股市小书生

价值投资首先,我想说的是做为一个资本投资者,是什么资产值得投资,而自己又懂得如何投资,就参与其中。或者说投资什么不是最重要的,应该怎样投资才是最重要的。

REIT和出租房作为一门生意,都是值得去做的,是生意总会有人做得好,有人做得差。

在下面谈论中网友提到的NLY, AGNC, CIM都不是直接投资房地产的,它们的商业模式和经营风险虽然和地产行业有关,但是它们都不是直接的地产投资者,将它们与出租房比较不太合适。这本质上是完全不同的二门生意。我个人是不把这类生意归类到房地产中的。

如果是通过MUTUAL FUND的形式,那么首先得搞明白了MUTUAL FUND的经营模式,还需要再研究具体的。同样的用MUTUAL FUND直接对比出租房也是不恰当的,因为这里多了层不该多的东西。

如果我们用REIT的方式来参与房地产投资,那么它与出租房生意的唯一区别就是REIT是由职业经理人经营管理的,其它的基本没有任何本质区别,这是对投资者而言。

"Rule No.1: Never lose money. Rule No.2: Never forget rule No.1." - Warren Buffett

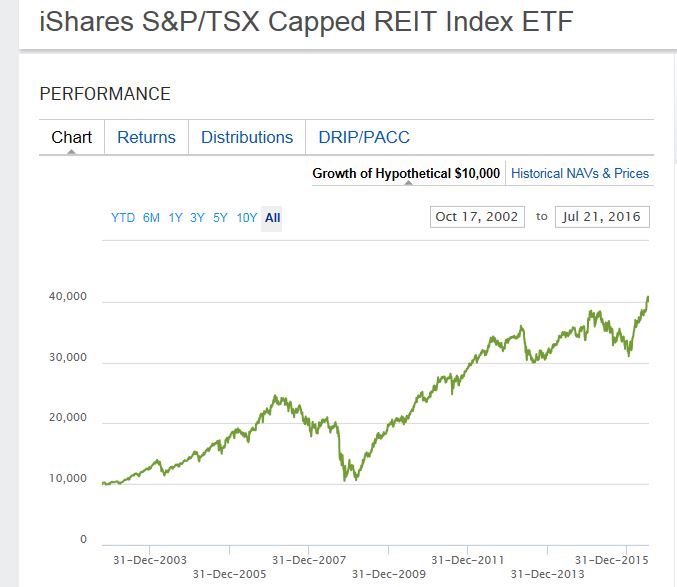

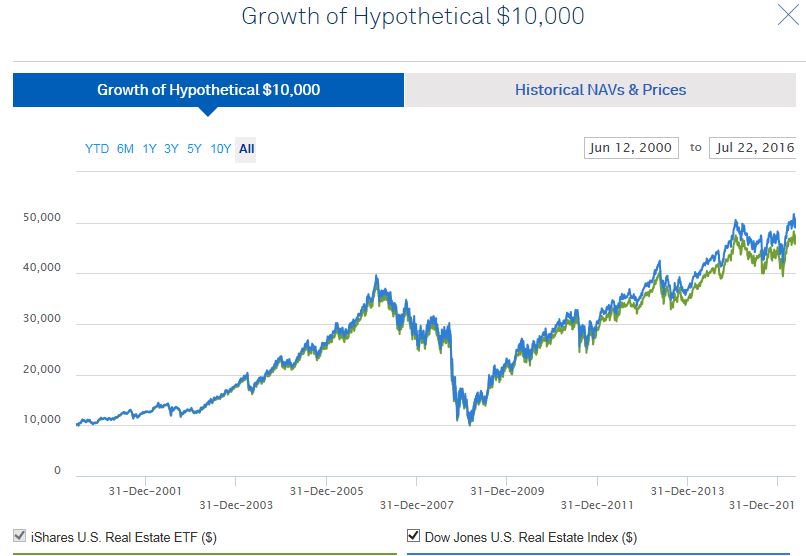

从长期投资看,REIT是大概率稳赚不赔的行当,这一点符合巴爷的教诲。

“I don’t want to buy into any business that I’m not terribly sure of. So if I’m terribly sure of it, it probably isn’t going to offer incredible returns. Why should something that is essentially a cinch to do well offer you 40% a year or something like that? So we don’t have huge returns in mind. But we do have in mind never losing anything.” - Warren Buffett 1998 Talk at University of Florida

地产行业相对而言,生意模式比较清晰,投资分析的可能性,可靠性会准确一些。

因为REIT有市场股性,自然有股票市场的波动,在投资中波动不是风险,是机会。这里需要了解 Mr Market, Margin of Safety 和 Permanent Loss vs Paper Loss 的基本投资概念。

如果你的出租房一个月没有租出去,收入为零,是否你的出租房的价值就是零了呢?

如果一个REIT的出租率,租金,租约,各项成本开支基本不变,仅仅是股票价格跌了50%,是不是REIT所持有的商业地产就贬值50%呢?你能用50%的价格买到REIT所持有的地产吗?

在股市波动中,市场会提供大量的投资机会。

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

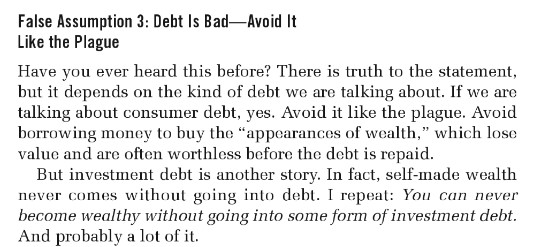

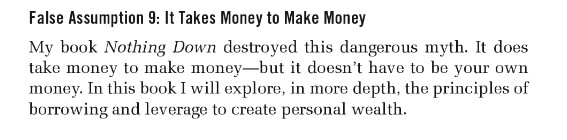

在出租房投资中金融杠杆是重要的一环,那么在REIT投资中是否可以同样使用金融杠杆呢?当然可以。

因为从长期投资看,REIT是大概率稳赚不赔的行当。

我以前的一个贴子:

===================================

如山博客有一篇“我怎样在美国走上了经营房地产之路”,下面是其中的一段:

顺着 “ Rich Dad Poor Dad ” 这本书推荐的相关书,我又读了另一本对我影响很大的书:“ Creating Wealth ” by Robert G. Allen (“Nothing Down” 的作者 ) 。 房地产是一个古老的行业。但也是一个永远都有人赚钱的行业。让我们看看 Robert G. Allen 这位房地产大师又是怎么说的: Wealth Principle 6: Choose Investments That Are Both Powerful and Stable………By power, I mean the ability of an investment to grow at high wealth-producing rates. What make an investment powerful? The reasonable use of leverage, or debt. ................. What make real estate so stable? It is the law of supply and demand . Real estate, especially residential property, is a commodity in critical shortage and one for which there is an enormous demand. It is a necessity, not a luxury. People can’t print up a hundred thousand homes as they might print up s stock offering. ( P.32 )

我从网上找了原作,读了一部分:

我要强调一点,REIT是商业地产的金融形式,所以我们投资REIT的目的是商业地产,商业地产是百分百的地产。

==================================

芒格的演讲 ART OF STOCK PICKING

They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.

在任何商业投资中,不是要不要用金融杠杆的问题,而是应该怎么用的问题。