股市小书生

价值投资

Nortel 曾经占有加国市场股指的30%,在Nortel的整个经营个过程中从未出现过有盈利的季度,也就是说Nortel这门生意在经营活动中从来没有过盈利 。

Operations not meeting these requirements are speculative.” - Benjamin Graham

我们不难理解,在 Nortel 的整个历史中,没有任何一个时刻存在合理的投资机会和理由,你只能用纯粹的投机方式参与其中。绝大的多数人会抵制不住或主动喜欢这类的市场诱惑,但它不会发生在成熟的投资者身上。

To be a successful investor, you have to have a philosophy and process you believe in and can stick to, even under pressure. Since no approach will allow you to profit from all types of opportunities or in all environments, you have to be willing to not participate in everything that goes up, only the things that fit your approach. To be a disciplined investor, you have to be able to stand by and watch as other people make money in things you passed on. - The truth about investing.

因为无法在任何时候找到充分的投资理由去投资Nortel, 所以Nortel在任何时候都不是一个值得投资的机会。

投资者与创业者是有区别,创业者可以尝试做改变世界的事,但是投资者从来只做高确定性的事,Nortel这门生意从未挣过钱,这是我们投资者不喜欢和不能接受的。

相比之下,黑莓的早期商业价值是确定, 存在合理的投资机会,早期投资者也是获利。主要的问题是后来的竞争失利,且无法扭转。在黑莓的后期商业变化中,我们可以借鉴前辈的投资经验。

"Both our operating and investment experience cause us to conclude that turnarounds seldom turn," Buffett wrote in 1979

认识到黑莓的商业竞争优势的迅速退化是非常简单的事,但是放弃对“Turnaround“的幻想是很难的,即使是加国最优秀的投资者也深陷其中。

投资并不需要完美,也不可能完美。在投资中有失败是一种常态。

"I have never met a rich man who hasn't lost a lot of money, but I have met a lot of poor men who have never lost a dime"

- Rich Dad and Poor Dad

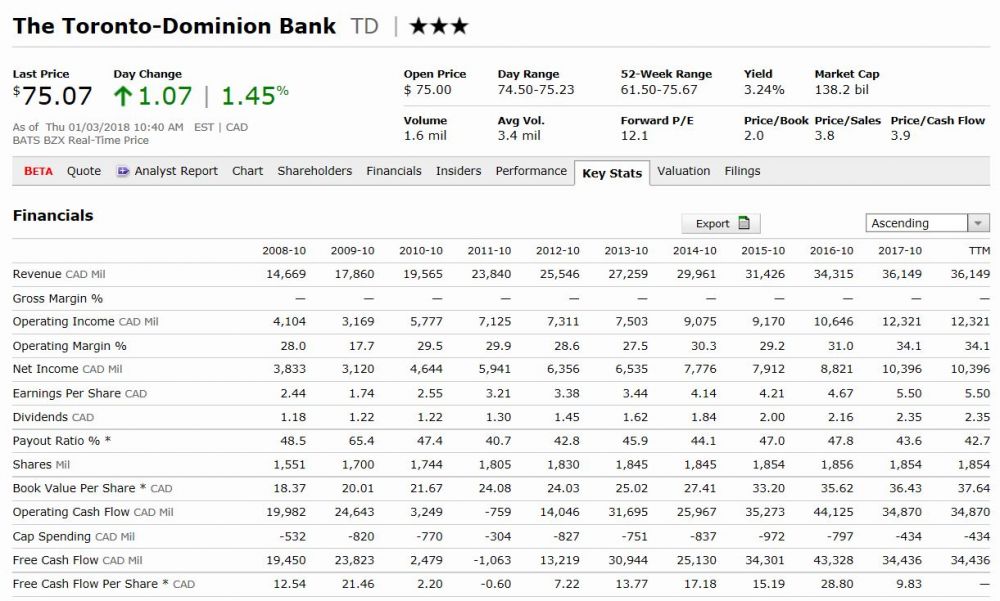

我们假设2000在Nortel, 黑莓和TD各投入1万,今天将Nortel和黑莓清零,TD的市值是7万多,所以在33%的成功概率下,也还是处于赢利状态的。我们能够承受投资中不可避免的失败部分。

The average P/E ratio for Japanese stocks in 1989 was about 70.

说实话,我不太明白为什么要去讨论一个PE值70的市场,没有任何意义。

1998年可口可乐PE值95,之后发生的一切仅仅是正常的价值回归,没有任何特别之处。

Chairman J. William Fulbright: What causes a cheap stock to find its value?

Benjamin Graham: That is one of the mysteries of our business, and it is a mystery to me as well as to everybody else. [But] we know from experience that eventually the market catches up with value.

Testimony to the Congressional committee on Banking and Commerce, Chairman: Senator Fulbright (1955).