天朝玉 (热门博主)

(原创所有,请勿转载)

金融评论:金融教授们是如何看待TA的 & 行为金融学

一般来说,金融教授是不相信 Technical Analysis的。他们在课堂上也花很少时间讲技术分析。即便讲的话,也会说它无用(见下面图片例子)。这个观点近年来有些变化。

In their doctoral training days, twenty, thirty years ago, they were likely taught that,in general, you couldn’t beat the market and earn abnormal returns by using past, historical information. Those past information has already incorporated into the equity price. Our current stock market is weak-form efficient and stock price follows a random walk. Technical Analysis using past information couldn’t help you outperform the market. This old school thinking has dominated the financial academic world for the past fifty years.

In recent years, behavioral finance came out and moved to the center stage of academic financial research. Nobel prizes were awarded to psychology economists, such as Daniel Kahneman, Robert Schiller, Richard Thaler, to name a few. Researchers start to examine how human psychology, sociology, investor sentiments affect investment decision making, trading patterns, and hence equity prices. Behavioral finance proposes that human flaws are consistent, measurable and predictable, and being aware of and utilizing this phenomenon can benefit a trader. They do find evidence that 20% to 50% of price behavior of a stock can be traced to overall market forces. Traders can take advantage of predictable human behavior, such as "crowd psychology", or "bandwagon effect”, to profit.

Personally, I keep an open mind and look forward to more research on behavioral finance and TA. I think behavior finance is a very exciting field which could bring new insights on the value of technical trading.

——————————————————————————

An Example

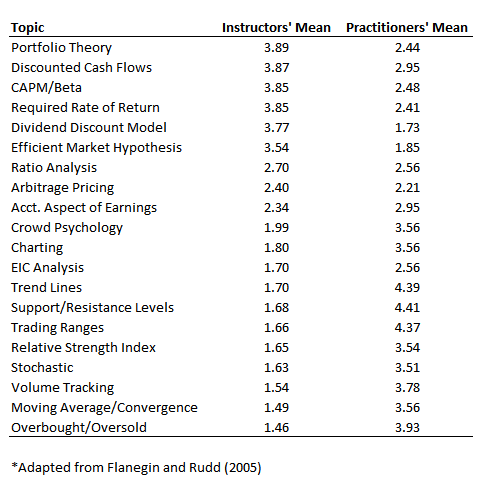

Although technical analysis is widely used by practitioners, its popularity is not mirrored in the academic community. The divergence in emphasis placed on technical analysis is highlighted by a study conducted by Flanegin and Rudd (2005) in which they surveyed both college professors and practitioners .

The college professors were asked how much emphasis they placed on each of the 20 topics in their investment courses. These professors ranked the subject areas on a 1 to 5 scale, with “1” indicating that they spend very little time in class on the material and “5” indicating that they spend considerable time on the topic. Given the same list of 20 topics, practitioners were asked which subject matter they utilized within the realm of their jobs on a fairly consistent basis. The table below provides a summary of their results.

The practitioners report showed them seldom using many of the topics most thoroughly covered by the professors. Likewise, professors report very little class time is spent teaching the subject material practitioners claim to use most often.