股市小书生

价值投资有网友问,我就再说明一下,水晶苍蝇拍是一位自学成才的投资者,他的第一份工作是餐厅服务员,关于他的成长经历,他自己写得很全面,网上都有。我也不知道是不是巧合,我经常学习的A股市场的价值投资者,没有一个人是有比较正规的金融专业学习背景的。

如果参考水晶的观点,从十年的角度来思考投资,是因为相信常识和复利。

"... (The true investor) will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies."

‐ Benjamin Graham World Commodities and World Currencies, 1944, p. 42

忘却市场是非常困难的一件事,但是多从生意的角度思考投资还是可以做到做好的。

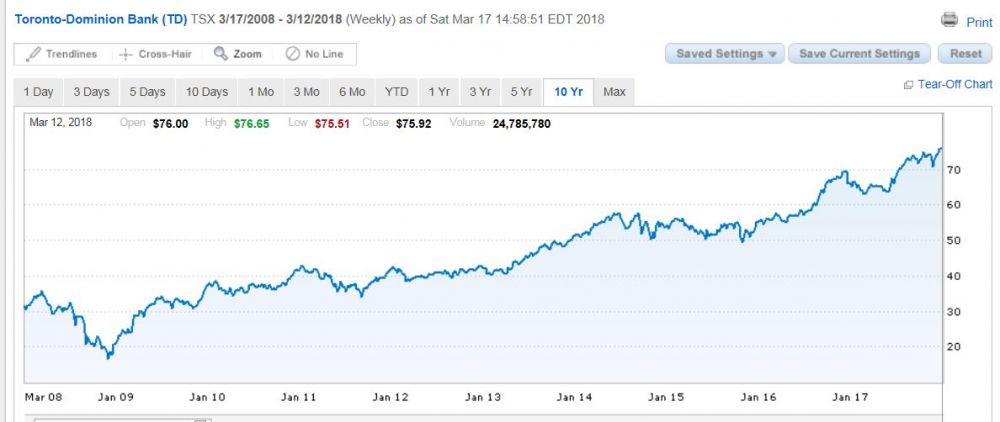

在上一贴中我提到了TD的表现在蓝筹股中是比较普通的,但是为什么这样一个其实普普通通的投资标的,却可以让一个投资者实现零到一百万,然后一千万,再然后一亿的目标呢? (理论上合理的成功概率)

I've learned many things from him (George Soros), but perhaps the most significant is that it's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.

- Stanley Druckenmiller as quoted in The New Market Wizards

加国地产基金上市4年,只有30%的股价涨幅, 低于市场长期均值水平,但是合理的投资可以解决一个普通家庭的财务自由问题。

同样的时代大家其实面临的机会都差不多,区别只在于把握度。

“在投资的世界里,一次大机会的成果远超过千百次的小折腾。同样的时代大家其实面临的机会都差不多,区别只在于把握度。真正的大机会,把握住一次足以改变境遇;把握住两次将开启全新的人生;把握住三次整个家族都会不同。从a股历史规律来看,其实每3-5年都大概率的会碰到一次好机会,然而大多数人早已在各种小折腾中荒废了。“ - 水晶苍蝇拍