2017 (316)

2018 (385)

2020 (208)

2021 (251)

2022 (260)

2023 (216)

2024 (270)

2025 (199)

2026 (4)

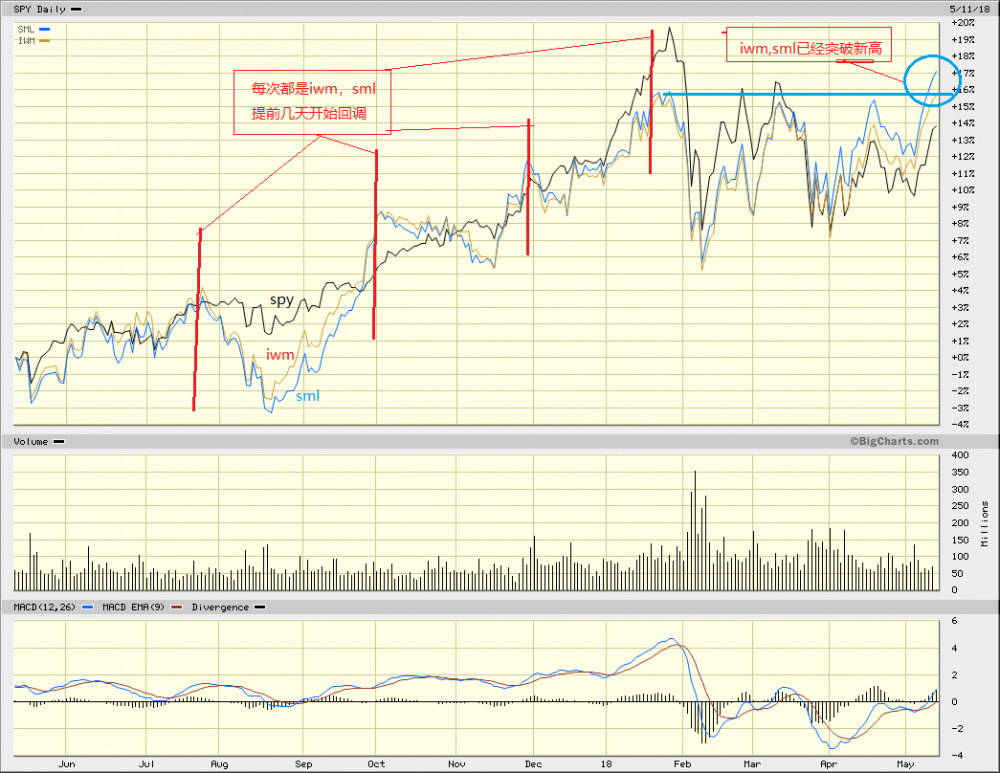

这是昨天看到的TA文章。大意是到昨天收盘,iwm(rut2000),sml(sp600)还在涨。iwm接近新高,sml已经走出新高,spx的后续走势会跟随这两股的走势继续上涨。

为了验证这篇文章内关点的可靠性,我对比了iwm,sml和spx一年内的走势图,发现,对于每个调整周期,都是iwm,sml比spx提前几天开始调整(见下图),规律非常清晰,原文作者的关点是经得起股市实践检验的。

由此,我们可以把iwm和sml作为判断大盘是否面临调整的先行指标。今天,iwm,sml还在继续上涨,spx大跌的可能性很·小。多头可以放心的继续持股,直到那一天iwm,sml出现回调迹象,再考虑减仓也不晚。当然,突发利空事件出现时,这个规则不再适用。

个人观点,仅供参考。

#######################################################

5月10收盘后发表

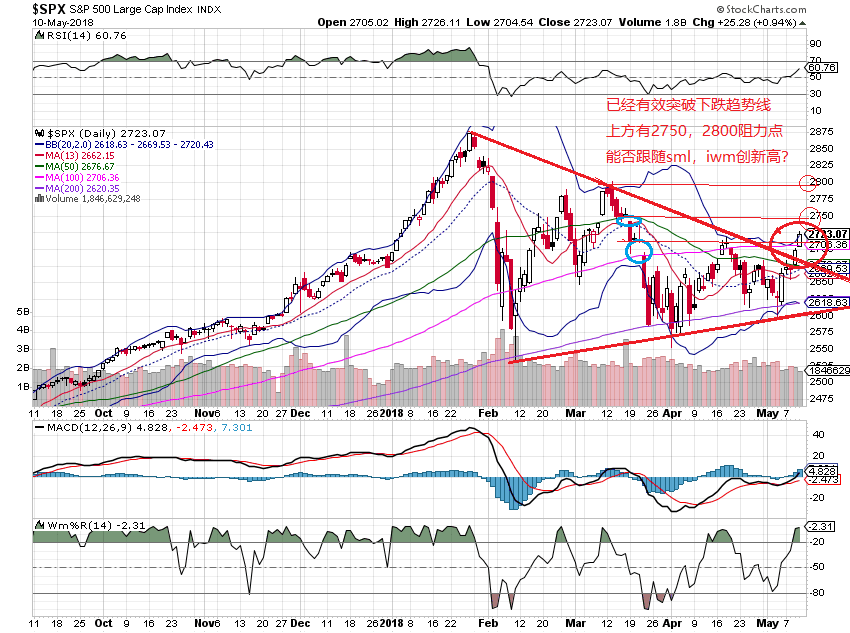

S&P 600 SMALL CAP INDEX BREAKS OUT TO A NEW HIGH ... Yesterday's message showed the S&P 600 Small Cap Index ($SML) nearing the top of a bullish "ascending triangle". Chart 5 shows the SML hitting a new record high today. That's a very bullish breakout. Chart 6 shows the Russell 2000 Small Cap Index (RUT) rising above its upper trendline drawn over its March/April highs (see circle). A close above that trendline would signal that the RUT has resolved its three-month triangle on the upside. It's normal for the SML to lead the RUT higher during an uptrend and reach a new high first. That's because the SML is made up of a smaller number of more highly rated small cap stocks. And as usually happens, upside breakouts by small caps is pulling large cap stocks up with them. And they're achieving bullish breakouts of their own.

############################################################

xx

xx

xx