笨狼发牢骚

发发牢骚,解解闷,消消愁

正文

月初(6月1日)我对油价想了想,做了个归纳。

页岩油:咱眼巴巴在等

页岩油:咱眼巴巴在等

总结:

需求

不会与改善,还是疲弱。

美元

只会帮倒忙。

供给

石油输出国组织

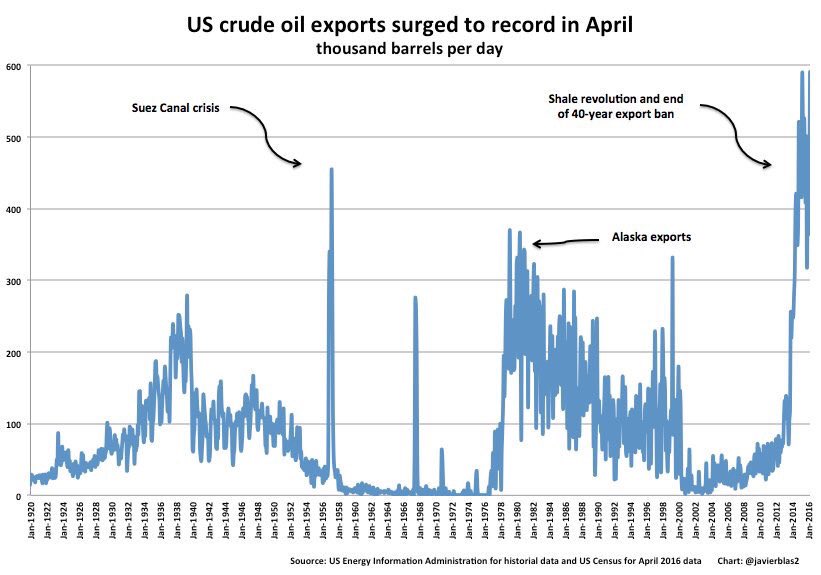

即使有尼日利亚加拿大的问题,石油输出国组织产油量还是处于高峰,所以别指望有啥帮助的。加拿大已经在回复,一定会会来的;伊朗伊拉克还会增加;利比亚增的成数远大于减的。整体还是不会大降。

美国页岩油

价格临界点。上周油井个数微增,有点暗示大家喘过气来了。上马,能维持,但没啥赚的。不过如果油价停滞在$50,难道大家永远等着?总会有人开工的。

就是说供需基本平衡,但供给还是略占上风,加上短期停产影响大,油价会在$48-52(美元)间波动。能打破这一均衡僵局的只有美国页岩油,故此将他们逼入进退两难的地步。也就是说我觉得$50是个中枢点。过了两天有人说Oil May Not Be Ready To Breach $50,我不会那么断然。

随后油价旋即上升,冲击$52,上升的契机是美央行(联储)暗示6月加息暂停,美元顿时黯然。大家还记得在前一周联储还再三表示美国经济让他们放心,会放开 手考虑加息步骤。美国经济学家衣冠楚楚,学问大经验多,,说话头头是道,其实是无知的代表,中国央行不论做啥事儿都没有任何必要觉得比他人丢脸。

油价上升的架势像是随时随刻冲破$52,不过$52压住了。

周线

涨到头没劲,不涨了,大家就找个借口,说跟着美元走。

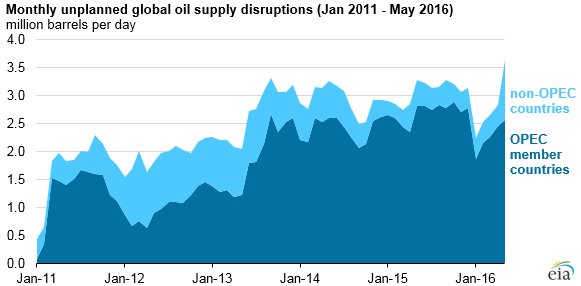

我上次就强调诸国因动乱、自然灾难造成的停产是大家判断供给平衡的主要原因,而不是真正的供给均衡,因为供给还是还是很强,尤其是伊朗,而世界经济依旧毫无起色。不过世上从砖家商人到期货大婶都像是不解。

《华尔街日报》Unplanned Outages Added $15/Barrel to Oil Price

Energy economist Phil Verleger Jr. says the rise in oil prices from $35 to $50 a barrel in recent weeks “seems entirely explained” by unplanned production outages in Canada, Nigeria and elsewhere. These outages have removed millions of barrels a day of production from the global market, effectively erasing the oversupply of crude that has persisted since mid-2014.

《彭博》能源记者Javier Blas

下面是几个主要因素。

伊朗

伊朗除了产量不断上升,出口能力也大大改善。以前提到伊朗有了油,苦于没船运,现在解决了:

Iranian Oil Exports Soar As Shipping Companies Return To Iran

Javier Blas:

#Oil Watch: @Shell to lift next month its first cargo of #Iran's crude in 4 years, joining European groups @Total and @Cepsa #OOTT

Javier Blas:

#Oil Watch: @Shell to lift next month its first cargo of #Iran's crude in 4 years, joining European groups @Total and @Cepsa #OOTT

Does Iran Have The Upper Hand In OPEC Oil War

Iran has been a dark horse since the lifting of sanctions, increasing its market share quickly to the surprise of many investors.

Iran has resorted to offering large discounts to its Asian customers, undercutting the Saudi and Iraqi prices to levels not seen since 2007-2008 in order to regain their market share, reportsReuters.

Ian Bremmer, the president of political risk consultancy Eurasia Group, told Reuters that the Saudi’s looked set to increase production after speaking with executives and a member of the Saudi ruling family.

Iran has been a dark horse since the lifting of sanctions, increasing its market share quickly to the surprise of many investors.

Iran has resorted to offering large discounts to its Asian customers, undercutting the Saudi and Iraqi prices to levels not seen since 2007-2008 in order to regain their market share, reportsReuters.

Ian Bremmer, the president of political risk consultancy Eurasia Group, told Reuters that the Saudi’s looked set to increase production after speaking with executives and a member of the Saudi ruling family.

沙特在伊朗面前自然不会让步。

加拿大野火灾已经过去,以前觉得加拿大产油量会很快恢复,但近日有人说因为油价低落的关系,加拿大的产油业资金奇缺,设备失修多时,故此维修、更换恐怕成问题,估计还得等到。

中国

中国还在买。

data out of China showed that oil imports stayed strong in May. China is the world’s second-largest oil consumer and news about its economy often sways the market.

While oil imports fell over the month, due to planned refinery outages, they rose around 40% compared with the same month in 2015. Chinese oil imports in the first five months of the year, combined, were 16% up on the same period last year, according to Commerzbank.

While oil imports fell over the month, due to planned refinery outages, they rose around 40% compared with the same month in 2015. Chinese oil imports in the first five months of the year, combined, were 16% up on the same period last year, according to Commerzbank.

然而这还是不能说中国需求回来了。以前说过中国政府现在允许民间炼油厂独立进口原油,今年民间炼油厂是进口的主力,国企垄断多年,缺乏竞争力,现在只能说民企来抢饭来了。但最近进口好像遇到了瓶颈:

印度

大家对印度经济还是众口交赞,对其原油需求还是乐观,成了主力,据说印度原油进口增速已超过了中国(不足为奇)。印度对原油很依赖,原油价格大跌,对印度政府财政预算帮了一大忙,也让通胀率稳住。这是个预测:

Javier BLas

Another consultant ups its 2016 #oil demand forecast on the back of US gasoline and #India: JBC Energy sees now 1.4m b/d y-on-y growth

虽然趋势还是不景气:

整个心态已经转过弯来了:

Shale King Returns to Fracking Wells After Oil Rallies to $50

Rebound In Oil Prices Changes Drillers’ Mindset

Rebound In Oil Prices Changes Drillers’ Mindset

The Wall Street Journal reported that there are a few spots where companies are stepping up drilling activity

A handful of companies telegraphed their intentions months ago before oil bounced up to $50 per barrel.

A handful of companies telegraphed their intentions months ago before oil bounced up to $50 per barrel.

资金状况也改善:

Javier Blas

US #oil and #gas companies have raised YTD nearly $17bn in new equity (down from $20.4bn in same period of 2015)

Javier Blas

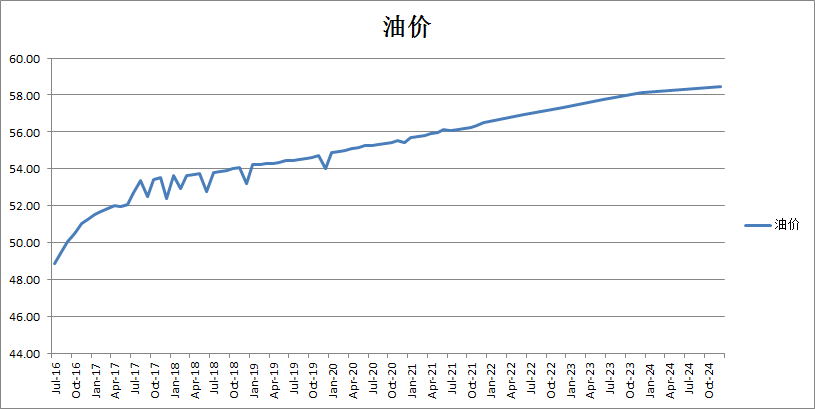

ICYMI: US crude #oil exports hit a record high of 591,000 b/d in April on European and Caribbean demand #OOTT #shale

但大局乐观:

油井个数连续两周稍微回升。

预测

砖家们说法还是满天飞

Saudi Arabia Raises Oil Prices to Asia But Cuts Prices to Europe

The prices increases are a sign that Saudi Aramco is “getting more bullish on demand"

How Far Can #Oil Rally? Options Investors Bet on Surge Above $100

The prices increases are a sign that Saudi Aramco is “getting more bullish on demand"

How Far Can #Oil Rally? Options Investors Bet on Surge Above $100

美国能源署预测世界产油量还会增加:

这与我的判断一致。

黑马:

市场是怎么说的?

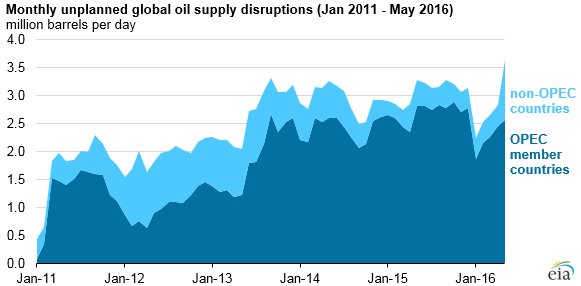

我的期货价格图较直观:

至2024年底。数据出自芝加哥期货交易所

市场上油价还会上升,但即使到了明年底,也不过$54。千万别激动过头。

The Wall Street Journal reports that net bets on rising oil prices represented 40 percent of all the front-month and second-month U.S. oil futures contracts in 2015 and 2016

见:美国油妈

见:美国油妈

最后一句话,一个月内还在在$48-52(美元)间波动。

油价动荡指数也说目前波动幅度不大:

呵呵,批评的有道理。我从小语文就差,大白字一大堆,现在依赖古狗拼音输入,很糟,老眼昏花有看不清,错了也看不见。

待会儿有时间再复查复查。

回复 '蓝天99' 的评论 :

我平时写此类随想多了,很少有人瞧得起的,也懒得到处张扬。不过谢谢您客气话,还是业余水平,大家交流交流。