PC2BUY

股經

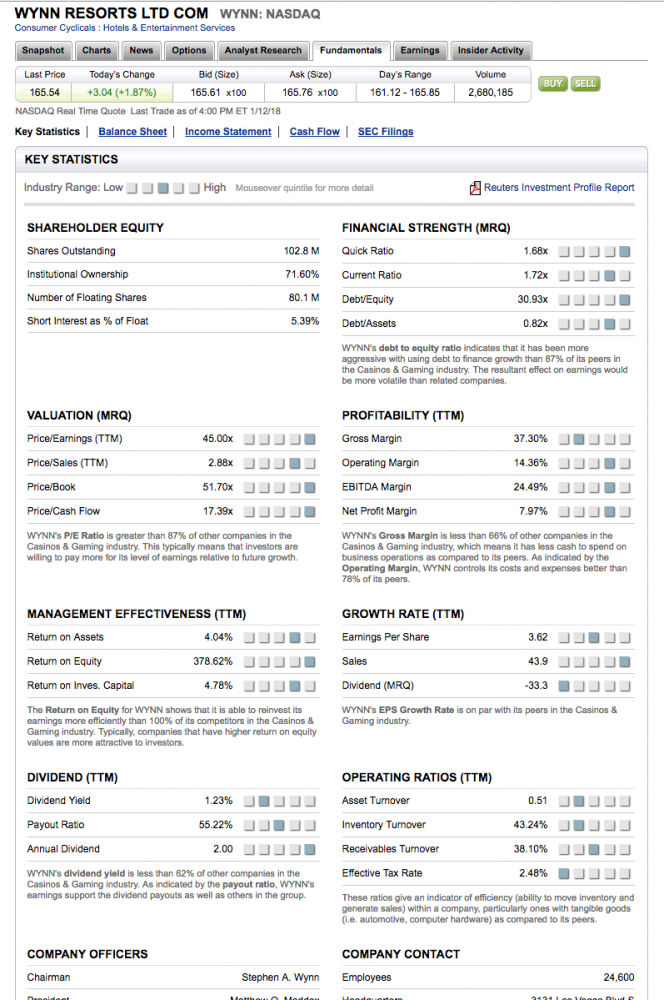

put spread

sell put @$160 collect $5.05

buy put @$145 pay $1.16

premium collected $3.89 / $15 capital needed

i.e. 26% potential ( if stock price is above $160 )

if buy 100 shares $16000 capital , up $10 i.e. 6.25%

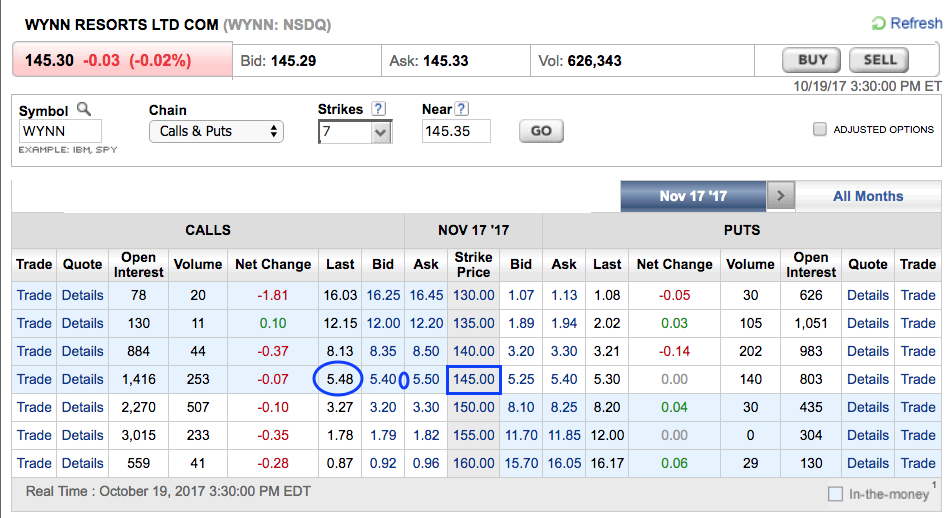

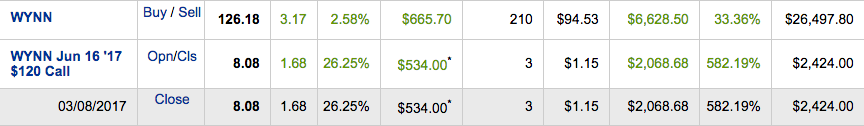

| 06/14/17 | 10:29 AM EDT | Sell 1 WYNN Jun 16 '17 $120 Call Executed @ $14.8 |

| 06/13/17 | 11:05 AM EDT | Sell 2 WYNN Jun 16 '17 $120 Call Executed @ $13.65 |

Screen Shot 2017-06-13 at 上午9.46.16

Screen Shot 2017-06-12 at 下午2.48.14.png

$133.88 , 06-01-2017

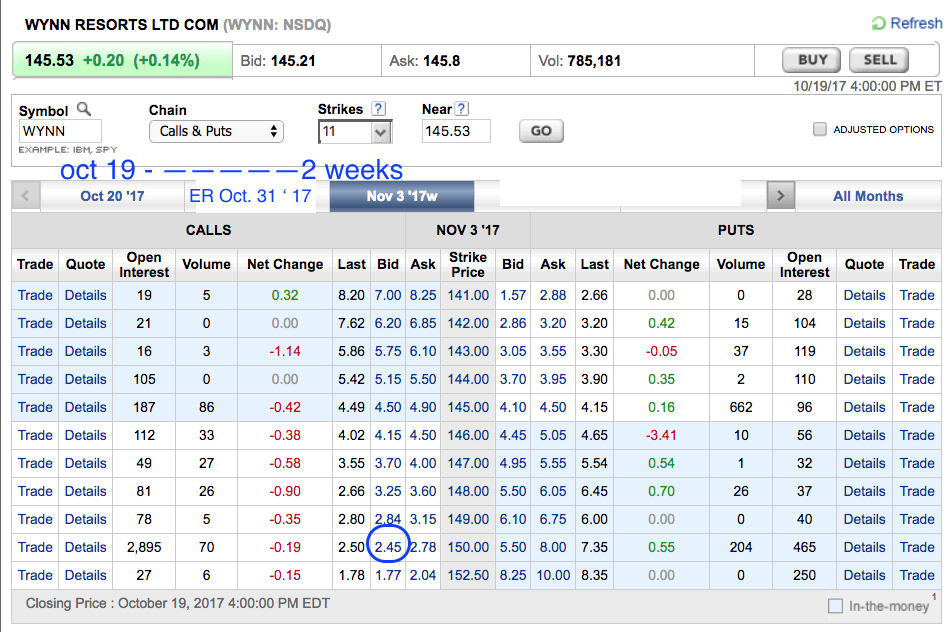

interesting strategy ... insurance approach .... good or bad ...

sell 2 covered calls Sep15 $130 for $6.35

buy 2 puts July 7 , $121 at $2.69 ( insurance )

$127.84 , 05-16-2017

$126.18 , 05-01-2017

$126.70 , 4-26-2017

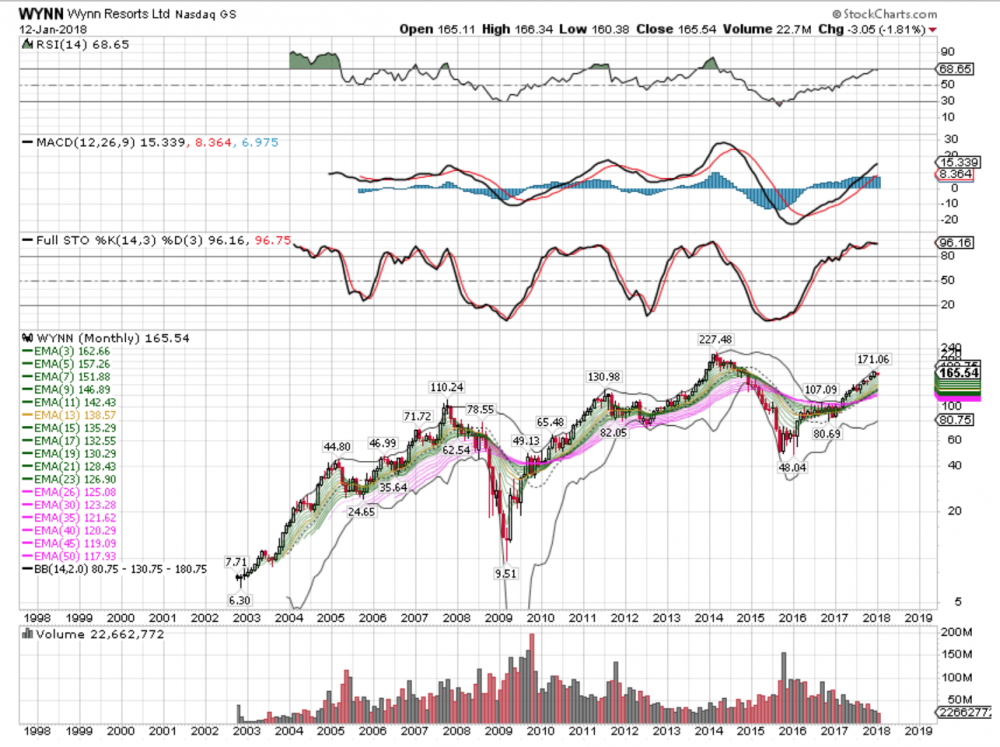

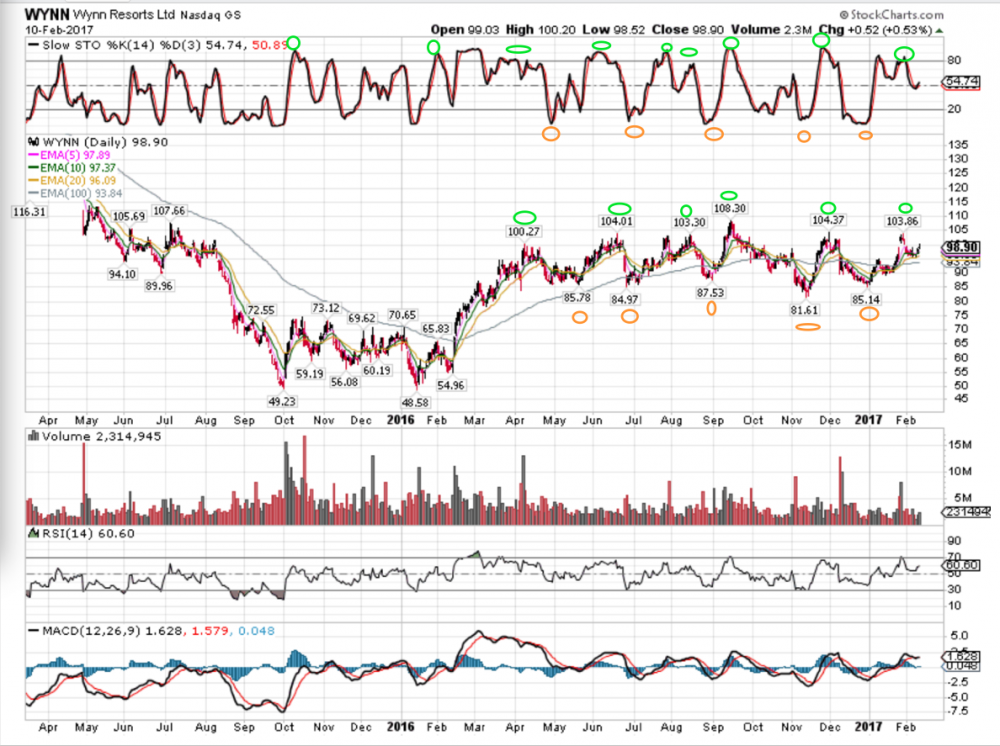

02-10-2017 broke out and dwindled ... now coming back up

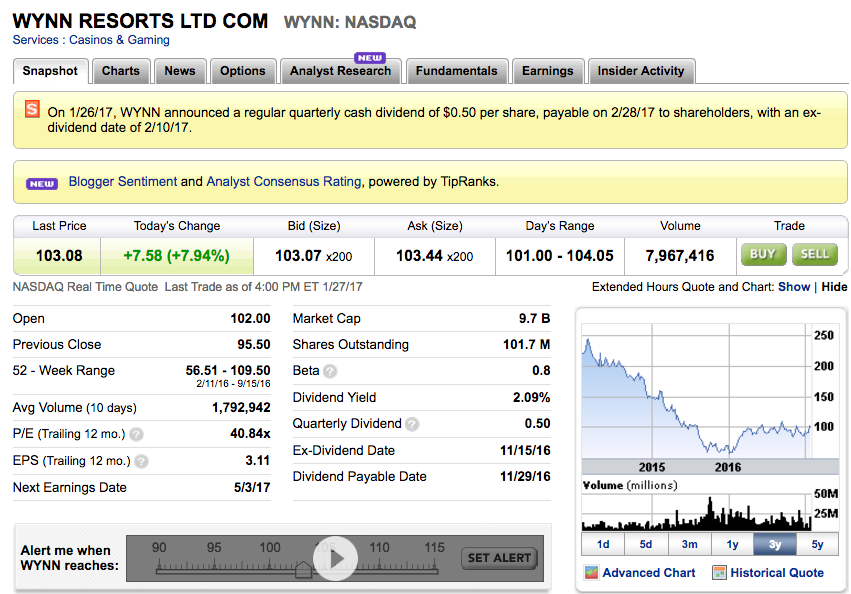

01-27-2017 WYNN breaks out..

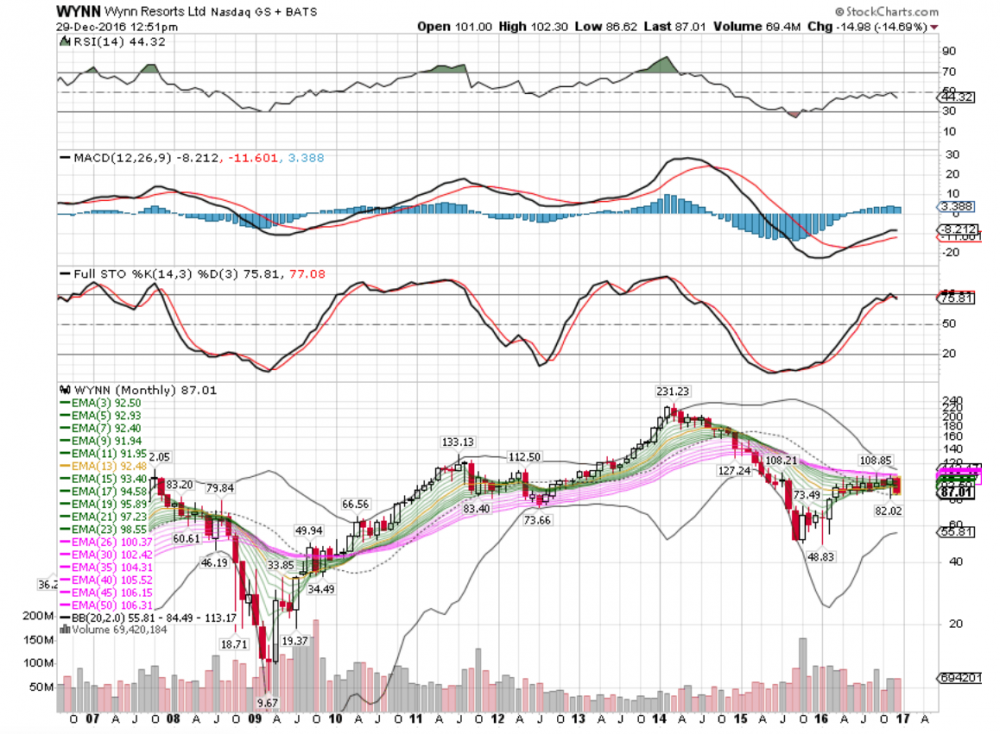

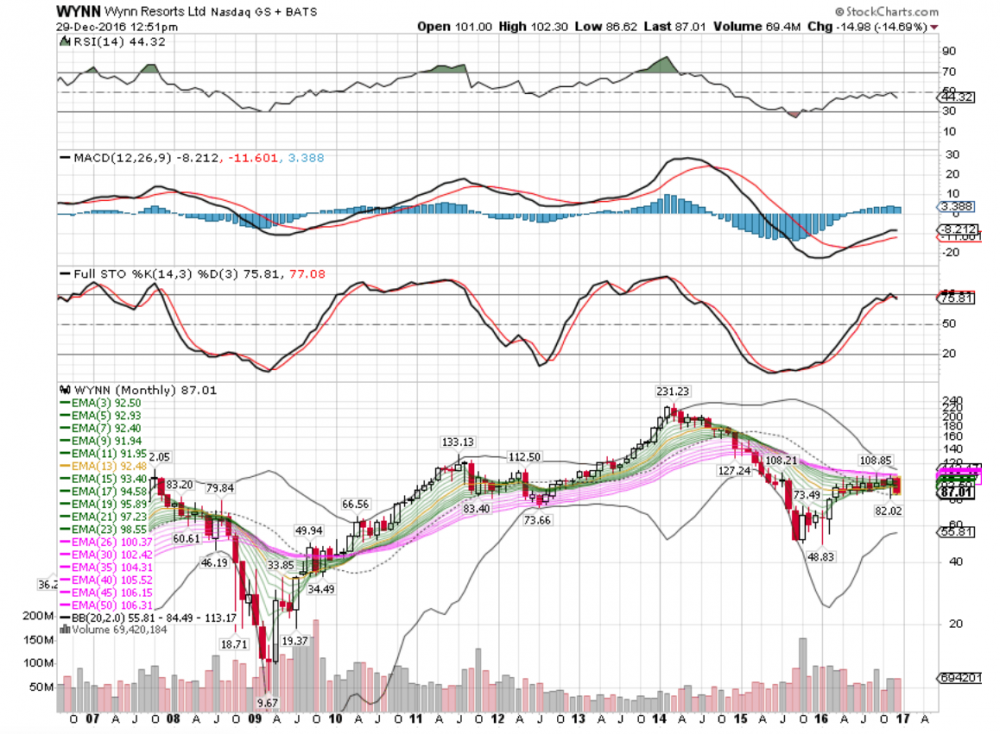

WYNN , watched closely for reversal at above ....$83.70

( reversed at $85.57 12-31-2016)

long term target : $150 summer 2017

do not take any actions for now .. just wait on it if you have positions.

01-06-2017 : $92.34

1y5m 6m 4m 10 year

Officially , recommended .. 12-29-2016 at $87.01