青海杂谈

趋势投资与价值投资的探索介绍几种老式价值投资法

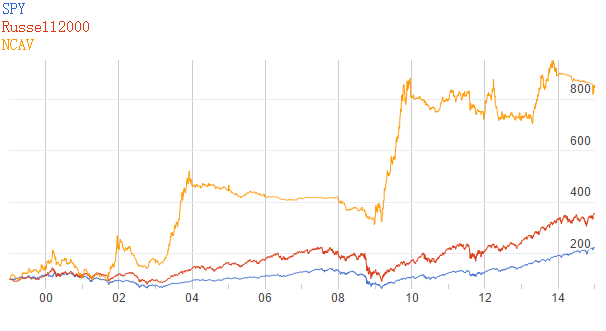

(1)Net Current Asset Value (NCAV)

格雷厄姆是价值投资的祖师爷。本文要介绍的是他在上世纪30年代初提出的“净流动资产投资法”(net current asset value approach or NCAV),这种方法要求买进的股票价格必须低于该公司净流动资产的三分之二。

NCAV = Current Assets - Total Liabilities

NCAV/share = (Current Assets - Total Liabilities) / Share outstanding

Bargain Price < (Current Assets - Total Liabilities) ×2 / (3 ×hare outstanding)

例如,一家公司流动资产(Current Assets)是每股 $25,流动负债是(Total Liabilities)是每股$18, 那么净流动资产就是每股$7,如果股价低于$4.67,按照格雷厄姆的净流动资产投资法”,就可以买进。

图片来源:www.oldschoolvalue.com

(2)Net Net Working Capital (NNWC)

与雷厄姆的净流动资产投资法”比较类似的方法,是净营运资本投资法: NNWC的计算公式如下:

NNWC = Cash + Short Term Marketable Investments + Account Receivable * 75% + Inventory * 50% - Total Liabilities

Or

NNWC = Cash & Equivalents + Account Receivable * 75% + Inventory * 50% - Total Liabilities

NNWC/share = NNWC / Share outstanding

NNWC计算结果就是股票的清算价值。

图片来源:www.oldschoolvalue.com

(3)Cash Return On Invested Capital (CROIC)

CROIC 使用自由现金流 (free cash flow - FCF) 计算得到的结果更能衡量公司的管理有效性(management effectiveness)。

CROIC = FCF / Invested Capital

图片来源:www.oldschoolvalue.com