笨狼发牢骚

发发牢骚,解解闷,消消愁上周中国公布本年一季总产值及相关经济数据,这是中外的报道、评论集。虽然只是堆积在此,但资料足够对一季中国经济有个概况,查起来也集中,浏览一下也有价值。

难以觉得大家会有耐心过目,细嚼就更无从谈起了,尤其是文学城。

我会在以后说说想法和判断。

《一财》

【1】一季度GDP增速定格6.7% 统计局称阶段性筑底

第一产业增加值8803亿元,同比增长2.9%;第二产业增加值59510亿元,增长5.8%;第三产业增加值90214亿元,增长7.6%

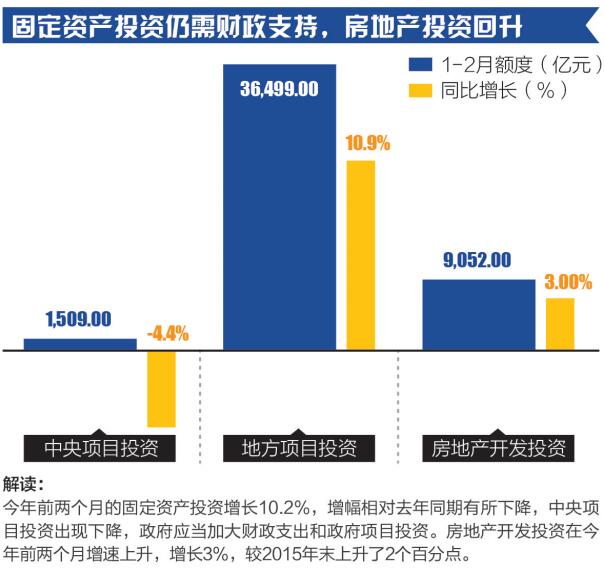

固定资产投资增速稳中有升,一季度,固定资产投资85843亿元,同比名义增长10.7%,扣除价格因素实际增长13.8%

全国商品房销售面积24299万平方米,同比增长33.1%,其中住宅销售面积增长35.6%

全国商品房销售额18524亿元,同比增长54.1%,其中住宅销售额增长60.3%

房地产开发企业土地购置面积3577万平方米,同比下降11.7%

【2】统计局新闻发布会,报道汇集

【3】一季度全国财收逼近4万亿 3月地方卖地收入猛增

- 公共预算支出16788亿元,同比增长20.1%

- 公共预算收入11511亿元,同比增长7.1%

- 财政收入增幅(6.5%)比去年全年增幅提高0.7个百分点

- 个人所得税3150亿元,同比增长18.2%,其中财产转让所得税增长28.2%

- 城乡社区支出3813亿元,增长33.5%

- 资源勘探信息等支出1059亿元,增长21.5%

- 住房保障支出921亿元,增长24.5%

- 今年1~2月,地方政府国有土地使用权出让收入(俗称卖地收入)4553亿元,与去年同期持平。但3月份,地方卖地收入同比增速高达16.9%

【4】一季度社会融资规模增量6.59万亿 同比多增1.93万亿

【5】3月出口由负转正 春季广交会或有较大改善

《财新》

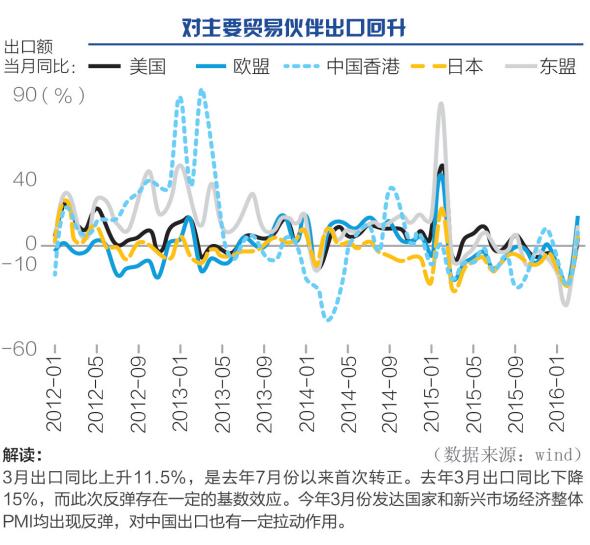

【6】一季度中国出口增速逐月回稳

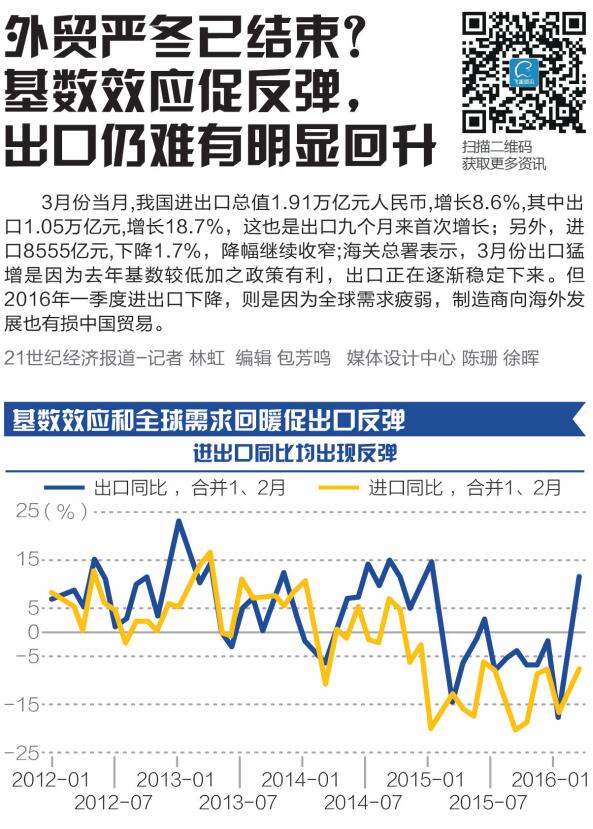

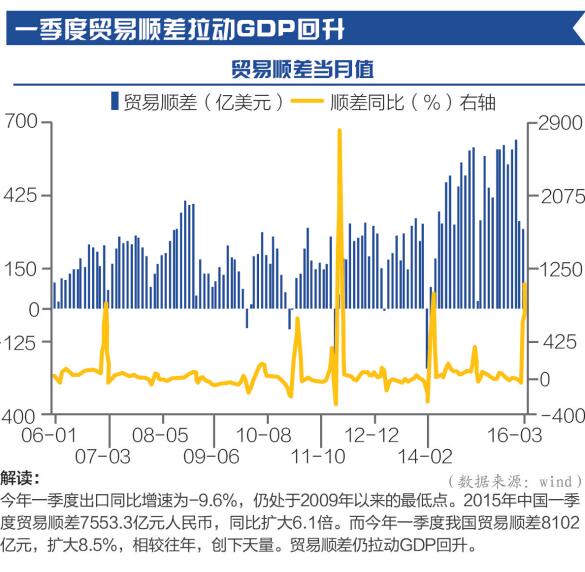

3月当月,中国进出口总值1.91万亿元人民币,增长8.6%。其中,出口1.05万亿元,增长18.7%;进口8555亿元,下降1.7%;贸易顺差1946亿元,去年同期顺差为146亿元

今年一季度,中国货物贸易进出口总值5.2万亿元人民币,比去年同期下降5.9%。其中,出口3万亿元,下降4.2%;进口2.2万亿元,下降8.2%;贸易顺差8102亿元,扩大8.5%

【7】海关总署:外贸形势依然严峻复杂

【8】一季度GDP同比增长6.7% 符合预期

一、农业生产形势平稳

二、工业生产缓中趋稳

三、固定资产投资增速稳中有升

四、市场销售稳定增长

五、进出口总额下降

六、居民消费价格温和上涨

七、居民收入增长平稳

八、结构调整步伐加快

【9】一季度固定投资增10.7% 大幅超出预期

1-3月,全国固定资产投资(不含农户)85843亿元,同比名义增长10.7%(扣除价格因素,实际增长13.8%),增速比1-2月加快0.5个百分点。

【10】3月工业增加值增速超预期升至6.8%

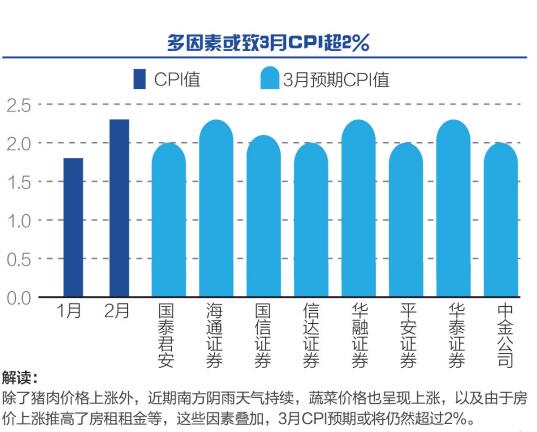

【11】3月CPI同比增速持平于2.3%

《新华社金融信息网》

【12】消费者价格指数

【13】生产者物价指数

2016年3月份我国CPI同比上涨2.3%,2016年3月份PPI同比下降4.3%

《财经》

【14】沈建光:中国经济回暖背后的喜与忧

【15】俞平康:数据大增难掩隐忧 经济还处L型拐点起始阶段

【16】汇丰:中国经济显示复苏迹象 但政府仍需继续支撑增长

【17】彭博经济学家欧乐鹰:中国一季度增速保持稳定 加码刺激必要性削弱

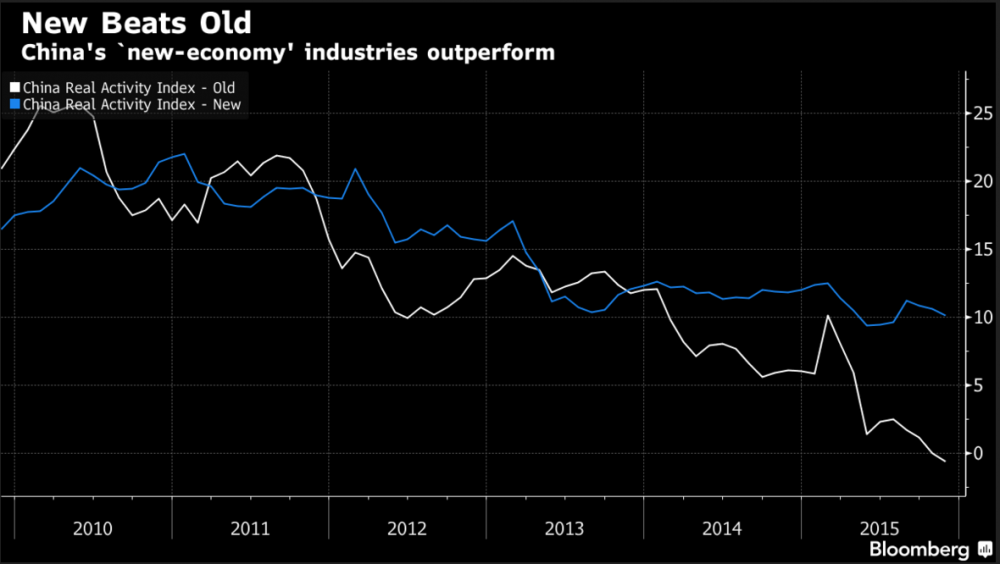

【18】盛来运:将来GDP增长不是看工业脸色行事

“中国经济不光要看速度,更要看结构,看增长的质量”;2015年消费对经济增长的贡献率超过60%,今年一季度仍然是这样的状况。“中国将来GDP的增长不是看工业的脸色行事,而是看服务业的脸色行事,这就是产业的升级”

【19】一季度全国居民人均可支配收入同比增8.7% 跑赢GDP

【20】一季度全国财政收入同比增长6.5% 财政支出增长15.4%

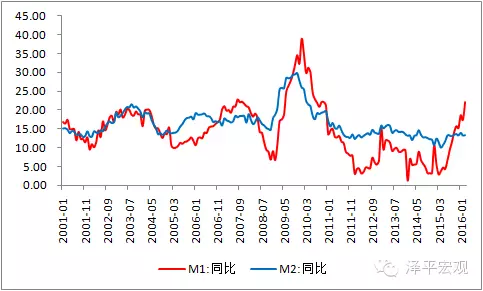

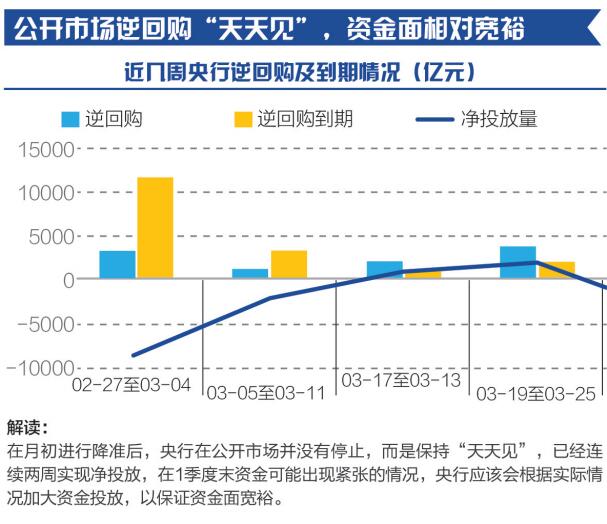

【21】盛松成:M1增速22.1%符合调控目标 反映经济企稳趋势

【22】统计局:农村外出务工劳动力1.68亿人 同比增长2.9%

【23】中国一季度进出口同比下降5.9% 3月出口转正增长0.9%

【24】2016年3月规模以上工业增加值增长6.8% 增速环比加快(图)

【25】《和讯》2016年首季中国经济数据十大解读

【26】《中金在线》海通证券:2季度GDP或回至6.8% 货币政策回归稳健

【27】《每日经济新闻》一季度新增信贷达4.6万亿 未来能否持续?

金融数据恍若3年前;天量信贷能否持续?

【28】《经济观察报》6.7%增速背后的春意

【29】《中青在线》青平:十大数据亮点,传递中国经济自信

【30】《凤凰财经》国泰君安周报(2016年04月17日):春季攻势 势如破竹

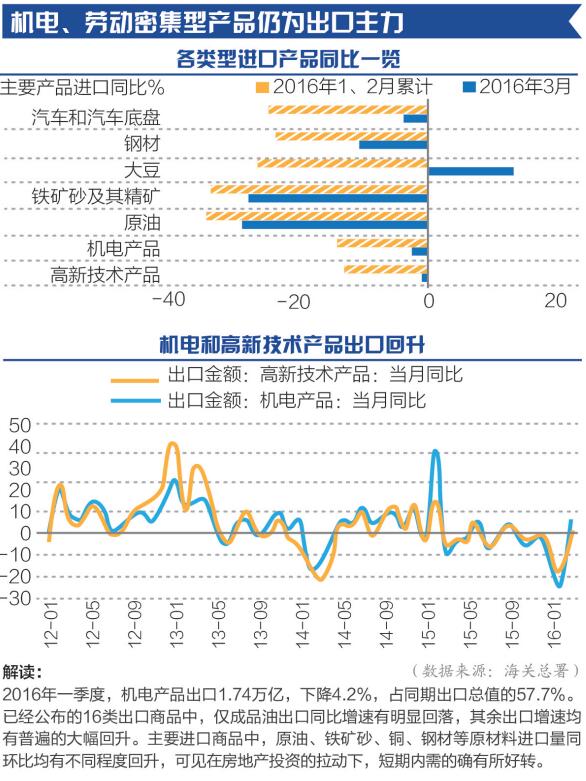

【31】《中国财经》3月外贸数据点评:一季环比走低,二季或有改善

【32】《台湾中财网》中国一季GDP低于预期 引发黑风暴 解读

《路透社》

【33】Chinese economy shows signs of debt-fueled recovery

【34】《RUSSELL专栏》中国取消钢铁出口补贴 实际影响有限但象征意义重大

【35】分析师看中国第一季GDP数据

中国一季度GDP同比增6.7%(路透调查中值为6.7%)

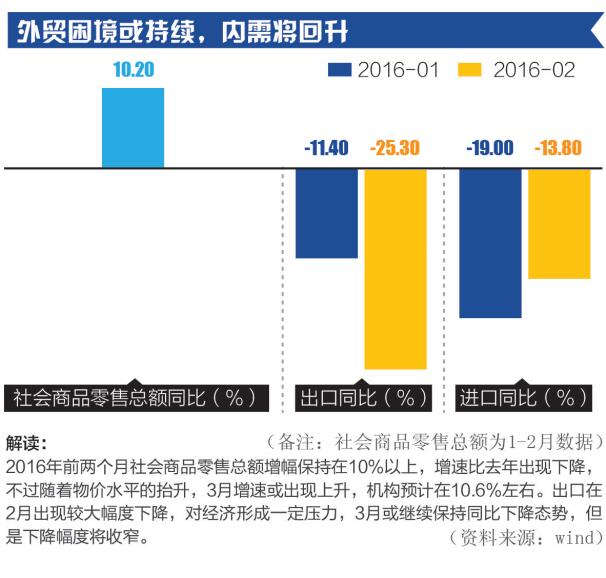

中国3月社会消费品零售总额同比增长10.5%, 路透调查中值为10.4%

华宝信托宏观分析师聂文:

3月数据全面大幅反弹,显示经济在一季度开始企稳回升,这主要由于房地产销售火热,带动投资触底回升,以及政府持续大力度的保增长,债务置换使得地方投资项目资金瓶颈缓解。

从目前来看,这种向好态势有较强持续性,约能持续半年的时间,二季度经济可能在6.8-6.9%。

房地产销售火热,已扩大至二线城市,不过鉴于高库存还难以消化,市场反弹高度有限,投资向好持续时间不会太长久,1-2个季度。工业3月大幅改善一是由于补库存,二是投资需求回升,一旦投资动能下降,工业增速也会下行。

【36】《中国2016年3月宏观数据路透调查中值一览表》--4月12日

【37】《中国2016年3月宏观数据路透调查中值一览表》--4月15日

【38】《英国广播公司》China's transition: What transition?

“China's economic figures show an economy that's still addicted to stimulus for growth"

【39】《南华早报》Back to 1997? Why Chinese yuan and Hong Kong property prices may go down by a fifth next year

里昂證券●中信里昂證券有限公司(CLSA Group):“人民币明年将于美元脱钩”,不过信这的人没几个。

《华尔街日报》的一些评论

【40】5 Things to Know About China’s First Quarter GDP Growth

【41】Economists React: China Q1 Growth Slows, But March Data Offer Hope

摩根大通中国首席经济学家和大中华区经济研究主管朱海斌

When the government talks about stability, infrastructure investment and real estate investment are quite important. In the first and second quarters, growth momentum will continue. But we don’t expect the improvement to last for the remainder of the year. Expanded fiscal and monetary policy will probably come to a half toward the middle of this year. The government will be comfortable they can achieve this year’s growth target. Deleveraging has obviously become secondary. The government still talks about deleveraging, but it’s now on paper rather than actually being implemented. Debt will continue to pile up. We echo concerns from the International Monetary Fund over China’s corporate debt issue. The latest credit growth adds to the risk. China needs to do some more serious work cleaning up balance sheets, not only through mergers and acquisitions but also through bankruptcies. That helps banks write off bad loans and supports growth in new sectors

【42】More Property, Less Pork: What’s Behind China’s Robust Economic Figures

Pork: Prices for pork, China’s staple meat, are surging, but the increase isn’t showing up in consumer-price inflation. March’s consumer price index came in unchanged from February’s level

《华尔街见闻》

【43】中国一季度GDP增速6.7%!统计局:经济短期可能呈现U型、W型

央行副行长易纲隔夜在华盛顿参加IMF春季会议间隙表示,他对今年中国经济增长6.5%-7%很有信心。从第一季度数据、用电量等指标来看,中国经济“相当强劲”。

3月制造业PMI为50.2,自2015年8月以来首次回到荣枯线以上;3月PPI环比上涨0.5%,是2014年1月以来首次转正;

2、3月CPI同比均上涨2.3%,其中3月通胀水平低于预期,滞胀短期证伪;

前2个月规模以上工业企业利润总额增长4.8%,为去年6月以来首次月度正增长;

3月出口暴增逾10%,进口降幅大幅缩窄。

1-3月城镇固定资产投资同比10.7%,预期10.4%,1-2月10.2%。

3月社会消费品零售总额同比10.5%,预期10.4%。1-3月社会消费品零售总额同比10.3%,预期10.2%,1-2月10.2%。

3月规模以上工业增加值同比6.8%,预期5.9%。 1-3月规模以上工业增加值同比5.8%,预期5.5%,1-2月5.4%。

【44】外贸数据出来后 分析师都“疯”了

【45】惊天大逆转:中国3月出口猛增逾10% 进口降幅大幅缩窄

(人民币结算)

(美元结算)

大多认为人民币贬值是主要因素,发达国家经济稍微回转是个帮助。

【46】5个月以来首次回升!中国3月外储意外增加103亿美元

【47】人民币企稳了 是否就可以高枕无忧?

【48】终结一年负增长!1-2月工业企业利润同比增4.8%

【49】海通李迅雷:加杠杆、补库存 换来开门红——首季经济数据解析

融资放巨量,投资加杠杆;民间投资跳水,政府投资挺进;去库存、补库存,都是做加法;脱实向虚格局未变,壮士已难断腕;宽松货币政策或会遇到挑战

【50】数据图表

(以上诸图见)

《彭博》

【51】China's Economy Stabilized in First Quarter

【52】China Averts a Hard Landing With a Credit-Powered Trampoline

Sugar Buzz●Currencies Rise●Consumers Spend●Debt Mountain

【53】What’s Behind China’s Stabilizing Economy?

【54】China’s Property Sector Helps Spur Economy

【55】China's GDP Data Shows a Very Predictable Pattern

【56】China's Worst Stocks Are Winning(垃圾股咸鱼翻生)

【57】Are Fears of a Hard Landing in China Justified?

【58】How Important Is China's GDP to the U.S.?

【59】PBOC's Yi (央行副行长易纲)Says Indicators Show `Robust' Economy Before GDP Data

【60】China's New Credit Growth Far Exceeds Expectations: Chart

【61】China March Home Sales Surge in Property Investment Rebound

【62】Why China’s Economy Will Be So Hard to Fix

【63】彭博北亚经济学家欧乐鹰(Tom Orlik)在中国关系多,且彭博数据齐全,常有很多有用的信息。

《21世纪经济报道》

【64】外贸严冬已结束?基数效应促反弹,出口仍难有明显回升

【65】GDP达6.7%!一季度数据全线回暖

“当前经济运行正在发生微妙变化。”交通银行首席经济学家连平表示,房地产投资超预期回升有利于推动投资企稳反弹,新开工和施工项目计划总投资大幅反弹,预示 未来基建投资增长上行,信贷增幅加大表明实体经济需求明显回升,工业企业利润恢复正增长,通缩状况正在改善,经济正在企稳向好。

管清友认为,二季度经济是传统的旺季,今年一季度的钱和去年以来的项目有望在二季度发酵。虽然中国经济的结构性问题还没有解决,但二季度经济可能会出现反弹,至少经济信心会进一步好转。虽然一季度经济运行初显企稳,但是中国经济下行压力依然较大,一些领域的风险不容忽视,稳增长、促改革、调结构还需加码发力。

【66】一季度GDP涨6.7% 3月拉升显著企稳还未巩固

【67】工业企业利润结束下滑,经济企稳信号待加强

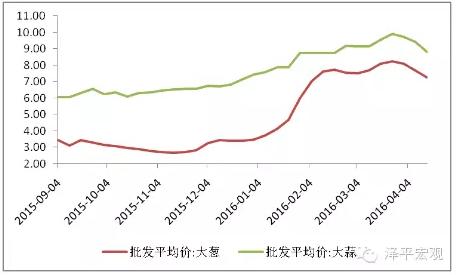

【68】猪价持续上涨,CPI或超2%

【69】3月M2增13.4%显示流动性宽裕 产能过剩行业贷款首次下降

“今年一季度末,产能过剩行业中长期贷款余额同比下降0.2%,首次出现负增长”,就这么一点点儿?

《金融时报》2016.04.24

China debt load reaches record high as risk to economy mounts

Gabriel Wildau in Shanghai and Don Weinland in Hong Kong

US-style credit crunch or Japan-style grinding malaise seen as increasingly likely

The Guangdong Tower seen in Guangdong Guangzhou, Guangdong Province, China, 18 April 2016. The Canton Fair, officially called the China Import and Export Fair, is the largest trade fair in China.

China’s total debt rose to a record 237 per cent of gross domestic product in the first quarter, far above emerging-market counterparts, raising the risk of a financial crisis or a prolonged slowdown in growth, economists warn.

Beijing has turned to massive lending to boost economic growth, bringing total net debt to Rmb163tn ($25tn) at the end of March, including both domestic and foreign borrowing, according to Financial Times calculations.

Such levels of debt are much higher as a proportion of national income than in other developing economies, although they are comparable to levels in the US and the eurozone.

While the absolute size of China’s debt load is a concern, more worrying is the speed at which it has accumulated — Chinese debt was only 148 per cent of GDP at the end of 2007.

“Every major country with a rapid increase in debt has experienced either a financial crisis or a prolonged slowdown in GDP growth,” Ha Jiming, Goldman Sachs chief investment strategist, wrote in a report this year.

The country’s present level of debt, and its increasing links to global financial markets, partly informed the International Monetary Fund’s recent warning that China poses a growing risk to advanced economies.

Economists say it is difficult for any economy to deploy productively such a large amount of capital within a short period, given the limited number of profitable projects available at any given time. With returns spiralling downwards, more loans are at risk of turning sour.

According to data from the Bank for International Settlements for the third quarter last year, emerging markets as a group have much lower levels of debt, at 175 per cent of GDP.

China debt web cards

The BIS data, which is based on similar methodology to the FT, put Chinese debt at 249 per cent of GDP, which was broadly comparable with the eurozone’s figure of 270 per cent and the US level of 248 per cent.

Beijing is juggling spending to support short-term growth and deleveraging to ward off long-term financial risk. Recently, however, as fears of a hard landing have intensified, it has shifted decisively towards stimulus.

New borrowing increased by Rmb6.2tn in the first three months of 2016, the biggest three-month surge on record and more than 50 per cent ahead of last year’s pace, according to central bank data and FT calculations.

Economists widely agree that the health of the country’s economy is at risk. Where opinion is divided is on how this will play out.

At one end of the spectrum is acute financial crisis — a “Lehman moment” reminiscent of the US in 2008, when banks failed and paralysed credit markets. Other economists predict a chronic, Japan-style malaise in which growth slows for years or even decades.

China debt web cards

Jonathan Anderson, principal at Emerging Advisors Group, belongs to the first camp. He warns that banks driving the huge credit expansion since 2008 rely increasingly on volatile short-term funding through sales of high-yielding wealth management products, rather than stable deposits. As Lehman and Bear Stearns proved in 2008, this kind of funding can quickly evaporate when defaults rise and nerves fray.

“At the current rate of expansion, it is only a matter of time before some banks find themselves unable to fund all their assets safely,” Mr Anderson wrote last month. “And at that point, a financial crisis is likely.”

Others believe the People’s Bank of China will retain its ability to ward off crisis. By flooding the banking system with cash, the PBoC can ensure that banks remain liquid, even if non-performing loans rise sharply. The greater risk from excess debt, they argue, is the Japan scenario: a “lost decade” of slow growth and deflation.

Michael Pettis, professor at Peking University’s Guanghua School of Management, says rising debt inflicts “financial distress costs” on borrowers, which lead to reduced growth long before actual default.

“It is wrong to assume that ‘too much debt’ is bad only if it causes a crisis, and this is a typical assumption made by almost every economist," Prof Pettis wrote in a draft of an forthcoming paper shared with the Financial Times.

“The most obvious example is Japan after 1990. It had too much debt, all of which was domestic, and as a consequence its growth collapsed.”

Distress costs include increased labour churn as employees migrate to financially stronger companies; higher financing costs to compensate for increased default risk; demands for immediate payment from jittery suppliers; and loss of customers who worry a company may not survive to provide aftersales service.

Many are now concerned that China’s debt could lead to a so-called balance-sheet recession — a term coined by Richard Koo of Nomura to describe Japan’s stagnation in the 1990s and 2000s. When corporate debt reaches very high levels, he observed, conventional monetary policy loses its effectiveness because companies focus on paying down debt and refuse to borrow even at rock-bottom interest rates.

“A financial crisis is by no means preordained but in our view, if losses don’t manifest on financial institution balance sheets, they will do so via slowing growth and deflation, à la Japan, a path China arguably already is on,” Charlene Chu, senior partner at Autonomous Research Asia, wrote recently.

Methodology: debt load obscured by complexity

Despite increasing attention to the risk from China’s rising debt, there is surprisingly little consensus over basic facts such as how much China actually owes. The increasing complexity of China’s financial system adds to difficulties in producing an authoritative estimate.

The Financial Times’ estimate of Rmb163tn ($25tn), or 237 per cent of gross domestic product, at the end of March uses data from China’s central bank on so-called “total social financing” (TSF), which covers lending to the non-financial sector by both banks and non-banks. It then adds finance ministry and National Audit Office data on, respectively, central and local government debt. Finally, data from Wind Information, a Chinese financial database, is used for government bonds issued in early 2016 but not yet reflected in NAO and finance ministry figures.

The FT’s methodology is similar to that of the Bank for International Settlements, which in September released a database that tracks total debt in 42 big economies. In addition to drawing on more recent TSF and NAO data, the FT seeks to eliminate possible double-counting in the BIS figures. Double-counting may arise from local governments’ use of special-purpose vehicles to borrow. Such borrowing is counted as corporate debt in TSF data but as government debt by the NAO.

Some analysts estimate that China’s debt load is significantly higher than both the FT and BIS estimates. A widely cited report by McKinsey last year placed China’s debt at 282 per cent of GDP by mid-2014, an estimate that includes debt owed by financial institutions.

Many analysts believe the McKinsey estimate suffers from significant double counting, since the money that banks and other financial institutions borrow is lent on to non-financial borrowers. But some analysts also believe that for China, including at least some financial debt is necessary to capture shadow-bank lending that is not included by TSF.

Rodney Jones, principal of Beijing-based Wigram Capital Advisors, provides Asia macro analysis to billionaire investor George Soros, who last week likened China’s economy to the subprime-saddled US before 2008. Mr Jones says Chinese banks use investments in wealth management products to disguise corporate loans as financial debt. Based on a detailed analysis of financial statements by more than 100 banks, he estimates China’s debt-to-GDP ratio at 280 per cent at the end of 2015.

“The financial engineers have run amok again. They’ve run amok in the US and they’ve run amok here. That’s what George sees," says Mr Jones.