笨狼发牢骚

发发牢骚,解解闷,消消愁国际货币基金组织,世行纷纷举手投降。

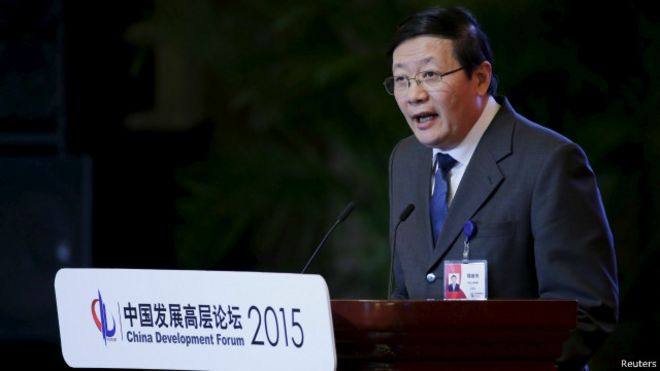

原中金董事长、亚投行多边临时秘书处秘书长金立群

《华尔街日报》

U.S. to Seek Collaboration With China-Led Bank

Obama administration proposes co-financing projects with new Asian Infrastructure Investment Bank

By Ian Talley, March 22, 2015 7:18 p.m. ET

【注】华尔街见闻翻译,中国真快。

WASHINGTON—The Obama administration, facing defiance by allies that have signed up to support a new Chinese-led infrastructure fund, is proposing the bank work in a partnership with Washington-backed development institutions such as the World Bank.

美国人世行行长金墉(Jimmy Kim)

【插入:环球时报综合报道】世界银行行长金墉日前公开表示,支持中国筹建亚洲基础设施投资银行(亚投行),他丝毫没有感到世行会因此受到威胁。这引起美国媒体的不满,美国《华盛顿时报》26日称,金墉是“奥巴马政府提名的世界银行行长”,却在此问题上与奥巴马意见相左。美国“国家利益”网站27日发文称,亚洲大部分发展中国家都加入了亚投行,但发达国家很多都没有参加,“他们的解释都是技术层面原因,如资本量、管理结构和过程等,但潜在的原因都是:美国不同意”。】

The collaborative approach is designed to steer the new bank toward economic aims of the world’s leading economies and away from becoming an instrument of Beijing’s foreign policy. The bank’s potential to promote new alliances and sidestep existing institutions has been one of the Obama administration’s chief concerns as key allies including the U.K., Germany and France lined up in recent days to become founding members of the new Asian Infrastructure Investment Bank.

The Obama administration wants to use existing development banks to co-finance projects with Beijing’s new organization. Indirect support would help the U.S. address another long-standing goal: ensuring the new institution’s standards are designed to prevent unhealthy debt buildups, human-rights abuses and environmental risks. U.S. support could also pave the way for American companies to bid on the new bank’s projects.

“The U.S. would welcome new multilateral institutions that strengthen the international financial architecture,” said Nathan Sheets, U.S. Treasury Under Secretary for International Affairs. “Co-financing projects with existing institutions like the World Bank or the Asian Development Bank will help ensure that high quality, time-tested standards are maintained.”

Mr. Sheets argues that co-financed projects would ensure the bank complements rather than competes with existing institutions. If the new bank were to adopt the same governance and operational standards, he said, it could both bolster the international financial system and help meet major infrastructure-investment gaps.

No decision has been made by the new Chinese-led bank about whether it will partner with existing multilateral development banks, as the facility is still being formed, though co-financing is unlikely to face opposition from U.S. allies.

Zhu Haiquan, a spokesman at China’s embassy in Washington, said Beijing is open to collaboration with the existing institutions and that the new bank “is built in the spirit of openness and inclusiveness and will follow high standards.”

“It will effectively cooperate with and complement the existing multilateral development banks such as the World Bank and the Asian Development Bank to provide investment and financing for the infrastructure building in Asia,” he said.

World Bank President Jim Yong Kim said through a spokesman that he and his lieutenants are already in “deep discussions” with the new Asian Infrastructure Investment Bank “on how we can closely work together.”

The U.S. suffered a diplomatic embarrassment last week after several of its key European allies publicly rebuffed Washington’s pleas to snub Beijing’s invitations to join the bank and instead said they would be founding members.

Backing the new bank through co-financing could also help the U.S. move past the diplomatic mess, reunite with its trans-Atlantic allies on this issue and counter any perceptions that the U.S. is wholly opposed to the institution as part of a China-containment strategy.

“Our concern has always bee…will it adhere to the kinds of high standards that the international financial institutions have developed?” U.S. Treasury Secretary Jacob Lew told U.S. lawmakers last week.

Co-financing, combined with European membership, “will make it more likely this institution largely conforms to the international standards,” said Matthew Goodman, an Asia expert at the Center for Strategic and International Studies adviser and former economics director at the U.S. National Security Council.

The World Bank, forged out of World War II, remains the leading international development institution with 188 nations as members. But others have emerged amid concerns about drawing more investment and attention to fast-growing regions. Those include the Asian Development Bank, the African Development Bank, European Investment Bank and the Inter-American Development Bank.

The banks’ loans are designed to foster infrastructure and development projects that are often high-risk and long-term, helping to lower the costs for governments that couldn’t afford borrowing from the private sector. For the most powerful lending countries, they cultivate regional growth prospects and can provide a political tool for influencing smaller countries.

Beijing has struggled to increase its influence within the World Bank, the Asian Development Bank and the world’s emergency lender, the International Monetary Fund. But as the founder and one of the new bank’s largest shareholders, it will have the greatest say in which projects to pick.

Infrastructure needs around the world are enormous. Emerging countries need new ports, railways, bridges, airports and roads to support faster growth. Developed economies, meanwhile, must replace aging infrastructure. The Asian Development Bank estimates its region alone faces an annual financing shortfall of $800 billion a year. The consulting firm McKinsey & Company estimates global infrastructure-investment needs through 2030 total $57 trillion.

By comparison, the Asian Development Bank has just $160 billion in capital and the World Bank-which has co-financed with other regional institutions for years—has around $500 billion. The China-led bank plans to have a $50 billion fund to start.

“We have every intention of sharing knowledge and co-investing in projects throughout Asia,” said Mr. Kim, who was picked by President Barack Obama in 2012 as the U.S. nominee to lead the World Bank.

“From the perspective simply of the need for more infrastructure spending, there’s no doubt that we welcome the entry of the Asian Infrastructure Investment Bank,” Mr. Kim said.

The brouhaha over the new bank highlights the growing complexity of the West’s relationship with China’s emerging power.

“In the European countries, there were often divides between the finance ministries that saw commercial opportunities and the foreign ministries that have some of the same concerns we do,” a senior U.S. administration official said.

Beijing has set up more than a dozen parallel structures that challenge the established international order, from the Chiang Mai Initiative, a regional currency swap facility designed to mimic the International Monetary Fund, to the Brics bank, an infrastructure bank named after the world’s largest emerging market economies.

But without the standards that the World Bank and other U.S.-influenced lending facilities have developed over decades, China’s new bank risks fomenting distrust with the U.S. and creating a host of social and economic issues. It could also help subsidize Chinese corporate interests.Lack of transparency in the new bank’s governance could nurture suspicion, for instance, about whether Beijing would use its financing to develop deep-water ports in strategic harbors that could accommodate China’s growing navy. Lending to countries without consideration of whether governments can pay back the loans could sow the seeds for future financial crises. Investment in dams that required massive population relocation could, without adequate safeguards, fuel human-rights abuses.As China’s economy slows faster than expected, the country faces growing spare-production capacity. Infrastructure investment could help sop some of that excess capacity up, as well as offer higher returns on its trillion-dollar holdings of low-interest U.S. Treasurys.

But while wary of China, Washington has at the same time been trying to pull the country into the global political and economic architecture based on the theory that Beijing’s participation cultivates greater responsibility. Co-financing could become a steppingstone for the U.S. to join in a few years.

That’s why economists such as Fred Bergsten, a senior fellow at the Peterson Institute and a former senior U.S. Treasury official, pushed for the U.S. to join the China-led bank.

“If this does meet high standards, then that would be a good thing and we’d take a look at it,” the senior administration official said. “But we’re still a few steps away from that.”

![]()

英国广播公司:Lagarde says IMF to co-operate with China-led AIIB bank

【注】拉加德( Christine Largarde,国际货币基金组织总裁)

International Monetary Fund chief Christine Lagarde has said the IMF would be "delighted" to co-operate with the China-led Asian Infrastructure Investment Bank (AIIB).

The AIIB has more than 30 members and is envisaged as a development bank similar to the World Bank.

Mrs Lagarde said there was "massive" room for IMF co-operation with the AIIB on infrastructure financing.

The US has criticised the UK and other allies for supporting the bank.

'High standards'

The US sees the AIIB as a rival to the World Bank, and as a lever for Beijing to extend its influence in the region.

The White House has also said it hopes the UK will use "its voice to push for adoption of high standards".

Countries have until 31 March to decide whether to seek membership of the AIIB. As well as the UK, other nations backing the venture include New Zealand, Germany, Italy and France.

Mrs Lagarde, speaking at the opening of the China Development Forum in Beijing, also said she believed that the World Bank would co-operate with the AIIB,

China established the Asian lending institution in 2014 and has put up most of its initial $50bn (£33.5bn) in capital.

彭博社评:Who’s Afraid of the Asian Infrastructure Investment Bank?

The U.S. is outraged that European governments are joining China’s alternative to the IMF and the World Bank, but America has no one to blame but itself

英国广播公司中文网:中国财长谈亚投行:西方规则不是最佳

新华网:楼财长呛声亚开行行长:西方规则并非最佳

【后记】

(1)据华尔街日报报道,英德法意之所以加入亚投行,其实中国做了个巨大的让步:放弃否决权。中国是成竹在胸,还是迫不得已?

(2)澳大利亚最终完成形式的一步,申请。