股市小书生

价值投资在下面的回帖中,有一位网友提到自己的一位同事在20年时间内,在自己的养老金帐户里买入12支股票,只买入,不卖出,目前资产市值3M。我刚开始学习投资的时候,经常阅读一位笔名BuyandHold2012(Seekingalpha网站)的帖子。他和他的母亲也都是使用这样一中投资方法,她的母亲是一位中学教师,45岁离异后,当时大概有5万本金,目前是1千万以上,BuyandHold2012 本人受母亲教诲,从14岁开始参与投资,他大致投入过10万本金,目前也是1千万以上,他最大最好的投资是XOM。BuyandHold2012曾经向她母亲推荐过老巴的股票(当时价格是100元以下),因为没有分红,被老太拒绝了。他的叔叔曾经听了他的推荐,在一家医药服务公司(类似于CVS Health Corp, 我记不得名字了。)投资了1万元,二十多年后获利2百多万,不过他自己没有投资。

Buy and Hold, Never Sell.这种投资策略是不常见的,我觉得一般只有在自己最亲密的至亲好友的贴身教诲下,才有可能,因为如果没有亲眼所见这种投资策略的效果,你是不太可能去接受和尝试的。BuyandHold2012 的母亲好像是从他姑姑那里学到的。

这里提到几位都不是投资专家,使用的投资策略也是很简单的,大多数人根本瞧不上。

如果一种投资策略是长期合理的,成功的,那么它的背后一定会有一个合理的投资逻辑。

股市市场是一个自身不断地进行优胜劣汰的优化系统,当长期选择BuyandHold的时候,就会自然而然地享受到优化系统的成果。股指投资策略的背后有非常深刻的投资基本原理。

Once, at a lecture, he was asked if Wall Street professionals were better at forecasting what would happen to market, and if not, then why, and here's what he said:

"Well, we’ve been following that same question for a generation or more, and I must say frankly that our studies indicate that you have your choice between tossing coins and taking the consensus of expert opinion and the result is just about the same in each case.

Everybody in Wall St. is so smart that their brilliance offsets each other. And that whatever they know is already reflected in the level of stock prices for the much, and consequently what happens in the future represents what they don’t know." - Benjamin Graham

股市的一个有趣的特点是,专业人士没有竞争优势,所以非专业人士可以很轻松的战胜专业人士(因为专业人士的成本是很高的,足以影响到投资结果)。

参考yourolddad下面提到的一篇文章。

Yet compared to that of the average real-estate investor over the same period, Trump's performance is even worse, according to John Griffin, a businessman and a real-estate investor who is also a professor at the University of Texas at Austin.

Griffin used an index of funds known as real-estate investment trusts, or REITs. The managers of these funds rely on their expertise in real estate to earn money for their clients by buying and selling interests in commercial property.

This index has earned 14.4 percent a year since 1976. Had Trump done as well as the average among others in the industry, making investments that returned 14.4 percent over the long term, he would have turned the $200 million he said he had in 1976 into $23 billion as of last year, Griffin calculated.

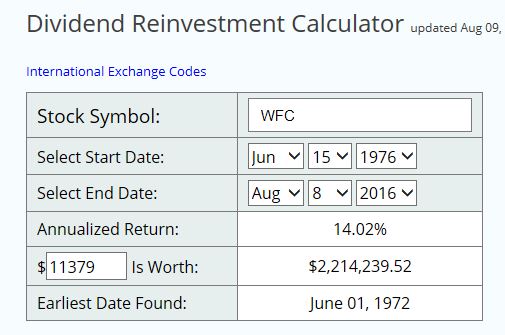

1976年美国家庭收入中位数 11379, 2015年是53657,一般一个人的工作年限为40年。

11379 投入REIT Index, 目前市值131万,可以每年有6万以上红利收入,市值相当于25年2015收入。

美国Wells Fargo 银行。

可口可乐公司。

美浮石油。

美国强生公司。

这里我们要注意,红利的复利投资回报占了整体回报的66%。

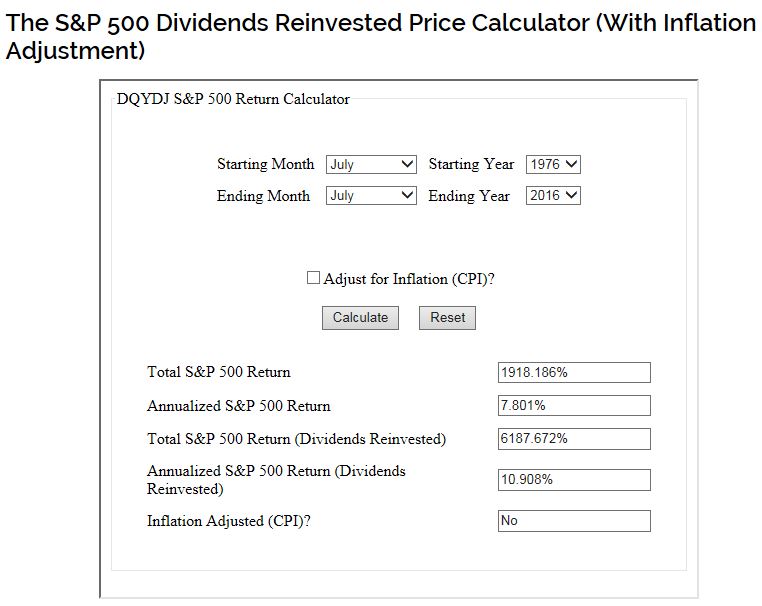

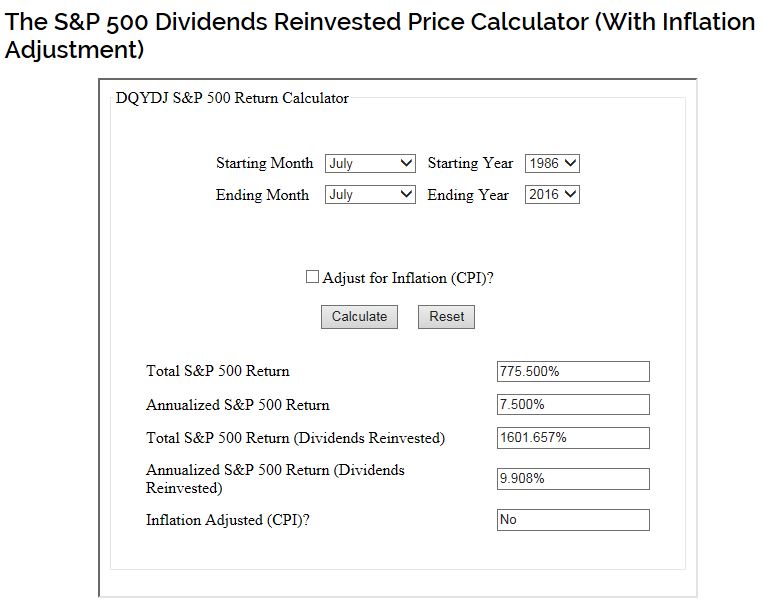

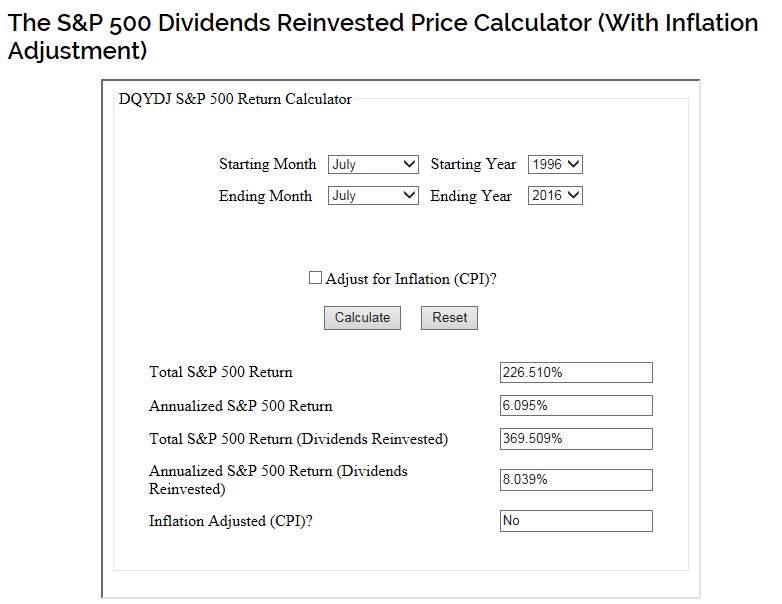

在过去四十年,股指投资策略的盈利概率是100%,十年以上未有过败绩,

所以股指投资策略是的非常简单方法,但是其中有着极其深奥的投资原理和哲学。

加国股指整体状况基本类似,

For the TSX, I also looked at how much of the time the return for the various periods TSX return was less than an average of 6% per year. For the 5 year periods, the 5 year average return was less than 6% for 16 periods or 33% of the time. Looking at the 10 year periods, the 10 year average return was less than 6% for 10 periods or 23% of the time. Looking at 15 year periods, the 15 year average return was less than 6% for 2 periods or 5% of the time. Looking at 20 year periods, the 20 year average return was less than 6% for 3 periods or 9% of the time. There were no other periods when the TSX return average per year less than 6%.

I also looked at the TSX index like Spencer Sherman for periods where the index return over the period was negative. For the 5 year periods, I found 3 times when the index declined over the 5 year period. The total 5 year return from 1969 to 1974 was -17.2%. The total 5 year return from 1972 to 1977 was -13.6%. The total 5 year return from 1997 to 2002 was -1.3%. There was only one 10 year period loss and that was from 1964 to 1974 and the loss was -1.1%.

The other thing we should consider is that dividends make up 30% of the TSX's total return on average. That means that the TSX total return is really 30% higher than shown by the index. So, if you invest in dividend paying stock, you can make very decent return over the long term. We need to keep this in mind when the stock market plunges as it has been doing of late.

待续。

我想对一些还无法区分股市投资和股市投机区别的人提一个建议,因为目前你对股市投资一无所知,你是不具备谈论评价股市投资好坏的资格的,只有在你学习了股市投资的基础常识以后,而且有了比较丰富的股市投资的实践经验以后,你才能有这个资格。

我们有时候走在大街,偶尔会遇见一二个愚昧无知的低能儿,因为他没有常人的正常理智,所以有时他会做出一些不文明,不恰当的举止,比如向你干净整洁的衣服上吐口水,作为一个有教养的正常人,我们应该以宽容的心态来对待这样的低能儿,如果你与一个低能儿去争论正常人之间的是非标准,那么你自己就主动的成为了一个愚昧无知的白痴。