股市小书生

价值投资

For the TSX, I also looked at how much of the time the return for the various periods TSX return was less than an average of 6% per year. For the 5 year periods, the 5 year average return was less than 6% for 16 periods or 33% of the time. Looking at the 10 year periods, the 10 year average return was less than 6% for 10 periods or 23% of the time. Looking at 15 year periods, the 15 year average return was less than 6% for 2 periods or 5% of the time. Looking at 20 year periods, the 20 year average return was less than 6% for 3 periods or 9% of the time. There were no other periods when the TSX return average per year less than 6%.

I also looked at the TSX index like Spencer Sherman for periods where the index return over the period was negative. For the 5 year periods, I found 3 times when the index declined over the 5 year period. The total 5 year return from 1969 to 1974 was -17.2%. The total 5 year return from 1972 to 1977 was -13.6%. The total 5 year return from 1997 to 2002 was -1.3%. There was only one 10 year period loss and that was from 1964 to 1974 and the loss was -1.1%.

The other thing we should consider is that dividends make up 30% of the TSX's total return on average. That means that the TSX total return is really 30% higher than shown by the index. So, if you invest in dividend paying stock, you can make very decent return over the long term. We need to keep this in mind when the stock market plunges as it has been doing of late.

SusanBrunner

成功的人生和成功的投资还有一个相似的地方:

需要坚持不断的去做大概率的事情,但是又要避免一些灭顶的小概率事件。-水晶苍蝇拍

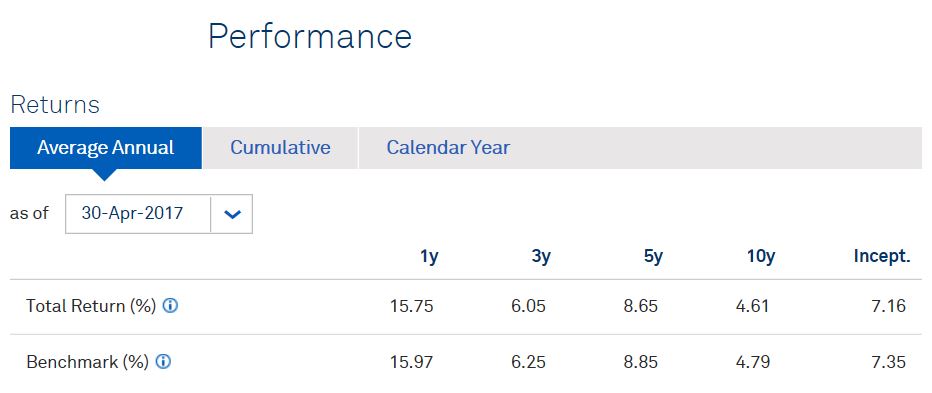

参考加国股市过去六十年的统计数据,今后五年,有非常接近100%的概率,我目前的投资组合会有正的投资回报率,有67%的概率可以取得8%以上的年均复合增长。以自己现有的投资能力合理评估,应该大概率的可以略微超越市场股指。所以综合考虑,在没有太过剧烈的市场波动的前提下,有非常大的概率,我的投资组合可以五年增长50% - 100%。目前的投资组合的常规红利收入已经较大幅度的超越了家庭工资收入,如果能够在此基础上再增加一倍,是一个比较理想的家庭财务状况,要实现这一目标,不需要更多的资金投入,但是要维持市场股指均值的投资管理表现。简单的说,只要不主动的犯违背投资常识的错误,基本上就可以实现投资目标。这是个大概率事件。

The market, like the Lord, helps those who help themselves.

But, unlike the lord, the market does not forgive those who know not what they do. - 巴菲特

FB 31.60%,GOOG 21.23%,NFLX 66.98%

加国市场比美国市场要小许多,也确实缺乏像FANG这样的高成长的科技公司,但是这并不妨碍我在加国市场上取得好的投资成绩32.83%.

最为个人投资者,资金量的小规模是会提供一些优势。

“If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.” - 巴菲特