看到这里争论这么多,随便说两句吧。网红股和ipo的股票在格雷厄姆聪明的投资者这本书

有讲到的,他强调聪明的投资者要避免买入这两种股票,巴菲特不买这两种股票也是深受

老师的影响。另外一位大师彼得林奇也在自己的one up on wall street上告诫大家远离热

门股,买自己熟悉但是不热门的股票最好。这几个都是有很多年投资业绩的,查一下这些

书也都能看到。原因无他,有没有在这两种股票赚钱的,肯定有,但是比较难,而且很难

持续,另外买这两种属于speculate, 这个看过Graham的书的都知道。

散户买这两种股,甚至加杠杆的目的也很明确,就是靠这个短期致富. 2021年的时候有一

大批这种股票,比如rivian, nio的电车股,还是不少其他的,但是后面几乎都是掉了90%

以上,原因就是这些公司没有自由现金流支撑。在经济变差,货币流动性减弱的情况下会

暴跌,所谓暴涨和暴跌在股市里是一对孪生兄弟的事情一再发生。

那怎么样才能在股市凭借较少的资金短期赚取第一桶金呢?其实还是需要有比较大机会出

现的时候,比如2020年疫情的时候,后面很多股票都从低点翻了好多倍,你买入平时研究

比较深入的好股票持有几年就可以。所谓的好股票是那种你几乎能够确定它不会倒闭,并

且未来很长的时间的自由现金流一定会增长的,或者现在情况很差,但未来大概率会好

起来的。做其他上杠杆的不是不能够赚到第一桶金,只是难度和风险太高,不太值得。

其它的办法可能就是定投,节约开支,熬时间了,这个需要学习的东西可能就少多了。

随便说说,不喜勿喷。

Understanding Stock Gaps:

Types, Examples, and

Trading Insights

so many gaps when stock rise up, why some of them got filled quickly,

some of them got refilled quite late?

-

Market Sentiment: The direction of the gap (bullish or bearish) can affect

how quickly it gets filled. Bullish gaps are often filled quickly as market

participants adjust their positions to reflect the new price level. Bearish

gaps may take longer to fill as they indicate a shift in sentiment away from

-

Market Conditions: The less liquid the market, the more and bigger the

gaps. This is because less liquidity means that prices are more prone to

slipping, since there might not be anyone to take the other side of the

trade at the bid price or closely neighboring prices.

Understanding these factors can help traders make more informeddecisions about when to enter or exit positions based on the nature

of the gaps they encounter.

Stock gaps are viewed by the close and open price because they represent a

discontinuity in the price movement of a security. These gaps occur when the

price of a security opens significantly higher or lower than the previous day's close

without any trading activity in between. This discontinuity can be caused by

the security's price movement over the course of a trading day. Gaps can signal

potential market shifts, and understanding the types of gaps—common, breakaway,

grasping the different types of gaps and their potential outcomes, traders can spot

potential trading opportunities and effectively manage risks. Gaps in stock prices

are caused by sharp movements in a stock's value between trading sessions, leading

to a difference between the closing price of one day and the opening price of the next.

The main factors that cause these gaps include unexpected earnings reports, major

news announcements, changes in market sentiment, and supply and demand shifts.

Understanding Stock Gaps:

Types, Examples, and

Trading Insights

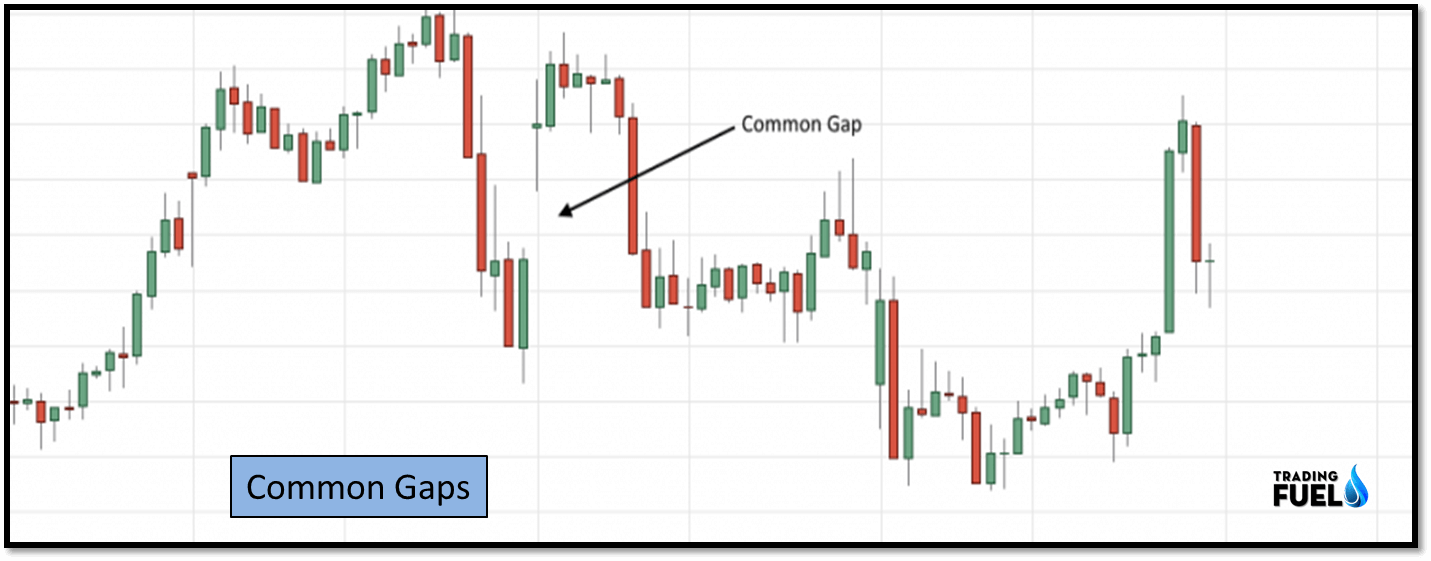

Common Gap: In general, there is no major event that precedes a common

gap. Common gaps generally get filled relatively quickly (usually within a

couple of days) when compared to other types of gaps. Common gaps are

also known as "area gaps" or "trading gaps" and tend to be accompanied by

normal average trading volume. Breakaway Gap: A breakaway gap occurs

when the price gaps above a support or resistance area, like those established

during a trading range. When the price breaks out of a well-established trading

range via a gap, that is a breakaway gap. A breakaway gap could also occur

out of another type of chart pattern, such as a triangle, wedge, cup and handle,

rounded bottom or top, or head and shoulders pattern. Runaway Gap:

A runaway gap, typically seen on charts, occurs when trading activity skips

sequential price points, usually driven by intense investor interest. In other

words, there was no trading, defined as an exchange of ownership in security,

between the price point where the runaway gap began and where it ended.

Exhaustion Gap: An exhaustion gap is a technical signal marked by a break l

ower in prices (usually on a daily chart) that occurs after a rapid rise in a

stock's price over several weeks prior. This signal reflects a significant shift

from buying to selling activity that usually coincides with falling demand for

a stock. The implication of the signal is that an upward trend may be about

to end soon.

Why Do Stock Gaps Fill?

A stock gap is a large jump in a stock's price after the market closes,

usually due to some news. When a gap has been filled, this means the

stock's price has returned to its "normal" price; the pre-gap price. This

happens quite often as the price settles after irrational buying and trading

has stopped after the news.

What Is Price Gap Risk?

Price gap risk is the risk that a security's price will fall or increase

dramatically from a market close to a market open, without any

trading in between. Traders should plan for price gap risk, such as

by closing out orders at the end of the day or putting in stop-loss

orders.

How Often Do Stocks Gap?

The amount of times stocks gap really depends on the time frame that

a trader is viewing and making trades. The shorter the time frame, the

more frequent the gaps. So a daily chart would have more gaps than a

monthly chart.

The Bottom Line

Stock gaps occur when an asset’s price jumps significantly between

trading sessions due to news or events, leaving a discontinuous space

on the chart. These gaps can signal the beginning of a trend or its

reversal, depending on their type. It is crucial for traders to accurately

identify these gaps—common, breakaway, runaway, or exhaustion—

and their causes, as misinterpretation can lead to missed opportunities

or losses.

Trading strategies might include playing the gap or managing price gap

risk with stop-loss orders. Understanding the implications of different

gap types helps investors make informed decisions in response to

market shifts

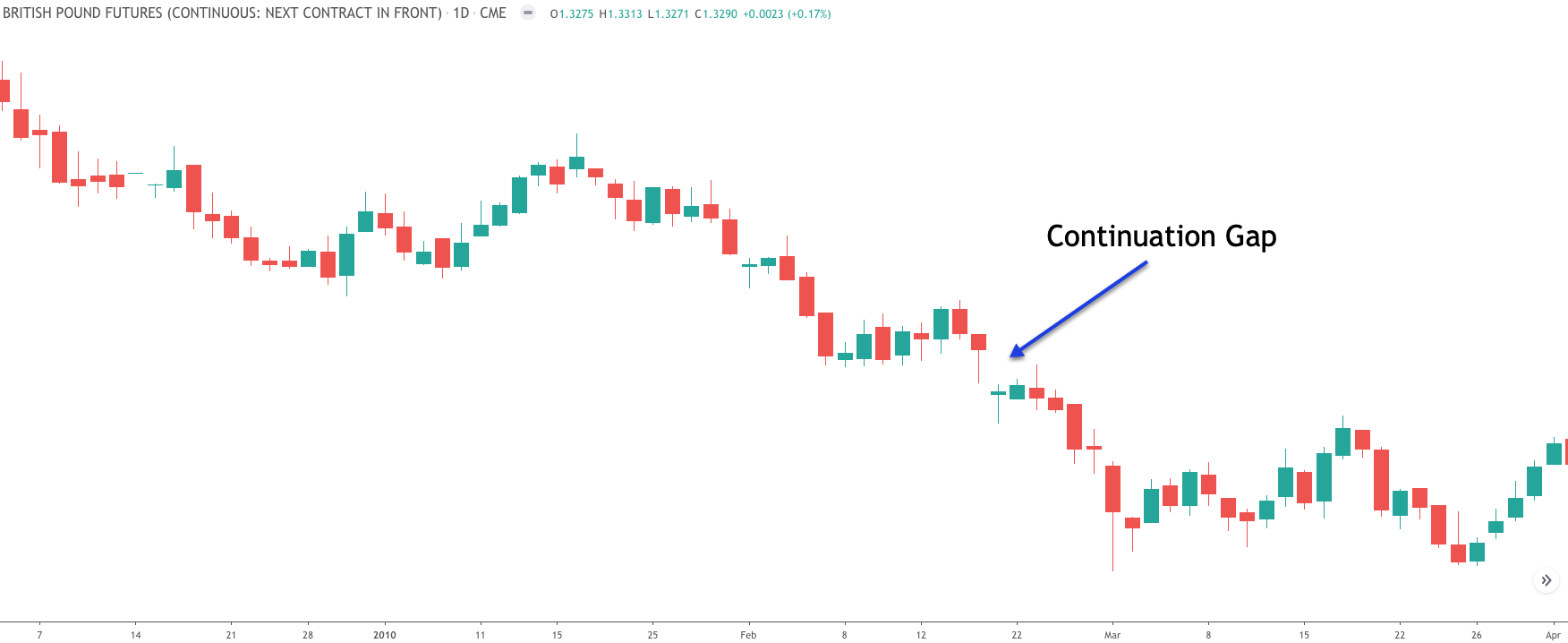

Gaps can be classified into four groups:

Breakaway gaps occur at the end of a price pattern and signal the beginning of

a new trend.

Exhaustion gaps occur near the end of a price pattern and signal a final attempt

to hit new highs or lows.

Common gaps can't be placed in a price pattern. They simply represent

an area where the price has gapped.

- Continuation gaps are also known as runaway gaps.

- They occur in the middle of a price pattern and signal a rush of buyers or

- sellers who share a common belief in the underlying stock’s future direction.

Gap Trading: How to Play the Gap

Part of the SeriesGuide to Technical AnalysisTraders can benefit from large jumps in asset prices in volatile markets if they can be turned into opportunities. Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down with little or no trading in between. The asset’s chart, on most trading platforms, shows a gap in the normal price pattern as a result. An enterprising trader can interpret and exploit these gaps for profit.

KEY TAKEAWAYS

- Gaps are spaces on a chart that emerge when the price of the financial instrument significantly changes with little or no trading in between.

- Gaps can occur unexpectedly as the perceived value of the investment changes due to underlying fundamental or technical factors, such as an earnings disappointment.

- Gaps are classified as breakaway, exhaustion, common, or continuation, based on when they occur in a price pattern and what they signal.

- The price has moved back to the original pre-gap level when someone says that a gap has been filled.

Gap Basics

Gaps occur because of underlying fundamental or technical factors. A company’s stock may gap up the next day if its earnings are much higher than expected. The stock price opened higher than it closed the day before, thereby leaving a gap.

It's not uncommon for a report to generate so much buzz in the forex (FX) market that it widens the bid-ask spread to a point where a significant gap can be seen. A stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons.

Automated program trading such as algorithmic trading is a relatively new source of gap price action. The algorithm might signal a large buy order if a prior high is broken. The size of the algorithmic order may be such that it triggers a price gap, breaking above the recent high and drawing in other traders to the directional movement.

Gaps can be classified into four groups:

- Breakaway gaps occur at the end of a price pattern and signal the beginning of a new trend.

- Exhaustion gaps occur near the end of a price pattern and signal a final attempt to hit new highs or lows.

- Common gaps can't be placed in a price pattern. They simply represent an area where the price has gapped.

- Continuation gaps are also known as runaway gaps. They occur in the middle of a price pattern and signal a rush of buyers or sellers who share a common belief in the underlying stock’s future direction.

To Fill or Not to Fill

The price has moved back to the original pre-gap level when someone

says a gap has been filled. These fills are quite common and can occur

due to three factors:

- Irrational exuberance: The initial spike may have been overly

- optimistic or pessimistic, therefore inviting a correction.

- Technical resistance: A price doesn’t leave behind any support

- or resistance when it moves up or down sharply.

- Price pattern: Price patterns are used to classify gaps and can tell

- you if a gap will be filled. Exhaustion gaps are typically the most

- likely to be filled because they signal the end of a price trend. '

- Continuation and breakaway gaps are significantly less likely to be

- filled because they're used to confirm the direction of the current

- trend.

It's referred to as fading when gaps are filled within the same trading

day on which they occur. Let’s say that a company announces great

earnings per share for this quarter and it gaps up at the open. It opened

significantly higher than its previous close.

Now let’s say that people realize that the cash flow statement shows

some weaknesses as the day progresses. They start selling. The price

eventually hits yesterday’s close and the gap is filled. Many day traders

use this strategy during earnings season or at other times when

irrational exuberance is at a high.

IMPORTANT

Gaps are risky due to low liquidity and high volatility but they offer

opportunities for quick profits if they're properly traded.

How to Play the Gaps

You can take advantage of these gaps in many ways. A few strategies

are more popular than others.

Some traders will buy when fundamental or technical factors favor a

gap on the next trading day. They’ll buy a stock after hours when a

positive earnings report is released, hoping for a gap up on the

following trading day if it hasn’t already happened in after-hours

trading.

Traders might also buy or sell into highly liquid or illiquid positions at

the beginning of a price movement, hoping for a good fill and a

continued trend. They may buy a stock when it's gapping up very

quickly on low liquidity and there's no significant resistance overhead.

Some traders will fade gaps in the opposite direction when a high or

low point has been determined, often through other forms of technical

analysis. Experienced traders may fade the gap by shorting the stock

if a stock gaps up on some speculative report.

Traders might buy when the price level reaches the prior support after

the gap has been filled.

You'll want to remember a few key things when trading gaps:

- A stock will rarely stop when it's started to fill the gap because there's

- often no immediate support or resistance.

- Exhaustion gaps and continuation gaps predict the price moving in

- o directions so be sure you correctly classify the gap you're going to

- play.

- Retail investors usually exhibit irrational exuberance but institutional

- investors and algorithmic systems may play along to help their

- portfolios. Be careful when using this indicator and wait for the price t

- o start to break before taking a position.

- Be sure to watch the volume. High volume should be present in

- breakaway gaps. Low volume should occur in exhaustion gaps.

Example of Gap Trading

This daily chart of Apple Inc. (AAPL) shows many gaps. This is quite

normal given the propensity for equities to gap above or below the

previous day’s price action when the market is closed but news is

still forthcoming and filtering into the market price.

We can see a bullish engulfing line starting from the left, suggesting that

the move lower may be reversing in candlestick analysis. This is followed

by a bullish gap higher, further suggesting that a low is being formed. An

attempt at the downside is made again but another large bullish

engulfing line signals a low may have been made.

We see a bearish exhaustion gap in the center, indicating that the move

higher is running out of steam and may be reversing. The gap is filled

relatively quickly but it continues to act as resistance at the horizontal

yellow arrow, suggesting that downside potential remains. Finally, we

see a strong runaway gap indicating further upside potential on the right

side amid a reversal higher.

As you can see, gaps are important price developments. They leave some

in the dust and lead others to quick profits. At the minimum, gaps are

important features of a security’s price action and should be monitored

closely for potential trading opportunities.

期权双杀是什么意思?期权多空双杀行情解析

分享至期权行情多空双杀是期权或股票市场中一种高风险现象,

表现为价格短时间内剧烈上下波动,同时触发多头和空头

的止损单,导致两类投资者均遭受损失。其本质是市场资

金博弈的极端表现,下文为大家科普期权双杀是什么意思?

期权多空双杀行情解析!

一、期权交易为什么会出现双杀行情?

期权双杀是指期权里面看涨期权和看跌期权同时下跌的情况,

这是期权市场中独有的特色,也让许多投资者迷惑,其实这与

影响期权价格的因素有关。

期权行情走势出现多空双杀是期权市场中一个较为专业的术语

,它描述的是一种市场现象,即无论市场是上涨还是下跌,投

资者都可能遭受损失。这种现象通常发生在市场波动剧烈、交易

策略不当或市场操纵等情况下。

期权交易为什么会出现双杀?

短期内影响期权价格的因素主要是期权的内在价值、时间价值、

波动率,而时间价值与波动率是导致期权出现双杀的主要原因:

1.时间价值

时间越长,期权内在价值提高的可能性就越大,所以期权就

有时间价值,因此期权离到期日越近,期权的时间价值就会

越小。当期权的内在价值没有什么波动的时候,时间价值的

下降就会导致双杀。

2.波动率

波动率越低,期权的相对价值也就越低,当内在价值变化不大

但是波动率显著下降的时候,期权也会出现双杀的局面。

期权出现双杀时怎么操作?

当出现这种情况的时候,投资者最好的选择就是空仓观望,

如果来不及平仓,那么就要采取一个卖出的策略。考虑作

为卖方,从而赚取时间价值的权利金。

股指期货最低2万一手保证金即可交易上证50,沪深300,中证500和中证1000股指期货,文华软件交易登录。

二、期权双杀是什么意思?期权多空双杀行情解析↑你懂得(0门槛)

什么叫期权多空双杀,那就是先让你追涨,再让

你杀跌。你信了,

就算是上当了,你不理他,他就会来理你。从技

术上来说,现在还

是盘整的一部分。用最小级别去考量市场,现在可

以认为市场的B反

弹可以结束。

但是,市场走势往往会更复杂,一般通过几次时间

延长的震荡,就

会把大部分人搞到彻底投降。其实转机往往都是

在所有人绝望的时

候出现,所以,我非常希望这里有一次比较大的

利空考验。

这样市场根本不需要什么条件,就能够直接拉起

来。从目前的时间

周期看,距离55天的周期还有七天的时间,留意

这个周期窗口的方

向变化。

期权双杀,也称为“沽购双杀”,是指在期权交易中

,无论是看涨期权

(认购期权)还是看跌期权(认沽期权),其价格

同时下跌的现象。

这一现象通常发生在特定市场条件下,例如标的资

产价格波动不足、

时间价值衰减或波动率下降等情况下。

具体来说,期权价格主要由三个因素决定:内在价值

、时间价值和

波动率。当标的资产价格波动较小时,期权的内在价

值可能不会显

著增加,而时间价值却会因期权到期日临近而逐渐减

少。同时,如

果市场波动率下降,无论是认购期权还是认沽期权,

其相对价值都

会降低。这些因素共同作用,导致期权双杀现象的发生。

期权双杀现象最常出现在期权到期日附近,因为此时时

间价值的衰

减速度加快,且波动率下降对期权价格的影响更为显著

。此外,在

市场横盘整理或震荡行情中,由于缺乏足够的价格波动

,无论是看涨

还是看跌期权的价格都可能受到负面影响。。

需要注意的是,期权双杀现象虽然令人困惑,但也是

期权市场中的一

种正常现象。理解其成因和影响因素有助于投资者更

好地制定交易

策略并管理风险。

总之,期权双杀行情的出现是市场中一个值得关注的

现象,它要求

投资者具备良好的风险管理能力、灵活的交易策略以

及准确的市场

判断。通过不断学习和实践,投资者可以提高自己在

复杂市场环境

中的生存和盈利能力。

期权双杀是指在期权交易中,无论是看涨期权(认购期权)还是看跌期权(认沽期权),其价格同时下跌的现象期权双杀是指在期权交易中,无论是看涨期权(认购期权)还是看跌期权(认沽期权),其价格同时下跌的现象。这种现象通常发生在特定市场条件下,例如标的资产价格波动不足、时间价值衰减或波动率下降等情况下。影响期权价格的主要因素包括内在价值、时间价值和波动率。当标的资产价格波动不足时,内在价值可能不会显著增加,而时间价值则会因期权到期日临近而逐渐减少。此外,波动率下降也会导致期权的相对价值降低,从而引发双杀现象【1】【2】【3】【4】。how about sell call sell put, if buy call buy put doesnt work?sell call sell put, if buy call buy put doesnt work

If the buy call buy put strategy does not work, it is important toconsider the following:Evaluate the market conditions: The success of options strategies canbe influenced by market volatility and price movements.Adjust the strategy: If the market conditions are unfavorable, consideradjusting the strategy to better align with the current market.Monitor the options: Keep an eye on the options you have sold, as theymay need to be rolled down or bought back to maintain the desiredposition.Learn from the experience: Understand the reasons for the failure and

solid understanding of the strategies and market dynamics before

6 Source期权怪象:“购沽双杀”是怎么

回事?为啥我看涨、看跌都不

对呢?

原标题:期权怪象:“购沽双杀”是怎么回事?为啥我

看涨、看跌都不对呢?

来源:期权时代

在一些初级期权交易者眼中,利用期权进行单边交易

,无非是看跌买认沽、看涨买认购。然而,有时盘面却出

现了“沽购双杀”的现象,这是怎么回事呢?

期权“购沽双杀”一般表现为:多数看涨期权并未同

此前指数反弹时一样大幅上涨,而是和认沽期权一样下跌

,且深度虚值认购期权跌幅更大。

为啥会出现单边看跌看涨都不对的情况呢?期权交

易的正确姿势究竟是什么?

1

行情回顾

波动率回落,期权市场上演“沽购双杀”

以2020年3月份行情为例,A股一度冲高,但认购期权

合约并未和市场情绪一样,出现大幅上涨,多数虚值认购期

权跌幅反而更大。随后,认沽认购期权曾一度出现双边下跌。

由于A股尾盘走弱,收盘还是以“购绿沽红”收尾。各个期权

品种看涨期权普跌,看跌期权尾盘翻红。

以上证50ETF为例,当时隐含波动率已经达到非常高的

水平,几乎创下上市以来的新高。

图片来源:期权论坛

图片来源:期权论坛出现这种现象的原因大致如下:

一是因为波动率具有均值回归的特性;

二是在2020年2月3号过后隐含波动率也是快速回落,而

之后的时间内虽然隐含波动率也持续上涨,但是历史波动率的

位置一直维持在更高。

而隐含波动率大幅超过历史波动率后,说明市场情绪过热

,隐含波动率被高估,出现一定回落也是很正常现象。此外,

投资者需控制好仓位,避免满仓卖期权,防止在市场出现波动

时因保证金不足产生额外损失。

2

深度解析

为什么会出现“购沽双杀”现象?

按照正常的思维理解,当标的物价格上涨的时候,买看涨期

权权利金应该上涨。当标的物价格下跌的时候,买看跌期权权利

金应该上涨。

但是盘面出现“沽购双杀”时,顾名思义,意思就是不管你

买的是看涨的期权还是看跌的期权,二者同时出现亏损的情况。

对于一些期权新手,难免产生疑问。下面我们再跟大家好好

理一理这个怪现象的原因:

影响期权合约价格最关键的三大因素:标的涨跌、时间

价值、波动率。

标的涨跌

简单说就是判断方向,抛开其他因素影响,而方向的判断

(标的的涨跌)表现在期权价格上最直接的就是内在价值部分。

而期权价格是由内在价值加时间价值,共同组成。

时间价值

时间价值说的是到期之前可能的“时间风险”(中性词)。

当期权合约距离到期日越来越近时,对于期权买方来说,

其所持有的期权增值的可能性也越来越小。

抛开其他因素影响,因此,随着期权临近到期日,其时间价

值将逐渐变小,并在到期日时加速衰减为零。

所以说时间对于期权买方来说是不利的一个变量。如果再

遇上假期,时间价值理论上一定是变少的。

波动率

波动率是一种市场情绪高低的体现,即价格波动的剧烈程度

,但是并不代表行情方向。

当其他因素不变时,波动率越高期权的价格也越高,波动率

越低则期权价格越低。

双买策略,为做多波动率的策略,波动率下跌时,即使看对

方向,也赚的少。

若在行情没有大变化的情况下,双买策略收益也许为亏损

状态。

无法达到上涨或者下跌均可能赚钱的目的。

Vega值作为衡量IV变化对于期权价格的影响指标,平值

期权的Vega值最大,因此波动率的变动对于平值期权价格的

影响也会很大。

3

举一反三

“购沽双杀”以及其他期权价格现象

当我们大概了解了内在价值、时间价值、波动率三者对

期权价格的影响之后,可以通过以下几组图形对比来认识到

为什么会出现“沽购双杀”等其他不同期权价格现象:

我们用“1”来代表内在价值,“2”代表时间价值 ,

“3”代表波动率。

沽购双杀

在一般波动很小的行情,方向收益微小,如果波动率

出现大幅下跌,加上时间价值的流失。体现在期权价格上就

是,认购也要亏钱,认沽也要亏钱,从而形成沽购双杀。

(常见)

沽购双红

在一些特殊的行情里,方向变化不大,如果波动率出现

大幅上涨,弥补了原本该流失的时间价值部分。体现在期权

价格上就是,认购会赚钱,认沽也会赚钱,形成沽购双红。

(极少出现)

价格暴涨

在一些大涨大跌的行情里,方向带来的增值潜力明显,

加上波动率出现大幅上涨足以弥补时间价值的流失。体现在

期权价格上就是,做对的一方期权价格出现暴涨,真正体现

买入期权“风险有限收益无限”的时候。

价格暴跌

在大涨大跌的行情里,如果波动率出现大幅下跌、时间

价值正常部分流失。体现在期权价格上就是,做错的一方期

权价格出现非常大的亏损。

4

善用工具

巧用期权做对冲,事半功倍

虽然“购沽双杀”这样的现象虽不多见,但充分揭示了

期权交易的复杂性。

相比一味“头铁”地在期权市场中搏杀,投资者朋友们

更应该利用期权特有的收益不对称性质,提前做好套保对冲,

不仅能应对股市下跌的风险,还能获取长期稳定的收益以及

更多的时间价值。

在沪深300ETF期权获准上市时,上交所就指出,近五年

来上证50ETF期权运行平稳,定价合理,风控措施有效,投资

者参与理性,交易和持仓规模稳步增长,市场功能逐步发挥,

为投资者提供了新的风险管理工具,新增上交所沪深300ETF

期权,丰富了投资者的风险管理工具。

股票期权对个人投资者的用途,分别是:

为持有的标的资产提供保险、降低股票买入成本、通过卖

出认购期权增强持股收益、通过组合策略交易形成不同的风险

和收益组合等。

目前来说,散户运用较多的策略则是备兑和领口策略。

假设一位投资者在三月初持仓10万份50ETF,市值约28万

元,投资者可以卖10手2.85的看涨期权进行避险,如果一个月

到期时50ETF收盘价低于2.85元,那么投资者将赚取权利金4650

元,在原有现货仓位不变,若每月操作,一年将获利5.6万元。

如果到期时ETF收盘价高于2.85元时,投资者将以2.85元的

价格卖出手中的50ETF,现货端也可赚取5000元左右的收益。

对于50ETF长期持有的投资者来说,利用期权特有的收益不

对称性质,能获取长期稳定的收益,还能获取更多的时间价值。

认沽期权买方:若标的资产价格下跌,卖方需按约定价格买入标的资产

(或支付差价),买方获利。

简言之:卖方亏的钱,直接流入买方的口袋。

02

“双杀”的常见场景

1. 横盘震荡后的突破

卖方策略:同时卖出认购和认沽期权(跨式/宽跨式空头),赚取时间价

值衰减收益。

风险点:若标的资产价格突破震荡区间,卖方需双向止损,亏损可能远超

初始收益。

资金流向:突破方向上的期权买方(如突破上涨时,认购期权买方)获利。

2. 黑天鹅事件

示例:重大政策变动、公司业绩暴雷等导致标的资产价格暴涨暴跌。

结果:卖方保证金不足被强平,买方(尤其是提前布局的对冲基金)获利。

03

资金的具体去向

期权买方(个人/机构)

散户:通过判断方向买入期权,赚取卖方亏损。

机构:如对冲基金、做市商,通过波动率交易或对冲策略获利。

市场其他参与者

做市商:为市场提供流动性,可能通过双向报价赚取价差,但极端行情

下也可能亏损。

套利者:捕捉期权定价偏差,间接分享卖方亏损。

04

案例分析

场景:某投资者同时卖出1张行权价50元的认购期权和1张行权价

50元的认沽期权,各收取权利金2元。

情况1(未突破):标的资产价格维持在50元附近,卖方赚取4元权利金。

情况2(突破上涨至55元):认购期权买方行权,卖方需以50元卖

出标的资产,亏损5元(55-50)。

认沽期权买方放弃行权,卖方赚取2元权利金。

净亏损:5元(认购亏损) - 2元(认沽收益) - 2元(初始权利金)

= 净亏1元。

资金流向:认购期权买方获利5元,认沽期权买方无损失,卖方总

亏损1元。

05

关键结论

零和分配:期权交易中,卖方的亏损直接转化为买方的盈利,无额

外“第三方”获利。

市场结构:买方可能是散户、机构或做市商,具体取决于交易对手。

风险管理:卖方需通过仓位控制、对冲(如Delta对冲)降低“双杀”风险。

06

延伸思考

为何卖方常被“双杀”?

期权卖方通过收取权利金赚取时间价值,但需承担尾部风险(

如黑天鹅事件)。买方则以权利金为成本,博取高杠杆收益。

如何避免“双杀”?

动态对冲:通过买卖标的资产调整Delta敞口。

止损纪律:设定最大亏损阈值,及时平仓。

选择合适策略:如牛市价差、熊市价差替代裸空头。

期权“双杀”的本质就是一场零和博弈,卖方亏的钱,最终都流进

了买方的口袋。不管是散户还是机构,只要押对了方向,就能从

卖方的痛苦中获利。

:max_bytes(150000):strip_icc():format(webp)/MHP-ChipHeadshot-2-d1d3928ade0f496abeb7411d3b2e1d4f.jpg)

:max_bytes(150000):strip_icc():format(webp)/AaplGapchart-9390d6a393b24f8caad9841065da8730.jpg)

广东

广东