笨狼发牢骚

发发牢骚,解解闷,消消愁房产税能救中国吗?

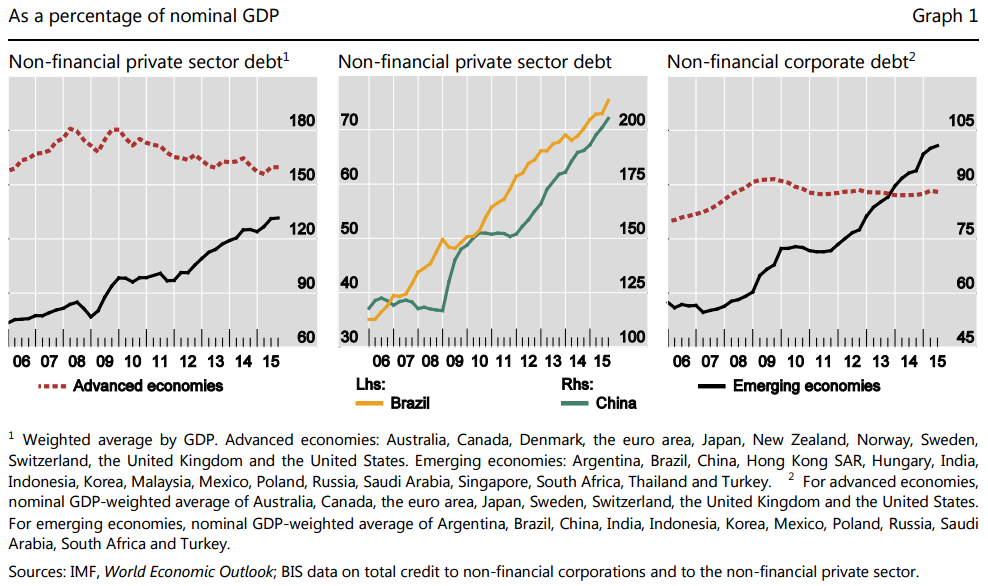

中国房产税改革,说了好多年了,还是定不下来,阻力太大,利益阶层占据中国中上层,几乎是所有城市居民,而且一线城市的房产在世界上也是天价,影响很大,说不定导致动荡。然而不改,中国房地产绑架经济的现实无法得到修正。说救中国,是一旦实施,产生的税收将可转移到低下层民众的手里,提高他们的生活水平。这是一种财富分配,对贫富分化有微弱的缓解作用,但同时是对经济的强有力的支持,因为生活压迫大的阶层往往会将大部分投回到经济里去,从而等于资金回笼,会给企业带来产生利润的机会,进而减缓企业在债务上压力。

2015.12.09 房产税改革更多细节出炉:收入将全划归地方

2015.04.07 房产税能取代土地财政?

以当前中国城镇住宅总量185亿平方米、2.5亿套来计算(2010年曾测算当时全国累计存量住房179亿平方米、2.2亿套),要征收每年超过4万亿元、两年过8万亿的房产税来替代土地出让金,每套房子都需要承担大约3.3万元的房产税(一年每套房子要缴约1.7万元的房产税)。2014年我们城镇居民人均可支配收入的中位数只有2.66万元,那么,这意味着居民需要把家庭年收入中的相当大一部分交房产税才可以替代土地财政。而且,随着房价地价走高,房产税也水涨船高,屋主还需要每年缴纳更多房产税,这会带来什么影响财税专家似乎没有说。这样的房产税可能实行吗?有合理性吗?答案应该是否定的【然而,不一定要全盘取代】

2015.12.14 社科院专家:开征房产税迎契机 预计可收入1.6万亿

负利率政策,既是推动内销不得已的下策,外人看来也是货币战争的手段。

Race To Bottom Enters Final Lap: ECB Will Cut To -0.7% In June, JPM Predicts

ECB cuts rates to -0.3%, the BOJ cuts to -0.1%

JPM's Striking Forecast: ECB Could Cut Rates To -4.5%; BOJ To -3.45%; Fed To -1.3%

2016.02.06 Is The Fed "Seriously Considering" Negative Interest Rates?

The Fed may "seriously consider" negative rates after moving rates back to zero, reintroducing forward guidance and making "stronger pleas" to Congress for fiscal policy action as there are complications for money markets, according to BofAML strategist Mark Cabana

How Low Can Central Banks Go? JPMorgan Reckons Way, Way Lower

日经亚洲评论:Negative interest rate's scope seen capped at 30tn yen

《彭博》:

Fed May Lack Legal Authority for Negative Rates: 2010 Memo(联储论文:Reducing the IOER Rate: An Analysis of Options )

2016.02.02 The Fed Wants to Test How Banks Would Handle Negative Rates

New York Fed President William Dudley said last month that policy makers were "not thinking at all seriously of moving to negative interest rates.

"But I suppose if the economy were to unexpectedly weaken dramatically, and we decided that we needed to use a full array of monetary policy tools to provide stimulus, it’s something that we would contemplate as a potential action," he said on Jan. 15.

2016.02.07 The Probability of Negative U.S. Rates Is on the Rise

2016.02.09 World's Negative-Yielding Bond Pile Tops $7 Trillion: Chart

2016.02.11 Yellen Says Legality of Negative Fed Rates in Question

《Econbrowser》

2016.02.07 Negative interest rates

Negative Rates: A Gigantic Fiscal Policy Failure

Kocherlakota

华尔街日报博文:A Surging Yen is Washing Away the Bank of Japan

2016.02.10 Goldman's Take: "Additional Hikes Remain FOMC Baseline"

高盛预测油价可能跌破$20

油价自一月十九日下跌近乎十几年来最低的$26之后,炒家们下赌触底,一拥而上,几番将油价推回$35左右,一直觉得投机性极强。

在这期间,石油开发组织曾希望达成减产协议,说是俄国和沙特都有次意愿。我有点怀疑,原因很简单,目前在中东、叙利亚动乱中俄沙对立的很厉害【1】,以至有兵戎相见的意思【2】。不过此类消息足以给炒家和不少股民入市的当了借口。

今天油价又重新跌破$27,在最低范围内徘徊。能源专栏网站OilPrice.com对此做了分析:

反弹是假的(The January 2016 Oil Price Head-Fake)

【1】沙特为了平衡与美国日益衰弱的关系,也试图跟俄国搞好关系,不久前沙特在俄国大举投资就是例子。

【2】2016.02.10 外媒称沙特制定出兵叙利亚计划

【3】2016.02.10 OPEC Will Not Blink First

【4】2016.02.11 大英石油工资(BP)称数月后所有原油储罐都将存满

【5】2016.02.09 高盛继续看空油价:跌破20美元也不足为奇

全国各省市总产值排名

凤凰财经

2016.02.17 21世纪宏观研究院汇总各地经济数据

2015

2014

全国各省市财政收入排名

凤凰财经

全国财政总收入

《凤凰财经/财政部》2015年全国财政收入152217亿元 增长8.4%

详细报道:2015年全国财政收入超15万亿元 收支差首次突破2万亿【收入:152217;支出:175768。总产值约为67.67万亿,赤字2.36万亿,约3.5%。经济增长率6.9%,人均可支配收入增加7.4%】,2015年全国财政收入15万亿增速创1988年来新低,《路透社》China fiscal deficit widens in 2015, revenue growth weakest since 1988

全国各省市融资排名

凤凰财经

2015年国企利润总额同比下降6.7% 营收下降5.4%

2015规模以上工业利润降2.3%

国资委:央企利润下滑得到遏制 37家利润过百亿

银行业愁贷:国有大行三季报净利增速降至零时代

2016.02.04 外汇管理局:2015年我国国际收支出由“双顺差”转为“一顺一逆”

2015.11.09 【智库】中国成为世界第二大对外投资国 2022年或超美国

2016.01.20 2015年中国实际使用外资7813.5亿 同比增长6.4%

若干基础材料:

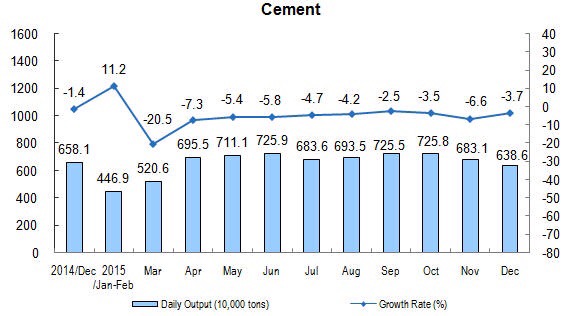

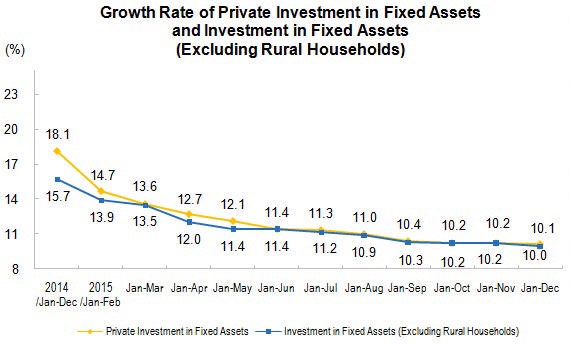

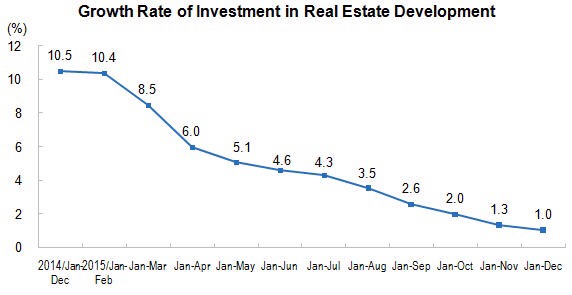

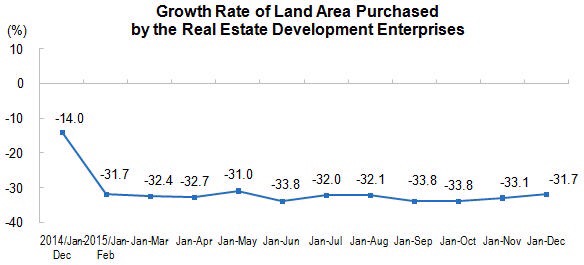

以上诸图见。

Kyle Bass:China’s $34 Trillion Experiment Is Exploding

商务部:2015年出口总值下降2.8% 进口下降14.1%

六年来首次外贸负增长,你需要了解的几个事实

《华尔街见闻》2016年中国经济恐会面临这五大挑战

美联储加息会为中国带来资本外流和货币贬值两大难题

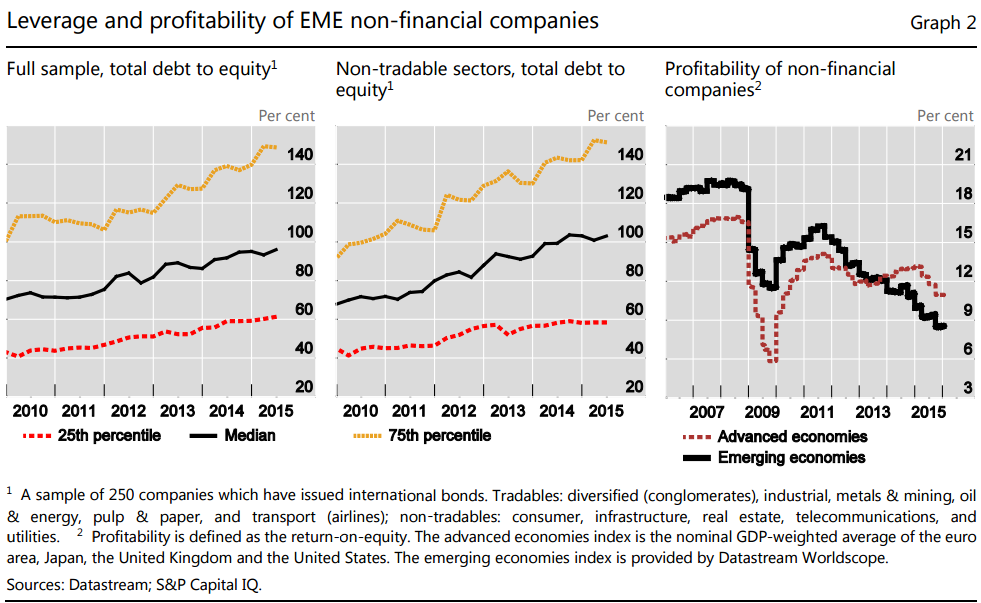

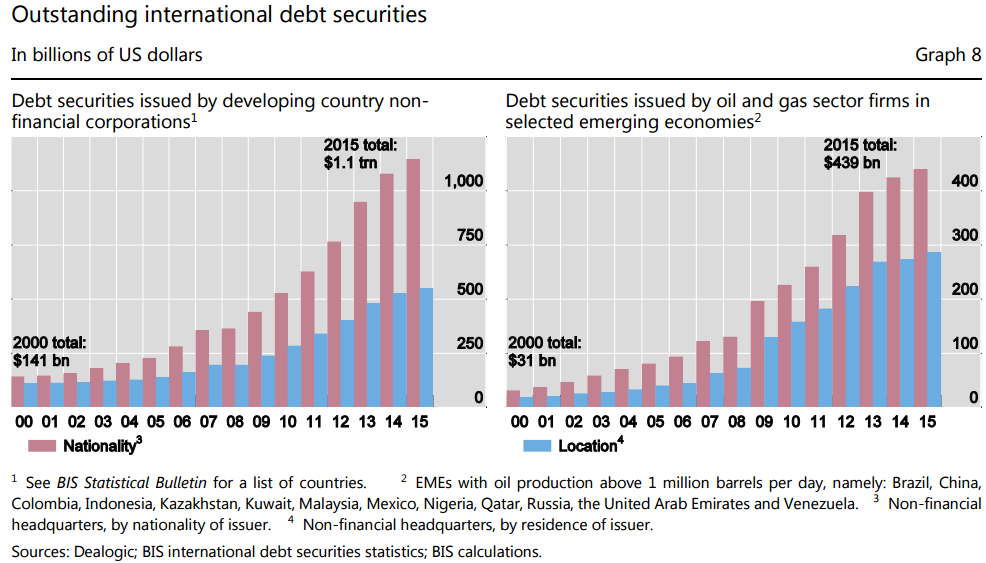

汇率变化会削弱中国企业美元债务的偿付能力

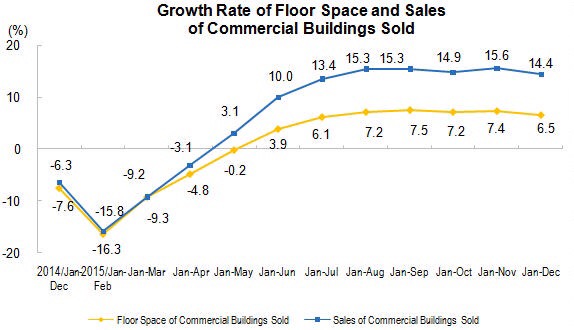

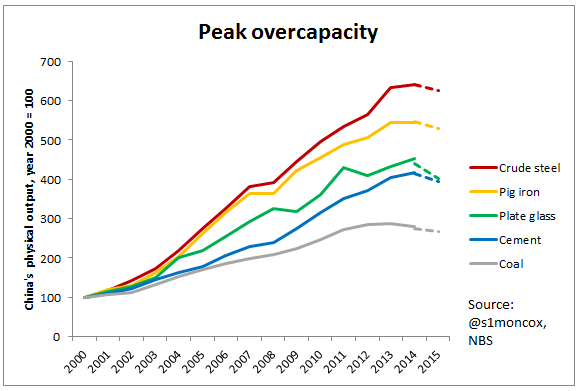

房地产去库存如果拉锯时间过长会拖累工业和投资

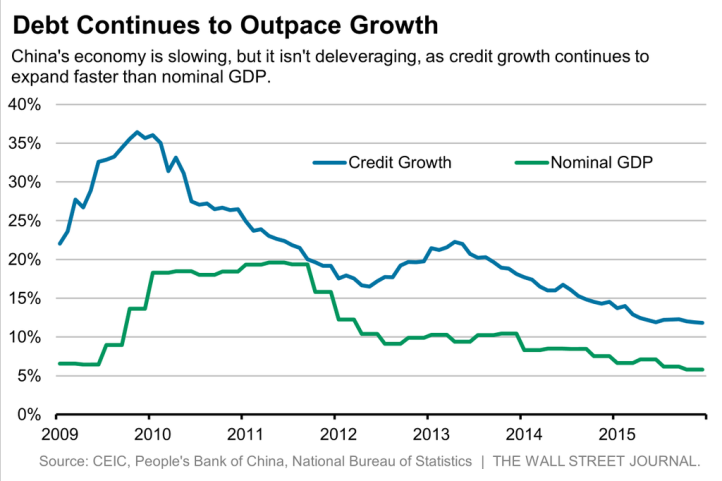

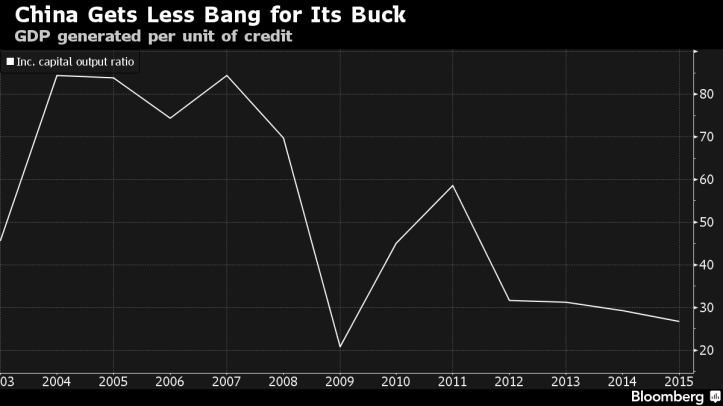

企业利润下降,债务违约事件频发,恐会令银行不良贷款进一步承压

多家分析机构下调了中国2016年的GDP增速

《草根网张平据此的分析》2016年中国经济将面对哪些棘手风险?

①美联储加息会为中国带来资本外流和货币贬值两大难题

②汇率变化会削弱中国企业美元债务的偿付能力

③房地产去库存如果拉锯时间过长会拖累工业和投资

④企业利润下降,债务违约事件频发,恐会令银行不良贷款进一步承压

⑤多家评估机构下调了中国2016年的GDP增速

《人民日报》

迈出大国经济铿锵步履(治国理政新实践)

十八大以来党中央领导经济工作述评

“...中国以壮士断腕的勇气...”

《财政部》

如何正确看待当前财政收支形势

减税

《路透社》2016.02.02

中国1月银行信贷可能突破2万亿 需强化信贷政策引导

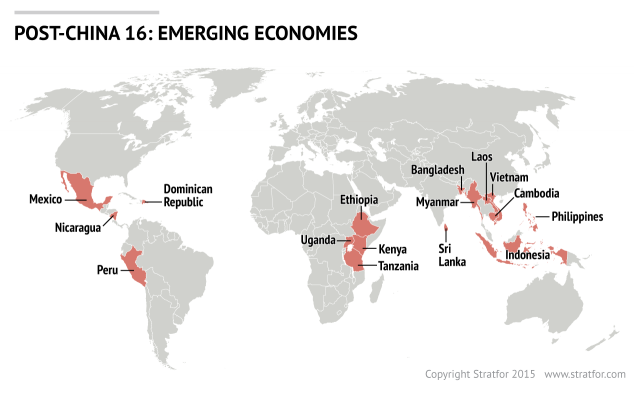

Straford Decade Forecast: 2015-2025

盛名之下难副其实,被政府“惯坏”的国产芯片行业如何扭转颓势?

【龙芯过度依赖政府救助、保护?】

Chinese farmers are illegally growing GMO corn: Greenpeace

东北严打转基因 “有些农民种了几年”

伊朗汽车工业和进口

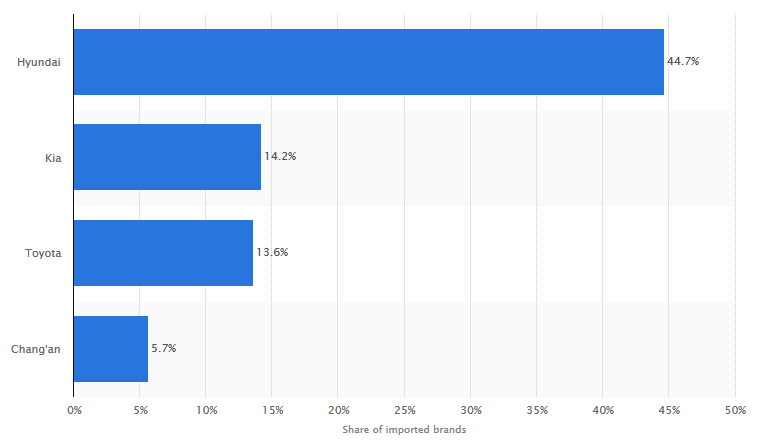

伊朗2015财政年度(大约2014。03-2015.02)总进口12万2千辆车【

Iran car imports up by 31%】

伊朗2016财政年度(大约2014。03-2015.02)汽车进口同比锐减,降68%【

Car imports into Iran down by 68%,此乃在核制裁解禁之前】

伊朗2016年度前六个月进口来源

《耶路撒冷邮报专栏转载》Iran and China: Business as usual

“Chinese car manufactures in Iran are well established”

“Some Iranian news outlets have run pieces predicting the “Golden age of Chinese cars [is] over in Iran”

《伊朗投资指南》Iran automotive industry is the second biggest sector in country

《中新社》皖产汽车出口量中国第一 伊朗成最大买家

奇瑞

“出口伊朗5.2万辆,伊朗成为安徽产汽车最大买家”

中国汽车品牌要像高铁一样“走出去”

伊朗从2014年起就成为我国最大的汽车出口市场,去年我国汽车出口72.3万辆,每7辆车中就有一辆车销往伊朗。在伊朗汽车市场中活跃着诸多中国汽车品牌,其中市场份额最高的当属奇瑞汽车。据了解,在习主席出访期间,由我国奇瑞集团扩建的伊朗汽车工业园项目就将正式确立

截止2015年底,奇瑞在伊朗汽车保有量已达到18万辆,占中国乘用车向伊朗出口的一半以上

2016.01.25访谈:我对伊朗各行业市场的解析-在伊贸易近20年的瞿总

经过几十年的制裁,伊朗几乎就是处于封闭的状态。但因为中伊关系的友好,给中国企业开发伊朗市场还是带来了不少机遇。在伊朗除了藏红花、开心果、香料等是伊朗本地的产品,可以说市面上约80%-90%的轻工类产品都是Made in China。在这边讲一个小插曲,前几年,我第一次带我妻子和孩子去伊朗,回国时想带点伊朗特产,在逛街的时候看到很多工艺品挺好看的,所以就想带些工艺品回国。但是,当我们询问清楚之后发现,我们所能看到的工艺品几乎都是从中国进口的,甚至在工艺品的底部还留有“Made in China”的标志。

就伊朗的汽车行业而言。汽摩配件是一个非常大的市场,尤其是汽车零部件。伊朗国内汽车消费量很大每年具有两三百万辆的市场空间。伊朗本国主要有2个汽车品牌Saipa & IKCO 是伊朗两大国有汽车企业,总计占47%的市占率,中国品牌占10%左右,日韩品牌占7%左右。现在各国的汽车行业都瞄准了伊朗市场。中国自主品牌在伊表现抢眼,如长安、江淮、力帆、奇瑞等都已经进入伊朗汽车市场,不仅有汽车合作项目,也占有一定的市场份额。法国汽车已经开始行动起来了,2015年3月,标致雪铁龙(PSA)集团已经与伊朗霍德罗汽车公司(Khodro)签订了合资协议。像在国内畅销的K5,在伊朗当地的售价几乎高出中国市场价的20%,而且都是现金交易。从这一点上,我们也可以看出伊朗强大的经济实力和消费能力。

首先是江淮汽车,江淮自进入伊朗市场以来,就获得了当地消费者的一致认可,产品销量快速增长。2014年,乘用车全年完成散件出口约15000套,同比增长近700%。2015年上半年,乘用车出口销量累计达20165台,半年度出口突破两万台大关,同比增长256%,超过去年全年出口量。其中,截至2015年6月,瑞风S5出口伊朗累计达10093台,从2014年12月S5 2.0T+6MT产品量产出口以来,仅仅用了6个月时间,S5单一产品出口伊朗就突破了万台大关。

再来说说力帆汽车。2014年前九个月,自主品牌在伊朗销量达到59794辆,涨幅达38%,其中力帆超越奇瑞跃居自主品牌排名第一,在伊朗所有品牌中排名第四,仅次于标致和伊朗两大国营汽车IRAN-KHODRO、SAIPA ,其中销售数额上涨最显著的就是力帆X60。

前面提到的长安汽车,在2014年就与伊朗第一大乘用车生产企业Saipa汽车集团联合,并与其签订战略合作协议,计划每年至少推出1-2款新车型,力争在2015年实现本地化生产,2020年销量达到10万辆。

最后来说说东风自主乘用车在伊朗的情况。2015年9月23日,东风公司国际事业部(东风进出口公司)、东风乘用车公司和东风公司和伊朗首都德黑兰的伊朗最大汽车企业霍德罗汽车集团公司,就东风风神CKD(全散件组装)出口项目的最后阶段工作进行研讨,内容包括在伊朗的装车测试数据分析、地产化配合及整车装调具体事宜等。目前,东风风神已按CKD模式向伊朗出口数百辆份试装车。

随着这一项目的完全落地,伊朗霍德罗公司将定期向东风乘用车公司提交订单,进口东风风神S30和H30 Cross汽车零件,在伊朗当地进行组装生产并销售。借助这一项目,东风乘用车全年出口量有望实现较大突破。

2014年4月的北京车展上,双方签订了整车分销协议和KD框架合作协议。当年年底,东风风神CKD项目在伊朗正式启动。从2015年3月起 ,霍德罗公司开始采购一些东风风神轿车散件进行装配和生产线的改造等工作。

I live in Iran. Here's how sanctions have shaped my life

西方媒体普遍认为伊朗大部分民众仰望西方政治上的自由,经济上的进步,生活方式和水平,尤其对美国很服。但此文说没那么回事儿。西方媒体描述的基本上不是中低层阶层,而是极少数的(经济上)中上甚至上层的阶层。

《国际先驱导报网络版》2016.01.15 中国在中东的新角色:“无处不在的中东贸易伙伴”

阎学通:中国有多少本钱 可以叫板美国

过狂,有眼高手低之嫌疑。

《纽约时报采访》

2016.02.09 Q. and A.: Yan Xuetong Urges China to Adopt a More Assertive Foreign Policy

Yan Xuetong, the director of the Institute of International Relations at Tsinghua University in Beijing, argues for a more assertive foreign policy for China in his latest book, “The Transition of World Power: Political Leadership and Strategic Competition.” In the book, which the Chinese state news media has reviewed favorably, he advocates what he calls moral realism as a rising China challenges the United States for world leadership. This approach would combine a greater emphasis on forging military partnerships abroad while building a more humane society at home.

Mr. Yan, 64, holds a Ph.D. in political science from the University of California, Berkeley, and in 2008 was listed among the world’s top 100 public intellectuals by Foreign Policy magazine. In an interview, he explained why it is time for China to cut back on economic aid to other countries, why North Korea is not China’s ally and why he sees rivalry but not war with the United States:

【问】 You say that China should establish military alliances, like the United States does. China already provides military assistance to Myanmar, Laos, Cambodia and some members of the Shanghai Cooperation Organization and is building a naval support installation in Djibouti. Should China have military bases in these countries?

Photo

Yan Xuetong Credit Courtesy of Yan Xuetong

【答】 For its own interests, China should consider having military bases in countries it considers allies. Unfortunately, the Chinese government insists on a nonalliance principle. It’s too early to say where China would build military bases, since China now has only one real ally, Pakistan.

【问】 You say that North Korea is not an ally despite the alliance treaty signed between the two countries in 1961. Why?

【答】 In 2013, China publicly denied that it had an alliance with North Korea and declared that the two simply had “normal relations.” The two countries’ leaders haven’t met for years, and that’s not how allies behave. China’s relations with North Korea are worse than those with South Korea, which is an ally of the United States.

【问】 What’s holding China back from forming alliances?

A: Some believe it’s due to a lack of military might, but I think it comes from not seeking truth from facts. The nonalliance principle adopted by the Chinese government in 1982 was the right strategy when China was a very weak power and served the country’s interests well for two decades. But since then China has become the world’s second-largest power, and the nonalliance principle no longer serves its interests. The major obstacle to China abandoning its nonalliance principle is years of propaganda criticizing alliances as part of a Cold War mentality.

【问】 How can China acquire more allies? Provide more economic and military aid?

【答】 It’s impossible to change the nature of China’s relations with other countries with just economic assistance or loans. So I don’t think China’s One Belt, One Road initiative for economic development across Eurasia can fundamentally change the nature of the relations.

【问】 You said recently that China should reduce its economic assistance to other countries. Why?

【答】 I think China should limit its economic assistance, including outright aid and loans, to 1 percent of its annual foreign reserves, which amounted to about $35 billion in 2015. The current amount has been way too high given China’s capabilities. In most cases, loans to underdeveloped countries end up being written off rather than repaid.

We should scale back this economic assistance and switch to military aid. Military aid should be given to friendly countries to improve strategic cooperation and secure political support. But China should be very cautious about participating in military conflicts in the Middle East. China should learn a lesson from Russia’s military involvement in Syria.

【问】 How would China abandoning its nonalliance policy change the dynamics between China and United States?

【答】 Any change would only be positive. The more allies China makes, the more balanced and stable the relationship will be. The more China shies away from alliances, the greater the chance that Washington will contain China, therefore resulting in an unstable relationship.

There won’t be a direct war between the two sides, because they’re both armed with nuclear weapons. The problem now is that the two are not willing to admit that they’re in competition. They’re still pretending to be friends.

During U.S. Vice President Joe Biden’s visit to China in 2011, Xi Jinping suggested the idea of “healthy competition” between China and the United States, and this was well received by Biden. When both sides define the nature of their relationship as competition rather than cooperation, they have lower expectations of the other’s friendly actions and higher tolerance of the other’s hostile actions. Thus both sides will be cautious about provoking the other side and will avoid allowing conflicts to escalate to disaster.

Unfortunately, “healthy competition” was later replaced by a “new type of great power relations” [Mr. Xi’s proposal of a relationship between equals based on cooperation and avoiding confrontation] and the chance for stabilizing bilateral relations perished.

【问】 In recent years, some of China’s neighbors seem to have felt less secure because of China’s greater assertiveness, especially in the South China Sea. Has the Chinese approach backfired?

【答】 It’s only the Philippines and Vietnam that have major disputes with China in the South China Sea, and they’re just two of China’s more than 30 neighbors. Singapore and Thailand, two longtime allies of the United States in the region, have become much closer to China in recent years.

China’s South China Sea policy is only intended to safeguard its own interests, so I don’t think it’s overly assertive, but rather that previous policies were not forceful enough.

The South China Sea dispute is just an obstacle on China’s path to greater power, which the United States has been unwilling to accept. It is a result, rather than the cause, of the rivalry between China and the United States. It will be up to the United States to decide if it wants to go to war with China for the sake of the Philippines and Vietnam. It’s not China’s call. The United States recently gave its support to Japan for its involvement in the South China Sea, which means the United States has not decided to confront China directly there.

【问】 You say that moral realism means building a better society at home, under a form of leadership based on an ancient Chinese philosophy called humane authority. What does that mean specifically?

【答】 Moral realism involves leading by example, which means China needs to practice the moral principles it advocates to the world both at home and abroad. The core principles suggested by moral realism are fairness, justice and civility. Equality, democracy and freedom are also important principles advocated by moral realism.

Moral realism suggests that the essence of democracy should be the same for all countries including China, even though it takes different forms. The essence is that political leadership should be corrected by criticism from the people.

In ancient China, remonstration officials enjoyed immunity from punishment while delivering complaints directly to the emperor. Freedom of speech is necessary for a humane authority, but the remonstration official system is more important because it’s a more efficient way of correcting strategic mistakes than freedom of speech.

【问】 Wouldn’t a “humane authority” lead the world by doing what is widely considered right? For example, should China sanction North Korea for its recent nuclear test?

【答】 That would be a Western hegemonic idea. A humane authority sees everyone on equal terms. If North Korea is not entitled to nuclear weapons, then China and the United States should guarantee North Korea its security in return for denuclearization. That’s what we call leading by example and fairness. It’s only Western countries that are calling for sanctions without considering a fair solution, and they make up only about 20 percent of the world’s 195 countries.

《华盛顿邮报》Fareed Zakaria:America’s self-destructive whites

《纽约时报》Death Rates Rising for Middle-Aged White Americans, Study Finds

《纽约时报》Paul Krugman:Despair, American Style

《沙龙杂志》White America’s Willy Loman crisis: Inside the suicide epidemic raging in the bastions of middle-class privilege

《亚特兰特杂志》Middle-Aged White Americans Are Dying of Despair

《亚特兰特杂志》The Great Republican Revolt

Which cities will contribute most to global growth?

e租宝的轶事

丁宁曾“奖励”给张敏5.5亿元(见“e租宝”控制人丁宁如何缔造金融泡沫帝国?,参见e租宝实控人送女下属5.5亿现金 随意支取投资款,参见扒一扒E租宝那个化妆后颜值尚可的美女总裁张敏)

面目姣好又有脑子,值。世界就是这么个理。

【一财科普】因为e租宝被扒出来的ENZO聚会圈是什么

呵,长见识。

相关:

文学城综合新闻:庞氏骗局“e租宝”诈骗500亿 曝央视卷入

《路透社》China's $7.6 billion Ponzi scam highlights growing online risks

《财新》e租宝被查 “钰诚系”版图起底

【财新网】(记者 吴红毓然 张榆)e租宝的被查是一次自上而下的全国大行动。据财新记者了解,33岁的e租宝实际控制人丁宁、多位高管及业绩突出的员工均被控制,所有相关资金亦被冻结。

12月16日傍晚,多地警方联合通报“e租宝”相关涉嫌犯罪问题,已对犯罪嫌疑人采取了强制措施,对涉案资产实施了查封、冻结、扣押。

12月8日,新华社发布消息称,“e租宝”的运营平台金易融(北京)网络科技有限公司及关联公司在开展互联网金融业务中涉嫌违法经营活动,正接受有关部门调查。e租宝在8日晚上7点关闭了网站。

e租宝实际控制人为安徽钰诚控股集团(下称钰诚集团)董事长、董事局主席丁宁,总裁为张敏,党委书记、首席运营官为王之焕。钰诚集团以安徽钰诚融资租赁有限公司为主体,还包括钰诚东南亚投资发展集团有限公司、兰花国际控股集团有限公司、东南亚联合银行等。钰诚集团首席执行官彭力在今年7月公开表示,集团总资产为800亿元。

全国各地的e租宝线下门店均已关闭。钰诚集团在起源地安徽蚌埠租的大楼,早已人去楼空,还被摘下了招牌。激愤的投资者们搬走一切值钱、不值钱的办公用品,甚至包括凳子。

2015年,钰诚集团总部搬至北京呼家楼,租下了安联大厦的多层。12月9日上午,有近百位投资者聚集在安联大厦27层,这一层本是钰诚集团高管办公室,但无一员工上班,仅有保安在。豪华装修的办公室内,大屏幕还在滚动播放钰诚集团的宣传片,室内喷泉流水依旧。

e租宝是目前线上规模第四大的P2P公司,多位权威人士认为,其实质涉嫌以融资租赁为形式的非法集资。e租宝诞生于2014年中旬,在2015年5月成交量为50亿元,以每天1个多亿的成交量猛烈扩张至700多亿元,员工过万人。

银行卷入

12月9日,e租宝声明表示,集团在调查期间,主动封闭冻结了中信银行风险保证金11亿元。

对此,中信银行回复财新记者,这并不是e租宝的主动行为。经核实,金易融(北京)网络科技有限公司(“e租宝”)于2015年11月在中信银行总行营业部开立一般活期账户,目前余额为0元。其关联方安徽钰诚融资租赁有限公司,于2015年6月28日在中信银行总行营业部开立风险备用金账户,目前风险备用金存款余额10.71亿元人民币。该笔存款已于12月8日晚被公安机关远程冻结。

据财新记者从多位银行人士处获悉,钰诚集团及相关关联公司,牵涉银行贷款在百亿元左右。

亦有银行理财产品牵涉e租宝关联公司。多位e租宝员工称中国银行代销了e租宝近3.5亿理财产品,还说“同样的产品,中行收益率6.5%,e租宝高达14.6%”。但中国银行对财新记者回复称:“不存在我行投资于该公司及e租宝产品的情况”。

据财新记者统计,中行的理财产品均为“中银智荟理财计划”,分别为15204期、15198期、15197-1期、15184期、15083-G期、15318期、15352期、15035-G期。

以中银智荟理财计划15204期为例,该产品99.36%的资金投向到了安徽钰诚融资租赁有限公司的融资租赁收益权资产,融资方为甘肃大唐国际连城发电有限责任公司,资金为1.75亿,期限为3年。该产品披露,预期年化收益率为6.5%,投资周期315天,于2015年5月25日发行,2016年4月7日到期;风险等级为中低级,全国发行。

其它的同系列理财计划也有资金投向了安徽钰诚融资租赁有限公司的融资租赁收益权资产,比例在2%到60%不等,发行时间从5月末到11月都有,融资方还包括甘肃兰石集团、宝舜科技有限公司等。

对此,中国银行官方回复财新记者表示:在理财计划中,安徽钰诚融资租赁有限公司作为通道机构仅起辅助作用,不存在该行投资于该公司及“e租宝”产品的情况。

“该产品销售人员的宣传与事实情况严重不符。”中行表示,已于2015年10月21日致函金易融(北京)网络科技有限公司、安徽钰诚租赁有限公司、钰诚控股集团有限公司,敦促其停止不正常宣传。

此前e租宝称,在7月末与兴业银行签订了第三方托管协议。但在e租宝被调查风波发生后,兴业银行却声明:“从未与安徽钰城融资租赁有限公司开展过任何形式的资金托管合作,其业务的资金安全与我行无关”。

与e租宝合作的第三方支付机构包括易宝支付、连连支付等。这意味着,投资者直接将银行卡上的钱这些支付通道,就可以转到e租宝的充值账户里。易宝支付公关人士对财新记者回应:易宝支付已与e租宝于2015年11月终止合作。

700亿扩张之谜

线上线下,e租宝可谓“老少通吃”。

在e租宝网站被关的前一秒,还有投资者投了十几万元。据财新记者了解,无锡是e租宝销售的“重灾区”,该地区业绩显著,常为每月的全国销售第一,有投资人投资了上千万元。

从财新记者了解的情况看,投资者年龄分布也比较广,不仅有年轻的,也有已退休的老人。e租宝的宣传模式主要通过线下传单、各渠道广告、业务员推广等。员工也需带业绩上岗,实习生的考核都是每月五万。

e租宝官网显示,e租宝产品预期年化收益率为9%到14.6%,投资门槛为1元,可自由赎回。但财新记者获得的一份合同显示,如果产品未到期提前赎回需要支付2%的手续费。有投资者表示,此前也听到过e租宝的一些负面消息想要提前赎回,但考虑到手续费损失当时就放弃了。

事实上,e租宝的突飞猛进之路,早已颇受业界质疑,认为其涉嫌自融自担、虚假标的。

上市公司重庆建峰、包钢股份、恒源煤电均向安徽钰诚融资租赁有限公司办理融资租赁业务,利率约6%。而安徽钰诚融资租赁又恰恰是e租宝上的借款人。“钰诚通过e租宝以14%的利息融资,却以6%的利率贷出去,这是怎么样的精神?”一位投资者表示,钰诚项目资金倒挂得太明显,无法理解e租宝怎么赚钱,因此决定撤离。

e租宝官网未披露产品具体信息,以含糊的“该企业”、“融资租赁机构”“保理公司”等进行替代,抵质押信息一栏显示“未披露”字样。只有投资之后才能看到。

以“e租稳盈融资租赁第275期A”产品为例,投资之后发现,借款企业为烟台市华迪铸钢有限公司。但工商资料显示,2015年6月7日,该公司还是个保洁公司,名为“华迪保洁有限公司”,注册金为3万元;6月8日,保洁公司摇身一变为注册金3000万的华迪铸钢有限公司。e租宝平台还显示该铸钢公司2014年的销售收入高达5.1亿元。股东则从山东烟台变为了安徽省蚌埠人士。安徽蚌埠,是钰诚集团的发源地。

“钰诚系”版图

33岁的丁宁为e租宝、钰诚集团的实际控制人。据财新记者了解,丁宁为缅甸国籍。

丁宁1982年生,安徽蚌埠人,2012年起为蚌埠市政协委员。1999 年,年仅17岁的丁宁办理长期休学进入蚌埠岩柏施封锁厂任技术员、销售员,后为厂长。2010年任合肥工业大学硕士研究生导师;2012年任安徽财经大学硕士生导师。

2012年3月,丁宁与其堂兄丁未巍共同成立安徽钰诚融资租赁有限公司,这是钰诚集团的主体。工商资料显示,该公司法人代表丁宁,成立于2012年3月;注册金由2000多万增至6亿美元。安徽钰诚投资发展股份有限公司持股66.66%;蚌埠市钰诚新材料科技有限公司持1.67%,GLENWOOD IMPORT AND EXPORT PTY LTD(格兰伍德进出口公司)持股31.67%。格兰伍德进出口公司是丁未巍在澳大利亚注册的公司。

2013年,在该融资租赁公司的基础上,丁宁组建了钰诚集团。钰诚集团总裁为张敏,党委书记、首席运营官为王之焕,副董事长李群芳,董事、副总经理为王兰兰,副总裁为杨晨、单良等。此外,丁甸、彭力、高俊俊等在多家关联公司担任股东或法人代表等。

工商资料显示,安徽钰诚控股集团股份有限公司,成立于2013年3月15日。在今年4月24日,法人代表由丁宁改为了高俊俊,注册金从1000万陡增至50亿元。此前的1000万中,丁宁持股51%。

e租宝的运营平台,为金易融(北京)网络科技有限公司。该注册于2014年2月,注册金1亿,法人代表王之焕,股东为王之焕、宋在庄;王之焕还是监事。

e租宝的线下运营、推介平台,为上海钰申金融有限公司。工商资料显示,上海钰申注册于2014年8月上海自贸区的,注册金1亿,法人代表为许辉;王之焕为监事。钰申金融是钰诚集团旗下全资子公司,全面负责集团旗下品牌“e租宝”在全国范围内的线下运营、管理及推介服务。目前上海钰申金融已经在全国各地设立了百余家分公司,员工总数近万人。

钰诚集团旗下还有P2P芝麻金融、惠仁财富、玖钰财富、一诺财富(北京)投资管理有限公司等。这些公司,有的连人带团队,被e租宝“野蛮”全部收购,有的则是e租宝的各种演化版本。比如11月刚成立的玖钰财富北京投资管理,就是钰诚集团的又一家子公司,号称发展P2P型理财产品。公开资料显示,“在母公司钰诚集团的支持下,玖钰财富虽然刚刚成立,已经在全国拥有30余家子公司,目前拥有员工1000人左右。”

对于公司团队的建设,钰诚集团也“颇费心力”,根据公开消息,钰诚控股集团专门成立了北京钰诚雅典娜学苑教育咨询有限公司,作为公司对外载体;集团内部构架名称为安徽钰诚控股集团,雅典娜学苑。

钰诚融资租赁有限公司官网上的新闻介绍,2015年5月16日-5月18日,雅典娜学苑在五星级的安徽蚌埠利事环球酒店,举办了为期三天的“启承转合“钰诚集团•钰申全国精英团队经理首期培训班。新闻稿中称,“在一次次、一声声的宣誓与呐喊中更加增强对自己、对企业的信心。”

一位曾经在钰诚集团工作的人士为琥珀金融帮撰文称,钰诚集团内部人事极大庞杂,一个集团9大主体,光品牌部就有四个部门,外加雅典娜学苑和维纳斯中心。钰诚集团招聘也极为残酷,但“工资特别高”。据她称,钰诚一个集团招聘中心,好几百人的规模,采用末位淘汰制,能坚持下来的寥寥无几,但对工资毫不吝啬,表现好的HR不仅有奖金,还有纯金金条。

更匪夷所思的是,丁宁在国内公司还成立了人民武装部。据公开消息,2015年4月17日,安徽钰诚控股集团召开人民武装部成立大会暨揭牌仪式。安徽蚌埠市军分区、蚌埠市政府、蚌埠市龙子湖区区委区政府及人武部相关领导、钰诚集团董事会负责人等出席了活动。

据财新记者了解,整个钰诚集团趴在银行账上的资金并不多。多位知情人士均指出,钰诚集团的资金去向集中在缅甸,但实际投入金额可能不足百亿。钰诚集团在多处宣讲,号称响应“一带一路”战略,投资400亿元建立前述自贸区。据钰诚集团官网消息,钰诚东南亚自贸区一期、二期项目已规划完毕,该自贸区中心城区位于佤邦首府邦康北60公里处,占地面积427公顷。

2015年,钰诚集团官网显示,该集团通过其海外子公司与缅甸第二特区(佤邦)达成协议,并经国家有关部门备案,成立钰诚东南亚自由贸易区,同时经佤邦政府批准,成立佤邦境内独家专营存贷款业务的商业银行——东南亚联合银行,该银行正在向整个东南亚地区相关国家进行业务发展。

值得注意的是,佤邦地区形势复杂,为战乱多发地带,也非常贫穷,是著名的毒品“金三角”核心腹地。

实施负利率政策后日本政府如何借钱?

日本是世界上中央政府负债最多的国家,达总产值的246%(见下金融时报文),但另一估计是约350%:

《金融时报》专栏名家沃尔夫

January 11, 2016

Japan’s weak private demand is the dominant challenge for Abenomics

Martin Wolf

The country saves too much, but higher wages and taxes could help eliminate the surplus

The policies known as Abenomics, after Shinzo Abe, Japan’s prime minister since December 2012, were a bold attempt to revitalise the Japanese economy. The quiver of Abenomics contains three “arrows”: fiscal policy, monetary policy and structural reforms. Will they deliver the revival Mr Abe promised? It is, alas, unlikely.

Of the three, monetary policy has been shot most aggressively. Under the policy of quantitative and qualitative easing adopted in April 2013, the Bank of Japan has increased its balance sheet from 34 per cent of gross domestic product at the end of the first quarter of 2013 to 73 per cent two and a half years later. Relative to GDP, the BoJ’s balance sheet dwarfs those of the Federal Reserve, the European Central Bank and the Bank of England (see charts).

The arrow of fiscal policy has, however, not been shot. According to the International Monetary Fund, Japan had a cyclically adjusted fiscal easing of only 0.4 per cent of gross domestic product in 2013. The cyclically adjusted fiscal deficit tightened by 1.3 per cent of GDP in 2014, largely because of a misconceived jump in the rate of consumption tax, from 5 to 8 per cent, in the spring of 2014. A comparable tightening is forecast for 2015.

Finally, structural reforms have been quite modest. The government has reformed agricultural co-operatives. It has also agreed to liberalisation in the Trans-Pacific Partnership (TPP), the US-led trade pact. It has made modest progress on energy and tax reform. Improvement in opportunities for women is moving at a glacial pace. Increasing immigration remains largely taboo. The labour market has entrenched differences between permanent and temporary workers.

What have been the results so far? On inflation, Japan has made modest progress. In the year to October 2015, core inflation (all items, less food, alcoholic beverages and energy) was just 0.8 per cent, still far below the 2 per cent target. On output, the outcome is also disappointing. Real GDP rose 1.7 per cent over the year to the third quarter of 2015. Yet, between the end of 2012 when Mr Abe became prime minister and the third quarter of 2015, the economy grew a mere 2.4 per cent in real terms, and was only the same size as the first quarter in 2008.

A fundamental question is whether Abenomics has correctly identified what is ailing the Japanese economy.

The labour market, for example, performs excellently. The unemployment rate was just 3.1 per cent in October 2015. When one allows for the shrinking labour force, the growth performance is not bad either. Trend annual growth of GDP per person of working age was 1.5 per cent between 2000 and 2010, and then 2 per cent between 2010 and 2015. Both rates were the highest in the Group of Seven leading high-income countries.

According to the IMF, Japan’s GDP per head at purchasing power parity was only 69 per cent of US levels in 2014, ahead only of Italy within the G7. Radical reform might generate faster catch-up growth. But it would be remarkable if Japan were to sustain annual growth of GDP per worker at more than around 1.5 per cent. Without mass immigration, even this would imply potential annual growth of around 1 per cent, well below the 2 per cent envisaged. According to the BoJ, the potential annual rate of growth rate is now only 0.5 per cent.

Supply, then, is not Japan’s problem — or, if it is, it is because of the shrinkage of the labour force. The real problem is the weakness of private demand. The indicator of that is the enormous private sector financial surpluses — the excess of private savings over private investment. This surplus has oscillated between 5 per cent and 14 per cent of GDP since the mid-1990s.

A country with a declining population does not need to build more houses — the main investment by households. Household investment has fallen from 7 per cent of GDP in the early 1990s to below 4 per cent. This fall has offset the decline in household savings rates. The result has been a chronic household financial surplus.

The corporate sector financial surplus is even bigger. It averaged 7 per cent of GDP between 2001 and 2013, and, at its peak, in 2009 and 2010, reached 9 per cent. This corporate surplus is due to strong corporate savings, which averaged 22 per cent of national income since the early 2000s, and mildly declining corporate gross investment, which averaged 14 per cent of GDP over the same period. But this investment rate is still remarkably high by the standards of other G7 countries.

The counterpart borrower has been the government. The ratio of gross public debt to GDP jumped from 67 per cent in 1990 to 246 per cent in 2015, while the ratio of net debt increased from 13 to 126 per cent. Yet, despite sustained fiscal deficits and near-zero short-term interest rates, the mild deflation has not been durably eliminated.

The BoJ’s purchases of low-yielding Japanese government bonds (JGBs) are highly unlikely to eliminate the private sector’s huge financial surpluses.

"It is, in brief, ‘not the supply, but the demand, stupid’"Tweet this quote

So what is to be done? A first option is to continue with today’s large fiscal deficits and central bank purchases of JGBs, in the hope that the surpluses of the private sector will soon disappear. Unfortunately, this seems unlikely. If so, the fiscal deficits cannot be safely eliminated. This policy will end up as permanent monetisation of deficits.

A second option is to admit that the policy is monetisation. The BoJ would agree with the government on monetary financing or on transfers to households. Moreover, given the public sector debt overhang in Japan, a new and higher inflation target could also be set, with a view to lowering the debt burden.

A third option is to impose fiscal austerity. Some will argue that the private sector would recognise the improved solvency of the state and so cut back on excess savings. In Japan, this argument looks implausible. The result is more likely to be a deep recession.

A fourth option is to export the excess savings via a bigger current account surplus. This is exactly what Germany has done. The real effective exchange rate has depreciated by some 30 per cent since Mr Abe became prime minister. To do this, the BoJ could purchase foreign bonds. Alternatively, the government could set up a sovereign wealth fund financed by the sale of JGBs. Yet such policies, if pursued on a large enough scale, would worsen global imbalances. That would be unpopular abroad.

A fifth option is to attack the private sector’s chronic savings surplus head on. To do that, one must first recognise that Japan saves too much. So raising taxes on consumption is the opposite of what should be done.

Shifting Japan’s excess corporate retained earnings into wages and taxes would go a long way towards eliminating the structural savings surplus. One could slash depreciation allowances, for example. Reform of corporate governance might also increase the distribution of corporate earnings. Yet another possibility would be to force up wages.

It is, in brief, “not the supply, but the demand, stupid”. The structural savings surpluses of the private and, in particular, of the corporate sectors have driven the government into its deficits and growing debts. Abenomics does not recognise this underlying reality. Japan must offset the private surpluses, export them or eliminate them. This is the dominant challenge.

The first step is to recognise the core problem — one of insufficient private demand. Only then can it be solved.

《金融时报》

Risk of US recession back on the agenda for markets

John Authers

Indicators show most severe US ‘growth scare’ since Great Recession in 2009

The risk of a US recession is back on the agenda, and rapidly moving towards the top of it. As the year turned, with many concerns facing the globe, it was treated as axiomatic that there was no risk of imminent recession in the US, and hence any damage would be limited.

Any growth in recession risk from that low level would inevitably lead to falls in the price of risk assets, which is exactly what we have seen, even if an outright US recession remains on balance unlikely. The litany of market indicators that make no sense unless there is a clear and imminent danger of a recession is growing longer.

Long-term inflation expectations are their lowest since the crisis; the spreads on corporate and particularly low-quality high-yield credit are widening; the yield curve — as shown by the gap between two- and 10-year Treasury yields — is the flattest it has been since 2007, showing scant belief that inflation or interest rates will be rising in the years ahead. And of course the stock market is down, while within it defensive stocks like Walmart or Procter & Gamble are far outperforming cyclical stocks that would fare worst in an economic downturn.

These are all market-generated indicators. They show that we are now in at least the most severe US “growth scare” since the Great Recession in 2009, and these financial conditions in themselves heighten the risk of a recession, by making life harder for companies and consumers. Should the recession fears be averted, this also implies that there is a nice rebound to be had from stocks and from betting against bonds.

So what is the possibility of a recession, and how can it be calculated?

According to the US fund manager John Hussman, who writes a widely followed weekly commentary and has been notably bearish in recent years, a recession is now an “imminent likelihood”. He suggests financial markets generally act as leading indicators — which they are doing — followed by data from the industrial economy. Industrial production has fallen in 10 of the last 12 months; historically, going back to 1919, every time it has fallen as many as eight times in such a stretch, there has been a recession.

More video

Over the past 12 months, Alan Ruskin of Deutsche Bank points out, no country’s ISM index has fallen more than that of the US — casting grave doubt on its ability to play the role of the world’s growth locomotive that many had put aside for it.

Mr Hussman adds weakness in retail sales as further evidence, while confirmation would come from worsening unemployment data and from big falls in consumer confidence.

Financial conditions are also important. When banks are making it harder to borrow, it is usually a good sign that a recession is coming — and that is what they are doing. The latest survey of senior loan officers by the Federal Reserve, produced this week, showed a growing majority of banks saying they were tightening their lending standards for commercial and industrial loans, in a way unseen since the crisis, which is a worrying sign — although there was no such tightening for real estate loans or for consumer loans.

Corporate profits provide ample cause for concern. Companies are finding it hard to maintain their profit margins or increase their revenues — again possibly a testament to the strength of the dollar.

However, the evidence that the US is not yet in recession remains strong. Aneta Markowska, of Société Générale, puts the chance that the US was already in recession in December at 3 per cent, using a model based on private employment, real income, real sales and industrial production. Only the last is anywhere near recession territory.

SocGen’s model of recession risks based on economic fundamentals suggest the risk is almost negligible; wage pressures are only just beginning, monetary policy is still very easy and profits made on domestic businesses are still high, while corporate balance sheets are healthy, outside of energy. All of this points to a cycle that does not turn into a downturn until 2018 or 2019.

Credit Suisse conducted a similar exercise, with a similar result as it concluded that the US is not in recession now, and will not be later this year either.

A clear signal that these forecasts were wrong, that would move the models towards a recession signal, would come from the labour market, where the rate of improvement has slowed in recent months.

The labour market provides the strongest evidence that the US is not heading for a recession and forthcoming data will be critical in determining whether this is a growth scare that will blow over — bringing a nice rally with it — or the start of the recession that markets are signalling.

《一财网》

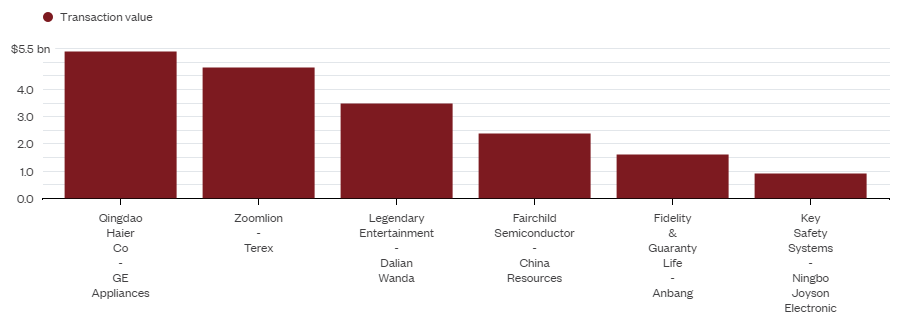

2016.02.04 对外直投五年翻番 中企海外大扫货

2016.02.04 中国基建何以打入欧美:实力+全款现汇

《华尔街见闻》

2016.02.07 80年代日本收购狂潮重现?中国企业以创纪录速度全球扫货

《参考消息》

2016.02.01 德媒称中企收购德企胃口大: 德国制造变成中国拥有

2016.02.04 德媒:买到就是赚到 中企斥巨资收购德国垃圾处理厂

《金融时报》

2014.02.04 中国企业开年掀起海外并购潮

《纽约时报》

2016.02.05 中国开发微芯片技术,美国疑虑重重(英文版原文,全文见下)

《华尔街日报》

2016.02.03 Chinese Companies Are Shopping Abroad at Record Pace(全文见下)

2016.02.17 Ingram Micro to Become Part of China’s HNA Group in $6 Billion Deal(全文见下)

2016.02.16 2015中企海外投资版图:国企去欧洲买工厂 私企去美国买楼

2016.02.16 德智库:去年中国对欧投资创200亿欧元新高

商务部合作司负责人谈2015年我国对外投资合作情况

对外投资创历史新高,1180.2亿美元,同比增长14.7%

2015年,我国对外直接投资主要分布在中国香港、开曼群岛(明显逃税)、美国、新加坡、英属维尔京群岛、荷兰、澳大利亚等。对前10位国家地区投资累计达到1016.3亿美元,占到全年对外非金融类直接投资的86.1%。对美国投资83.9亿美元,实现了60.1%的较高增长

主要是一带一路带动下的基建工程,没人要的,苦,而且通常得中国自己出资,风险大

中国化工橡胶有限公司以46亿欧元收购意大利倍耐力集团公司近60%股份

《彭博》

China Can Have the Chicago Exchange

《纽约时报》2016.02.05

Concern Grows in U.S. Over China’s Drive to Make Chips

PAUL MOZUR and JANE PERLEZ

HONG KONG — China is spending billions of dollars on a major push to make its own microchips, an effort that could bolster its military capabilities as well as its homegrown technology industry.

Those ambitions are starting to be noticed in Washington.

Worries over China’s chip ambitions were the main reason that United States officials blocked the proposed purchase for as much as $2.9 billion of a controlling stake in a unit of the Dutch electronics company Philips by Chinese investors, according to one expert and a second person involved with the deal discussions.

The rare blockage underscores growing concern in Washington about Chinese efforts to acquire the know-how to make the semiconductors that work as the brains of all kinds of sophisticated electronics, including military applications like missile systems.

In the case of the Philips deal, the company said late last month that it would terminate a March 2015 agreement to sell a majority stake in its auto and light-emitting diode components business known as Lumileds to a group that included the Chinese investors GO Scale Capital and GSR Ventures. It cited concerns raised by the Committee on Foreign Investment in the United States, which reviews whether foreign investments in the country present a national security risk.

James Ding Jian, managing director and chairman of GSR Ventures, whose bid for Lumileds was blocked by the United States for national security reasons

Philips said that despite efforts to alleviate concerns, the committee — known as Cfius — did not approve the transaction.

“There is a belief in the Cfius community that China has become innately hostile and that these aren’t just business deals anymore,” said James Lewis, a senior fellow at the Center for Strategic and International Studies, a research firm, who speaks to people connected with the committee’s process.

Philips did not respond to requests for comment. GSR Ventures, which sponsors GO Scale Capital, declined to comment.

Cfius, an interagency body that includes representatives from the Treasury and Justice Departments, declined to comment and does not make its findings public.

Cfius reviews have been a growing problem for outbound Chinese deals. According to the most recent data available, in 2012 and 2013 Chinese investment accounted for more committee reviews than money coming from any other country. A 2008 Chinese effort to invest in the network equipment company 3Com was withdrawn while the committee was reviewing it.

Recently, the committee found acceptable a number of major Chinese deals, including a takeover of Smithfield Foods by Shuanghui International and Lenovo’s takeover of IBM’s low-end server unit. In 2012, President Obama ordered a Chinese company to stop building wind farms near an American military installation in Oregon after a negative Cfius review.

At the center of the committee’s concerns on the Philips deal, according to Mr. Lewis, was a little known but increasingly important advanced semiconductor material called gallium nitride. Though not a household name like silicon, gallium nitride, often referred to by its abbreviation GaN, could be used to construct a new generation of powerful and versatile microchips.

It has been used for decades in the low-energy light sources known as light-emitting diodes, and it features in technology as mundane as Blu-ray Disc players. But its resistance to heat and radiation give it a number of military and space applications. Gallium nitride chips are being used in radar for antiballistic missiles and in an Air Force radar system, called Space Fence, that is used to track space debris.

Wan Long, right, of the WH Group, and Larry Pope of the American pork company Smithfield Foods. WH Group acquired Smithfield in 2013. The Committee on Foreign Investment in the United States approved that deal

“Gallium nitride makes better-performing semiconductors that were key in upgrading Patriot radar systems,” said Mr. Lewis. “It’s classic dual use, sensitive in that it could be used in other advanced weapons sensors and jamming systems.”

Advancing its chip industry has been a major political initiative for Beijing. In recent years, analysts said, Chinese corporate espionage and hacking efforts have been aimed at stealing chip technology, while Chinese firms have used government funds to buy foreign companies and technology and attract engineers.

Last year, different subsidiaries of the state-controlled Tsinghua Holdings made a number of bids for American companies, including an unsuccessful $23 billion offer for the American memory chip maker Micron Technology and a successful $3.78 billion purchase of a 15 percent stake in the hard-drive maker Western Digital.

Last year’s spree of deal activity, and lack of American regulatory response, spurred a Sanford C. Bernstein analyst, Mark Newman, to say in a November report that the United States “runs the risk of being asleep at the wheel.” He cited efforts by South Korea and Taiwan to prevent China from acquiring some technology assets.

The Lumileds block is being interpreted by the chip industry as the United States “waking up a bit to the threat,” Mr. Newman said in an email.

Gallium nitride is particularly sensitive. One military industry magazine called the material the biggest thing since silicon, which is now commonly used to make the transistors in microchips. It cited Raytheon’s use of the material to make smaller, low-powered radar for American missile systems.

“Many say it’s the most important semiconductor material since silicon,” said Colin Humphreys, a British physicist at Cambridge University.

He said that while it was not clear what the United States government was worried about, research by LED companies into technology linking gallium nitride and silicon could have broader implications for creating advanced microchips that could be used in a wide array of electronics.

The would-be investor in Lumileds, GSR Ventures, also holds a stake in Lattice Power, a Chinese company that has been vocal about its efforts to develop technology related to gallium nitride and silicon.

In a November 2015 statement about a recent investigation into Chinese industrial espionage, Taiwan’s Ministry of Justice also expressed worries about China aiming at the material. Calling the mass production of gallium nitride a “key development project” for China, the ministry said it was concerned about the theft of trade secrets from Taiwanese companies working on the material and Chinese-led recruitment of engineers knowledgeable about it.

《华尔街日报》2016.02.03

Chinese Companies Are Shopping Abroad at Record Pace(全文见下)

Acquisitions have totaled roughly $68 billion so far this year, the strongest volume ever for this period

If approved by Syngenta shareholders and regulators, ChemChina’s $43 billion offer to buy Syngenta would be the largest foreign takeover by a Chinese company

KATHY CHU and JULIE STEINBERG

Chinese companies have launched a record wave of foreign acquisitions in the first few weeks of 2016 as they seek inroads into overseas markets amid China’s slowing economy and falling currency.

China National Chemical Corp., known as ChemChina, on Wednesday said it would pay $43 billion to buy Swiss pesticide maker Syngenta AG in a deal that, if approved by Syngenta shareholders and regulators, would be the largest foreign takeover by a Chinese company.

Including the ChemChina deal, the combined value of China’s outbound mergers and acquisitions has reached about $68 billion so far this year, the strongest volume ever for this period and already more than half of 2015’s record annual tally, according to deal tracker Dealogic.

Other Chinese companies, such as Haier Group and China Cinda Asset Management Co., have also been ramping up their foreign-asset purchases in recent years as China looks to bolster its capabilities in industries including agribusiness, real estate and energy.

Companies such as ChemChina that are run by China’s government—or state-owned enterprises—are among those buying. A push by President Xi Jinping to boost overseas trade through the “One Belt, One Road” initiative aims to open up new markets from Central Asia to Europe for Chinese companies that previously focused at home.

The policy, invoking the spirit of the old Silk Road trading route between East and West, means government cash may be available to help finance state-owned enterprises, or SOEs, wanting to buy foreign assets.

But Chinese companies’ purchase of foreign assets may come under scrutiny at home, as the deals come at a tricky time for the economy.

Beijing is stepping up efforts to halt a flood of money leaving the country in response to the slowdown and a currency that has fallen 5.5% against the U.S. dollar since August. China’s latest efforts involve curbing the ability of foreign companies in China to repatriate earnings and banning yuan-based funds for overseas investments, people with direct knowledge of the matter have said.

The Chinese government’s concern over capital outflows—which may have been as high as $1 trillion last year, by some estimates—may mean that regulators in Beijing look more closely at certain acquisitions of foreign assets, analysts said. But the government will still likely support foreign deals that are seen as a cornerstone of Chinese companies’ overseas expansion, they said.

“It’s the nature of the assets that determines Beijing’s support,” said Derek Scissors, resident scholar at the American Enterprise Institute, a Washington-based think tank.

Chinese acquisitions of key Western technologies are likely to face stiff scrutiny overseas.

In the U.S., a federal agency that screens corporate takeovers for security concerns recently nixed a deal by a Chinese investment fund to buy the lighting business of Royal Philips NV. The business had manufacturing, research and development facilities in the U.S.

The agency, the Committee on Foreign Investment in the U.S., is likely to look closely at the ChemChina-Syngenta deal because most of Syngenta’s seed business is in the U.S.

Overall, “we see the deals getting bigger and bigger,” said Patrick Yip, mergers and acquisitions leader for Deloitte China, referring to Chinese companies’ acquisitions of foreign companies. “I am working on a number of them. Chinese companies want brand power and high technology.”

David Brown, transaction services leader for PricewaterhouseCoopers China and Hong Kong, predicts around 50% growth for outbound Chinese mergers and acquisitions every year, for the next several years.

There is “huge pent-up demand,” said Mr. Brown, as Chinese companies gain confidence to pursue global deals.

The depreciation of the yuan—and the expectation that it will continue falling—means that Chinese companies are looking to buy now before the price of foreign assets gets more expensive, said Rocky Lee, a Beijing- and Hong Kong-based partner at law firm Cadwalader.

China’s yuan, after strengthening by more than 30% over the past decade, has fallen 8% against the U.S. dollar since the beginning of 2014 as policy makers seek to make their currency more market-driven and grapple with a deepening economic slowdown.

Some analysts believe the yuan could fall up to 10% more by the end of this year amid fears that the Chinese economy is slowing faster than expected and as the government’s moves to contain market forces send capital flooding out of China.

Chinese state-owned enterprises, for one, are receiving strong backing for strategic foreign acquisitions from the central government.

“A lot of the [state-owned enterprises] are fairly cash-rich,” says Ben Cavender, a Shanghai-based principal at China Market Research Group. “One of the issues they’re running into is they’re out of room to grow in their home market.”

ChemChina, when it agreed to buy Italian premium tire maker Pirelli & C. SpA for roughly $7.7 billion last year, had secured funding from an overseas investment vehicle championed by China’s president.

Under the deal, Silk Road Fund Co.—an investment vehicle controlled by China’s State Administration of Foreign Exchange and other state-owned entities—took a 25% stake in the ChemChina subsidiary set up to acquire Pirelli’s shares.

The government is likely to continue providing financial support for SOEs to buy foreign assets in areas such as technology, energy and infrastructure, said Mr. Lee of Cadwalader.

《金融时报》

Debt levels cast cloud over march of China Inc(中文)

James Kynge February 3, 2016

ChemChina, the company making China’s biggest takeover bid yet, is part of a phalanx of highly-leveraged corporations that are spearheading “China Inc’s” purchase of foreign assets and raising questions over the financial sustainability of acquisitions.

So high are the debt levels at ChemChina and several other companies behind some of the country’s biggest overseas investments that financing for the deals would have been difficult or prohibitively expensive were it not for the backing of the Chinese state, analysts said.

ChemChina, which bid $43.8bn for Syngenta, a Swiss company, is in poor financial shape. It made a net loss of Rmb889m in the third quarter of last year and carried a total debt of Rmb156.5bn ($24bn). The debt load was equivalent to 9.5 times its earnings before interest, tax, depreciation and amortisation at the end of 2014, well above the international standard for excessive leverage of 8 times ebitda.

However, Kalai Pillay, a director at the Fitch credit-rating agency, said ChemChina’s status as an enterprise owned by Beijing’s State-owned Assets Supervision and Administration Commission (Sasac) ensures that it can get “unlimited access to funding from state banks”.

But there is a danger for Syngenta and other acquisition targets. If Chinese state backing for an overseas deal starts to ebb, then a highly-indebted parent company could squeeze its new subsidiary for dividends to repair its balance sheet, Mr Pillay said.

Such concerns, in the case of ChemChina, are exacerbated by a scattergun pattern to the company’s acquisitions, raising doubts over where its strategic priorities lie. The company’s core business involves oil, pesticides and animal feed, but it has recently bought Pirelli, the Italian tyremaker, for $7.9bn and agreed to pay $1bn for KraussMaffei, the German machinery company.

Questions over the strategy and sustainability of China Inc’s outward embrace do not end with ChemChina. Zoomlion, a lossmaking Chinese machinery company that is partially state-owned, made a $3.3bn bid for US rival Terex last month. Its total debt stands at 83 times its ebitda.

“Zoomlion’s bid is a desperate attempt to remain relevant,” said Mr Pillay.

Fosun International, a serial Chinese acquirer that spent $6.5bn on stakes in 18 overseas companies during a six-month period last year, had a total debt load 55.7 times its ebitda in June 2015. Fosun has bought brand names such as Club Med and Cirque du Soleil as well as a host of other assets including the German private bank Hauck & Aufhaeser.

chart: China companies debt

Similarly, the high-profile acceptance by Greece of a €368.5m bid by China Cosco Holdings for the Piraeus Port Authority, heralds the acquisition of one debt-ridden enterprise by another. Cosco had total debts equivalent to 41.5 times its ebitda last September, but has promised to invest €500m in the Greek port.

Cofco Corporation, which recently reached an agreement with Noble Group under which its subsidiary, Cofco International, would acquire a stake in Noble Agri for $750m, has total debts equivalent to 52 times its ebitda. Bright Food, which bought the breakfast group Weetabix for $1.2bn last year, has total debt at 24 times ebitda.

Diversification away from China’s slowing domestic economy has been one motivator behind the surge in outbound acquisitions, said David Lubin, head of emerging markets economics at Citi, an investment bank.

In recent decades, Chinese companies had been largely content to earn renminbi revenues because of a consensus that the Chinese currency was undervalued and because the return on capital inside China was strong.

“Now this has all changed. The return on capital inside China has fallen, the renminbi is no longer obviously undervalued and the capital account has been opened, allowing outward investment,” Mr Lubin said.

《华尔街日报》2016.02.17

Ingram Micro to Become Part of China’s HNA Group in $6 Billion Deal

Tianjin Tianhai Investment to pay $38.90 a share for technology and supply chain company

Technology distributor Ingram Micro Inc. agreed to be acquired for about $6 billion by a unit of Chinese conglomerate HNA Group.

The deal is the latest in a string of investments by Chinese companies in U.S. tech companies, including deals involving U.S. makers of computer chips that have attracted scrutiny on national-security grounds.

Ingram, founded in 1979, is one of the largest distributors of personal computers and other technology products including printers, scanners, TVs, videogame consoles, video monitors and software. The Irvine, Calif., company recently branched into a range of higher-margin professional services.

HNA’s Tianjin Tianhai Investment Co. will pay $38.90 a share for Ingram, representing a premium of about 39% over the average closing share price of Ingram Micro for the 30 trading days ended Tuesday. Ingram shares rose 23.6% to $36.65 in after-hours trading.

HNA Group, which claims more than 180,000 employees, evolved from marine shipping into operations that include transportation, logistics, tourism, banking and insurance. Its logistics group includes companies such as Jinhai Heavy Industry Co.

Alain Monié, Ingram Micro’s chief executive, said the deal would allow his company to accelerate investments in technology while becoming part of a larger organization with “complementary logistics capabilities and a strong presence in China.”

Chinese companies have become more aggressive lately in pursuing deals amid concerns about China’s weakening economic growth, investment bankers say.

In January, Zoomlion Heavy Industry Science & Technology Co. offered to buy U.S. crane-maker Terex Corp. for about $3.3 billion, an attempt to override an existing deal between Terex and Finland’s Konecranes Oyj.

In December, a group including China Resources Microelectronics Ltd. and Hua Capital Management Co. made an unsolicited bid for Fairchild Semiconductor International Inc., which already had a deal with U.S. chip maker ON Semiconductor Corp.

Fairchild on Tuesday rejected the Chinese proposal, stating a preference for the ON transaction. Fairchild cited, among other factors, risks that the deal would be rejected by U.S. authorities on national-security grounds.

Royal Philips NV in January terminated the planned $2.8 billion sale of most of its lighting components and automotive-lighting unit to a Chinese investor, after the U.S. Committee on Foreign Investment blocked the deal on national-security grounds.

Many technology companies use Ingram to run their supply chains. Ingram, a longtime wholesaler of computer components and peripherals, launched a third-party logistics unit in 2000.

The U.S. company has completed many acquisitions over the years, like a deal for e-commerce fulfillment company Shipwire. It launched a cloud-computing-services portfolio in 2007.

For the nine months ended Oct. 3, Ingram posted sales of $31.7 billion. In late October, it projected fourth-quarter sales of $12 billion to $12.6 billion.

Along with the deal, Ingram Micro is suspending its quarterly dividend payment and its share-repurchase program. Ingram’s management team will stay in place, including Mr. Monié, and the company will remain in Irvine, Calif.

The boards of both companies have approved the transaction, which is expected to close in the second half of the year.

《金融时报博文》

(点击放大)

《金融时报》

China’s renminbi bears should beware

Dan Bogler,2016.02.09

The People’s Bank of China still has the determination and the capacity to hold the line

Where once China could do no wrong in the eyes of investors, many are now too negative about the country.

This applies to its economy, which is slowing but not crashing, as resilience in consumer spending and the property market offsets sharp declines in heavy manufacturing; and it applies even more to its currency, with the bears who are betting on a sharp devaluation of the renminbi likely to be frustrated.

At first sight, the pessimists have a case. The People’s Bank of China announced over the weekend that its foreign exchange reserves fell by $99.5bn to $3.23tn in January. Ignore the fact that this was actually less bad than feared, and the counterargument that the figure was manipulated (since it was just a little too conveniently below $100bn). The truth is that FX outflows of this magnitude are simply not sustainable in the long run.

While China’s international reserves remain the largest in the world, they have dropped nearly three quarters of a trillion dollars since their peak in late 2014 as Beijing has spent heavily, indeed desperately, to shore up the renminbi. But ever since the mishandled tweak to its currency regime last August, the markets have lost confidence in the capabilities of China’s policymakers — and expressed that in increasingly heavy bets on renminbi depreciation through the CNH (the offshore version of the currency).

These speculators believe that at some point soon the PBoC will no longer be able to tolerate the rapid decline in reserves and its impact on domestic liquidity and will be forced into a significant one-off devaluation (of, say, 15-20 per cent) before potentially attempting to refix the renminbi against either the dollar or a broader currency basket.

What this view fails to appreciate, in the view of Medley Global Advisors, a macro research service owned by the FT, is both the determination and the capacity of the Chinese authorities to hold the line, while they work to reduce and eventually reverse the current expectations of further, relentless depreciation.

The first task is to reduce the level of outflows. Here officials are putting in place a plethora of capital controls while increasing their bureaucratic interference and oversight. For example, while households can still exchange up to $10,000 a day, they now need an advance appointment if they want more than $5,000 in hard currency.

Companies are also facing increased paperwork and regulatory checks on current account transactions. Some banks have been suspended from FX transactions, while the purchase of overseas insurance policies via credit cards has also been capped.

While these measures seem small and piecemeal, they could have a meaningful effect on the balance of payments at a time when China is still running a monthly trade surplus and is stepping up attempts to entice inbound capital flows, especially from long-term managers such as central banks and sovereign wealth funds by giving them greater access to various markets, such as the domestic interbank bond market.

Another aspect that is often ignored is that a sizeable portion of China’s recent FX outflows has been due to its companies repaying overseas debt . . . an outflow for sure, but perhaps a “good” one and certainly one that will decline as those liabilities are reduced from overly high levels.

Meanwhile, another chunk of the reduction in reserves is down to changes in portfolio valuations — looking at differences between data from the PBoC and Safe (the foreign-exchange regulator) suggests that fully a third of last year’s “outflows” were really just valuation adjustments.

Finally, Beijing will do its utmost to keep its currency stable ahead of hosting a G20 finance ministers meeting in late February, while the dollar’s recent weakness (over the past week or so) is undoubtedly relieving pressure on the PBoC.

So if the central bank can get past Chinese new year and the G20 to the meeting of the National People’s Congress in March, it should then be able to rely on further domestic policy support to help stabilise the economy. Until then, it seems prepared to continue intervening and enhancing the capital restrictions that have already been put in place.

China’s policymakers do not appear ready to give up the fight and the currency bears should beware.

【舒立观察】从美国大选看中美关系

随着预选日前在艾奥瓦州和新罕布什尔州举行,美国2016年总统选战序幕已经拉开。中美战略关系正经历重大而复杂的变化,而这场大选没有现任总统或其班子成员寻求连任或参选,因此,未来中美关系走向如何,令人关切。

奥巴马总统任上八年,是世界格局和中美关系风云激荡的八年。2008年,全球金融危机爆 发,全球经济的结构性失衡的弊端尽显,中美互为因果的贸易失衡关系难以为继,由此酿出重重矛盾。危机后,中国在全球经济重要性相对上升,寻求在国际舞台更 大的发言权,包括参与G20等全球治理机制、推动IMF改革、建立金砖银行和亚洲基础设施投资银行等国际金融机构、加入IMF特别提款权货币篮子以推动人 民币国际化。在美方看来,这些举措挑战了其在全球经济事务上的传统主导权。中国扩大的政治军事影响力,也让个别邻国产生了疑惧。在此背景下,奥巴马政府一 度力推“重返亚洲”策略,以图夯实美国在亚太经济与政治事务中的领导力,却因乌克兰危机、中东局势恶化和“伊斯兰国”的兴起而力不从心。因此,奥巴马的外交政策在美国国内多受诟病,对于更为进取的外交政策呼声强烈。无论是民主党还是共和党胜选,都可以预期,美国对华政策将有显著调整。

同时,美国民众过去几年来对中国印象整体却有所恶化。据皮 尤全球研究中心2015年9月公布的一项报告,2013年以来,美国民众中对中国持有偏负面印象的比例超过了一半,比对中国抱有正面印象的比例竟高出15 到20个百分点。这逆转了2012年之前几年美国民众对中国总体更抱好感的情况。

这些因素自然反映到美国两党参选人的竞选话语中去。当前,预选辩论焦点仍以国内事务为主,但是,各位候选人都已不可避免地谈到了中国。对华贸易逆差和就业转移,是横贯左右的一致关切,从关注劳工权益和社会公平的民主党左翼参选人桑德斯(Bernie Sanders),到依靠煽动排外情绪获取人气的共和党参选人特朗普(Donald Trump),无不把这类问题挂在嘴边。不止于此,南海问题、网络安全、气候变化等,也频繁出现在参选人关于中国的评论中。众所周知,两党中,共和党更具现实主义思维,也更强调从军事层面制衡中国。来自佛罗里达州的联邦参议员鲁比奥(Marco Rubio)和来自得克萨斯州的联邦参议员克鲁兹(Ted Cruz)对中国批评最为激烈,主张最为强硬。

这并不意味着,这些参选人就一定要与中国为敌。实际上,两 党政客都承认与中国合作的必要。民主党人强调应对气候变化需要各国协力,重视中美经贸关系;共和党人也看到,要解决朝核等全球安全问题,中国不可或缺。在 全球化“你中有我、我中有你”的现实下,管控矛盾、寻求共赢仍是主流。美国政治的多元和制衡特征决定了,极端的政策主张难以占上风;意识形态导向再强烈的 领导人,也须在现实的多重博弈中找到理性落脚点。政客们在竞选阶段为吸引一部分选民而不无夸张的主张,进入实际政策制定和执行阶段,必然要受到多元利益的 约束,趋向缓和。

但是,随着世界经济与政治格局的演化,特别是中国更加积极 地参与塑造世界秩序,中美关系必将进一步复杂化。经济上,两国还将相互渗透依赖,同时面临永恒的利益竞争;政治上,两国体制的反差日益凸显,对话的机会增 多但沟通的难度却在加大。中美和平共处,需经过双方努力方可达致。中国领导人提出建立“新型大国关系”,显然是意识到了这种复杂性的挑战。其要义是管控分 歧、防止战略误判。不过,要真正避免守成大国与崛起大国必有一战的“修昔底德陷阱”,并不能仅仅依靠两国领导人的承诺和意愿,更要正视两国结构性矛盾在各 自社会造成的深刻影响,并加以妥善应对。

格外需要警惕的,是被猜忌与怨恨所绑架的民族主义情绪。毋 庸讳言,民族主义抬头,是当今世界范围内的普遍现象。这恰恰是全球化深化后经济社会矛盾积聚的表现。即便在深深受益于全球化的美国,就业流失、贫富差距导 致社会愤懑不断郁积,在此次大选中便被特朗普等“另类”政客所发掘,发出贸易保护、拒斥移民的经济民族主义主张。在中国,民族主义则与不断被强化的屈辱历 史记忆、“冷战”斗争经历相交织,被30多年艰苦生聚的国力相催化,形成一股日益难以掌控的能量。负面情绪需要充分的公共空间来表达和释放,否则,它便可 能如洪峰激流通过狭窄河道,随时可能迎头相撞。

37年前的春节,邓小平访美,为中国改革开放营造了长期有 利的外部环境。如今,中国面临全面深化改革、转变发展方式等重重挑战,同样需要稳定的外部环境。中美关系是全球最重要的双边关系。透过此次美国大选,中国 方面可真切感知美国民众如何看待“中国影响”,知己知彼,寻求理性应对之策