股市小书生

价值投资Because of the under-performance of most of the nifty fifty list, it is often cited as an example of unrealistic investor expectations for growth stocks. - Wikipedia

只要是对美国股市历史有一些了解的人,都知道 Nifty Fifty ,股市投资者在投资过程中期望值过高,脱离实际是经常发生的事,从有交易所开始,这类的不理智行为就从来没有中断过,以后也不可能消失。一个最好的例子就是2000科技泡沫,因为这是发生在Nifty Fifty 之后,而且投资者整体都认可了在Nifty Fifty中犯的投资错误,但是大家依然集体重复了之前的相同错误。

Critics of Dividend Growth Investing love bringing up examples of failed companies. Polaroid and Eastman Kodak are two favorites. Sears and Kresge are popular, too.

And when a naysayer really wants to score comment-stream points with like-minded cynics, he or she will smugly ask a buy-and-hold DGI proponent: "Yeah, but what if you had bought the Nifty Fifty?"

Well, here's what-if: I'd be a multimillionaire, thank you.

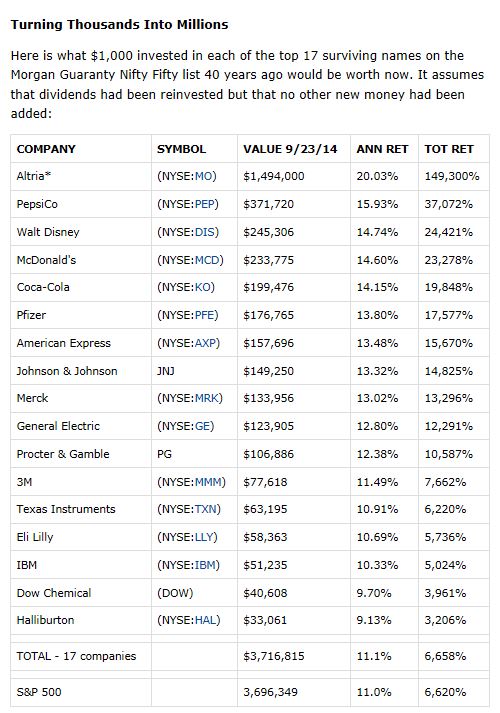

Let's say I had $50,000 to invest 40 years ago. And let's say I bought $1,000 worth of each company in that famous -- some would say infamous -- collection of stocks. That means I not only got Procter & Gamble (NYSE:PG) and Johnson & Johnson (NYSE:JNJ), but I also got stuck with the likes of J.C. Penney and Emery Air Freight.

And no, I haven't forgotten about the outrageous commissions that brokers charged back then. Erring on the side of "Yikes!" let's say each trade cost $100. That means my total investment on September 23, 1974 would have been $55,000.

We now know that Polaroid and Kodak stock went on to be worthless. Other eventual losers included Sears and Schlitz. Still others, such as Gillette and Anheuser-Busch, changed materially through mergers or acquisitions.

But here's the deal: There were some pretty nifty survivors, too.

按照今天的市值,这个投资组合的市价会在500万以上。 Nifty Fifty 是作为一个失败的投资案例写进教科书的,基本上 , 大多数人都会将投资失败归咎于股市和市场,很少有人会愿意承认是投资者自己犯了最基本的常识错误。有多少人愿意承认2000年科技泡沫,自己应该承担最主要的责任,而且是犯了最基本的投资常识错误。大多数人想的只是如果自己能出手快那么一点点 ,。。。。。。

从美国股市的长期投资回报率来看,在整个美国股市历史上还从未出现过一个长期市场投资亏损的投资者。

以平均人口寿命,工作时间,薪酬收入为假设条件。

野花网友的养老金帐户的实例说明大多数中产家庭的投资资产的平均值应该在二百以上,如果是双收入,就是四百万,事实当然并非如此。如果兔子网友使用了与野花相同的长期投资策略,他的投资组合现在也会有二百万以上,一个长期市场均值回报率,兔子的投资回报将是他工资收入的二倍以上,实际情况是兔子刚刚把以前的损失捞回来。

在上面的Nifty Fifty的投资计算中,投资组合从未卖出过一股股票,其中66%的股票清零了,即使是33%存活的股票的投资起始价位也是高估状态。

在投资上,技术要从属于策略,策略要从属战略,战略最终从属于信念和价值观。投资失败和成功的程度,技术层的影响其实很小,策略层的影响有限,大部分结果取决于投资战略是否正确和基本信念的牢靠程度。但绝大多数人每天的眼里都是技术,几天换一个策略,从不思考战略,永远未曾理解和坚守信念。- 水晶苍蝇拍

Nifty Fifty 在投资技术上是彻底失败,买入明显高估的股票,也没有任何的价格波动的交易,策略上马马虎虎,分散在50个股票上,没有明确的重点,没有任何投资分析的主动性,战略上坚持了长期投资,复利投资。

One of my coworker is retiring end this year after working here for 20 years. He own two houses--one for primary living and one for vacation. He bought 12 stocks over the past 20 years. never sale any one. Now, his asset is over 3 M. Our company offer good benefit including health insurance for life. Pention about 100K per year. He will have a good retirement life. 二年前一位网友的跟贴。

这位退休人士在退休后的二年,投资组合大概又升值了一百万(2018年大概也已经有20万升值了),而他在这二年中可能什么都没做,也许连一次的股票交易都没有。 毫无疑问,这是一位业余个人投资者,他的投资方法根源于几十年前的Nifty Fifty, 但是有改进。

比较有意思的是,在NIfty Fifty 的幸存名单里,老巴投资过其中半数的股票,而且有几个是老巴极其重要的投资,这些投资标的,在老巴参与投资的多年之前,就已经用正式的方式公诸于世了。

同样的时代大家其实面临的机会都差不多,区别只在于把握度。- 水晶苍蝇拍