笨狼发牢骚

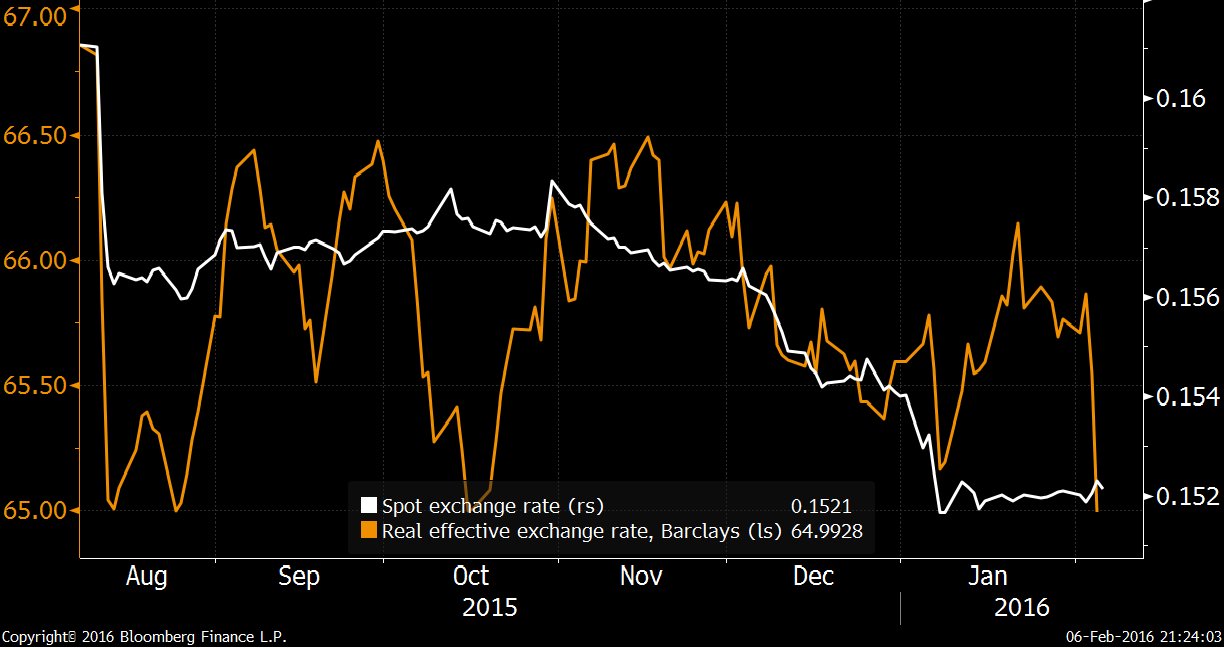

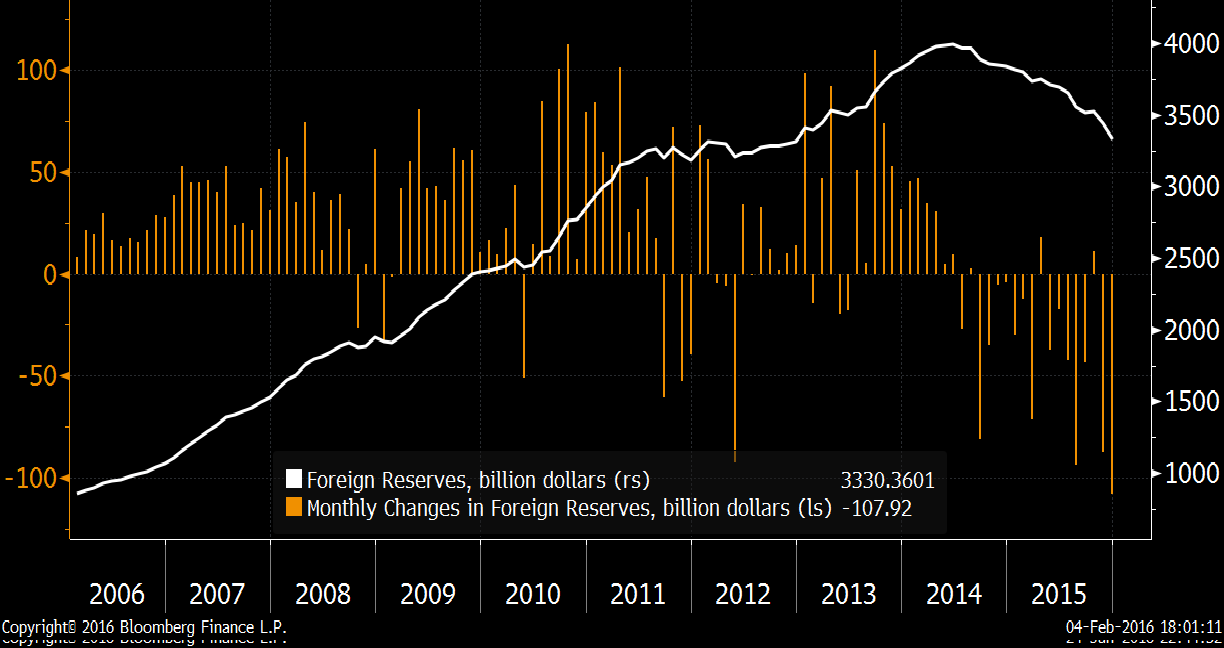

发发牢骚,解解闷,消消愁央行周末发布例行数据,中国一月外汇储备再994亿美元,总量降到3209亿美元【6】,参见【2】,【5】。

央行数据

增减数量

大家都担心的是国内民众会一拥而上兑现美元,那国务院可能被迫紧急管制,目前还没有迹象。彭博中国经济学家Tom Orlik的说法是中国政府基本瞄准美元,不会大幅贬值,故此没必要:

我以前说过中国政府维持对美元的稳定的好处远大于贬值,也是这个看法。不过中国除了出口的压力,还在让汇率市场化,有一些具体的开放政策【1】,【2】,结果人民币汇率允许的幅度自然有较大的空间,故此有更大的动荡,让人感到不安。

李稻葵(清华大学中国与世界经济研究中心主任)【7】近日在北京表示,2015年中国的外汇储备下降超过了5000亿美元,如果按照这个态势下去的话,将加剧人民币贬值的预期,故今年须严守3万亿美元大关。我不知道这是学者建议还是政府借他放风,中国政府也曾经给股市设过下限,这类人为的目标往往让自己丢脸的不切实际的空头口号,我实在不知道三万亿这一数字有任何意义。倒是国家外汇管理局综合司(政策法规司)司长王允贵说没限制资本流出,显得心里有数。

《一财网》

【1】2016.01.12 马骏:人民币参考一篮子汇率体制 ,对美元汇率不再单方向变化

【彭博】

【2】2016.02.06 PBOC to Explore Rate Corridor in Step Toward Liberalization

【3】2016.02.06 China's Foreign-Exchange Reserves Decline to $3.23 Trillion

【4】2016.02.07 Holding Back China's Capital Flight ‘Dam’ Is Key

【路透社】

【5】2016.02.06 China FX reserves fall almost $100 bln to lowest since May 2012

【华尔街见闻】

【6】2016.02.07 中国1月外汇储备下降994亿美元 意外好于预期

《观察者网》

【7】2016.02.07 1月份外储下降994亿美元 李稻葵称应严守3万亿美元大关

《澎湃》

【8】2016.02.07 国家外汇局谈外储下降:未限制资本流出,QDII额度已用完

《华尔街日报》

【9】2016.02.07 China’s Forex Reserves Plunge to More-Than-Three-Year Low(见下)

参见:

《华尔街日报》

China’s Forex Reserves Plunge to More-Than-Three-Year Low

The world’s largest stockpile of foreign currency fell by $99.5 billion last month

By LINGLING WEI

Feb. 7, 2016

China’s foreign-exchange reserves fell to the lowest level in more than three years in January, raising questions about how long Beijing can keep burning through the rainy-day funds to defend the yuan without triggering a huge flight of capital.

The People’s Bank of China said Sunday that the world’s largest stockpile of foreign currency plunged by $99.5 billion last month, to $3.23 trillion. The drop follows a record $107.9 billion plunge in December and continues a decline that picked up speed in August, as China’s exchange-rate policies started to appear to be in flux.

In mid-August, the central bank unexpectedly devalued the yuan, saying it wanted to bring its value more in line with market forces. But the action backfired, as investors sold the currency in panic fashion, forcing the Chinese central bank to dig into the reserves to stabilize it.

Last month, the central bank again had to draw on the reserves in the wake of a botched effort to guide the yuan weaker, a move that sparked fears of a deeper-than-expected slowdown in China’s economy, setting off a sharp selloff in global markets for stocks and commodities.

Many investors and analysts are questioning the central bank’s ability to continue such interventions. Already, the central bank is finding itself in a vicious cycle: As it repeatedly draws on the reserves to prop up the yuan, doubts grow about its ability to keep the currency stable, which then causes more money to leave the country, eroding the reserves further.

“It likely will be a long battle,” said an official at China’s central bank. The official cited the difficulties of stabilizing the currency and managing investors’ expectations as the economy slows. “But China still has sufficient reserves to withstand any external shocks,” the official said.

The news will only add to traders’ anxiety heading into Monday. While some analysts were expecting an even larger outflow, the decline in the central bank’s stockpiles is likely to contribute to concerns that China could be forced by deteriorating domestic economic conditions to again devalue the yuan.

Chinese leaders have ruled out for now the possibility of a one-off sharp devaluation of the yuan as urged by some economists and investors, saying that would undermine Chinese purchasing power just as the government is trying to shift to an economy driven by consumption.

But many investors view a possible decline in the yuan as the greatest risk facing financial markets, contending that it could spur rounds of competitive devaluations across the emerging world as China’s trade partners mimic its actions in a bid to defend precious export growth at a time when nearly all nations around the globe are struggling with inadequate domestic demand for goods and services.

The drop in China’s foreign reserves was smaller than expected, which probably would make people less nervous about China for now, said Gerardo Rodriguez, a portfolio manager of emerging markets at BlackRock. Still, “people need to find out more details to have a better understanding of the factors that could be explained for the [smaller-than-expected] decline,” he said.

Markets in recent months have been rattled by a broad retreat from riskier investments, and a corresponding flight into safe government debt, amid investor fears that China’s problems, slowing global growth and turmoil in emerging markets could spill over into what has been the strongest-performing large economy in recent years, the U.S.

While broad stock indexes have largely stabilized since a rout of the first two weeks of 2016 that was fueled by a free fall in the price of crude oil, prices of stocks, bonds, currencies and commodities have remained volatile. A sharp selloff in technology stocks on Friday, along with a softer-than-expected U.S. employment report, underscored the lingering fears that the U.S. could be headed for a recession that would likely spur further selling of shares and lower-rated bonds around the globe.

“We’re in an environment where there’s so much fear and uncertainty from a lot of perspectives,” said Lew Piantedosi, head of growth investing at Eaton Vance.

The notion that China has lost a measure of control over its currency is new to a country long criticized for its iron grip to ensure the yuan didn’t appreciate in a way detrimental to its exporters. Similarly, the recent plunge in China’s reserves is a contrast to years of buildup in the pile of cash as China’s economy and export sector boomed.

One question now is how much foreign currency China actually needs to have in reserve. When the reserves peaked in mid-2014 at nearly $4 trillion, Chinese officials were concerned that the stockpile had become too big to manage efficiently. Much of the reserves are in low-yielding U.S. government bonds.

The current $3.23 trillion still gives Beijing a large war chest to meet its obligations to foreign creditors. About half of China’s external debt outstanding, which stands at $1.53 trillion, is yuan-denominated debt raised overseas, data from the central bank show.

But the reserves appear to be less than abundant if gauged by another measure, the ratio of the currency reserves to M2, or the broad money supply This includes assets such as savings deposits and money-market funds as well as cash. The International Monetary Fund, the World Bank and others use the ratio to gauge the sufficiency of countries’ exchange reserves. The higher the ratio, the lower the likelihood of huge flight into other currencies.

Based on that measure, China should maintain between $2.13 trillion and $4.26 trillion worth of currency reserves to fend off any destructive capital outflow, estimates Zhang Ming, a senior economist at the Chinese Academy of Social Sciences, a government think tank.

“Whether China can keep adequate foreign-exchange reserves will depend on what the central bank is up to,” Mr. Zhang said. If the central bank intends to continue to intervene heavily to keep the yuan stable, he said, “the current level of reserves may not be adequate enough.”

On the other hand, he said, if the central bank presses ahead on giving the market bigger sway in the exchange rate by reducing intervention and at the same time tightens capital controls, “the reserves will undoubtedly be enough.”

The People’s Bank of China has been doing both, prioritizing the yuan’s stability over market reforms. In recent weeks, while intervening to prop up the currency, the bank has imposed fresh controls aimed at preventing money from leaving the country. That strategy has confused investors both inside and outside China, resulting in both businesses and individuals rushing for the exit.

Western officials including U.S. Treasury Secretary Jacob Lew and the International Monetary Fund’s Christine Lagarde recently have urged Beijing to better communicate its policy intentions with the market.

Senior Chinese officials said in recent weeks that they recognize the need for clearer communication to avoid roiling global markets. That said, they ruled out for now the possibility of a one-off sharp devaluation of the yuan as urged by some economists and investors, saying that would undermine Chinese purchasing power just as the government is trying to shift to an economy driven by consumption.

“A sharp weakening of the yuan is not in China’s interest,” said an official close to the leadership. Executives at China’s top four state-owned banks, which are among the market makers in China’s currency trading, say the central bank appears to be holding the line at 6.6 yuan per dollar in the near term.

The plunge in China’s currency reserves also reflects a smaller flow of foreign investment into China and greater demand for foreign currencies by Chinese companies and individuals.

Du Hanbin, an exporter in the southern Chinese boomtown of Shenzhen, said that since late last year, his company, a toy and furniture maker that mainly sells to the North American market, has been hoarding its dollar revenues rather than converting them immediately into yuan, also known as the renminbi. “The dollar is strong and the renminbi is depreciating,” Mr. Du said. “I want to minimize my losses by holding on to the dollar.”

The scale of China’s capital outflows is larger than the net decline in its reserves, as the latter reflects foreign currency coming into the country as part of foreign investment. An analysis by GavekalDragonomics, a research firm specializing in China’s economy, estimates that the country’s outflows topped $700 billion last year, while central-bank data show currency reserves dropped a total of $512 billion in 2015.