笨狼发牢骚

发发牢骚,解解闷,消消愁

正文

大拿赋

作者:梦鱼人

大拿之称,高手之谓;大拿之名,大腕可追。术有专攻,能造非凡之伟器;业有尖精,可立绝世之懋功。三教九流,皆有至尊之师;七十二行,尽显状元之能。

求之于史,无大拿之雅文;征之于野,乃俚俗之称谓。源自民间,意思直白直舒胸臆;乡土味浓,赞美有加赞出神奇。某一地区,凡事都能拿主义者谓大拿;某一单位,各项规程了然者谓大拿;某一行业,操办事情完满者谓大拿。多面手与年龄无关,一招鲜往往出少年。虽然上不得庙堂,常奔走于城乡;虽然下不得厨房,习惯活动有场。劳神之能,不求职位高低,但落事主满意;劳心之人,不图学历文凭,但得事无巨细。东西南北混熟,场面之人常相遇;上上下下迎合,大拿出手求名誉。左右逢源,磨平棱角为修心;前后通达,圆滑处事是本份。

奇哉!大拿之功夫非常人能比;妙哉!大拿之技巧非凡人匹敌!

【出自网面】

大腕,有“大拿”的意思源自“拿摩温”,是英文NUMBER ONE的谐音,意即“第一号”,原先只特指旧中国时期帝国主义在上海设立的工厂中的工头,以后上海的华商工厂也有沿用此名称的。后有引申多种释义。另有冯小刚导演,华谊兄弟广告公司等公司联合出品的同名电影。。

《华尔街日报》

2016.07.07

Jon Hilsenrath and Bob Davis

When U.S. economic leaders in April 2000 gathered in the White House to mark a decadelong expansion, the consensus was clear. Trade, technology and a wise central bank had helped fuel an era of rising prosperity.

Stick to that model, Alan Greenspan, then Federal Reserve Chairman, told the assembly, and “I do not believe we can go wrong.”

Much did go wrong. The economic stability and robust growth the U.S. enjoyed in the previous decade proved to be in its final throes. After 2000, the economy would experience two recessions, a technology-bubble collapse followed by a housing boom, then the largest financial crisis in 75 years and a prolonged period of weak growth.

The past decade and a half has proved so turbulent and disappointing it has upended basic assumptions about modern economics and our political system. This string of disappointments has resulted in one of the most unpredictable and unconventional political seasons in modern history, with the rise of Donald Trump and Bernie Sanders.

Median household income, accounting for inflation, has dropped 7% since 2000, and the income gap widened between the wealthy and everyone else. Even though official measures of unemployment have receded from postrecession peaks, seven in 10 Americans believe the nation is on the wrong track, the most recent Wall Street Journal/NBC poll found.

The 2016 election is shaping up in large part as a referendum on an economic model that is widely seen as failing. Messrs. Trump and Sanders argue that policies celebrated 16 years ago no longer work for most Americans, a message that is resonating widely among those who have most suffered the consequences. Mr. Trump confounded expectations to win his party’s presumptive nomination. Mr. Sanders, though losing his, will take his message to the convention and has yanked his party to the left.

The Promise

America had an economic model that wouldn’t fail.

The Reality

American median household incomes, adjusted for inflation, have fallen 7% since 2000. In the process, a persistent majority of individuals have come to believe the country is on the wrong track.

Median household income, adjusted for inflation

Percentage satisfied with where things are going in the U.S.

Sources: Labor Department (income); Gallup (satisfaction)

This article begins a series examining the economic roots of that disillusionment and its social and political consequences.

The disappointments are many and deep seated. China, whose vast market seemed to promise prosperity for U.S. exporters, itself became a giant exporter, dealing blows to U.S. communities far more damaging than earlier import waves from Japan and Mexico.

Technology delivered gadgets and software but didn’t produce the anticipated economic growth or jobs, especially for those without advanced education. Central bankers, once deified globally, couldn’t foresee or manage the financial storms that eventually leveled the global economy.

Economic maelstroms deepened social problems, as working-class communities especially were challenged by drugs, out-of-wedlock births, a dearth of employment opportunities, suicides and fraying social institutions. The problems are scrambling Democrats and Republicans, sending them to new populist frontiers and forcing party leaders to grapple with their purpose and values.

Contributing to the rethink is a sense that Washington, because of gridlock, venality or incompetence, is itself broken and can’t fix what ails America.

Workers have come out short-handed. In 2000, they collected 66% of national income through wages, salaries and benefits. That dropped to 61% after the recession and has only recently partially recovered. Profits have risen to 12% of income from 8%.

I do not believe we can go far wrong if we maintain a consistent, vigilant, noninflationary monetary policy…a trade policy that fosters international competition…and an education policy that ensures all Americans can acquire the skills needed to participate in what may well be the most productive economy ever.—Alan Greenspan, April 2000

In the process, 30 years of established wisdom about how to manage capitalism has been upended by events and challenged by Mr. Trump and Mr. Sanders—the most serious challenge thus far to the post-Cold War economic consensus. Red states and blue states are being redefined along new lines: haves and have-nots.

A recent Pew Research Center poll found 61% of Trump supporters and 91% of Sanders supporters see the economic system as tilted toward powerful interests. Both embrace a new nationalism that rejects global integration and the influence of what they describe as moneyed interests.

It isn’t just the public rethinking the old model. Among policy makers and leading economists themselves, the desultory results of the past decade and a half have prompted soul-searching and a re-evaluation of some central tenets of what drives prosperity.

Alan Greenspan, then Federal Reserve Chairman, and President Bill Clinton entered a White House meeting of economic leaders in 2000, where the consensus was that trade, technology and a wise central bank had helped fuel an era of rising prosperity

“I went back to square one and asked, ‘Where did I miss it and why?’ ” Mr. Greenspan says. He was wrong about his faith that markets on balance acted rationally, he says. “I had presumed that irrational behavior on the whole was essentially random and produced nothing of value.”

Instead, he says, bouts of fear and greed are systematic, leading markets to overshoot and undershoot.

“We’ve all had to get a dose of humility,” says Martin Baily, chairman of President Bill Clinton’s Council of Economic Advisers in 2000 and an attendee at that celebratory White House reception.

The Promise

Central banks can manage the balance between growth and inflation and the fallout from financial bubbles.

The Reality

The Fed didn’t deliver the growth it expected, consistently undershot its own inflation objective, and missed the buildup of financial excesses which caused the 2007-2009 financial crisis.

GDP growth

Inflation

The economic rethinking under way is far from complete and echoes the re-examination that occurred after the Great Depression. A new army of economists is investigating what went wrong. Their work will shape how the U.S. deals with trade, monetary policy, technology, the workforce and fiscal policy for decades, though their conclusions aren’t always in line with the populism embraced in the political arena.

Mark Gertler, a New York University economics professor, is rewriting models for central banking and the macroeconomy, filling gaps in how economists thought financial markets and monetary policy affected the economy.

For Fed officials in the early 2000s, an article of faith was that manipulating a single interest rate—an overnight-lending bank rate called the federal-funds rate—could keep the economy on an even keel. Mr. Gertler’s research partner, Princeton professor and future Fed chairman Ben Bernanke, argued central banks helped create a “Great Moderation” of stable growth and low inflation.

The moderation turned out to be a mirage.

We have had a Federal Reserve that has focused on elongating this economic expansion and has also emphasized appropriate regulation of our banking institutions.—Abby Joseph Cohen, Goldman Sachs analyst, April 2000

“There certainly was a lot of hubris about the ability to stabilize the economy,” says Mr. Gertler.

Mr. Gertler is seeking new ways to account for the risks of financial crises, collapsing banks and other unstable financial institutions. Yet many central-banking dilemmas the last crisis uncovered remain unresolved. Among them: Central bankers aren’t at all sure better regulation, the preferred tool of Mr. Gertler and Mr. Bernanke, can prevent another crisis.

Perhaps most vexing, central banks themselves might spark crises by pushing rates down in a quest for growth. “We’re stuck,” says Raghuram Rajan, the Reserve Bank of India’s governor. “We cannot admit the tools we have are less and less powerful than we predicted and may have perverse effects.”

The Promise

Technology would lead to rising incomes and broadly shared prosperity.

The Reality

Productivity and output growth have slowed and technology has been polarizing the workforce.

Nonfarm labor output per hour, change from a year earlier

At the Massachusetts Institute of Technology, Erik Brynjolfsson is looking at unexpected ways technology has reshaped the economy by sharply reducing jobs and adding to the pool of disillusioned workers. In the 1990s, he was among the first economists to show computer technology was finally boosting worker productivity, a crucial ingredient in economic growth.

His view about workers’ gains from technology has turned gloomier. Measured productivity growth has slowed dramatically. He and co-author Andrew McAfee, an MIT business-technology specialist, found that as computing power transforms society, it swallows more jobs—a development they say is accelerating.

Software investment doubled to 1.6% of GDP in the 1990s, as factories and offices added computers that helped firms manage with fewer workers. The shift started hurting workers whose skills computers could replace.

Information technology today represents only 10% of American jobs, but is responsible for 30% of our economic growth…rifling through every sector of our economy, increasing the power of American firms and individuals to share broadly in its prosperity.—Bill Clinton, April 2000

For a time, those with bachelors’ degrees in science seemed safe from automation-prompted layoffs—their knowledge was tough for computers to duplicate—as did less-educated workers in personal service, such as home health aides. Economists argued more education was crucial to future success.

That advice, says Mr. McAfee, turned out to be “way too narrow.”

Between 2000 and 2012, estimates Harvard economist David Deming, the hollowing-out of work spread to professions including librarians and engineers. Those with the right skills came out ahead, a big reason the income gap widened. The top 20% of American families accounted for 48.9% of total income in 2014, Census figures show, versus 44.3% in 1990.

The U.S. is on the cusp of a new innovation wave, Mr. Brynjolfsson says, represented by Google’s self-driving car. Look for demand for Uber and taxi drivers to expand, he says, then crash, eliminating another job with a middle-class salary—adding still more workers to the ranks feeling betrayed by old economic models.

Most presidential elections turn on voter perceptions of the economy, from Ronald Reagan’s 1980 invocation of a “misery index,” which combined readings of inflation and unemployment, to Barack Obama’s call for a powerful government response to the 2008 financial-sector collapse.

Something similar is happening today, only more dramatically. Until Mr. Trump’s successful primary run, Republicans cast themselves as the champions of free markets and low marginal-tax rates. Democrats have been the party of activist government that tries to tweak the economy so it shifts in a desired direction.

The economy’s long underperformance has scrambled the debate. Old prescriptions, such as tax cuts by Republicans in the early 2000s and government spending by Democrats, haven’t delivered prosperity, leading voters to cast about for alternatives.

Those alternatives narrowed to Mr. Trump, who promised to rip up trade deals and deport millions of illegal immigrants, and Mr. Sanders, who would break up big banks, tax stock trading and match Mr. Trump as an opponent of free-trade deals.

China, more than any other issue, shows the disillusionment with globalization.

At the 2000 White House conference, President Clinton said expanded trade with China would “open their markets to our goods and services.”

The Promise

Trade with China and other nations would have a net positive impact on the economy as it would expose the world’s largest population to U.S. goods and services, while those hurt by trade in America would adapt and be supported.

The Reality

Trade with China turned out to be a bigger shock to the economy than anybody expected, and the adjustment of the workforce slower.

U.S. imports as a percentage of GDP

Reality has been rougher on American workers. Hillary Clinton, who pushed a Pacific Rim trade deal as secretary of state, now positions herself as tough on China and opposes that same trade deal.

Mr. Trump has made China-bashing a campaign centerpiece. Of America’s 100 counties with industries most exposed to Chinese imports, 89 voted for him in Republican primaries. Of the 100 least-exposed counties, before all of his competitors dropped out, 28 gave him the nod. Mr. Sanders takes a tough line on China.

The economy's failure to bring broad prosperity has prompted a growing anger that contributed to the rise of Donald Trump and Bernie Sanders

Economists long recognized import competition hurt some workers but generally dismissed the costs as small relative to benefits such as cheaper goods. Research from widening trade with countries such as Japan and Mexico confirmed that theory, despite activists’ targeting the North American Free Trade Agreement as a job-killer.

Economists were blinded, though, to the scale of potential downsides, says Gordon Hanson, a University of California at San Diego economist. His work shows how soaring Chinese imports, which picked up after Beijing joined the World Trade Organization in 2001, magnified technology’s impact on jobs. “We were the high priests protecting free trade,” he says. “There was a little bit of intellectual insularity.”

We in this country have to worry about those who have been left behind in this country, and we have to worry about our role in the world and the vote in China in the next several months will be a crucial test of our country’s international sentiment.—Lawrence Summers, Treasury Secretary, April 2000

Chinese competition, goosed partly by a currency China kept cheap, had far greater effects on U.S. manufacturing than any country since World War II—a finding MIT labor economist David Autor has helped make mainstream with Mr. Hanson and David Dorn of the University of Zurich. The trio studied 722 communities around the country and how they responded to import competition.

Their conclusion overturned conventional wisdom. China was simply different, they found in a 2013 paper. Its workforce was so vast, wages so low and productivity rising so fast, it caused greater disruptions in the American labor market than any country before.

“Washington and we in the establishment spent too much time celebrating the efficiency gains of trade,” says Timothy Adams, U.S. Treasury undersecretary under President George W. Bush, “and not enough time thinking about the people who were impacted.”

Between 2000 and 2007, import competition from China accounted for 982,000 manufacturing jobs lost, about one-fourth of all manufacturing job losses. Between 1999 and 2011, work published this year found, China accounted for 2.4 million jobs lost, including manufacturing and service jobs.

That loss might have been less damaging if U.S. workers were shifting from declining industries and towns and into growing ones, as they once did. However, fewer workers are willing to move, Mr. Autor and his co-authors wrote. Moreover, America is producing fewer fast-growing startups.

Surveying U.S. economic prospects, former Clinton Treasury Secretary Lawrence Summers invokes a Depression-era idea, “secular stagnation,” to argue a dearth of investment opportunities is holding back spending and growth while the income gap has created an overabundance of savings pushing down interest rates.

In the slow-growth world he foresees, global trade becomes more fraught as competitors grab for pieces of a pie that isn’t growing rapidly. Tensions over currency policies mount. Central banks have limited tools to cushion blows, putting pressure on fiscal policy—taxes and spending to boost investment—to spur demand.

That wasn’t what Mr. Summers argued at the 2000 White House conference, where he said the private sector was so abundant “with staggering high quality investment opportunities” it was the government’s job to get out of the way.

Today he says the government must help. “The world has changed,” he says. “So my views have changed.”

2016.05.30

专栏Gerald F. Seib

Economic Scars Help Explain Bizarre 2016 Race

Polling suggests the recession scared and scarred the electorate in ways not understood until now

Polling suggests the recession scared and scarred the electorate in ways not understood until now

Republican Donald Trump, left, and Democrat Bernie Sanders, right, have both tapped into the postrecession concerns of many voters that have left them willing to consider alternative candidates

The search for an explanation of this year’s bizarre political climate leads to a basic conclusion: The recession that started in 2007 and the financial crisis of 2008 and 2009 scared and scarred the electorate more deeply and more permanently than has been recognized before.

Yes, the economic statistics say there’s been a recovery—a relatively nice one at that. But mentally, many Americans have never recovered, and perhaps never will. The experience has altered their attitudes about the political and economic systems and their leaders, and left them willing to consider risky alternatives.

What the country is experiencing “is the difference between a car crash and having your house burn down,” says Democratic pollster Peter Hart. “A car crash is something that fades as the three or six months mark goes by. Your house burning down is never forgotten. It is always there and there is no half-life.”

What’s new here isn’t that the recession was traumatic, of course, but a dawning realization that its psychological aftereffects have been so deep and long-lasting. Why is this becoming clear now, as opposed to four years ago, when an incumbent president was re-elected with relative ease? In 2012, Mr. Hart says, “Americans were still digging out.” Today, they have dug out, yet are still feeling a hangover the isn’t going away. They are acting accordingly.

This delayed effect explains how so many allegedly smart people failed so completely to see what was coming in the campaign of 2016. It explains the staying power of Sen. Bernie Sanders on the Democratic side, the parallel struggles of Hillary Clinton there, the demise of a whole string of seemingly strong but completely conventional candidates on the Republican side, and, of course the mind-bending rise of Donald Trump.

Here’s one way of reading where we stand: The country hasn’t so much chosen Mr. Trump and Mrs. Clinton—assuming she survives her primary challenge—as the two best alternatives, but rather has found itself left with them at the end of a primary process in which other alternatives were cast aside.

The deeply negative views of these two suggest Americans still aren’t finding the answers they have been seeking. Mr. Trump’s attitude fits the times but his temperament isn’t really right; Mrs. Clinton is plenty competent but also represents a bit too much the times and the system Americans want to move beyond. The scars may not be fully healed in 2016 any more than they were in 2012.

There is data to support this mega explanation of 2016. Nominally the economy has been expanding for 6½ years, well above the average for a post-World War II recovery. The economy has added jobs for 74 straight months.

Yet the Wall Street Journal/NBC News poll has found that Americans’ view of the path the country is on actually has turned darker as the economic recovery has unfolded. At the beginning of 2009, while the financial crisis was in full swing but tempered by the optimism that accompanied the coming inauguration of Barack Obama, 59% of Americans surveyed thought the country was off on the wrong track.

Two years into the recovery, views actually began to darken, at least as measured by this “wrong track” reading. By the middle of 2011, 67% said the country was off on the wrong track. By late 2013, that number had reached 78%. It has since moderated a bit, but last month stood at 70%.

A newly published survey of American households by the Federal Reserve helps explain this mix of anxiety and anger amid recovery. Some 69% of adults surveyed at the end of 2015 reported that they were either “living comfortably” or “doing OK,” up from 65% in 2014 and 62% in 2013. Americans were slightly more likely to say their financial well-being had improved during the year than to say it had declined.

Yet those numbers mask a sense of eroding confidence born of stagnant or declining wages and job insecurity. Just 23% said they expected their income to be higher in the coming year. Almost half of adults said they couldn’t cover an emergency expense costing $400, or would have to cover it by selling something or borrowing money.

A Pew Research Center study offers a similar picture. At the beginning of this year, 70% of Americans were dissatisfied with the state of the economy, up from 61% at the beginning of 2007, before crisis struck.

Economic attitudes don’t fully explain the national unease, of course. Terror scares and culture wars play a part as well.

But whatever the precise causes, the depth of the scars, and the dissatisfaction with the alternatives, do little to suggest we should expect some feeling of satisfaction and national unity to emerge miraculously after the election of 2016, regardless of outcome.

2016.02.16

Nick Timiraos

Concerns of a global slowdown may shift campaign spotlight to U.S. growth

A housing recovery, financial markets’ turmoil, job growth and low fuel prices offer signs of both weakness and strength in the U.S. economy.

Renewed concerns about a global slowdown point to how quickly the 2016 election could shift to the performance of the U.S. economy, offering promise—and peril—for both political parties.

To figure out which party has the advantage this fall, say political scientists, pay less attention to campaign gaffes or debate pratfalls and more attention to the economy over the coming months.

It is hard to predict how the economy will fare this year, but things are off to a hair-raising start. Stocks, bonds and other financial-market signals are pointing to a possible recession, while domestic economic data offer bewildering signs of both weakness and strength.

Consumers are enjoying a windfall from cheap gasoline prices, a steadily recovering housing market and job growth that has sent the unemployment rate below 5%. Businesses, on the other hand, have watched profits squeezed by slumping overseas demand, a strong dollar and cutbacks in the once-hot energy sector.

The lack of clarity around the economy’s prospects has so far deprived both parties of a straightforward economic narrative.

Democrats can’t turn the election into a referendum on the economy “because growth hasn’t picked up enough to say, ‘Good times are here again,’ ” said Brendan Nyhan, a political scientist at Dartmouth College. “But the economy isn’t in such a bad state that Republicans can say, ‘Kick them out to bring the good times back.’ ”

Candidates will find that if “you don’t have the economy at your back, it’s really hard to steal the election away,” said Lynn Vavreck, a political scientist at the University of California, Los Angeles.

In predicting whether the incumbent party can hold the White House, political scientists say two gauges rise above all others: the president’s approval rating and the economic growth trend in the first half of the election year.

The current expansion is now 7½ years old, the fourth longest since World War II. Since January, many economists have cut their growth forecasts for the year as they fret about whether troubles abroad will nudge the U.S. into a recession.

Many see the biggest risks to the U.S. economy emanating from abroad, including some combination of a hard landing for China’s slowing economy, a big plunge in commodity prices and deeper recessions sweeping emerging markets. Sectarian war in the Middle East could disrupt oil markets and end a run of steadily lower gas prices.

Democrats stand to gain if those threats don’t materialize and if wage growth improves. But if the economy deteriorates, “Democrats are really on the defensive,” said Andy Laperriere, political strategist at Cornerstone Macro LP who served as economic-policy adviser to former House Majority Leader Dick Armey, the Texas Republican, in the 1990s.

Democrats say President Barack Obama deserves greater credit for preventing a deeper recession and nurturing an economic recovery that, while slower than his administration predicted, has become the envy of the industrialized world.

The share of Americans looking for work who said it was a good time to find a job hit 50% in December, the highest level witnessed in 15 years of the Gallup survey.

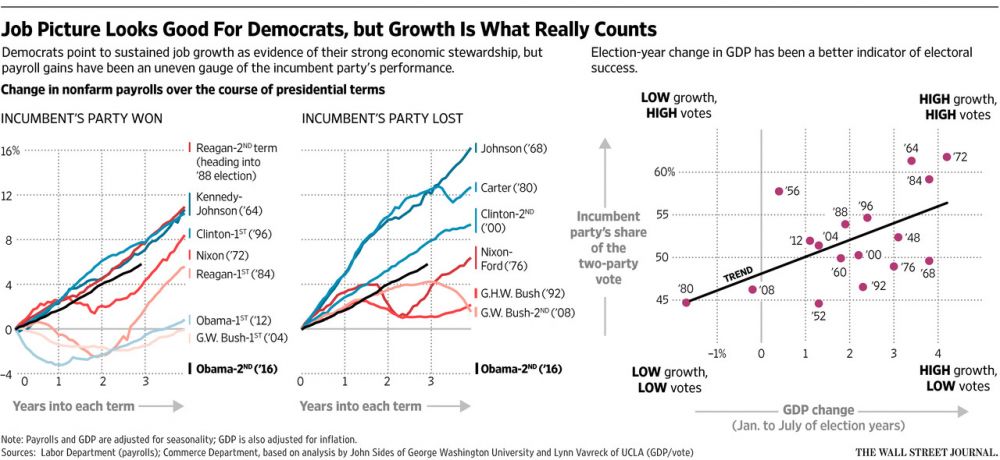

(原图)

“Democrats can point to an economy that is doing a lot better than Republicans were saying it was going to be,” said George Perry, an economist at the Brookings Institution who served in the Kennedy administration.

During the 2012 campaign, for example, Newt Gingrich promised gas prices would fall to $2.50 a gallon if he was elected, and Mitt Romney said he would reduce the unemployment rate to 6% in four years. Gas prices are now below $1.75 a gallon and the unemployment rate is 4.9%.

The advantage for Republicans is that Americans remain frustrated by improvements that have taken too long to materialize.

“If you listened to the Democratic debates, you would think there was a Republican in the White House,” said Mr. Laperriere. “No one is talking about ‘Morning in America’ ”—the iconic 1984 campaign ad touting Ronald Reagan’s economic record.

Already, Democrats start at something of a disadvantage because only once in the postwar period has a nominee succeeded a two-term president of his own party: George H.W. Bush in 1988.

And if Americans feel better about the economy, it hasn’t been reflected in Mr. Obama’s approval numbers, which hovered between 43% and 48% last year.

“I don’t see that providing a significant tailwind for the Democratic nominee,” said John Sides, a political scientist at George Washington University. “At least not yet.”

评论

目前还没有任何评论

登录后才可评论.