股市小书生

价值投资什么是信念?我来举一个 例子:

“若你要矫情,说要是美国完蛋了呢?美国完蛋呢,那这世界也玩完了,你玩完也无所谓了。” - 大千网友蓝海_蓝海

Why?

不管是什么原因,反正这一次的大牛市不是投资者的救世主。至少大千还没有被拯救。

To get what you want, you have to deserve what you want.

The world is not yet a crazy enough place to reward a whole bunch of undeserving people. - 芒格

为什么在2016年一月,股市下跌幅度最大,老朽发帖调侃股市投资者的时候,小书生要特意和朽哥好好聊聊呢?

我和朽哥聊几句

朽哥的投资成绩确实很棒,我也反反复复的重复这样一句话,“我说过我不反对投资出租房,我要说明的是在股市投资中同样可以实现财务自由。 ”

为什么小书生的一个投资策略一个月的时间就可以实现初级水平的财务自由,绝大多数家庭都具备了实现的硬件条件(财务基础),当然都会缺乏软件条件(投资常识)。

像2016年1月这样的投资机遇以后还会有吗?加国牛市何时到来呀? 没牛市,能有好的投资机会吗?

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

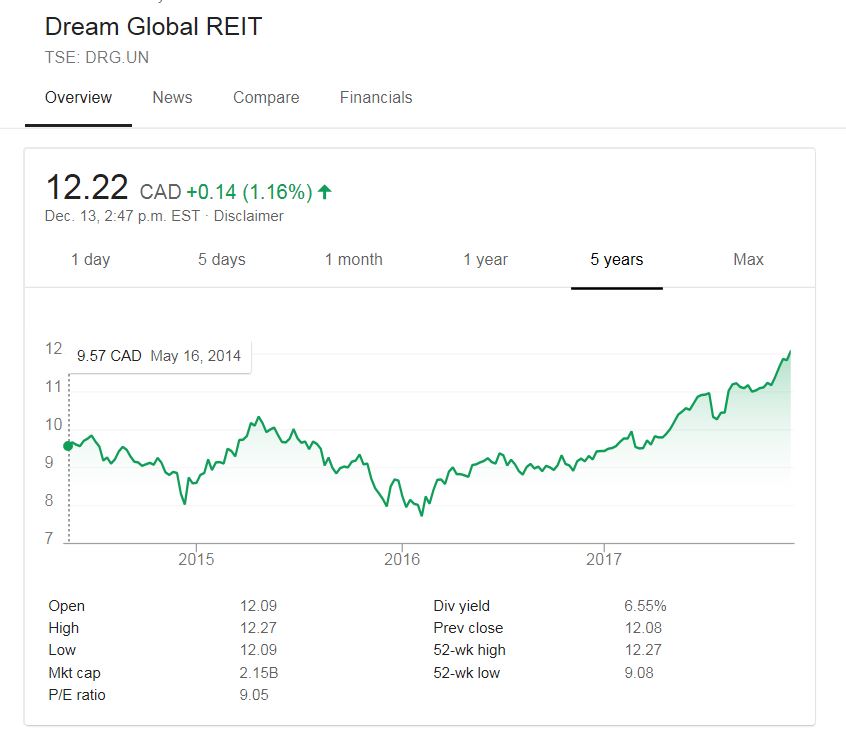

老巴的回答是在2018年像2016.1DRG这样的机会一定有,而且非常多,但是你不可能都能发现(能力圈),可是你一定可以发现那么一二个。发现 以后怎么办呢?

They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.

芒格的回答是 :那么简单的问题,冲上去!。

At Berkshire we focus almost exclusively on the valuations of individual companies, looking only to a very limited extent at the valuation of the overall market. Even then, valuing the market has nothing to do with where it's going to go next week or next month or next year, a line of thought we never get into. The fact is that markets behave in ways, sometimes for a very long stretch, that are not linked to value. Sooner or later, though, value counts. - 巴菲特1999年公开演讲

多年一次的熊市下跌幅度基本上是小于50%,一年一次的个股波动幅度会大于50%,所以老巴的话告诉我们投资个股的机会非常多,因为是每年都发生,大幅度的股价波动与有没有牛熊市没有任何关系。

待续