股市小书生

价值投资'Investing is more intelligent when it is most businesslike'

Mr. Market is an allegory created by investor Benjamin Graham

The Intelligent Investor chapter eight covers Mr. Market and Warren Buffett thinks that this is the best part of the book. Buffett described it as "by far the best book on investing ever written".

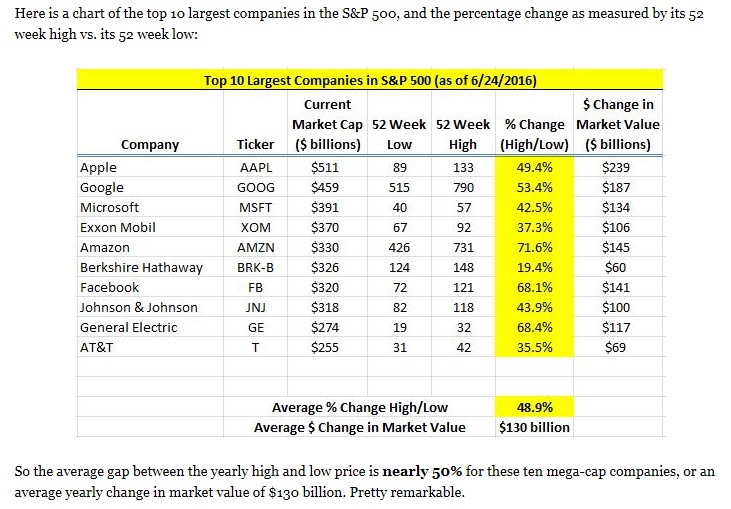

加国的金融保险地产等蓝筹股的整体市场波动要比美股小许多,在过去一年大致在15-30%的幅度。从一个整体考虑,无论发生怎样的市场变化,这样大幅度的短期股价变动一定是由于投资者情绪起伏造成的,而不是公司的商业价值的变化。如果能够学习和理解 Mr Market 和用生意的角度思考投资的价值投资的基本常识,你就有机会发现好的投资机会。这样大幅度的短期股价波动不是过去一年才有的,而是每年都有的(老巴的话 ),所以无论市场高低牛熊,都会有许多投资机会的,年年如此。

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

芒格的演讲 ART OF STOCK PICKING

Here again, look at the pari-mutuel system. I had dinner last night by absolute accident with the president of Santa Anita. He says that there are two or three betters who have a credit arrangement with them, now that they have off-track betting, who are actually beating the house. They're sending money out net after the full handle a lot of it to Las Vegas, by the way to people who are actually winning slightly, net, after paying the full handle. They're that shrewd about something with as much unpredictability as horse racing.

And the one thing that all those winning betters in the whole history of people who've beaten the pari-mutuel system have is quite simple. They bet very seldom.

It's not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it who look and sift the world for a mispriced be that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.

That is a very simple concept. And to me it's obviously right based on experience not only from the pari-mutuel system, but everywhere else. And yet, in investment management, practically nobody operates that way. We operate that way I'm talking about Buffett and Munger. And we're not alone in the world. But a huge majority of people have some other crazy construct in their heads And instead of waiting for a near cinch and loading up, they apparently ascribe to the theory that if they work a little harder or hire more business school students, they'll come to know everything about everything all the time. To me, that's totally insane. The way to win is to work, work, work, work and hope to have a few insights.

How many insights do you need? Well, I'd argue: that you don't need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it. And that's with a very brilliant man Warren's a lot more able than I am and very disciplined devoting his lifetime to it. I don't mean to say that he's only had ten insights. I'm just saying, that most of the money came from ten insights.

So you can get very remarkable investment results if you think more like a winning pari-mutuel player. Just think of it as a heavy odds against game full of craziness with an occasional mispriced something or other. And you're probably not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up. It's just that simple.

遵照老巴和芒格的投资哲学,在加国市场的2016年1月份,出现了地产基金的投资机会,如果我们听从芒格的教诲,When you get one insight, you really load up, 就可以在六个月的时间内,从零增长到100万,实现财务自由。对于普通人,一生中即使只有一次这样的成功投资,就已经非常好了,可以享用小半辈子了。