风萧萧_Frank

以文会友债务“雪球”越滚越大!特拉斯式危机恐在美国上演?

美国国会预算办公室(CBO)主任菲利普·斯瓦格尔(Phillip Swagel)周二警告称,如果政府忽视美国不断膨胀的联邦债务,美国将面临利兹·特拉斯(Liz Truss)式的市场冲击。

斯瓦格尔表示,美国的财政负担正在以“前所未有”的速度增加,有可能引发类似于2022年导致英镑挤兑和英国特拉斯政府垮台的危机。

2022年9月,英国前首相特拉斯推出了震惊世界的“迷你预算”。在英国通胀飙升,政府债务不断增加的背景下,这份以“无资金减税”为核心的预算一经曝光,就立即引发了英国金融市场的混乱,也拉开了英国抵押贷款利率不断上涨的序幕。

斯瓦格尔表示,美国“尚未走到那个地步”,但随着更高的利率导致其在2026年偿还债务的成本上升至1万亿美元,债券市场可能会“迅速反弹”。

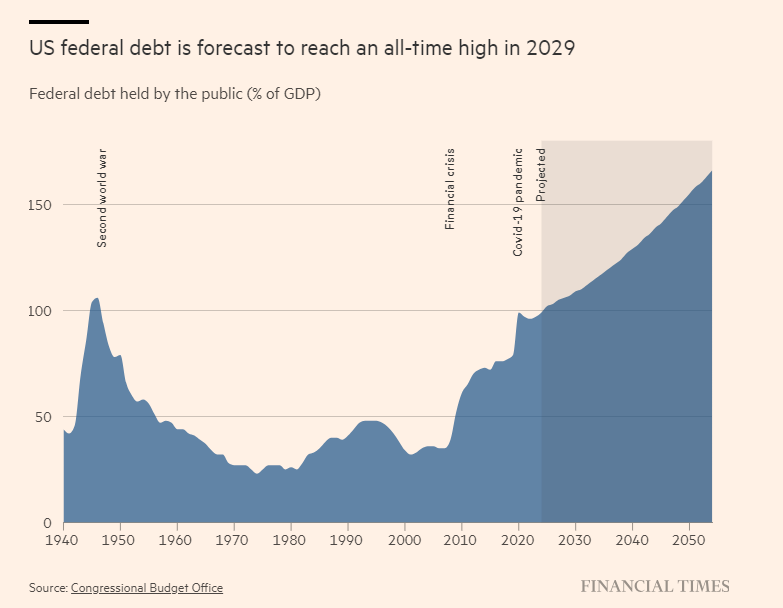

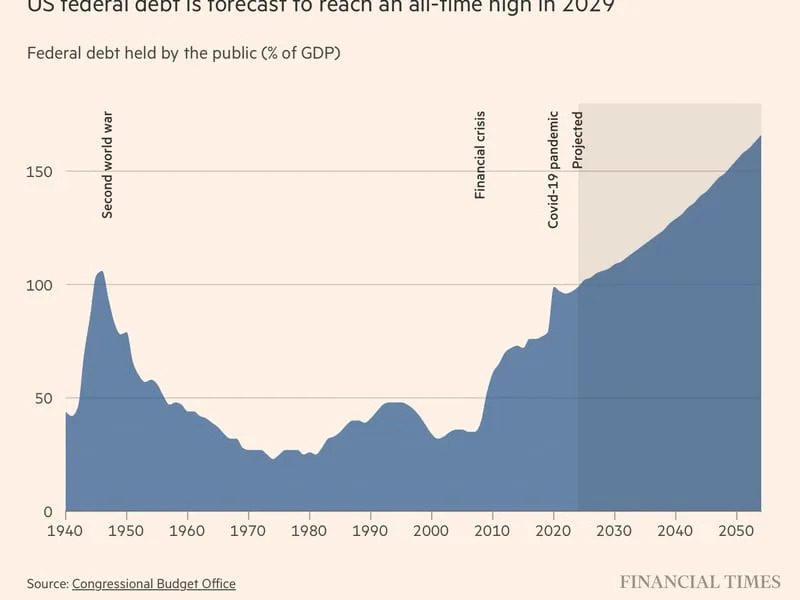

据CBO称,截至去年底,美国联邦债务总额达26.2万亿美元,占国内生产总值(GDP)的97%。

2017年美国前总统特朗普实施全面减税措施,并在疫情期间推出巨额刺激计划后,美国债务规模激增。特朗普承诺,如果他在今年的总统大选中击败拜登,他将延长原定于明年到期的减税措施。

斯瓦格尔表示:“一些看似温和的变化——或者可能一开始是温和的,然后变得更加严重——可能对利率产生巨大影响,从而对财政轨迹产生影响。”

斯瓦格尔向英国《金融时报》发表上述言论的前一天,该独立监管机构发布了新的长期经济预测。预测显示,到2054年,美国债务水平将升至GDP的166%。

惠誉去年将美国的信用评级从“AAA”下调至“AA+”,理由是担心“政府债务负担过重且不断增加”。穆迪仍将评级定为AAA,但去年11月表示,已将评级展望从“稳定”下调至“负面”。

在斯瓦格尔就美国的债务负担发出警告之际,经济学家们担心民主党和共和党多年来的财政挥霍行为将给美国经济带来麻烦。

彼得森国际智库高级研究员金伯利·克劳辛(Kimberly Clausing)表示:“政策制定者有必要大幅削减赤字,部分原因是我们面临巨大的人口压力。”

安盛投资管理公司宏观经济研究主管戴维·佩奇(David Page)表示:“两位总统候选人都没有谈论财政廉洁,其中一位甚至还在谈论延长减税政策。”

美国尽责联邦预算委员会(CRFB)的一家智库表示,如果特朗普延长减税政策,2026年至2035年间联邦债务将增加5万亿美元。

特朗普延长减税政策将导致2026年至2035年间的联邦债务增加5万亿美元

CBO的预测显示,未来10年,美国年度财政赤字占GDP比重将徘徊在约6%的水平——这是基于特朗普减税政策计划于2025年到期的假设。

斯瓦格尔曾担任布什政府时期的美国财政部长。他承认,考虑到有关延长减税和奥巴马医疗保险额外补贴即将在明年到期,明年“对财政政策尤其重要”。

本周发布的CBO预测显示,2029年债务占GDP的比率将超过二战时期的最高水平,即116%,斯瓦格尔将这一趋势描述为“前所未有的”。

美债占GDP比例将在2029年超越二战水平

斯瓦格尔说:“二战期间欠下的债务大部分在参战的那一代人的时间内就还清了。如今产生的财政负担不是我们这一代人所能承受的。”

他警告称,随着债务利息支付的增加,美元作为世界储备货币的地位并不总是能够使美国免受市场压力。

“我们需要向外国人借款,因为外国资本有助于保持美国的低利率,”斯瓦格尔说,“但这也有两面性,一方面,现金流向海外意味着国民收入损失。另一方面,如果没有资本流入供我们借款,那就更糟糕了。”

Soaring U.S. Debt Has Potential to Replay U.K.'s 2022 Market Shock, CBO Warns

https://ca.finance.yahoo.com/news/soaring-u-debt-potential-replay-121220987.html

Omkar Godbole ·3 min read

-

Unattended mounting U.S. debt concerns means potential for a Liz-Truss style market chaos, Phillip Swagel, director of the Congressional Budget Office told Financial Times.

-

Debt concerns may have helped bitcoin and gold rally to record highs amid elevated interest rates worldwide, analysts said.

In 2022, former U.K. Prime Minister Liz Truss announced radical economic measures, including deep tax cuts and billions of pounds of spending even as surging government debt called for fiscal prudence. The result was market chaos, with the British pound (GBP) crashing to record lows against the U.S. dollar (USD) and the collapse of Truss' government, the shortest in the country's history.

Now, the U.S. faces a similar risk if the government continues to ignore mounting debt concerns, according to Phillip Swagel, director of the Congressional Budget Office (CBO).

“The danger, of course, is what the U.K. faced with former Prime Minister Truss, where policymakers tried to take an action, and then there’s a market reaction to that action,” Swagel said in an interview with the Financial Times.

Swagel added that the U.S. is not yet in the same position, but higher interest rates could raise the debt servicing cost to $1 trillion in two years, and bond markets could "snap back."

A pound-like crash in the U.S. dollar, a global reserve currency with an outsized role in international finance, could boost demand for alternative assets with a haven appeal like bitcoin and gold. Trading volumes in bitcoin-pound pairs spiked during the U.K. crisis in September 2022.

Both bitcoin and gold may already be pricing in a crisis scenario. Despite elevated interest rates and bond yields worldwide, the two so-called zero-yielding assets have rallied to new record highs above $70,000 and $2,000, respectively. Both have surpassed their previous peaks set in 2020-21, when interest rates in the U.S. and other parts of the world were pinned near or below zero.

"Rising debt levels and geopolitical turmoil may have contributed to offset the impact of higher yields on both assets," Paris-based crypto data provider Kaiko said in Monday's edition of its newsletter.

U.S. federal debt totaled $26.2 trillion at the end of 2023, about 97% of gross domestic product, according to the CBO. The non-partisan, independent agency expects the debt-to-GDP ratio to rise past the Second World War high of 116% by 2029 and reach as high as 166% by 2054.

The bigger the debt, the greater the pressure to keep real – or inflation-adjusted – interest rates and bond yields artificially low. Higher rates and higher debt levels push the government's interest expenses higher, aggravating debt concerns.

Negative real rates often lead investors to move money out of fixed-income investments and into high-risk, high-return assets like technology stocks, cryptocurrencies and havens like gold, as seen in 2020-21.

"In a highly indebted economy, negative real [inflation-adjusted] rates and financial repression are a necessary condition to keep the system running, and fiat currency debasement remains the escape valve," the founders of newsletter service LondonCryptoClub said in Monday's edition, explaining debt concerns as a macro tailwind for bitcoin and gold.

According to the founders, Federal Reserve Chairman Jerome Powell's recent decision to stick to forecasts of three rate cuts in the coming months despite continued labor-market strength and a renewed uptick in inflation shows the central bank is now "focused on the U.S. debt spiral."

"Gold continues to signal that the macro sands are shifting. Should net ETF inflows turn positive this week, don’t be surprised if Bitcoin catches the macro winds and accelerates to new highs," the founders noted.

The Nasdaq-listed spot ETFs accumulated over $15 million in Monday, snapping a five-day streak of outflows. Bitcoin changed hands at $70,780 at press time, representing a 5% gain on a 24-hour basis, according to CoinDesk data. The CoinDesk 20 Index, a measure of the broader crypto market, added 5.5%.

UPDATE (March 26, 13:39 UTC): Rewrites headline