风萧萧_Frank

以文会友The UK Cannot Afford to Look This Ridiculous

The Bank of England may have saved gilts, but scorn and political danger for Truss and Kwarteng still have a long way to run — and could cut their careers short.

Ridicule is something politicians need to be very, very scared of.

Ridicule is something politicians need to be very, very scared of.

Who Looks Ridiculous Now?

Adam Ant once sang that “ridicule is nothing to be scared of.” He was wrong. For a politician, all kinds of crises can be survived. Ridicule cannot. Once you’ve looked truly ridiculous on the public stage, you’re done for.

That leads to the extraordinary situation where the new government in the UK, installed only three weeks ago, looks so ridiculous after a revolt from international markets that the jobs of its new finance minister, and even the prime minister, have been called into question. Appalling misjudgments led to one of the greatest bond market implosions in history.

What Happened

The price of the current 30-year British bond, or “gilt,” tells the story. From the Bank of England’s scheduled meeting last Thursday until the early hours of Wednesday morning, it fell by more than 24%. Then the BOE announced that it would buy as many long bonds as were needed to restore stability to the market. The price rallied by 24% from its low in a matter of hours. It’s still down a (massive) 6% since last Thursday:

This was a staggeringly implausible event. Let’s go through it in stages.

What the Bank of England Did

The announcement in the London morning said that the Bank was going to buy long bonds “on whatever scale is necessary” to restore orderly market conditions. These purchases won’t be sterilized (meaning the bank isn’t selling something else to balance the market impact), so they’ll be stimulative. Plans to embark on quantitative tightening, or selling off the BOE's massive bond portfolio to push up yields as part of the attempt to tighten monetary policy and combat inflation, were due to start next week. That’s now been postponed until Oct. 31. At least in some sense, this means a return to the quantitative easing (QE) that prevailed after the Global Financial Crisis and entailed buying bonds to push down their yields.

The full statement was a joy for Kremlinologists who follow the Bank’s internal politics. This might look to most of us like a monetary policy decision, but it wasn't made by the BOE’s Monetary Policy Committee. Rather, it was left to the executives who run day-to-day operations to make the call. It says:

The Bank of England’s Financial Policy Committee noted the risks to UK financial stability from dysfunction in the gilt market. It recommended that action be taken, and welcomed the Bank’s plans for temporary and targeted purchases in the gilt market on financial stability grounds at an urgent pace... The Monetary Policy Committee has been informed of these temporary and targeted financial stability operations.

The message here is two-fold. First, this was a tactic adopted swiftly by the adults in the room to avert true disaster. The Bank is still the lender of last resort and can fulfill that role without asking permission from a nine-person committee. Second, the BOE really wants everyone to treat this move as involving no step back in its monetary policy, and hence no step to accommodate or fall into line with government fiscal policy. It’s unlikely to be viewed this way. Brian Hilliard, UK economist at Societe Generale, put it this way:

We seem to have moved from a situation where market dysfunction is tackled directly by the MPC, which then gives the instructions, to one where the operational arm of the Bank listens to the concerns that the FPC has about financial stability and then it acts. These nuances won’t matter to the markets. ‘The Bank’ decided to buy gilts to calm the markets and that is QE.

It will also be hard to fight the perception that the BOE's independence, which it has only had since 1997, has been compromised. But this is one of those occasions when the Bank is really telling the truth. Ajay Rajadhyaksha of Barclays put the problem as follows:

Bond and currency markets have reacted so poorly since the mini-budget, at least in part due to fears that the move added new fiscal stimulus to an economy that already had 10% inflation and a very low jobless rate. It’s difficult to see how this perception can be corrected by new monetary policy stimulus. At the CEPR Monetary Policy Forum hosted by Barclays earlier this week, BOE Chief Economist Huw Pill did highlight the BOE’s independence. But the fact pattern is clear. After bond markets rebelled at news of fiscal stimulus and larger government debt issuance, the central bank postponed its plans to reduce its balance sheet, and instead proceeded to expand it by buying government debt. The risk is that investors adopt a cynical interpretation; that the BOE is enabling the fiscal authority’s spending plans, even as financial markets have sounded the alarm.

This is not a new dilemma for a central bank. Indeed, it’s been a recurring pattern during this century that central bankers tried to stand back and encourage (or force) elected policymakers to take necessary action on fiscal policy, only eventually to intervene when politicians’ inactivity threatened to create outright disaster. Mario Draghi’s “whatever it takes” comment only came after the eurozone’s debt crisis had been raging for more than two years and had felled a succession of governments; Ben Bernanke tried to leave bank rescues to the Treasury and Congress in 2008, before embarking on the many emergency policies that tided the financial system through its crisis. The BOE is in a similar position now. On principle, and for the sake of long-term policy, it would prefer not to be buying bonds. But with an imminent risk of a financial implosion, there was no choice. Better to tide the patient through with huge doses of debilitating drugs than let him die.

Why They Did It

The crisis the BOE stepped in to eliminate was triggered by the speed with which longer gilt yields rose after the government’s “mini-budget,” unveiled by the new Chancellor of the Exchequer Kwasi Kwarteng last Friday and featuring steep tax cuts with no detail of any spending cuts to help pay for them. This had already prompted several mortgage lenders to withdraw new offerings, an alarming incursion on the real world inhabited by most Britons.

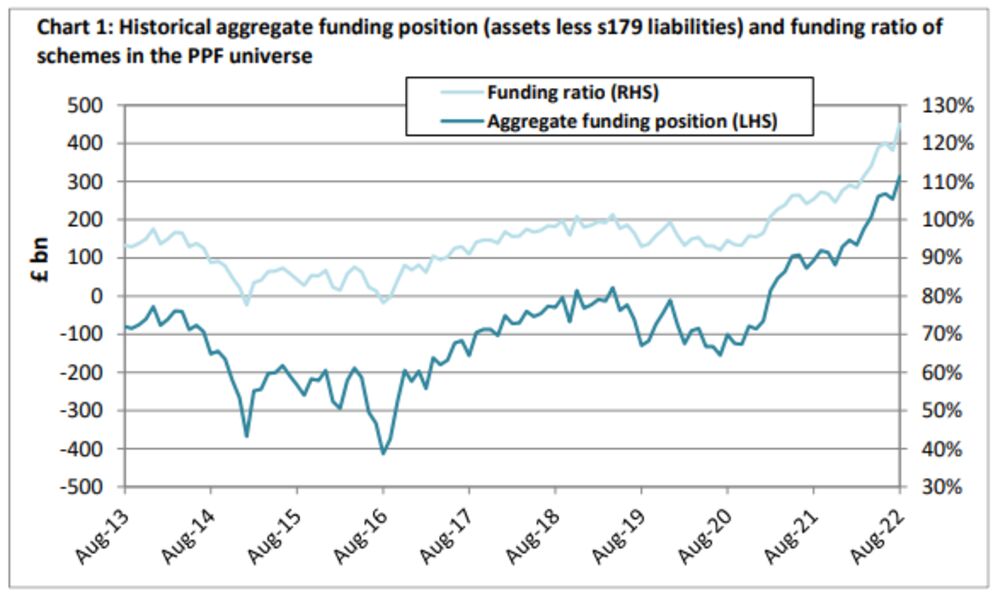

The heart of the darkness, however, was in pension plans. As in the global crisis, sharp moves triggered an accident for systemically important institutions that had taken on leverage in an opaquely technical way. It stems, ironically, from an impeccably prudent and conservative reform. For the last two decades, British pensions in the public sector and from large companies offering a final-salary or “defined benefit” on retirement have been required to match assets to liabilities. Intended to ensure that promises to pensioners could be honored, this in practice meant that pension funds had to buy a lot of gilts. This successfully bolstered their finances. The following chart comes from the Pension Protection Fund and shows that both in absolute amount of money and as a proportion of their liabilities, UK pensions ended last month in good shape, with assets comfortably enough to meet their promises:

So why is there a problem? This is complicated stuff. This blog post for BondVigilantes.com by Jim Leaviss of M&G in London drew attention to the issue on Tuesday, while this blog post by Toby Nangle in FT Alphaville does a great job of explaining how the crisis blew up. In simple terms, if you have a large portfolio of very long-dated bonds, a 25% fall in their price is a serious issue. Second, if you’ve been playing around with derivatives to try to get a little more return out of the lumpen mass of those bonds, you have a real problem. Pension funds would enter into swap contracts, using the gilts as collateral. While the funds’ bet was going well, the counterparty would pay them something. If the bet turned out wrong, they’d have to pay something to the counterparty. And if the collateral suddenly and unprecedentedly took a massive fall, the counterparty would make a margin call.

By Tuesday, the margin calls had turned into a cascade. Pension funds sold their gilts to meet these calls, pushing their price down further. In such conditions, the funds also faced the need to sell other assets that were sufficiently liquid. This is a classic example of contagion, of the kind that drove the "Lehman Moment" of 2008, when numerous complex financial products collapsed almost simultaneously. By Wednesday morning, the BOE faced the prospect of imminent widespread pension fund insolvencies. This was both unthinkable in itself, and so were the potential systemic aftereffects on the economy.

The swift action was decisive. A 24% rise in the 30-year gilt price has ended this particular crisis. But I doubt we’ve felt the last of the psychological blow from the fact that it was pension funds, of all things, that proved to be a critical systemic weak point.

Why Risk Rallied

To grasp the scale of the crisis, look at the effect some technical difficulties for the UK’s pension funds had on the rest of the world. It’s difficult to see the drama of the day’s trading in US Treasuries if you put them on the same scale as gilts, but the BOE announcement was the catalyst for a 30 basis-point fall in the 10-year Treasury yield in one day:

Britannia Rules the Waves (Of Risk Appetite)

The Bank of England helped trigger a 30bps decline in Treasury yields

Source: Bloomberg

This was also the best day for global stocks in a while, with Wall Street rallying nicely after six consecutive down days. It also had a very favorable impact, as we’ll see, on risk sentiment in the eurozone.

But it’s probably best to view this as a bullet dodged, rather than a turning point. Traders the world over knew that such a sudden and disorderly fall for gilt prices could only have happened if something was systemically very, very wrong. They were right. The BOE dealt with it, and so other markets could also relax a bit. All the problems we were worried about at the end of last week remain.

To offer one illustration, overnight index swaps suggest that the market does buy the BOE’s contention that its move was about crisis prevention, not monetary policy. Its estimate of the peak Bank Rate, expected to be reached in May next year, came down a lot on Wednesday. But it’s still 150 basis points higher than on the day of the Queen’s funeral, which seems an age ago now:

After The Funeral

The expected peak bank rate is 150bps higher than on the Queen's funeral day

Source: Bloomberg World Interest Rate Probabilities

The journey to a 6% base rate is not going to be easy.

It’s the Politics, Stupid

Even if some smart bankers in Threadneedle Street have saved us all from a crisis, broader confidence in the UK economy is barely affected. That’s because the problem lies in fiscal policy, and therefore requires a political solution.

Fiscal policy can only be changed by the chancellor. And doing so this quickly would be politically fatal. Therefore, plenty of Tory MPs were briefing journalists Wednesday that that will mean that Kwasi Kwarteng must lose his job. Others pointed to how closely he is identified with Liz Truss, and how she had firmly shown her intent to make a big tax cut. They suggested that markets would also require the prime minister’s head on a stake.

There are precedents for finance ministers losing their jobs that quickly, but none that I can think of in the developed world. As for the prime minister, her greatest problem may be that there is an obvious alternative. This clip from her debate with former chancellor Rishi Sunak during the summer is understandably garnering attention. Sunak said that bond yields and mortgage rates would go up and the currency down if Truss persisted with her plan, and he was proved right. He was more popular with MPs than Truss, and his margin of defeat in the party as a whole was surprisingly small. Installing him as prime minister would calm the market. Alternatively, if the party cannot stomach the Shakespearean drama of getting rid of yet another premier, Truss might offer Sunak a deal something like the one that Tony Blair gave to Gordon Brown — he can be chancellor, and with it gain total control over economic policy. More or less any deal Truss offered that Sunak could accept would be appallingly humiliating for her, so this is unlikely. The markets would love it.

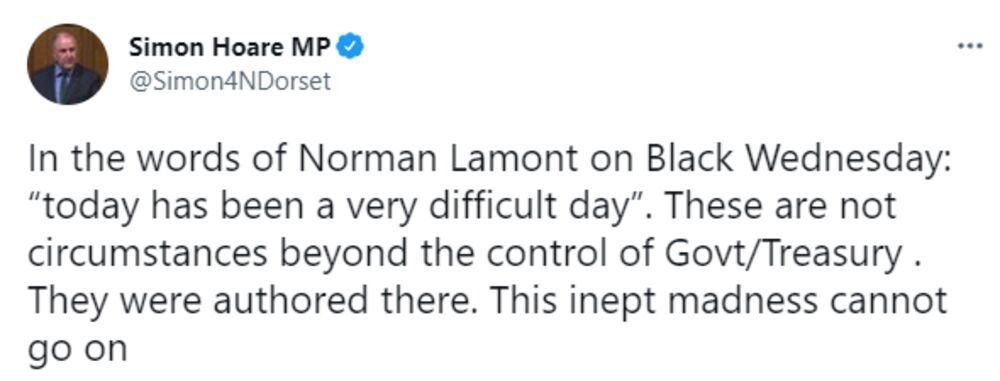

And the critical problem, enunciated by Adam Ant, remains. Perhaps the single most damning comment of the day came in a tweet from the Conservative MP Simon Hoare:

When members of your own party accuse you of “inept madness,” you’re in trouble. Even more telling is the comparison to Norman Lamont, the chancellor 30 years ago who had to defend sterling (a policy in which he did not personally believe) and then admit defeat on Black Wednesday. Cheaper sterling allowed for a new policy that helped drive an economic boom in Britain for the rest of the decade. But Lamont didn’t get to take the credit for that, because he was fired soon afterward. Even though the Conservative government had turned the situation around by the next general election in 1997, it didn’t matter. Black Wednesday had opened it to ridicule. That wasn't forgettable or survivable. Tony Blair came to power in a landslide.

Britain’s new leaders will have to subject themselves to much more ridicule if they are to end this crisis. It’s something to be scared of.

Meanwhile, in Italy

It’s an odd thing. The world had been braced for a market crisis this week, when a new, woman prime minister running on a very populist and anti-European platform took the helm of one of Europe’s major economies. Giorgia Meloni’s track record suggests that she is the hardest-right Italian leader since Mussolini. Yet so far, at least she has avoided a market crisis.

The key gauge of perceived political risk is the spread of Italian BTP yields over equivalent German bunds. After the last election in March 2018 produced an ungainly coalition of the League and the Five Star Movement (populist right and populist left), the spread ballooned to more than 300 basis points. This Sunday’s election took the spread as far as 257 basis points, but the relief following the BOE’s announcement brought it back down to 241:

Giorgia Who?

Bond markets have taken the Italian election result with comparative calm

Source: Bloomberg

This is certainly not to say that all is fine. The absolute yield on BTPs stands to put the Italian government’s debt-servicing costs above 4% for the first time in almost a decade. The 2012 pledge by Mario Draghi, then head of the European Central Bank and now about to stand down as Italian prime minister, to “do whatever it takes” to defend the euro had kept Italian yields at a sustainable level. They are now moving into territory that could make life hard for the incoming government:

Whatever It Took: Italian Yields Hit a 10-Year High

High borrowing costs could make life much harder for Italy's new government

Source: Bloomberg

So, why the (relative) calm? Jean Ergas of Tigress Capital Partners, a veteran Italy-watcher, lists the key factors:

- Meloni (unlike Truss) has studiously tamped down the rhetoric since winning.

- Her coalition is for now emphasizing social issues like abortion, and not the economy.

- Word is that she is interviewing various veteran trusted economic technocrats as possible finance ministers. Personalities matter, and investors are comforted by the evidence that the finances will be run by someone they personally trust.

- The ECB was already giving air cover, by reinvesting maturing bonds in its portfolio into BTPs rather than bunds. That buoyed market confidence, while in the UK, the markets needed to press the BOE into showing that it would do the same.

Still, Italy remains the major economic fault line within the eurozone, which has enough problems already. Don’t forget about Meloni’s Italy.

Survival Tips

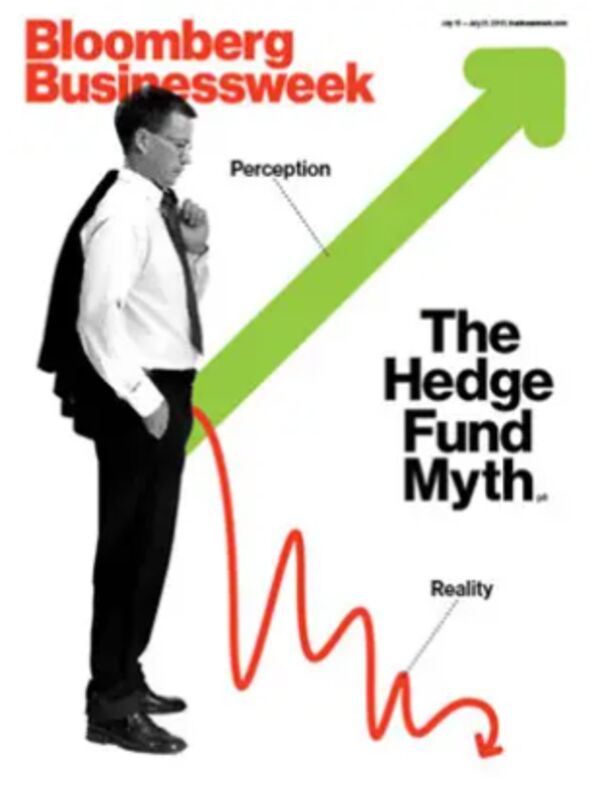

You can’t judge a book by its cover, but that might not apply to magazines. Their covers are an art form. Yesterday, I shared this one that had made me laugh out loud:

It's now been pointed out to me that this was itself an homage to this Bloomberg Businessweek cover from 2013:

There have been some other great ones in history. This Economist cover from 1994 is a work of genius (which also made me laugh out loud):

Most recently, however, it’s an online headline, from The Spectator, that has gone viral. Much like the New European’s image of Kwasi Kwarteng, it makes a profound point about the mess that the UK is still in — just not the point intended at the time:

The first paragraph was meant to be funny. It now reads as prophetic and deadly serious:

Meant to show that Sunak was desperate and irresponsible, these words now make him look like the leader Britain should have had, and greatly increase the chance that he still, somehow or other, becomes the prime minister.

More From Bloomberg Opinion:

- Daniel Moss: Will Powell Get Greenspan’s ‘Oasis’ Feeling?

- Mark Gilbert: Gilt Market Carnage Prompts Risky Bank of England U-Turn

- Lionel Laurent: Italy's Right-Wingers Spook Markets Less Than UK

Want more Bloomberg Opinion? OPIN <GO>. Web readers click here.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

John Authers at jauthers@bloomberg.net

To contact the editor responsible for this story:

Patrick McDowell at pmcdowell10@bloomberg.net