笨狼发牢骚

发发牢骚,解解闷,消消愁今天油价反弹较大,回升到约$46一桶,是刚刚白小时内发生的,对联储“温和的”利率导引而导致美元(指数)大跌的反应。有人说是联储暗使坏招,压住美元,保美国出口。好招坏招,对那些叫嚷人民币崩溃的人,可是一扇子耳光,不光彩。

目前油价低迷,中国中国作为世界第一原油进口国,是得益最大的国家(之一)。大家常常引用的这$46左右一桶的油价,中国能拿到吗?

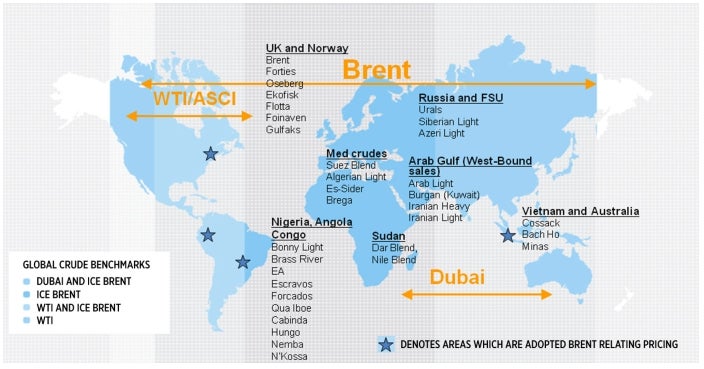

答案是不能。$46一桶,是美国德州中期油价(West Texas Intermediate,简称WTI),只是美国国内才买得到(所以美国得益不小),国际油价要高些,而且多半以博兰特原油(Brent)为准。据投资百科所说,世上大部分是博兰特油:

- Brent Blend – Roughly two-thirds of all crude contracts around the world reference Brent Blend, making it the most widely used marker of all. These days, “Brent” actually refers to oil from four different fields in the North Sea: Brent, Forties, Oseberg and Ekofisk. Crude from this region is light and sweet, making them ideal for the refining of diesel fuel, gasoline and other high-demand products. And because the supply is water-borne, it’s easy to transport to a distant locations.

- West Texas Intermediate (WTI) – WTI refers to oil extracted from wells in the U.S. and sent via pipeline to Cushing, Oklahoma. The fact that supplies are land-locked is one of the drawbacks to West Texas crude – it’s relatively expensive to ship to certain parts of the globe. The product itself is very light and very sweet, making it ideal for gasoline refining, in particular. WTI continues to be the main benchmark for oil consumed in the United States.

- Dubai/Oman – This Middle Eastern crude is a useful reference for oil of a slightly lower grade than WTI or Brent. A “basket” product consisting of crude from Dubai, Oman or Abu Dhabi, it’s somewhat heavier and has higher sulfur content, putting it in the “sour” category. Dubai/Oman is the main reference for Persian Gulf oil delivered to the Asian market.(估计伊朗油属于这种低质油 )

博兰特油价通常比德州中期贵得多:

而且差值(spread)近来有增大的趋势。我猜中国能买到的,即使到期货市场现在买,也得起码是$50一桶的价钱。在美国页岩产业债务堪比中国地方债,面临破产之危里提到,美国法律禁止原油出口(不知道为什么在世贸协议下这是合法的,中国稀土可以学学),不过美国油多到没地儿存了,利润之上,嚷嚷着出口的大有人在。不过该法律,几天改不了,然而一旦允许出口了,国际价压力会加大,博兰特油与德州中期的差值就会减少。

不过,还是好价钱。

相关:

美国页岩产业债务堪比中国地方债,面临破产之危和里面列举的文章。

【参见】

Brent vs. WTI

The Reemergence of the WTI/Brent Spread

【附录】

外媒:中国战略石油储备接近满仓 收储行动暂停

此文是根据以下两篇文章翻译而成:

2015.02.25华尔街日报Forecasting China’s Oil Buying Grows Harder(更详细的翻译)

2015.03.18路透社中国油储接近满仓令进口减慢 市场供应过剩料因此加剧

2015.03.23华尔街日报博客India Won’t Pick Up China’s Oil Slack

这对油价压力就更大了。

世界原油产量状况

(crude + condensate + natural gas liquids: C+C+NGL)

美国《国家利益》

China: The Real Reason for the Great Oil-Price Crash?[1]

Anthony Fensom [2] [3]

Plunging oil prices have sent shockwaves around the world, threatening to topple governments and bankrupt businesses even while U.S. consumers celebrate cheap gasoline.

Yet while rising supply has been largely blamed for the precipitous price fall, China’s lower demand growth and its long-term implications for the global economy have been largely ignored. Is Beijing a winner or loser from cheap oil?

On January 7, U.S. benchmark oil prices dipped below $48 a barrel, the lowest since April 2009 and half the level of just five months ago. The slump follows November’s decision by the Organization of Petroleum Exporting Countries (OPEC) not to curb production, despite surging U.S. shale supply and weakening Asian and European demand.

(Recommended: Can China Rise Peacefully? [4])

China’s role in oil’s rise and fall reflects its re-emergence on the world stage. During the past decade, the communist giant’s industrialization spurt saw it become the world’s second-biggest economy and top consumer of resources such as iron ore and coal, as well as the world’s largest net oil importer.

According to Societe Generale [5], a French multinational banking and financial services company, Beijing’s opening to world trade at the start of the 21st century, signified by its joining of the World Trade Organization in 2001, was responsible for increasing the oil price from around $20 a barrel to $100. During this period, China’s demand grew by the equivalent of Japan and the United Kingdom’s total oil consumption, giving oil markets a similar shot in the arm to that of other commodities.

As a result, China became the world’s largest oil importer in 2013, surpassing the United States, and currently imports nearly 60 percent of its supply.

(Recommended: Would Iran Start a Nuclear War? [6])

‘New Normal’

However, China’s oil demand growth is falling, with Beijing now struggling to prop up a faltering economy. ANZ Research predicts China’s economy will expand by only 6.8 percent in 2015, down from an estimated 7.4 percent last year and the slowest expansion since 1990, amid continued deleveraging and overcapacity in a number of industries.

While now expanding from a much larger base, the nation’s “New Normal Economy”of slower growth is not conducive to another surge in oil demand and prices, argues MarketWatch columnist Craig Stephen.

“The oil market is unlikely to find another country, or even a continent, that can take over this degree of heavy lifting in demand growth. Meanwhile, longer-term forecasts that China can maintain anything close to its recent pace of growth increasingly look misplaced,” he argues.

(Recommended: Machiavelli - Still Shocking After 5 Centuries [7])

Chinese government researchers estimate [8] that there was nearly $6.8 trillion worth of “ineffective investment” in China between 2009 and 2013, which has resulted in massive overcapacity in many Chinese industries. Even some consumer markets appear to be slowing sharply, causing inventories to skyrocket. Most notably, with regards to China’s oil demand, in November, Chinese passenger-vehicle sales posted [9] only a 5 percent gain, a major slowdown compared to previous double-digit rises in the world’s biggest automobile market.

“In the past, demand appeared inelastic as growth continued even as crude prices reached triple-digits. But this period coincided with state-funded industry being the dominant driver, whereas demand for gasoline for cars can be expected to be dependent on the income growth of the middle class,” Stephen says.

(Recommended: Russia's Military is Back [10])

The IEA’s December oil market report [11] notes a “sharp slowdown in Chinese oil demand growth” along with Europe and Japan as contributing to the weak outlook. It estimates total Chinese demand growth of just 2.5 percent in 2014 and 2015, with gains in transport fuels and petrochemical feedstocks only slightly outweighing weakening demand for gasoline, diesel and fuel oil.

Despite recent falls in oil prices, Beijing’s move in late November to hike consumption taxes for oil products has resulted in “little discernible price change to Chinese consumers,” negating an expected economic benefit that would have come from lower prices, the IEA said.

Net Benefit

Yet lower oil prices are still seen as a net benefit for the Chinese economy. Bank of America Merrill Lynch estimates China’s GDP [12] increases by about 0.15 percent for every 10 percent drop in the oil price, with its current account balance growing by 0.2 percent of GDP and consumer inflation declining by 0.25 percentage point.

International Monetary Fund researchers have estimated [13] that falling oil prices could boost China’s GDP by 0.4 to 0.7 percent this year and by 0.5 to 0.9 percent in 2016.

In 2013, China imported around [14] 280 million metric tons of crude oil at a total cost of nearly $220 billion, but recent lower prices could shave more than $30 billion off the bill, Lin Boqiang, director of China Center for Energy Economics Research at Xiamen University, told China’s state media [15].

China’s consumers, manufacturers and transportation companies are major winners from cheaper oil, while the losers include its own energy companies and workers, including its nascent shale gas sector [16].

Falling oil and other commodity prices add pressure on China to devalue its currency to boost exports, potentially sparking a “deflationary wave” emanating from its manufacturing sector, J2Z Advisory’s Jay Pelosky told the Australian Financial Review.

Chinese producer prices have fallen by 10 percent over the past three years and annual inflation is at only 1.5 percent, indicating the extent of the deflationary threat.

Even at $60 a barrel, global inflation is set to plunge to levels not seen since the global financial crisis, from 1.5 percent to 1 percent, although it would still lift global economic growth by 0.5 percentage point, according to JP Morgan Securities. [17]

For a global economy already struggling to cope with deflationary downturns in Europe and Japan, China’s slowdown would add to the focus on the United States as the key driver of global growth, along with Asia’s emerging economies.

Politically, oil’s slide has the potential to reduce geopolitical instability by weakening anti-Western nations.

“Any massive redistribution of income can raise political tensions,” Berenberg Bank economist Holger Schmieding said in a recent [17] research report. “But, net/net, strengthening the U.S., Europe, Japan, China and India, while weakening Russia, Iran, Saudi Arabia and Venezuela, is likely to make the world a safer place in the end.”

However, analysts do not see low oil prices lasting forever, with a rebound to $100 predicted by securities firms [18] Morgans and UBS.

While China is expected to dominate energy demand growth until the mid-2020s, an aging population and declining economic growth could see India become the leading engine of energy demand by 2040, the IEA predicts [19].

The IEA also notes that [20], similar to Washington’s predicament before the shale boom, rising crude oil imports by China and India from the Middle East and other regions “increase their vulnerability to the implications of a possible shortfall in investment or a disruption to oil supply.”

For now though, both Beijing and Washington have much to gain from oil’s sudden slide.

Links:

[1] http://nationalinterest.org/feature/china-the-real-reason-the-great-oil-price-crash-12002

[2] http://nationalinterest.org/profile/anthony-fensom

[3] http://twitter.com/share

[4] http://nationalinterest.org/commentary/can-china-rise-peacefully-10204

[5] http://www.marketwatch.com/story/china-plays-big-role-in-oils-slide-2014-11-30

[6] http://nationalinterest.org/blog/the-buzz/would-iran-start-nuclear-war-11995

[7] http://nationalinterest.org/commentary/machiavelli-still-shocking-after-five-centuries-9126

[8] http://www.ft.com/intl/cms/s/0/002a1978-7629-11e4-9761-00144feabdc0.html#axzz3OF4wVcv6

[9] http://www.bloomberg.com/news/2014-12-05/china-auto-sales-slow-in-november-as-dealer-stockpiles-increase.html

[10] http://nationalinterest.org/commentary/russias-military-back-9181

[11] https://www.iea.org/oilmarketreport/omrpublic/currentreport/

[12] http://www.csmonitor.com/Environment/Energy-Voices/2014/1202/Who-wins-from-low-oil-prices-China

[13] http://blog-imfdirect.imf.org/2014/12/22/seven-questions-about-the-recent-oil-price-slump/

[14] http://www.cnbc.com/id/102238085#.

[15] http://usa.chinadaily.com.cn/business/2014-11/29/content_18997384.htm

[16] http://nationalinterest.org/feature/china-the-next-shale-gas-superpower-11432

[17] http://www.bloomberg.com/news/2015-01-07/oil-at-40-means-boon-for-some-no-ice-cream-for-others.html

[18] http://thediplomat.com/2014/12/low-oil-prices-wont-last/

[19] http://www.worldenergyoutlook.org

[20] http://www.iea.org/media/news/2014/press/141112_WEO_FactSheet_EnergyTrends.pdf

[21] http://commons.wikimedia.org/wiki/File:Oil_platform_in_the_North_Sea.jpg

[22] http://nationalinterest.org/topic/security/energy

[23] http://nationalinterest.org/topic/economics

[24] http://nationalinterest.org/region/asia/northeast-asia/china