insight

工程技术,地产投资,信仰家园,时尚生活Roman Abramovich, a Russian billionaire and the 53rd richest person according to 2011 Forbes list, said: "investors have very short memories". In today's bullish climate it is hard to imagine that just about two years ago, there were genuine fears of a global financial meltdown. These days we are no longer concerned about our assets becoming worthless; instead we are more concerned about property prices escalating beyond what we can afford.

In view of this, some people may inevitably believe that this current "bull" run will last forever and make risky investments in fear of losing out. They attempt to rationalise that it is different this time round and that the spectacular market performance is due to the emergence of Asia as a new financial powerhouse.

John Templeton, a very prominent stock investor once commented," the four most dangerous words in investing are 'This time it's different'." According to the historical URA Private Property Price Index (PPPI), we can tell that the property market is cyclical and no trend lasts forever. In a blog post I wrote in July 2009, I mentioned then that the property market will not remain depressed indefinitely. In a similar vein, I am confident that the current price appreciation will not go unabated and it will correct in the near future.

The question is how can we tell when the Singapore property market is going to dip?

In my second book entitled Buy RIGHT Property — Taking the R.I.G.H.T. Approach to Property Investing in Singapore, I shared that my company has developed a proprietary index called the Ascendant Assets Index (AAI).

Figure 1: Ascendant Assets Index

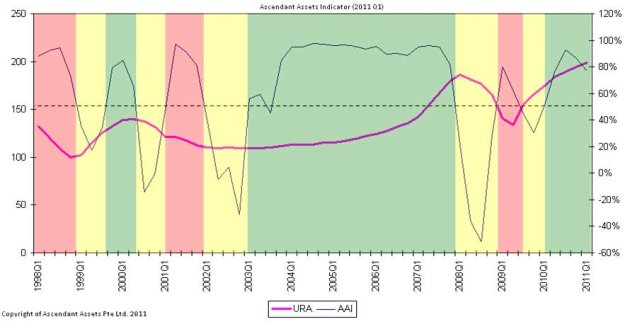

The basic premises of the AAI are (1) there is a lead-lag relationship between the stock and property market and (2) we are able to tell how the property market is performing by analysing the correlation between the stock and property market. For example, in bullish (or bearish) market conditions, we would expect the correlation between the stock and property market to be high as prices are increasing (or decreasing) in tandem. On the other hand, we would expect the correlation between the stock and property markets to be low during turning points as stock prices, being more liquid, would diverge from the less responsive property prices.

So how is the market like now? Figure 1 shows the AAI for the recent quarter 2011Q1. From the figure, we can tell that the Singapore property market (shown in green colour) is presently in the strong growth stage with both STI and URA PPPI increasing in tandem. However, it is noteworthy that the AAI has dropped from over 90% to under 80%. Over the next few quarters, we expect the AAI to drop further. When the AAI falls below the 50% mark (represented by the dotted line), it signals a turning point as the stock market will be almost completely out of sync with the property market. It signals an overall change in underlying market sentiments and the property market would be expected to decline shortly after.

Figure 1: Ascendant Assets Indicator (2011Q1)

Conclusion

It is important to note that the AAI is only one tool to gauge how the property market is performing. There are other aspects to consider before making a buy or sell decision. Nonetheless, I have been asked by several prospective clients if it is a good time to buy properties. My personal view is that unless it is an essential purchase (e.g. buying a home to stay), I would stay out of the market right now. In fact, I had recently sold two properties to accumulate cash to prepare for the next market downturn.

As a parting shot, let me leave you with a quote by Warren Buffett that I often make reference to, "We simply attempt to be fearful when others are greedy and to be greedy when others are fearful". With the URA PPPI reaching a new peak in the last quarter, I can't help but to feel a slight sense of fear…

By Getty Goh, Director of Ascendant Assets, a real estate research and investment consultancy firm. Posted via www.Propwise.sg, a Singapore property blog dedicated to helping you understand the real estate market and make better decisions.

Property prices worry National Development Minister

National Development Minister Khaw Boon Wan on Thursday sounded the alert on the spike in property prices in his latest blog posting.

He said things can go very wrong suddenly and gave three reasons.

Firstly, 35,000 private homes have already been sold – though still in construction – with payments in various stages of completion.

And there are 45,000 units in the pipeline, waiting to be built and sold.

Secondly, URA on Thursday announced its Government Land Sale Programme for the second half of the year which will inject another 8,000 private residential units into the market.

Together with committed investments, some 53,000 units will be looking for buyers over the next few years.

Lastly, Mr Khaw said the external situation is not exactly bullish.

The European sovereign debt crisis will take a long time to clear.

The Middle East crisis can still go ugly.

If that leads to a spike in oil prices and halts the fragile global economic recovery, the impact on Asia and Singapore will be direct and immediate.

Moreover, foreign buyers of these properties have been strong.

In the recent quarter, they made up 16 per cent of all buyers of these private properties.

Many Singaporeans also buy properties with the intention to rent them to foreigners who come here to live or work.

In the event of any external shock, both foreign demand and rental demand can fall quite quickly.

Mr Khaw said the impact can be serious if the drop in demand happens at a time when there is a substantial increase in supply.

Further, low interest rates will not remain so forever. Cost of borrowing and repayment must go up and households must factor this in.

Mr Khaw said he’s not the only one worried.

He cited a property analyst who recently said some property investors seem either “blissfully ignorant” of the massive supply that will hit the market from 2013.

Mr Khaw said market correction or any crash is not a given.

If all goes well, the economy will continue to grow and those who bought properties here will enjoy good returns when their units are completed in the next few years.

But no one is immune to mishaps.

With so much uncertainties, the Minister advises investors and upgraders to bear these considerations in mind when they go to show rooms and contemplate if they should sign up.

Source : Channel NewsAsia – 9 Jun 2011