知道。美国也不是到了无政府主义的地步,但这几年不断地愈益回归到反科学反理智的心态,在现代文明的环境这现状是对整个世界既有观念的冲击,政府还有什么值得信赖的?

看来我们快把中国的策略使出来了,现在只是说得“高尚”一点而已

不说多的,就说美国政府现在还不能提供大范围测试这窝囊,信心从哪来?

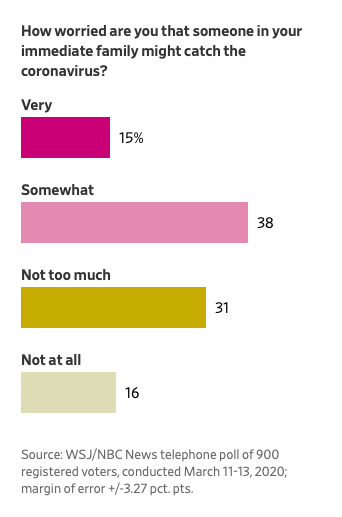

《华尔街日报》民调

还是说你要这样的领导?

“If you’re healthy, you and your family, it’s a great time to go out and go to a local restaurant, likely you can get in easy. Let’s not hurt the working people in this country...go to your local pub” pic.twitter.com/jXdhOfwe9R

— Acyn Torabi (@Acyn) March 15, 2020

《大西洋月刊》的Anne Applebaum把美国现在空虚的底子接出来:The Coronavirus Called America’s Bluff

What it reveals about the United States—not just this administration, but also our health-care system, our bureaucracy, our political system itself—should make Americans as fearful as the Japanese who heard the “distant thunder” of Perry’s guns

“I am not writing this in order to praise Chinese communism—far from it. I am writing this so that Americans understand that our government is producing some of the same outcomes as Chinese communism”。

【后注】

中国政府如果真的想在中国和世界面前赎回这次灾难(前期)处理失误的罪孽,首先要停止阴谋论,然后宣布每天出口一千万个口罩,十万个N95,和逐渐增加的其他医疗设备,如呼吸机,和适当排除医务人员支持其他国家。

《金融时报》

The world economy has fallen into recession, suffering from a “wicked cocktail” of coronavirus and the dramatic action to limit its spread, according to four former IMF chief economists.

As the virus has spread from China to the rest of the world, economists no longer feel they have to wait for data to confirm the world is in recession, even though official forecasts remain more optimistic.

The former top officials agreed that addressing the public health needs was the first priority, but said that with a sharp downturn likely, governments should be preparing to spend significant sums to protect businesses and households.

Serving policymakers and officials have so far sought to contain alarm over the economic consequences of the coronavirus. Mark Carney, Bank of England governor, has declined to predict a UK recession while Christine Lagarde, European Central Bank president, said only that it would be a “major shock”.

Gita Gopinath, IMF chief economist, said it was hard to predict what might happen but that the pandemic did not look like a normal recession. Data from China has shown a much steeper drop in services than a normal downturn would predict for instance.

“There’s not an easy lesson,” Ms Gopinath said, adding: “This should be a transitory shock if there is an aggressive policy response that can stop [it] morphing into a major financial crisis.” The most affected sectors will be leisure amenities, tourism, travel, transportation, energy, financials Vítor Constâncio, former vice-president of the European Central Bank

She also said there was no reason why the economic effects of a health crisis should linger, in the way that long periods of slow growth have tended to follow financial crises as households and companies work off their debts.

But her predecessors at the IMF were less guarded in their assessment. Kenneth Rogoff, a Harvard University professor, said: “A global recession seems baked in a cake at this point with odds over 90 per cent.”

Maurice Obstfeld, a professor at University of California, Berkeley, said recent events were “a wicked cocktail for the global growth”. He added: “I do not see how, given the events in China, Europe and the US, you are not going to see a severe slowdown.”

Olivier Blanchard, senior fellow at the Peterson Institute, said there was “no question in my mind that [global economic] growth will be negative” for the first six months of 2020. The second half would depend on when peak infection was reached, he said, adding that his “own guess” was that this period would probably be negative as well.

Raghuram Rajan, professor at Chicago Booth School of Business and a former Indian central bank governor, said the depth of any economic hit would depend on the authorities’ success in containing the pandemic, which he hoped would be decisive and rapid. “Anything prolonged obviously creates more stress for the system,” he said.

A long outbreak could also lead to a second round of consequences, where workers were let go and there was another fall in demand, eroding long-term confidence, he warned. “These kinds of effects — firms closing down — depend on how prolonged the first round is, and what steps we take to alleviate that first round. So it is up in the air,” he said.

The IMF defines a global recession as being when growth — normally about 3.5 to 4 per cent a year — falls below 2.5 per cent. Not all of the IMF alumni believe this definition is sensible in the circumstances but all said the conditions for a global recession were met regardless of the precise definition.

The IMF has said that the impact of the virus will be “significant” and that growth in 2020 will be lower than in 2019, which was 2.9 per cent.

To help offset the slowdown Profs Obstfeld and Rajan called for cash help to vulnerable households while Prof Blanchard said it was necessary to “prepare fiscal measures, including transfers and backstops to banks”. He concluded: “Do whatever it takes.”

Other economists were also clear that the economic effects of coronavirus will be serious. Vítor Constâncio, former vice-president of the European Central Bank, said: “The recession is coming from a demand deficiency and the disturbance on the supply chains. The most affected sectors will be leisure amenities, tourism, travel, transportation, energy, financials.”

He continued: “[It is] possible that banks’ risk aversion and lack of market liquidity for bond issuance may affect credit and provoke liquidity squeezes.”

Erik Nielsen, chief economist of Italy’s UniCredit, noted that four consecutive quarters of negative global growth followed the 2008 financial crisis but said he expected the impact of coronavirus to last only a couple of quarters. But he also predicted that the quarterly fall could be as deep as the 3.2 per cent contraction that the global economy experienced in the first quarter of 2009.

Gilles Moec, chief economist at French insurer Axa, said that trying to plot the disruption from the virus was almost impossible. “Our forecasting models are not set up to deal with this scenario,” he said.

Pointing to the lack of large-scale virus testing in the US, Danny Blanchflower, a Dartmouth College professor, said: “The worst is yet to come . . . I assume consumer confidence is going to collapse.”

评论

目前还没有任何评论

登录后才可评论.