笨狼发牢骚

发发牢骚,解解闷,消消愁

正文

大题昨天说了,美国一季经济几乎停止不前,美国一季经济失望:

确实没面子。圆场的说,还好了,没减产,而且,同比还不赖:

有人说中国也就这水平(不是剥去通胀后的,大家常说的增长值),因为一季度中国整个物价贬值(通缩),“名义上”的总产值增长率很低。美国要跟中国比个头,就看这“名义上”的总产值,所以赶上中国了。

对整天为三顿发愁的人来说,这无异扇了个耳光,整个没心没肺,因为工资没涨,通胀,穷人越穷,而富人的资产者增值了,更有钱了。

什么撑着本季度的经济了?厂家的库存(Inventory):

这说明企业厂家信心十足,开足工厂生产。在美国的“老常态”讲到美国去年下半年总产值说,医保消费是主力(本季还是,见下),这次没有库存(Inventory),或“囤积”,总产值增长率非得是负的不可。

昨天联储定论,“暂时性的”,皆因一季天气影响,以后会好的。不信的:

华盛顿邮报博文:Why you should be skeptical of the biggest excuse for the weak economy

专门点批了经济学家Kellner的意见:Opinion: Second-quarter GDP will tell the tale。

联储也有道理,美国就业还是稳健,今早失业报告说,领救济金的人15年来最低了:

联储的话有分量,因为联储说什么,对美元又直接的影响,不但对美国进出口至关重要,还影响着石油(和黄金)。这是美元小时图,美元开始大跌,联储表态后反弹:

最烦的是经济学家,老说都知道了,老错,还活的好好的。

出口拖了总产值后腿,什么帮了忙?消费的项目里:

医保、房子维修保暖之类是主力。

但整个消费虽然没死,也马马虎虎,还能撑着吗?

投资低迷,油价、页岩油业的影响,还是整体经济?

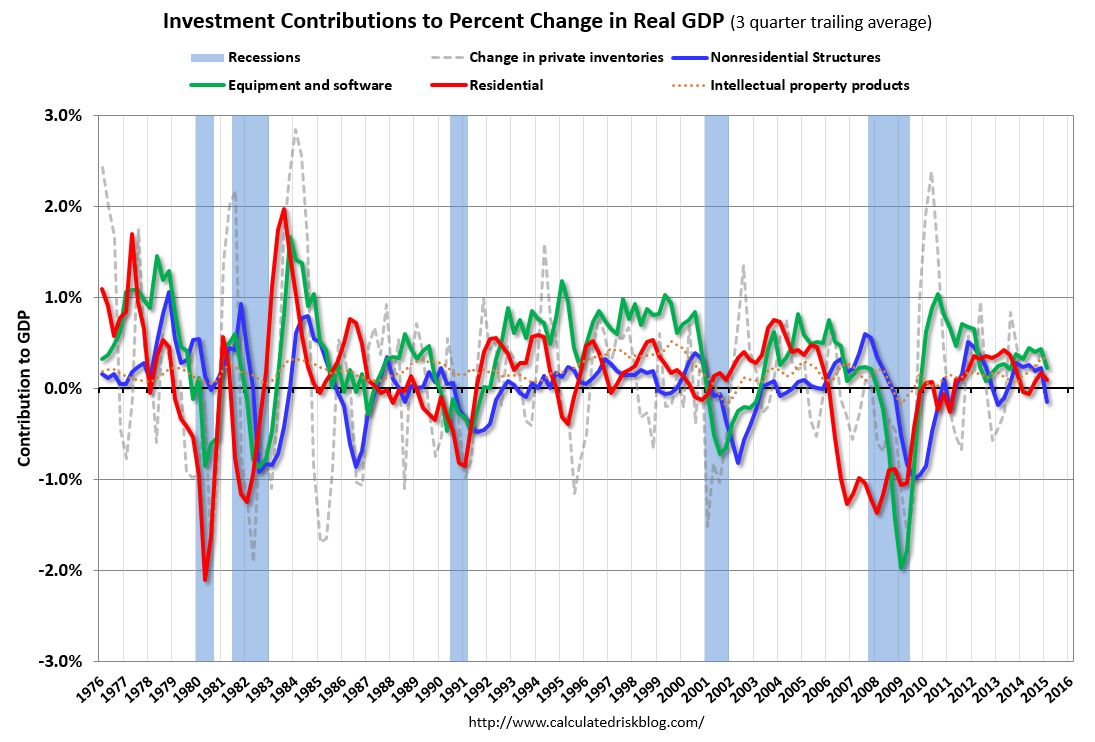

还是投资图:

房产业投资:

房产业投资占经济的比例:

感觉是美国百姓不会有反应,接着花钱。

(点击放大)

我们不惧!

现实如何呢?一季度预测最准的联储亚特兰特分行如是说:

一季成绩:

还是一团糟。美国人得使劲儿。

确实没面子。圆场的说,还好了,没减产,而且,同比还不赖:

有人说中国也就这水平(不是剥去通胀后的,大家常说的增长值),因为一季度中国整个物价贬值(通缩),“名义上”的总产值增长率很低。美国要跟中国比个头,就看这“名义上”的总产值,所以赶上中国了。

对整天为三顿发愁的人来说,这无异扇了个耳光,整个没心没肺,因为工资没涨,通胀,穷人越穷,而富人的资产者增值了,更有钱了。

什么撑着本季度的经济了?厂家的库存(Inventory):

这说明企业厂家信心十足,开足工厂生产。在美国的“老常态”讲到美国去年下半年总产值说,医保消费是主力(本季还是,见下),这次没有库存(Inventory),或“囤积”,总产值增长率非得是负的不可。

昨天联储定论,“暂时性的”,皆因一季天气影响,以后会好的。不信的:

华盛顿邮报博文:Why you should be skeptical of the biggest excuse for the weak economy

专门点批了经济学家Kellner的意见:Opinion: Second-quarter GDP will tell the tale。

联储也有道理,美国就业还是稳健,今早失业报告说,领救济金的人15年来最低了:

以前多次说过,美国如火如荼的经济主要体现在就业上,总产值很难见到,资产也增值,穷人未必得到多大的好处。

参见我的其它经济帖子

联储的话有分量,因为联储说什么,对美元又直接的影响,不但对美国进出口至关重要,还影响着石油(和黄金)。这是美元小时图,美元开始大跌,联储表态后反弹:

最烦的是经济学家,老说都知道了,老错,还活的好好的。

Deutsche Bank's (德银) US chief economist Joseph Lavorgna(吹鼓手) — writing before the release — picked up on the uncertainty it creates: "These figures are highly preliminary and prone to massive revisions. Last year, the first reading on Q1 output was reported at 0.1%, only to be revised down to -1.0% one month later and then to -2.9% one month after that."

...

Additionally, there was a much larger inventory build ($110 billion) in Q1 than what we had expected—it added 74 basis points to Q1 real GDP. This was the largest inventory accumulation since the $116.2 billion build in Q3 2010. Given the fact the various regional purchasing manager surveys have been weak in April, it appears that producers will allow inventory positions to run off. This tells us that current-quarter growth is likely to run around 2.5%, not the 4% snapback we had previously been anticipating.

强劲美元对出口的影响

华尔街日报(悲观居多) “In an entirely unsurprising turn of events, first quarter GDP was weaker than expected, growing just 0.2% as compared to the 1.0% rate expected. To repeat a refrain of ours, weakness in the first-quarter GDP report is not exclusive to 2015; we’ve seen this for the entire recovery….Our working assumption is that this quarter, like previous first quarters, will be the year’s low point and the economy should accelerate from here. Admittedly, the data does not yet support the type of snapback seen in 2014, but more growth is better than less and we expect that to occur this year.” –Dan Greenhaus, BTIG

“You were forewarned. First-quarter economic activity was not pretty. But that was pretty ugly. Real GDP in the first quarter barely registered a gain, rising just 0.2% annualized, the slowest pace since the polar-vortex quarter a year ago. (And before that, the fourth quarter of 2012.) But the positive takeaway is that all of the temporary factors that held activity back were just that–temporary. And the second quarter is widely expected to rebound.” –Jennifer Lee, BMO Capital Markets

WSJ’s Josh Zumbrun joins MoneyBeat and explains whether surprisingly downbeat first-quarter GDP report should be seen as a blip or a trend.

“The U.S. economy all but stagnated in the first quarter, as lower energy prices triggered a big drop in mining investment, but did little to boost consumer spending because of the impact of the unseasonably cold winter in the Northeast. The 0.2% annualized gain will raise fears that the recovery is somehow coming off the rails but, just like last year, we anticipate a marked acceleration in growth over the remaining three quarters of this year. Over the past 12 months the economy has expanded by 3% and we would expect it to continue growing at around that pace this year too.” –Paul Ashworth, Capital Economics

“A quick look at the underlying numbers suggests few surprises. Consumption of +1.9% was okay, not great, and concentrated in weak durables demand. Business investment was very poor, falling 3.4%, which a bit weaker than our numbers, revised in the wake of durables. Exports lower, imports higher. That’s the clearest evidence that the rising dollar is impairing growth, though the number was a bit worse than we’d forecast. Further declines in defense spending were also a decent headwind for the quarter. This is another quarterly number which confirms the long term ‘slo-gro’ thesis, but there are good odds we get a bit of a bounce later in the year from (a) stabilized business spending and (b) the housing markets, which are setting up quite promising.” –Guy Lebas, Janney Montgomery Scott

“In short, even weaker than expected. We believe weakness was grossly exaggerated and there will be significant catchup in the second quarter, but, of course, that remains to be seen. Apart from fundamental slowing and normal volatility, possible factors include harsher-than-usual winter weather, port delays and seasonal adjustment problems relating to the first quarter specifically. More fundamentally, lower oil prices account for the plunge in the mining component of business investment in structures, although we think the positive effects of lower oil prices will ultimately offset the negative effects. Also, not all the weakening in exports appears to be due to port delays. All in all, we believe the underlying trend is still at least 2.5% and we forecast catchup with a 4.0% pace in the second quarter.” –Jim O’Sullivan, High Frequency Economics

“Most of this deceleration is likely transitory—due in part to particularly bad weather in the first quarter. Growth in the rest of 2015 will most likely be faster than previously projected, as the economy bounces back from this weak start to the year. Yet data on GDP in recent years confirms that the U.S. economy has not reached escape velocity—growth rates have not broken past the 2%-2.5% pace that normally is associated with rapid declines in economic slack. Because growth has been steady for years, it might be tempting for some policy makers to shrug their shoulders and declare that this is the ‘new normal’ and the best we can do. The economic evidence clearly suggests otherwise—this economy still needs active measures to boost demand to achieve a full recovery. At a minimum, this means the Federal Reserve should put off interest rate increases for the rest of 2015.” — Josh Bivens, Economic Policy Institute

出口拖了总产值后腿,什么帮了忙?消费的项目里:

医保、房子维修保暖之类是主力。

但整个消费虽然没死,也马马虎虎,还能撑着吗?

投资低迷,油价、页岩油业的影响,还是整体经济?

还是投资图:

房产业投资:

房产业投资占经济的比例:

感觉是美国百姓不会有反应,接着花钱。

(点击放大)

我们不惧!

现实如何呢?一季度预测最准的联储亚特兰特分行如是说:

一季成绩:

还是一团糟。美国人得使劲儿。

评论

目前还没有任何评论

登录后才可评论.