股市小书生

价值投资在20170503的最新季度报告中,DRG地产基金的经营业绩表现良好,特别是FFO和AFFO的增长,这是该基金从2011年上市以来首次出现的实质性的大幅增长。

HIGHLIGHTS

Continued strong leasing performance supported by robust German fundamentals

Occupancy reaches 90.1% in Q1 2017, the ninth consecutive quarter of occupancy growth and the highest occupancy level in the Trust’s history;

Year-over-year rental rate growth of 7.2% across the entire portfolio to €10.36 per square foot in Q1 2017, reflecting the Trust’s leasing and asset management program;

New record-low in Germany’s office vacancy rate with vacancy rates in the seven largest office markets declining by 100 basis points year-over-year to 5.3% at the end of Q1 2017;

Low unemployment of 4.0% in a continuously strengthening economy with Germany’s Ifo business climate index reaching a 10-year high;

Continuing yield compression in Germany’s largest office markets, fuelled by strong investor demand, low vacancy rates and moderate new supply of office space.

Delivered strong operating results with improved funds from operations

Basic Funds from Operations ("FFO") increased to 23 cents per unit in Q1 2017, up 15% year-over-year, reflecting the Trust’s key initiatives put in place over the last year, including its refinancing, leasing and capital recycling;

Basic Adjusted Funds from Operations ("AFFO") increased to 22 cents per unit in Q1 2017, up 10% year-over-year from 20 cents in Q1 2016;

Improved capital structure

Closed $115 million equity issue on March 21, 2017, including the full exercise of an over-allotment option;

Lowered weighted average face interest rate of Trust’s overall debt to 1.76% at the end of Q1 2017 from 1.85% at the end of Q4 2016 and 2.48% at the end of Q1 2016;

Increased interest coverage ratio to 4.02 times at the end of Q1 2017 from 2.78 times at the end of Q1 2016;

Reduced level of debt to 48% at the end of Q1 2017 from 52% at the end of Q4 2016 and 55% at the end of Q1 2016 as a result of the Trust’s financing initiatives over the last 12 months;

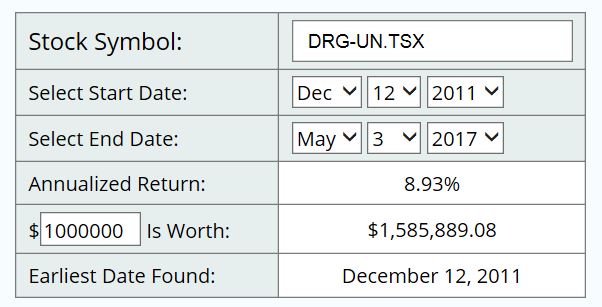

DRG20111212的IPO价格是10元,今日的股价依然还在10元以下,所以DRG不是什么出色的成长公司,事实上它是一个非常普通,甚至于是投资回报表现比较差的一只股票。

如果考虑地产基金红利的高税率,那么DRG的长期投资回报率是比较低的,没有任何特别之处,但是如果能够合理的运用投资常识对DRG进行合理的投资,我们仍然可以取得非常令人满意的投资结果。

这里也可以参考一下中国A股市场的成功价值投资者的长期表现:

上证综指自3,525点到3,216点,-8.77%;

香港恒指自20,520点到24,218点,+18.02%;

道琼斯自12,923点到20,692点,+60.12%;

专栏投资组合自100万元到700.03万元,+600.03 %。

在过去十年中国的上证综指是-8.77%,杨天南的月度专栏投资组合的回报是600.03%,因为是月度财经杂志,所以他的投资组合的变动频率只能在一个月以上,他没有机会进行短期投机交易。

如果在一个极其普通的投资标的上合理使用投资策略,都可以取得(而且是反复再现)令人满意的投资结果,那么我们就不用担心市场中没有足够的投资机会实现自己 的投资目标。

“There’s almost nothing where the game is stacked more in your favor like the stock market”

2011年,老巴印度之行的谈话