Lastnight,NGfuturejumped5%higher.Butattheendoftheday,itlost11%.Suchbigswingusuallyindicatesweakness.AnotherindicatoristhatDQisparticularlybullishaboutit.Somesaysitisgoingto$8.Well,USenergycompaniescontinuetoproduceNGatimpressivepace.Oncethecoldweathermoveson,excessiveNGwillcontinuetocome.Atthispoint,bullsneedtobeverycautious.However,3XinverseETFdecaysfast.Soonceadropathand,tradeonDGAZshouldbeclose...[

阅读全文]

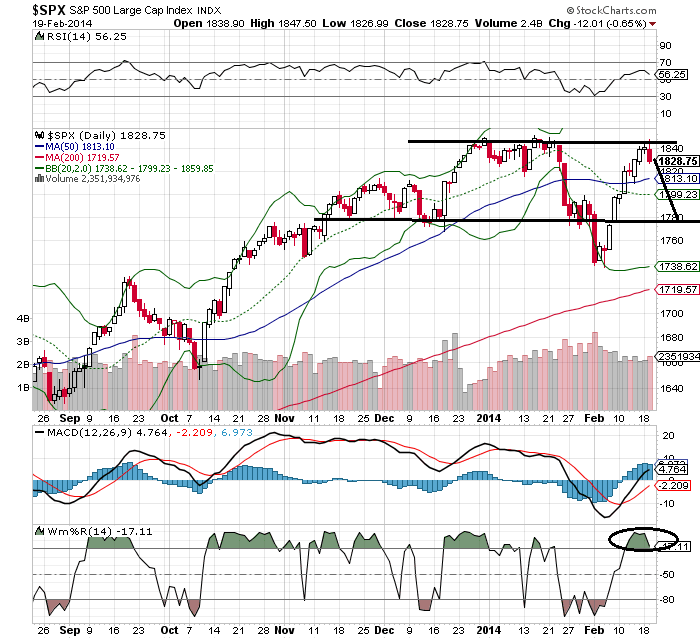

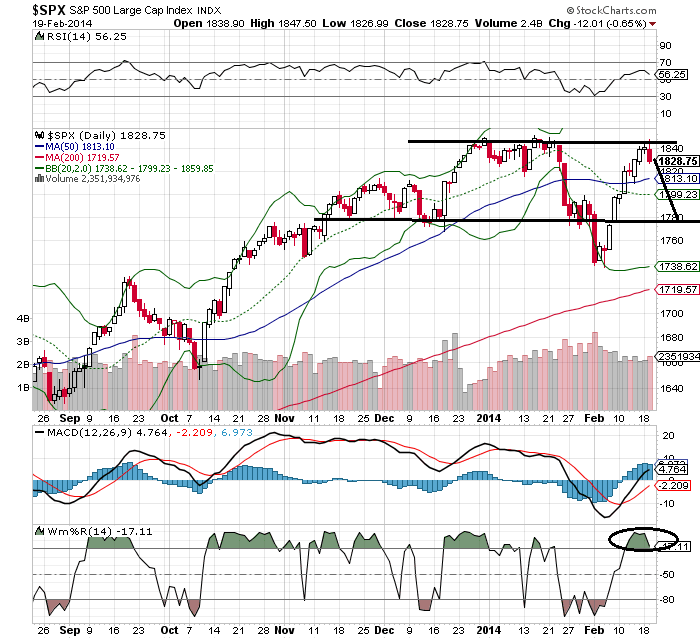

Wehasareversaltodayrightaroundresistance.Takingoutthisresistancewouldmeanthat1900isathand.Butitislikelytopullbacktosupport.Thesupportlineis1780.

UseTWM/DGAZtohedgedownsideriskwithstopoftoday'slow.

[

阅读全文]

传说中的V型反转居然实现啦.但52周新高的股票仍在减少.2014年大宗商品大幅领先.现在阻力和支撑已经明显.

[

阅读全文]

Unfortunately,supportisbrokentoday.Iwasexpectingabounceto1825toformtherightshoulder,butitdidn'thappen.Instead,stopsgottriggeredoneafteranother.Nowmarketison3rdwavedown.Wave1:from1850to1775,wave2:from1775to1795,wave3:startedfrom1795.Wave3isusuallythemostpowerfulwave.Firsttargetis1710-1725areawhichiasalso200movingaverage.IfFriday'sjobreportispoor(Delllikelytoannouncealayoffofnorth15,000jobssoon),itc...[

阅读全文]

Mostmajorsectorsareatsupport.Momentum,Put/Callratio,VIXindicatethatmarketisatsupport.Breakdownfromthislevelwillbringmoreconcernsoftheuptrend.

Butifmarketindeedreboundsfromhere,wehavetoseehowhighitcanreach.Since2012,whenmarketstartstobounce,therewerenobigpullbacksontheway.Marketwentstraightupwithoutpausewhichleftmanypeopleonthestation.Let'sseewhatitdoesthistime.

Reboundtargetis1825onS&P...[

阅读全文]

虽然并不是每次都应验,但是一些常见图形确实可以帮助规避风险.感觉风险靠近是散户应该培养的素质.

BBY'scommonH/Sbearishpattern.Alsoanalystswerewidelybullishonthisoneofthebestperformerin2013.ButweknowretailersareintroublebackinNov2013.Althoughittookalittletimeforthisbabytoplayout(30%dropinoneday).Nowaround$24-25,thisoneisnolongerexpensive.

Thereactionmightbetodramatic,whereopportunityshowsup.Expe...[

阅读全文]

Sofar,earningseasonhasbeendisappointing.Resultfrombanksaremixed.MS/BACaregood.Cisterriable.GS/JPMareflat.Therearesomesellingpressueinbankingstocks,butnothingun-usual.

Theproblemisconcentratedinretailsector.Entiresectorisunderserioussellingpressue.

GE/COF/UPS/INTCreporteddisappointingearningalso.WhichgiveswarningsignstoUSstocks.

UStreasuryisturningaroundwhichindicatessoftpathahead.

...[

阅读全文]

2013-03-02:小心别在金矿上吃亏太多2014-01-01:GDXisnear2008low.ButDUSTisnowherenearrecenthigh.Tripplebearsisnogoodasshortingvehichleoverall(waywayshortoffutures).[

阅读全文]