Introduction

I started writing this book almost immediately after my first book, Buy Bye Property: Mistakes You Want to Avoid in Property Investing was published. I received much positive feedback for the first book and I am happy to know that many people, especially those looking for their first property, have found the book very useful. The first book was intentionally written to be an easy read as I wanted to reach out to as many people as possible and not just to aspiring property investors. Some readers felt that topics like market timing, finding good locations and determining the property’s fair price could be addressed. This is what the second book is about. In the course of this book, I will focus on the nuts and bolts of property investing in Singapore, and address issues ranging from identifying the characteristics of the Singapore property market to finding value-for-money properties.

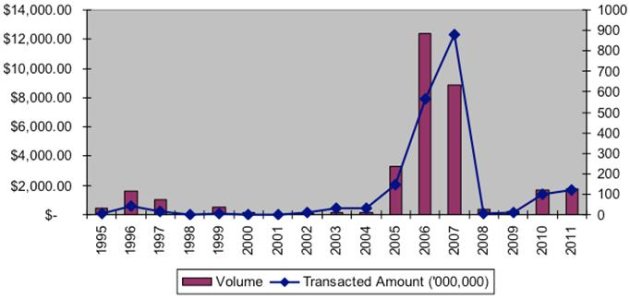

This book contains my observations of the property market over the past 7 years. Although the actual writing took only a few months, most of my time was spent on researching and understanding the Singapore property market. During the last few years, I was fortunate enough to witness the property recovery from 2005 to 2006, the property boom from 2007 to mid-2008, the property market crash from end-2008 to early-2009, and most recently the recovery of prices from 2009 to 2010. This gave me the opportunity to observe how property prices reacted during the different phases and how property investors behaved. As a result, I was able to validate my findings by investing in the market myself. In doing so, I was able to experience firsthand the mixed emotions of fear and greed that confronted property investors.

Why did I write this book?

Property, unlike other forms of investments, is something that most of us will come intocontact with. Based on Singapore’s Department of Statistics, home ownership rate for 2008 was more than 90%, which means that 9 out of every 10 Singaporean or Singapore Permanent Resident (PR) households own the property that they stay in. Hence, it is beneficial to learn how to spot good property deals as most of us will buy a property at least once in our lifetimes.

However, there are many sources of property information available, such as the newspapers, magazines and the internet. With more than 1,000 registered property agencies and an even larger number of property agents touting their views on whether it is a good time to buy, hold or sell, it is understandable why everyone seems to have an opinion of how the property market is performing. Over time, some of these views become “conventional wisdom” that some individuals may rely on to make their buying or selling decisions. Alas, more often than not, such “conventional wisdom” does not accurately reflect how the property market behaves.

Allow me to give you an illustration. If I told you that a yearly property cycle exists and made you guess the months that have the highest and lowest property transactions, what will your answer be? Many people believe that January has the highest level of property transactions as most employees receive their year-end bonuses in December. With the bonus, they will likely have sufficient cash to pay for the property down-payment. Many people also believe that August, being the Lunar Seventh Month, has the lowest level of property transaction activity as it is generally perceived to be an inauspicious month to buy properties. Do you share such similar views?

From my research, I found that this was not the case. Figure 1-1 shows the distribution of monthly transaction volume for the sale of owner-occupied non-landed properties.

To derive the figures, transaction volume for the respective months over the last 14 years was added together. For example, the number of transactions done in all the Januarys for the last 14 years amounted to 5,090. From the distribution, we can see that “conventional wisdom” does not accurately reflect the realities of the Singapore property market, and January is typically a low activity month while August is one of the highest transaction months.

How did this analysis help me in my own property investment journey? Back in January 2007, I owned a one-bedroom unit near the central area and I wanted to sell it to profit from the recovering property market. In early 2007, the Singapore property market was showing signs of recovery and there were constant media reports on how prices around Marina Bay and parts of Orchard were setting new records, with some properties transacted for as high as $3,000 per square foot (psf). Since my property was in town and within walking distance to amenities like restaurants and pubs, I thought that I would have no problems selling it for $1,250psf. I even foolishly thought that potential buyers would see it as a good deal and start a bidding war over my unit. However several weeks passed and my agent told me that she was unable to find a buyer to match my asking price. The highest offer then was only $1,100psf. This puzzled me.

How did this analysis help me in my own property investment journey? Back in January 2007, I owned a one-bedroom unit near the central area and I wanted to sell it to profit from the recovering property market. In early 2007, the Singapore property market was showing signs of recovery and there were constant media reports on how prices around Marina Bay and parts of Orchard were setting new records, with some properties transacted for as high as $3,000 per square foot (psf). Since my property was in town and within walking distance to amenities like restaurants and pubs, I thought that I would have no problems selling it for $1,250psf. I even foolishly thought that potential buyers would see it as a good deal and start a bidding war over my unit. However several weeks passed and my agent told me that she was unable to find a buyer to match my asking price. The highest offer then was only $1,100psf. This puzzled me.

Wasn’t the Singapore property market booming? Wasn’t the media constantly carrying articles on how well the property market was doing? Weren’t the property agents who were trying to sell my unit exhorting a property boom? If there was indeed a property boom, then why was I not able to sell my unit for the price I wanted? What could have been the reason behind the lack of buyers’ interest? Was the property market about to turn as a result of the bursting United States housing bubble (the issues of Collateralised Debt Obligations and US Financial Crisis had not surfaced in early 2007) or was I asking too much for my property? Could there be other reasons that I was not aware of?

At some point, I was worried that I would not be able to sell my property and I seriously considered lowering my asking price. Fortunately, I decided to do a bit more research and having some stock investing experience, I was aware that a monthly trend existed for the stock market. For example, the trading volume for the United States stock market tends to be lower during the summer months of June and July as traders will be away on vacation, while trading towards the end of the year is generally more active due to window dressing by financial institutions. Window dressing is a strategy used by fund managers near the end of the year or quarter to improve the appearance of the fund performance by selling stocks with large losses and purchasing good performing stocks before reporting them as part of the fund’s holdings. This made me wonder if there could be a trend for Singapore property as well. This was how I came up with the monthly distribution analysis for the Singapore property market. From the monthly volume analysis, I concluded that buying sentiments, represented by transaction volume, was generally low in the first few months of the year.

The findings assured me that the lack of buyers who were willing to meet my asking price was not necessarily due to changing market sentiments or to mis-pricing of my property. From my research, I also noticed that high transaction months generally lasted from April to August while low transaction months generally lasted from September to March the following year, thus a good point to lower my asking price would be from September onwards. If I could not sell my property during the high activity months, how likely was I able to sell it without lowering my asking price during the low activity months? In the end, I decided to hold on. As a result of that decision, I eventually sold my unit in May 2007 (one of the high volume months) at my asking price. This whole experience made me realise the importance of doing my own research before making any investment decision. Had I not done my due diligence, I would likely have succumbed to fear and greed, and sold my unit for much less. Now that you know such a trend exists, how does it affect your investment decision?

The findings assured me that the lack of buyers who were willing to meet my asking price was not necessarily due to changing market sentiments or to mis-pricing of my property. From my research, I also noticed that high transaction months generally lasted from April to August while low transaction months generally lasted from September to March the following year, thus a good point to lower my asking price would be from September onwards. If I could not sell my property during the high activity months, how likely was I able to sell it without lowering my asking price during the low activity months? In the end, I decided to hold on. As a result of that decision, I eventually sold my unit in May 2007 (one of the high volume months) at my asking price. This whole experience made me realise the importance of doing my own research before making any investment decision. Had I not done my due diligence, I would likely have succumbed to fear and greed, and sold my unit for much less. Now that you know such a trend exists, how does it affect your investment decision?

Using facts and figures, I intend to dispel some of the “conventional wisdom” surrounding the Singapore property market. I also hope to share a process to help buyers consistently find value-for-money properties. After all, buying a property is a hefty financial commitment, thus it is important for us to know what we are doing. If you recall, 1996 was one of the hottest years for the Singapore property market. It was just before the Asian Financial Crisis and the collapse of the Singapore property market. Of the properties that were purchased in 1996, more than 80% were sold for a loss, with the largest drop in value amounting to more than $1466psf. In other words, if the unit was 1,000 square feet in size, the total loss would have amounted to more than $1 million. This goes to show that the simple buy-and-hold strategy does not always work and properties are definitely not “sure-win” investments.

Who is this book for?

Through this book, I hope to help aspiring property investors and potential homeowners to better understand the Singapore property market. As the Singapore property market becomes more mature, it may not be enough to simply buy and hold and we will have to be more selective in order to maximise profits. Although I talk about finding good properties to buy, I would like to emphasise that this is not a get-rich-quick book. I personally believe that get-rich-quick schemes do not work as it takes time to master any discipline. What would you think if I told you that you could master swimming by simply reading a book (and without actually getting into the pool to swim)? By extension, it is not possible to master a complex subject like property investing by simply reading a book and not giving it an actual shot. Hence, I do not expect you to become an instant expert after reading this.

Instead, the purpose of this book is to help those unfamiliar with the topic to overcome this steep learning curve. I also intend to approach the topic of property investing in a more systematic manner. To do that, I will be sharing a proprietary selection process called the RIGHT approach. RIGHT is the acronym for Realities, Investment considerations, Goals, Hotspot and Target price, which are the 5 key considerations for any potential property buyer to think about before making a purchase. We will focus on the buying process and put less emphasis on the selling process as I believe that once you get the fundamentals right and buy value-for-money properties, it will not be very difficult to sell it for a good profit.

Conclusion

Understanding the Singapore property market is a continuous learning process as the property market is constantly evolving. Along the way, I have learnt that finding good property deals is dependent on both external and internal factors. External factors refer to things that are beyond our control such as market timing, location and price, while internal factors refer to things that stem from within us, such as risk appetite, investment horizon, investment objectives, emotions (e.g. fear of losing out, greed for more profit), etc.

I have come across buyers who focus excessively on one aspect at the expense of others. For example, some buyers are so adamant in making a quick profit that they end up taking unnecessary risks. While in theory, anyone with a sufficiently long investment horizon will almost certainly expect to make money from the real estate market, some let emotions cloud their judgment and they end up paying more than what the property is worth. They justify their action of paying excessively by mistakenly believing that if they wait long enough, prices will eventually go up. While that may be the case, have they accounted for the opportunity cost of the ownership? In other words, had they bought another property instead, they could have reaped the same returns in a much shorter time. To avoid such errors, you should take your time to weigh your options before proceeding. As the saying goes, “More haste, less speed”, which brings me to my second takeaway.

I believe that there are plenty of investment opportunities available. Buyers are sometimes pressured into jumping on to the bandwagon from fear that they would lose out. During hot property launches, some buyers even go to the extent of passing blank checks to property agents in order to book any unit. In reality, I believe that there are plenty of opportunities available, you just need to look a little harder. Let me share a personal investment story with you to illustrate the case.

In March 2010, the Singapore property market was on the road to recovery. If you recall, the media then was filled with news on how hot the property market was and the asking prices of some properties had even exceeded the peak price set in 2008. I had just sold my unit at Robertson Quay for a profit of $400,000 and was looking to reinvest my money. However, I was a little concerned whether I would be able to find a good deal as prices were increasing rapidly. I took my time to explore different possibilities and check out various sectors of the property market. Eventually I managed to secure a conservation shop house which had an indicative bank valuation of $1 million for about half the price. Had I decided to flip this deal, I would have made a handsome profit within a short period of time.

Some people commented that I was lucky to come across this deal and it was not likely to be repeated. Although I agree that such deals are not easy to find, it was the belief that these opportunities existed that motivated me to search relentlessly. More importantly, had I not taken proactive steps to seek these opportunities out, I would definitely not have come across such a deal. My purpose of illustrating this is simply to reinforce my point that plenty of opportunities abound even in a hot market. With more than 150,000 private apartments and condominiums units in Singapore (and more being constructed), there is ample choice for property buyers.

If we were to look at past property booms, there were always some “hot” properties of the time. In the 1980s, developments around the Bayshore location were very popular. In the 1990s, properties located at Tanjong Rhu and landed properties were highly sought after. In the 2000s, Marina Bay was considered the “it” place for property investors. Hence you can be assured that you are not missing the boat if you currently do not own a swanky apartment in the Marina Bay area as property market cycles come and go. I am certain another hotspot will emerge in the coming years; the only question is where and when. However this time round, after reading this book, you will be ready for it!

Happy reading.

Buy Right Property is available now in major bookstores such as MPH, Kinokuniya and Popular.

How did this analysis help me in my own property investment journey? Back in January 2007, I owned a one-bedroom unit near the central area and I wanted to sell it to profit from the recovering property market. In early 2007, the Singapore property market was showing signs of recovery and there were constant media reports on how prices around Marina Bay and parts of Orchard were setting new records, with some properties transacted for as high as $3,000 per square foot (psf). Since my property was in town and within walking distance to amenities like restaurants and pubs, I thought that I would have no problems selling it for $1,250psf. I even foolishly thought that potential buyers would see it as a good deal and start a bidding war over my unit. However several weeks passed and my agent told me that she was unable to find a buyer to match my asking price. The highest offer then was only $1,100psf. This puzzled me.

How did this analysis help me in my own property investment journey? Back in January 2007, I owned a one-bedroom unit near the central area and I wanted to sell it to profit from the recovering property market. In early 2007, the Singapore property market was showing signs of recovery and there were constant media reports on how prices around Marina Bay and parts of Orchard were setting new records, with some properties transacted for as high as $3,000 per square foot (psf). Since my property was in town and within walking distance to amenities like restaurants and pubs, I thought that I would have no problems selling it for $1,250psf. I even foolishly thought that potential buyers would see it as a good deal and start a bidding war over my unit. However several weeks passed and my agent told me that she was unable to find a buyer to match my asking price. The highest offer then was only $1,100psf. This puzzled me. The findings assured me that the lack of buyers who were willing to meet my asking price was not necessarily due to changing market sentiments or to mis-pricing of my property. From my research, I also noticed that high transaction months generally lasted from April to August while low transaction months generally lasted from September to March the following year, thus a good point to lower my asking price would be from September onwards. If I could not sell my property during the high activity months, how likely was I able to sell it without lowering my asking price during the low activity months? In the end, I decided to hold on. As a result of that decision, I eventually sold my unit in May 2007 (one of the high volume months) at my asking price. This whole experience made me realise the importance of doing my own research before making any investment decision. Had I not done my due diligence, I would likely have succumbed to fear and greed, and sold my unit for much less. Now that you know such a trend exists, how does it affect your investment decision?

The findings assured me that the lack of buyers who were willing to meet my asking price was not necessarily due to changing market sentiments or to mis-pricing of my property. From my research, I also noticed that high transaction months generally lasted from April to August while low transaction months generally lasted from September to March the following year, thus a good point to lower my asking price would be from September onwards. If I could not sell my property during the high activity months, how likely was I able to sell it without lowering my asking price during the low activity months? In the end, I decided to hold on. As a result of that decision, I eventually sold my unit in May 2007 (one of the high volume months) at my asking price. This whole experience made me realise the importance of doing my own research before making any investment decision. Had I not done my due diligence, I would likely have succumbed to fear and greed, and sold my unit for much less. Now that you know such a trend exists, how does it affect your investment decision? Roman Abramovich, a Russian billionaire and the 53rd

Roman Abramovich, a Russian billionaire and the 53rd