我心悠悠

随笔应避免 TLT [大千股坛] -2022-04-11

持有美国国债最保守的方式是持有至到期,保证还本付息,灵活的是它可以在任何时候以市场价格出售,基本上,买债券是把它当作资金库房,获得小红利, 作为跳台,市场时机条件有利于重新做多,卖出债券,买入股票.

每只债券都有到期日,当10年期债券剩余到期日仅剩3年时,也视为3年期债券, 每只债券都有固定的收益率coupon rate, 这个利率是您将获得的股息金额的计算依据. 它不会改变. 所以您会发现你买了不同的3年期债券,实际股息是不同的,那是因为债券票面收益率是固定的, 您购买不同的3年期债券,市场价格将进行调整,因此为什么不同的3年期债券都有大致相同的实际股息率. 每个国债都有一个代码 CUSIP, 国债是在二级市场买/卖,通常经纪人有一个交易屏幕做这个交易

第一部分

(1) 债券的基本概念

以高于账面价值买入的债券叫溢價购买

以低于账面价值买入的债券叫贴现购买

(2) 持有至 到期日 (排除收到的定期股息)

票面價格1000, 財政部將支付 1000.

購買價格 1100, 溢價 100. 資本損失 100

購買價格 900, 贴现 100. 資本利得 100

(3) 在到期日之前賣出 (排除收到的定期股息)

賣出價格扣除購買價格, 交資本利得稅或申報資本損失

- 税务后果请与您的税务会计咨询

- 财政部国债豁免州和地方所得税。

- 债券溢价产生的资本损失可以扣除资本利得吗?

- 贴现债券产生的利润需要支付资本利得税吗?

Do Bonds Bought at a Premium Produce Capital Losses?

Taxable bonds do, but municipals don't. We'll walk you through it.

https://www.thestreet.com/story/906504/1/do-bonds-bought-at-a-premium-produce-capital-losses.html

债券 示例

第二部分

购买中期国债(2-3年到期)[**不是债券基金**] - 这是一个话题,需要一些时间来了解, 还没有成为计划。 当市场处于下跌趋势,债券能够充当临时存放处与跳板. 现在三年期国债 (Treasury Note)市场利率约为2.69%,.

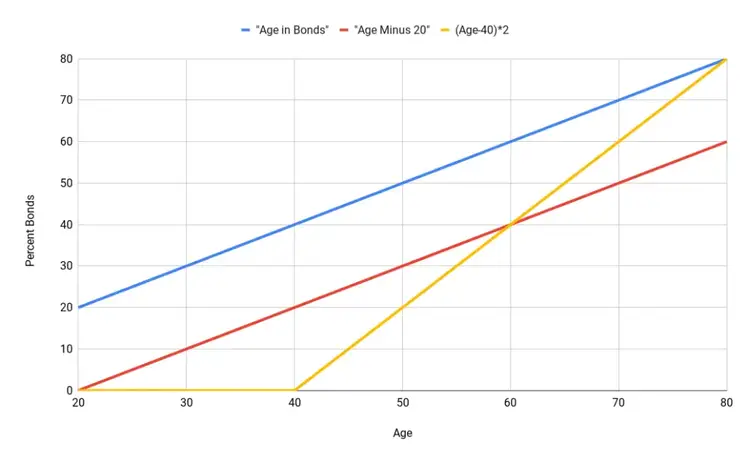

There are several quick, oft-cited model calculations used for dynamic asset allocation of a portfolio of stocks and bonds by age, moving more into bonds as time passes because they’re safer. For the sake of clarity and consistency of discussion, we’re going to assume a retirement age of 60.

- The first and simplest adage is “age in bonds.” A 40-year-old would have 40% in bonds. This may indeed be fitting for an investor with a low tolerance for risk, but is too conservative in my opinion. In fact, this conventional wisdom that has been repeated ad nauseam goes against the recommended asset allocations of all the top target date fund managers. This calculation would mean a beginner investor at 20 years old would already have 20% bonds right out of the gate. This would very likely stifle early growth when accumulation is more important at the beginning of the investing horizon.

- Another general rule of thumb is a more aggressive [age minus 20] for bond allocation. This calculation is much more in line with expert recommendations. This means the 40-year-old has 20% in bonds and the young investor has a portfolio of 100% stocks and no bonds at age 20. This also yields the stalwart 60/40 portfolio for a retiree at age 60.

- A more optimal, albeit slightly more complex formula may be something like [(age-40)*2]. This means bonds don’t show up in the portfolio until age 40, allowing for maximum growth while early accumulation is more important, then accelerating the shift to prioritizing capital preservation nearing retirement age. This calculation seems to most closely follow the glide paths of the top target date funds.

Generally speaking, it could be said that these 3 formulas coincide with low, moderate, and high risk tolerances, respectively.

illustrates the 3 formulas above in the chart below: