njrookie's random thoughts

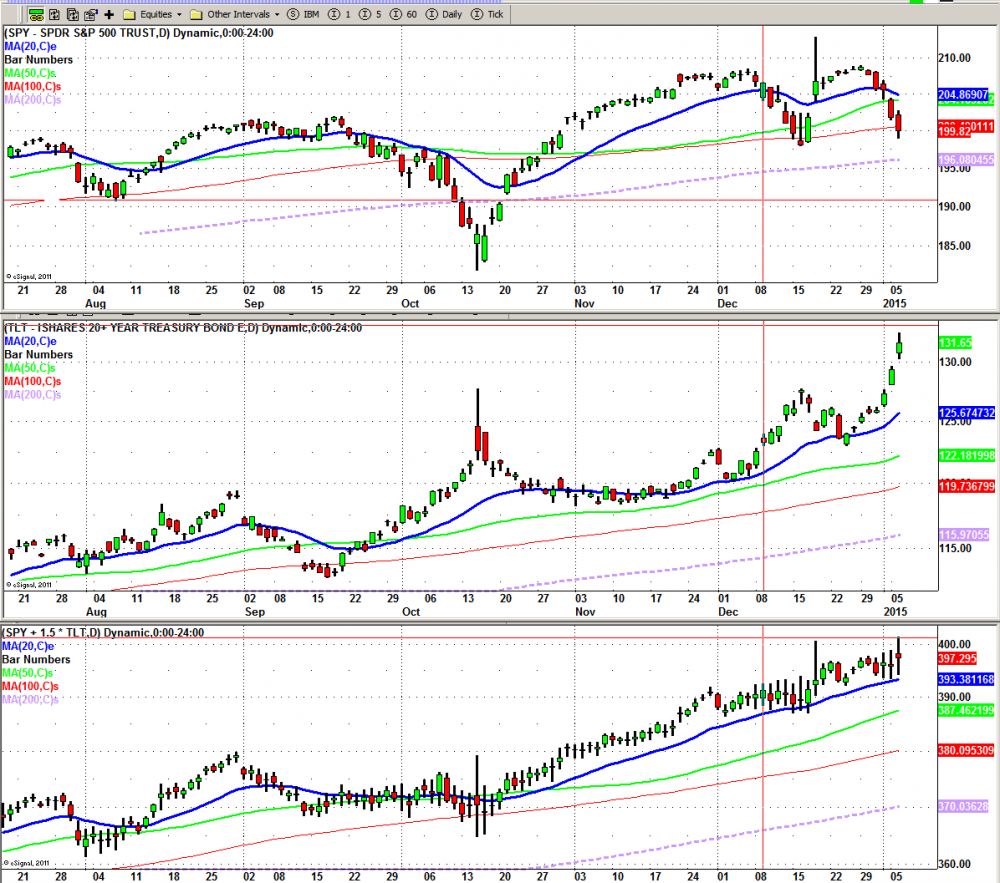

A collection of my posts on investment, trading, and life...First a picture is worth 1000 words. What do you see below?

1. stock (SPY) goes up and down;

2. bond (TLT) goes up and down;

3. but they tend to move in opposite way;

4. both tend to go up over time (company makes things and earns money; bonds pay interest);

5. so if you combine them, you account is much less volatile.

So if you do not want to spend too much time watching market minutes by minutes, you can just hold a well-diversified index in stocks and bonds in more or less stable proportion. Say you start with 50-50 in $ term. You can adjust back to the benchmarkt proportion when it is too much out of the way, say at every 10-20% interval:

Say SPY went up 10% and TLT went down 10%, and know you are at 55-45%, then you can sell some stocks and buy some bonds to get back to the benchmark ratio.

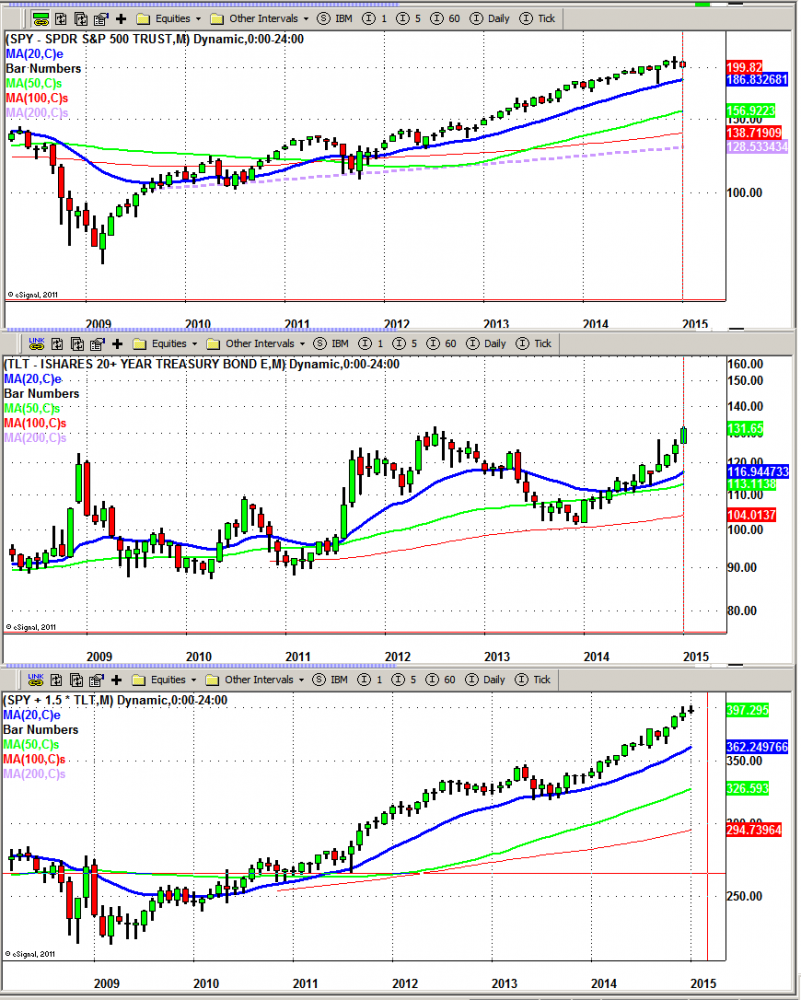

The second same candle chart below is at monthly frequency. so each bar is a full month. This way you can see how the portfolio works out all the way back to 2008 and 2009, ie the financial crisis.

Note the third panel in both chart is simply 1 share of SPY + 1.5 share of TLT, without periodic mechanical rebalancing, which will improve performance further. Also the actual return is higher as both SPY and TLT pay dividends/coupons (around 2% for SPY and 3% for TLT) annually.

During the crisis of 2008-2009, TLT helped to dampen the shock to SPY, but not completely.

Holding this type of portfolio has two disadvantages:

1. Your overall return will be lower than 100% stocks when market is in a bull trend as TLT does not yield much, and likely will lose as higher required yield leads to lower bond price. The so-called risk parity approach calls to use a little bit of leverage as the diversification improves the return-risk profile.

2. When the dominating concern in the market is tightening of monetary policy, you might lose money from both. however my observation is that those issues tend to be of second order in magnitude and few and far between.

In the current low yield environment, the role of t-bond is less of a yield play. it is more of a panic insurance that pays a positive carry. you can think of it as GLD but without carry cost, and pay you a small amount instead. i would not hold TLT by itself, but would not mind holding some as part of a portfolio to protect downside in equities.

Just my 2c.