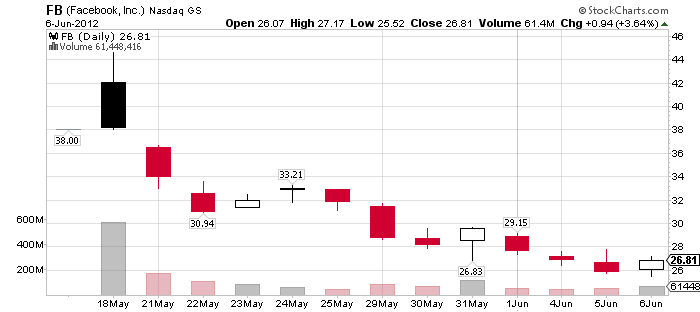

So Facebook keeps falling, and is now floating around the $27 mark. We’re a third of the way down to my IPO valuation of FB as worth roughly $2-4 a share (or 5-10 times earnings), although I wouldn’t be surprised for the market to stabilise at a higher price (at least until the next earnings figures come out and reveal — shock horror — that Facebook is terrible at making money).

The really stunning thing is that even after all these falls, FB is still trading at 86 times earnings. What the hell did Morgan Stanley think they were doing valuing an IPO without any viable profit model at over 100 times earnings? The answer is that this was an exit strategy. This IPO was about the people who got in early passing on a stick of dynamite to a greater fool which incidentally is precisely the same bubble mentality business model as bond investors who are currently buying negative-real-yielding treasuries at 1.6% hoping to pass them onto a greater fool at 0.5% (good luck with that).

This was achieved by convincing investors to ignore actual earnings and instead focus on projected future earnings. From Bloomberg:

Facebook, with a market capitalization of $79.1 billion, is trading at 29.5 times the company’s projected 2014 profit of $2.69 billion, data compiled by Bloomberg show.

Or much more simply, counting chickens before they hatch.

There’s an interesting comparison to the development of AAPL. Steve Jobs — who went on to do great things — was never fully in charge of AAPL until much later on. AAPL externally recruited CEOs with business experience, and Jobs was eventually thrust out of the company he founded, to continue his journey on his own. Failure is a really valuable lesson. Jobs was lucky to experience it and learn from it early before he ever got a chance to destroy AAPL.

FB isn’t really a bad business, and prospects would look much rosier if it were priced more realistically. It’s generating a profit — just a much smaller one than suggested by the IPO pricing. And management are being swept along by everyone else’s irrational euphoria. Zuckerberg can freely throw away a whole year’s earnings buying Instagram — an App whose functionality FB actually duplicated in-house almost certainly for a tiny fraction of the cash thrown at Instagram. And Zuckerberg — who controls a majority of the voting rights — isn’t going to get thrust out into the cold by shareholders. He can keep wildly throwing cash around so long as it keeps flowing into FB. The problem is, given the steep price falls, it looks like the river is running dry.

As I wrote before FB started falling:

The big money coming into Facebook just seems to be money from new investors — they raised eighteen times as much in their flotation yesterday as they did in a whole year of advertising revenue. For an established company with such huge market penetration, they’re veering dangerously close to Bernie Madoff’s business model.

That’s life. Bubbles get burst; the Madoff bubble, the securitisation bubble, the NASDAQ bubble, the housing bubble, the Facebook bubble, the treasury bubble. The trick is not getting swept up by the irrational euphoria. Better to miss a blow-out top than to end up holding a stick of dynamite.