insight

工程技术,地产投资,信仰家园,时尚生活

London luxury home prices rise fastest in 14 month

This white-stucco-fronted house at 10 Belgrave Square, owned by Lebanese developer Musa Salem, is now the most expensive home on the market in the world.

Mr. Salem bought this property many years back on a long lease from the Grosvenor Estate, with a condition to restore the house to full Victorian glory. The lavish amenities contained in 21,000 square feet of lavish living space spread over 6 floors include an indoor swimming pool in the basement, a gym, a home theater, a garage room, a news house . The home has 12 bedrooms, 20 ft. ceilings, an indoor swimming pool in the basement, a gym, a home and a home theater. - TELEGRAPH

The number of London houses and apartments that sold for more than £5 million rose 31 per cent to 262 in the nine months till September, real estate broker Savills plc said last month. Overseas buyers comprised 65 per cent of the market for homes costing that much, according to the report.

Russians have accounted for about 12 per cent of non-British purchases this year, compared with about 10 per cent in 2010. The prospect of an election in the eastern European country next year may prompt more investors to target the UK -- 2011 Nov 5 Bloomberg

- Coming soon - Bulgari Residences in Knightsbridge Luxury hotel in time for Olympics

London luxury home prices rise fastest in 14 month

EU recession fears, foreign purchases push up Nov prices by average of 12.6 %

Luxury home prices in central London climbed the most in 14 months in November as the risk of a recession in Europe grew and overseas buyers sought safer investments, Knight Frank LLP said.

Values of houses and apartments costing an average of £3.2 million (S$6.5 million) rose by an average of 12.6 per cent from a year earlier, the London-based broker said in a report on Tuesday.

That's the most since a 14.2 per cent increase in September 2010.

'This growth has taken place against a backdrop of ever-worsening global economic news and rising threats of a second credit crunch,' said Liam Bailey, head of residential research at Knight Frank, in the report.

'A typical prime London property has risen in value by more than £1,202 per day over the past year,' Mr Bailey said.

The euro dropped 0.4 per cent to US$1.2996 at midday yesterday, the first time the 17-nation currency bloc's currency has traded under US$1.30 since January, in a fresh sign that Europe's deal last week to enforce more budgetary disciplines on the 17 eurozone countries is being met with scepticism in the markets.

Before the deal reached by European leaders last week, the leaders had also pledged that central banks will channel 200 billion euros (S$339 billion) through the International Monetary Fund, sped the start of a 500 billion euro rescue fund and diluted a demand that bondholders shoulder losses in rescues to help alleviate the region's debt crisis.

Values gained one per cent on a monthly basis.

Prime central-London prices have advanced about 40 per cent since the market's low in March 2009, Knight Frank said.

House prices across the UK rose 0.4 per cent from October, according to a Nov 29 Nationwide Building Society report.

The number of homes on the central London luxury market has increased by 8 per cent in the past 12 months, Knight Frank estimates. The company didn't say how many properties were available.

Prices in affluent neighbourhoods such as Knightsbridge and Belgravia will reach £10,000 per square foot (psf) by 2016 because of a lack of luxury-home supply in the city's best locations, the property broker said.

An apartment at One Hyde Park, the luxury condominium complex in Knightsbridge, sold for £7,500 psf, Nick Candy, one of the two brothers who conceived of the development, said in an October interview.

The glass-and-steel building has had sales of more than £1.4 billion, he said. -- Bloomberg 2011 December 15

According to a recent report one-in-three buyers of newly built London homes come from China. Property developers say London offers a safe haven in the current global economic downturn. But they also hope major Chinese investment will help them finish building developments hit by cash-flow problems ever since the financial crisis first hit

New UK properties find strong Asian support

Singaporeans make up 10% of buyers in projects where construction hasn't begun

Singaporean buyers now account for around 10 per cent of all purchasers at 'new-build' properties in Central London, industry players say.

According to estimates from sales agents at major property firms, buyers from Asia make up about 40 per cent of all investors for new-build projects (that is, projects where construction hasn't begun) in Central London. And Singaporean buyers figure prominently, accounting for about a quarter of transactions by Asian buyers, they said.

Many UK-based developers now launch properties in Asian cities such as Singapore, Hong Kong, Jakarta and Kuala Lumpur ahead of their UK release dates to capitalise on buying interest from this part of the world. In Singapore, this has translated to some two to three new projects from London and the rest of the United Kingdom being marketed here every weekend, industry players said.

The Savills head of international sales, told BT recently that UK developers hope to sell enough units in Asia to fund the start of construction.

This is because Asian buyers are more willing to buy properties off the plan, while buyers in the UK prefer to pick up units in only completed properties, he said.

'Asian buyers accounted for about 40 per cent of new developments that were sold in 2010, and the buying trend has continued into the first three quarters of this year,'.

He said that Singapore buyers could account for about half of these Asian buyers at some launches. Other agents put the figure at closer to 25 per cent.

UK-based property consultancy Black Brick Property Solutions has also noticed the keen Asian interest in 'safe haven' London.

'Asian clients represent over 22 per cent of our client base as they have a huge appetite for London property,' said managing partner at Black Brick. 'It is viewed as a safe haven, many children are educated in the UK, and the weakness in sterling is a key driver.'

Black Brick noted that Singapore clients are benefiting from a 35 per cent discount on London property prices compared to 2007 as a result of currency movements. Similarly, Hong Kong buyers now benefit from a 25 per cent discount, while Malaysian buyers are seeing a 28 per cent discount.

Central London estate agency Kay&Co also noted that bigger homes are still in vogue. Some 41 per cent of the firm's overseas applicants - 25 per cent of whom are Asian - purchase properties in excess of £2 million apiece, Kay&Co said.

But buyers here are not indiscriminate, agents said.

Asian buyers are looking for attractive 'buy-to-let' investments in London. Mark Collins, head of residential at CB Richard Ellis (CBRE), said: 'They are ideally looking for properties in areas of strong rental demand and from developers with established and trusted brands.'

Added Knight Frank Singapore's head of international project marketing, Linda Chern: 'Right now, week in week out, there are a lot of property launches (in Singapore), so clients are spoilt for choice. So unless you have a good location and attractive prices, the take-up is not going to be good.'

But there is no doubt that sales are taking place every weekend. Buyers are usually a mix of investors and those buying for their children who are studying in universities in London.

Knight Frank, for example, marketed Baltimore Wharf (in London's Canary Wharf) several weeks ago, and sold around 15 units in the 473-unit project in Singapore. Ms Chern attributes the take-up to the project's good location.

Boutique London developer Vision Homes also recently brought The Metropolis to Singapore. The small 15-unit development in the Elephant & Castle area sold well and Singaporeans bought around 30 per cent of the units sold, the developer said.

Savills is marketing Caro Point, which is next to the Thames Embankment (among other projects), while CBRE launched Langham Square in Putney, London. Knight Frank recently previewed One Tower Bridge, a luxury development on the banks of the River Thames. -- 2011 November 7 business times

- Wealthy Greek and Italians buying in London

- Previously, hot Asia property market allowed profits to invest abroad

- China Property Buyers Went Global as Yuan Rises

- Joseph Lau purchased at Eaton Square

- Asian property investors account for 49% of purchases in Central London

- One Hyde Park for £140 m

- Beaufort offering in Hong Kong

- Canary Wharf offering in Hong Kong

- Woodberry Park pre-sale in Hong Kong

- Chinese are cutting back though due to fallout in stock market

Kensington & Chelsea Most Expensive Addresses in UK

The 20 most expensive streets in England and Wales

- Wycombe Square Kensington and Chelsea Greater London £5,401,447

- Ingram Avenue Hampstead Greater London £4,872,500

- Cottesmore Gardens Kensington and Chelsea Greater London £4,288,125

- Mallord Street Kensington and Chelsea Greater London £3,864,444

- Stormont Road Highgate Greater London £3,375,277

- Brunswick Gardens Kensington and Chelsea Greater London £3,085,590

- Bedford Gardens Kensington and Chelsea Greater London £2,944,388

- Sloane Gardens Kensington and Chelsea Greater London £2,695,125

- Parkside Merton Greater London £2,689,562

- Paultons Square Kensington and Chelsea Greater London £2,667,500

- Moles Hill Leatherhead South East £2,645,000

- Duchess Of Bedfords Walk Kensington and Chelsea Greater London £2,629,447

- Arthur Road Wimbledon Greater London £2,578,333

- Imperial Wharf Hammersmith and Fulham Greater London £2,578,000

- South Road Weybridge South East £2,550,625

- Leys Road Leatherhead South East £2,549,545

- Woodlands Road West Virginia Water South East £2,543,500

- Hans Place Kensington and Chelsea Greater London £2,537,515

- Halsey Street Kensington and Chelsea Greater London £2,358,333

- Phillippines Shaw Sevenoaks South East £2,351,538 --2009 December 28 TELEGRAPH

Prince Charles' Letter on Chelsea Barricks

Real estate blog The Rat and Mouse report : the judge in the Chelsea Barracks case released a facsimile of a letter sent by Prince Charles to Sheikh Hamad bin Jassim bin Jabr Al-Thani... part of a behind-the-scenes campaign in which, investors claim, the Prince abused his position and influence to scupper development plans. --The Rat and Mouse

Market Sours for Condo Kings : Candy & Candy

Nicholas Candy, who sells luxury apartments to the super-rich, recently showed off a $41 million, four-bedroom property here that boasts a private swimming pool and a life-size statue of a boy, encrusted in Swarovski crystals, with his middle finger raised.

But the brand of conspicuous consumption that Mr. Candy and his brother and business partner Christian marketed to wealthy clients is being put to a severe test by the economic crisis.

From London to New York to Dubai, the luxury residential market is hurting as the economic crisis deepens. Plunging property prices are making even the wealthy who still have money to spend nervous about buying. Property specialists say it may be at least a couple of years before demand recovers significantly.

In the U.S., luxury condo sales have taken a nosedive in recent months as prices have fallen and job losses have begun to take their toll in the upper ranks of a wide range of businesses. Some projects in Miami have been forced to sell in bulk at fire-sale prices. Sales have fallen well short of targets at the Trump International Hotel and Condominium in Chicago. In New York, where there have been tens of thousands of job cuts on Wall Street, prices of luxury units have fallen 15% to 25% since last summer, brokers say.

Over the past decade, the Candy brothers became splashy emblems of London's boom and the extravagant lifestyles it spawned. Nicholas, 36 years old, and Christian, 34, rocketed to celebrity status here by selling luxury apartments, often as a second or third home, to the international billionaire crowd that flooded into London from Europe, the Middle East and Asia.

The brothers' property development business, CPC Group Ltd., has helped change London's landscape with towers of glass and modern blocks in the center of the U.K. capital. Their high-end portfolio includes One Hyde Park in Knightsbridge, where an apartment sold last year for about $148 million.

Today, the brothers are emerging as a barometer of whether overseas wealth can continue propping up the city's luxury market. Much of the foreign money has gone into retreat or been wiped out during the global financial crisis -- downsizing the lifestyle of the wealthy Russians, Middle Easterners and other foreigners who made up much of the Candys' customer base and causing the London real-estate market to fall, property specialists say.

In November, the Candy brothers undid their biggest deal by agreeing to sell their share in a prominent central London development. They are now trying to save their first overseas development, a high-profile project in Beverly Hills, Calif., where the brothers plan to build luxury condominiums but have defaulted on a $365 million loan and are scrambling to restructure it. They have given up a stake in another London project in exchange for a greater share of the U.S. site.

The brothers' problem is twofold. Overseas buyers accounted for about 26% of purchases of London's high-end real estate in 2007, according to British real-estate company Savills PLC, but that dropped to less than 20% in 2008, in a market that was half the size.

At the same time, prices are plummeting. Prices in London's high-end real-estate market -- typically houses valued at about $1.5 million or more -- plunged 8.7% during the last three months of 2008, according to Savills. That compares with a 3.9% drop during the quarter ended Sept. 30, 2008. The market for houses with an average value of about $7.3 million declined by an even wider margin, falling 9.6% in the fourth quarter of 2008.

The Candy brothers say they can ride out the downturn. CPC Group has about $300 million of cash, they say, and their business interests are set up to prohibit the failure of one development project from affecting the others. They say that one of their highest-profile developments, One Hyde Park, is on track for completion next year and they have a healthy interior-design business.

"It's tough times across the board," says Nicholas Candy, who acknowledges "challenging times ahead." But he adds, "we put ourselves in a very strong financial position."

The Candys created the property equivalent of a designer label around their last name. The brothers, neither of whom are married, socialize with the wealthy set they sell to and say they count the likes of Ivanka Trump and Prince Albert of Monaco among their acquaintances. Based in Monaco, the Mediterranean tax haven where they moved to a few years ago, they jet between London, New York, Los Angeles, Dubai and elsewhere.

Sons of an advertising executive, they grew up in middle-class Surrey on the outskirts of London. Nicholas, the more gregarious of the two, went into marketing while Christian became a commodity trader. On the side, they made their first property deal in the 1990s, using a loan of about $8,870 from their grandmother as a deposit on a London apartment.

They began buying and selling properties, decorating them along the way. In 1999, they launched Candy & Candy Ltd., decorating the homes of wealthy Londoners. Their trademark look: black floors, minimalist furniture, lavish flourishes such as $5,800-a-roll, hand-stitched, silk wallpaper and oversized plasma screens.

Software entrepreneur Martin Edmondson, 40, bought a three-bedroom apartment in Knightsbridge from the Candys about five years ago. He says he liked the dark-walnut interior and "cool gadgets," including a fingerprint reader to open the front door. An added attraction: The apartment came fully decked out, down to bed linen, cutlery and silver toothbrushes in the bathroom.

"They were creating a lifestyle," says Louise Hewlett, a managing director at real-estate agent Aylesford International Ltd. In the U.K. real-estate business, "no one had done it in that way."

The brothers took on increasingly ambitious property deals via CPC Group, the business founded by Christian Candy -- plowing ahead as the real-estate market swelled. In 2006, they teamed up with Iceland's Kaupthing Bank hf to buy a three-acre site in London's bohemian Bloomsbury neighborhood with plans to build some 180 luxury apartments, calling the project Noho Square.

Keen to expand into the lucrative U.S. market, they signed their first overseas development deal in 2007 after a broker introduced them to the Beverly Hills site. Partnering again with Kaupthing, they paid $500 million for an eight-acre plot between Wilshire and Santa Monica boulevards, which only four years earlier had traded hands for less than $50 million. They named it 9900 Wilshire and drew up plans for some 240 luxury condominiums.

The brothers' other key source of finance came from Qatar, a small oil-producing Persian Gulf emirate. Following an introduction by a banker, the Candys teamed up with the Qatari prime minister, Sheik Hamad Bin Jassim Bin Jabr Al-Thani, to develop a six-unit luxury apartment building in London's affluent Belgravia neighborhood. Later, they again secured the prime minister's backing for the massive One Hyde Park development, near Harrods department store in Knightsbridge. An assistant to the prime minister referred questions to an official at the Qatar Investment Authority, who declined to comment.

Even as the real-estate market slowed, the Candys pressed ahead. Early last year, they partnered with the Qatari government's real-estate arm, Qatari Diar, on their biggest deal yet, paying $1.4 billion to acquire a 13-acre, former army barracks site in Chelsea. To celebrate, the brothers hosted a party in Cannes on their 148-foot yacht Candyscape -- with acrobats and stilt-walkers as entertainment -- even as they fended off opposition to the project from Alexander Macmillan, grandson of former Prime Minister Harold Macmillan, who described the glass-towered development as "an abomination."

Undeterred, the brothers in September moved their staff to sleek new offices overlooking the River Thames, where a wall of 32 plasma screens descends in an L-shape from the black-marble lobby to the floor below.

Within days of moving into the new offices, however, U.S. investment bank Lehman Brothers Holdings Inc. collapsed. That sent markets reeling -- wiping out billions of dollars of net worth from the likes of the Middle Eastern wealthy and Russian oligarchs who make up the Candys' client base.

The impact on the real-estate world was immediate. The market for such ultra-high-end apartments, which cost tens of millions of dollars, effectively froze, with some buyers even walking away from deposits, according to property specialists.

As a result, the brothers were left sitting on plans for several hundred apartments, most of which had not even been built. At One Hyde Park -- the ongoing project that is furthest along -- about half of the 80 apartments, which cost on average tens of millions of dollars or more, have been sold. And those have only been paid for in part, the Candys say. The Candys haven't made any new sales in the past few months.

"We're getting a few offers on things, but in reality, everyone is sitting on their hands," says Nicholas Candy.

Dressed in a black Gucci blazer and white shirt, Mr. Candy recently toured the vast One Hyde Park construction site. Looking over the site's four unfinished "pavilions," Mr. Candy said they have sold enough apartments in the development to pay back the construction loan -- assuming all the clients that have already paid deposits do pay in full.

But, he adds, raising money to build new properties will be almost impossible. "Construction finance across the world has completely dried up," he says, before stepping into a black chauffeur-driven car where his brother waited.

On Oct. 9, the credit crisis claimed one of the Candys' key financial partners -- Kaupthing Bank, which was nationalized by the Icelandic government. That same day, CPC Group and Kaupthing were due to repay the loan on the Beverly Hills site. The Candys say they had the funds to pay their $160 million share, but were forced to default with their partners.

Nicholas and Christian Candy tried to take full control of both the Beverly Hills site and another they jointly owned with Kaupthing, Noho Square in London. They cited a clause in the contract that allowed them to take over in the event that Kaupthing went into some form of liquidation.

But their Kaupthing banker, Mike Samuels, fought back saying the bank wasn't insolvent, it had been nationalized, so that clause didn't apply. Mr. Samuels proposed instead that the Candys swap their equity stake in Noho Square for Kaupthing's share of the Beverly Hills project.

The brothers agreed to the swap in late October. They lost more than $3 million on Noho Square but the swap left them owning 90% of the Beverly Hills project.

"We still maintain a good working relationship with CPC and Candy & Candy," said Mr. Samuels.

In November, the brothers also agreed to give up their stake in the Chelsea barracks site to Qatari Diar. The Candys say they will remain involved as development managers among other roles and that CPC still made money on the project. "We've taken our profit today instead of in years to come," says Nicholas Candy. "I try not to get emotional about property."

The Candys still face losing the Beverly Hills project if they can't restructure the debt or produce additional funds to the lending group, which includes Banco Inbursa SA, the Mexican banking group led by billionaire Carlos Slim.

Christian Candy, along with other CPC Group representatives, has been shuttling to New York and Beverly Hills to meet with representatives of the lending group to negotiate restructuring the deal.

CPC Group has proposed injecting funds in exchange for an extension of a reduced loan, according to a person familiar with the matter. But it is unclear whether differences over the amount of fresh capital, among other details, can be bridged, this person says. Even if the Candy brothers can strike a new financing deal, they may still need to reconfigure the project to make it economically viable.

The Candys say they hope to get the deal done. Even if they don't, it won't jeopardize their other projects, they say. If they ultimately lose the site, it won't put them out of business, they say. "We just lose a lot of money," says Nicholas Candy.

The ever-bullish Candys say they already are thinking about their next move. They say they haven't canceled orders for two private jets, a helicopter and a bigger yacht. Still, even they are making some adjustments. "My brother and I are not buying new jets today," says Nicholas Candy. "We are waiting to see what happens in 2009." - 2009 February 12 WALL ST JOURNAL

Ultra-luxury real estate developers, Candy & Candy were sucked into what could have been a disastrous situation recently when one of their partners in two large scale projects, Icelandic bank Kaupthing, was nationalized by the Icelandic government this month. Candy & Candy have apparently come to a deal whereby they have relinquished interest in NoHo Square, a 12-acre project on the old Middlesex hospital site in London, in exchange for a majority stake in 9900 Wilshire, a luxury condominium development in Beverly Hills, Los Angeles.

Perhaps not the ideal timing, but I understand CPC Group, who represent Candy & Candy were in a position to take majority stakes in both shemes. This could have resulted in a lengthy legal battle with Kaupthing, so a quick decision was reached. NoHo square has already been put up for sale, although there are some suggestions that it has now lost as much as £160 million in value, due to falling property values in London.

Candy & Candy must still re-negotiate the loan on 9900 Wilshire - which is now in default, and face the issue of selling luxury condominiums into an already over supplied market. Los Angeles is one of the hardest-hit US markets currently, with the S&P Case shiller index showing a fall of 26.7% in home values in LA over the last year.

Fortunately, Candy & Candy are well placed to weather the current financial storm, and their Chelsea Barracks project appears to have solid backing. Considerable opposition was voiced when the project was first announced, with the Duke of Westminster voicing the opinion that the development, which is being financed by the Qatari royal family after buying the site from the Ministry of Defence, is “more akin to office complexes,” than homes.

Many of C&C’s developments are at the very top end of the luxury real estate market, such as One Hyde Park in London, so assuming the Russian government continues to pump money into their ailing financial markets at the rate they are doing, there should be enough Russian billionaires left to keep them out of trouble. - 2008 October

One of 太太's best finds is a three-bedroom flat in Knightsbridge owned by her friend. If not for the fact that her 91-year old Mother did not move in , this renovated unit would not be available for purchase. This location is exceptional.

![]()

This is my all-time favourite

but Anne says it doesn't have parking

Next door, across 'the walk' is better

- Floorplan

- One house on the street is asking $158 million! Bad numbers! Didn't their Agent tell them?

London luxury-home prices jump again

1.1% rise in average price of units costing £2.5m or more; overall market unchanged

![]()

Symbols of wealth: The UK's most expensive home (above) was purchased by Indian billionaire Lakshmi Mittal for £57 million.

Luxury-home prices in London, the world's most expensive city for prime real estate, rose at the fastest rate in four months as the overall UK market stagnated, industry reports showed.

The average price of houses and apartments costing at least £2.5 million (S$6.96 million) climbed 1.1 per cent in January from December, Knight Frank LLC said in a statement on Tuesday. There was no change in the average cost of homes across the country, HBOS plc said in a separate report.

'It is being totally led by the purchase of properties of £10 million or more,' Liam Bailey, head of residential research at Knight Frank, said in an interview. 'The number of deals done at that level in the past three months was double a year ago.'

The wealthiest property buyers don't need to borrow money to make purchases, so they're not dependent on lenders that have made it more difficult and costly to obtain mortgages, Mr Bailey said.

Britons are now buying between 40 and 50 per cent of all London homes priced at more than £10 million, up from 30 per cent a year ago, according to Knight Frank, a real estate broker based in the city.

London's most expensive new- built home was sold for £50 million last month to Hourieh Peramaa, a 75-year-old real estate entrepreneur from Kazakhstan, Sunday Times reported on Jan 27.

The house on Bishops Avenue in Hampstead, northwest London, has nine main bedrooms, 16 bathrooms and five reception rooms, and was acquired from Turkish businessman Halis Toprak.

Ms Peramaa plans to spend another £30 million extending and redecorating the property, the newspaper said.

Earlier in January, Lev Leviev, an Israeli diamond billionaire, paid £35 million for a house in the same district as Ms Peramaa, according to Daily Telegraph.

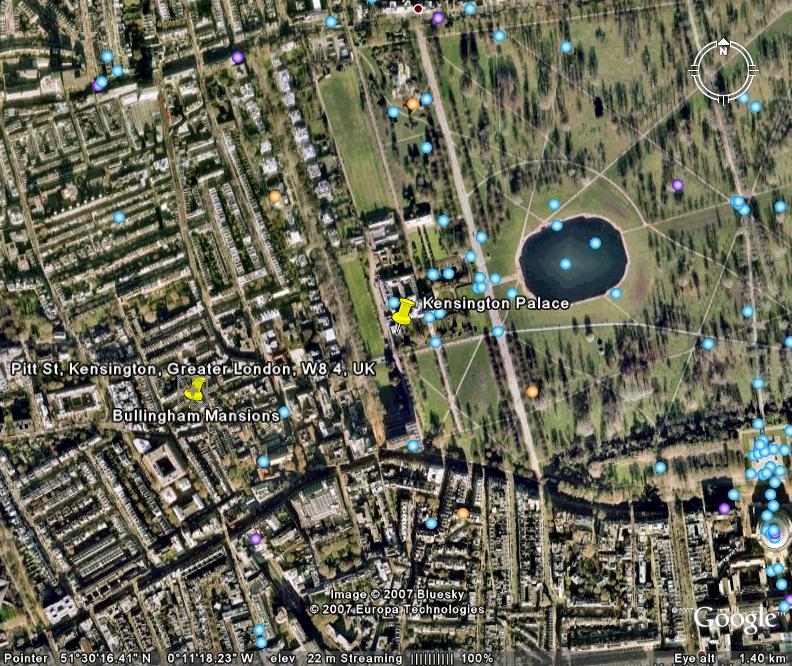

Indian steel entrepreneur Lakshmi Mittal owns the UK's most expensive home. He paid £57 million in 2004 for a home close to Kensington Palace in central London. Both Kensington Palace Gardens and Bishops Avenue have been dubbed 'Billionaires Row'.

January's increase in luxury-home prices was the biggest since September, when prices advanced 1.2 per cent.

For the year ended Jan 31, the gain was 26 per cent, the smallest since October 2006.

Across Britain, prices in January were 4.5 per cent higher than a year earlier, according to HBOS, the country's largest mortgage provider. Lenders are selling fewer mortgages as they contend with losses stemming from the collapse of the US sub-prime mortgage market.

Properties at the lower end of Knight Frank's prime index are now moving more in line with the UK market, said Mr Bailey.

Bonus-earners in the UK's financial industry will invest £2 billion in homes this year, compared with £5.5 billion in 2007, as they look for higher returns, Savills plc said in November. Savills and Knight Frank are the biggest brokers for prime London properties.

This year, top-quality dwellings in the UK capital will appreciate about 3 per cent, Knight Frank said on Tuesday, reiterating an October forecast. The Bank of England's ability to cut interest rates to ward off an economic slowdown may be hindered by inflationary pressures, said Knight Frank.

'It is fair to say that the issues of confidence and affordability that have so far dogged the main market may now promote a more cautious purchasing environment in the prime sector too,' Mr Bailey said.

Britain is home to about 68 billionaires, according to the Sunday Times 2007 Rich List. Many are investors from China, India and Russia who have bought homes in London for its schools, stores, theatres and restaurants.

The most expensive houses can fetch as much as £4,000 a square foot, CB Richard Ellis Hamptons International estimates. That compares with about £2,075 a square foot in New York, the broker said.

Purchasing at such prices so far isn't being inhibited by the prospect that the UK may impose an annual tax of £30,000 on wealthy individuals who live in the UK and keep their residence elsewhere for tax purposes, said Mr Bailey.

'There is a lot of interest in deals being done by super-rich foreign buyers,' he said. -- 2008 February 7 Bloomberg

London luxury home prices lose momentum

Homes worth at least £2.5m up just 0.3% in Oct, slowest pace since July '05

Luxury-home prices in London rose last month at the slowest pace since July 2005 as the prospect of job cuts and smaller bonuses deterred investment bankers and other buyers, Knight Frank LLC said.

The average price of houses and apartments costing at least £2.5 million (S$7.55 million) increased 0.3 per cent in October from the previous month, according to an index compiled by the London-based property broker. Prices gained about 34 per cent from a year earlier.

Companies in the City of London financial district may cut 6,500 jobs and reduce bonuses by 16 per cent this year, the Centre for Economic and Business Research said on Oct 8. For the past two years, most of the bonuses have been spent on real estate, fuelling demand for apartments in London neighbourhoods such as Chelsea, Kensington and Notting Hill.

'The impact of the credit crunch and a weaker City economy have contributed to a more sober market,' said Liam Bailey, head of residential research at the London-based firm.

Bonus-earners in the city will invest only £2 billion in homes next year, compared with £5.5 billion this year, as they seek assets that offer higher returns, according to Savills plc estimates. Savills and Knight Frank are the biggest brokers for prime London properties, the most expensive in the world.

The lack of investment will restrict the gain in luxury-home prices to 3 per cent in 2008, less than a tenth of this year's rate, Knight Frank forecast this week. The company cut its estimate from 10 per cent.

For homes costing more than £5 million, the average price increase will probably be about 8 per cent next year compared with the estimated 2007 gain of 34 per cent, Knight Frank said. The main customers for the most expensive houses and apartment are wealthy investors from Russia and the Middle East, according to the broker.

The contrast with the rest of the London market 'illustrates the strength of the super-prime market with demand from international buyers remaining very strong,' Mr Bailey said. -- 2007 November 6 Bloomberg

London Housing in the £1 million bracket may flatten

Fears that City bonuses will be slashed have affected sales of Central London flats in the £1 million bracket.

The disclosure from Knight Frank, one of the capital’s biggest upmarket property agents, comes with a warning that any indication over the coming weeks that investment banks will cut bonuses would cause house price growth in Central London to flatten for the rest of the year.

Parts of Central and Northern England have witnessed falls over the past month on the back of successive rises in interest rates.

Until now, however, upmarket London homes have been insulated from any wobbles in the general market by the estimated £5 billion of City bonus money that has been flowing into the captial’s smartest addresses after a record period of corporate and financial deals in the past year.

Knight Frank’s riverside division, which caters typically for bankers and other professionals looking for a pad on or near the Thames, has reported demand grinding to a halt for homes costing less than £1 million.

Sarah Haslam, head of the division, said: “It has been like a ghost town in the under£1 million market so far in August. We were very busy in the core market under £1 million for the past two years and we are very busy in the £1 million and over market, but under that it is as if there is no one out there. Typically, they are single and young people. They are quite nervous and saying they will wait to see if anything happens to their bonus.”

Liam Bailey, head of residential research at Knight Frank, said that he could not foresee any crash in prime Central London prices because of the chronic shortage of supply. However, he said that prices could flatten rapidly if bonuses and banking jobs were cut.

September will be a crucial month for testing the health of London’s prime markets, from Kensington and Chelsea to Belgravia and St John’s Wood. Next month is the usual period for the market to pick up as bankers return from their summer breaks.

Third-quarter figures from a quartet of American investment banks are due out in a month, setting the tone for City bonuses.

Last autumn agents at Savills predicted that £5 billion of the £8 billion of bonus money would be ploughed into London property. So far they have been right. Boom years for the City in 2005 and 2006 have caused prime London properties to rise by an average of 50 per cent over the past two years. - THE TIMES 2007 August 23

UK house prices may rise 40% by 2012

Average prices in London will jump 48% on shortage of properties: report

UK house prices will increase 40 per cent over the next five years because of a shortage of properties, a report by the National Housing Federation said.

The average value of a home will rise to £302,400 (S$929,716) by 2012, the London-based organisation, which represents 1,300 housing associations, said yesterday. Prices in London will jump 48 per cent to £478,300.

Prime Minister Gordon Brown has promised to build more homes to make property more affordable for Britons after prices tripled in the past decade.

A property crash is 'unlikely' because Brown's proposals won't resolve the supply shortage any time soon, forcing first-time buyers to rack up debt or rely on their parents to get a foothold in the market, the report said.

'Continuing house price rises and the resulting housing crisis are set to stay with us for a long time,' said David Orr, chief executive of the National Housing Federation.

'Home owners may see this as good news, but it carries a sting in the tail. 'More and more people are going to find themselves priced out.'

The average price of a home is currently 11 times the average workers' annual earnings.

The government should push ahead with plans to build three million homes by 2020, and should invest more in social housing, the National Housing Federation said.

In London, where the average house value is 13 times earnings, prices will continue to be driven higher by wealthy foreign investors and financial-services workers, the report said. -- BLOOMBERG 8 August 2007

One-bedroom flat for sale at record £3m

A one-bedroom flat, believed to be the most expensive in Britain, is on the market for £3 million.

The flat in Eaton Place, central London, is one of the most desirable addresses in the world and its valuation is a sign that, in fashionable areas, prices show no signs of slowing down. The 1,400 sq ft property, which has a 125-year lease, consists of a drawing room, a bedroom with en suite bathroom, a separate lavatory and a kitchen. At least 10 other flats are for sale in the same street for more than £3 million, but they have either two, three or four bedrooms.

Elizabeth Hurley, the actress, owns a £5 million house in the same street, while David Blunkett, the former home secretary, Roman Abramovich, the Russian billionaire, and Sir Roger Moore, the actor, live close by. - TELEGRAPH 6 June 2007

London flat goes for £100 million

The world's most expensive flat has just been sold in London for £100 million according to reports.The most expensive flat in London has been bought by the foreign minister of Qatar - the largest and most luxurious apartment in the One Hyde Park scheme.

For Sheikh Hamad it really is all about location, location, location - the £100 million penthouse is located opposite Harvey Nichols in Knightsbridge and has stunning views over Hyde Park.

The site comes with underground parking for 115 vehicles and private lifts direct to each flat so residents don't have to accidentally bump into their neighbours.

The development, designed by Richard Rogers Partnership, also features a special tunnel linking to the Mandarin Oriental Hotel.

When completed in 2010 it will comprise 86 flats spread across four blocks. Prices are expected to begin at around £4 million.

It also comes equipped with some seriously high-end facilities: 24-hour room service of a quality comparable to the Ritz Hotel, personal lifts from the underground car park equipped with eye-scanners, floor to ceiling fridges, panic rooms and bullet-proof windows and walls.

The £1.5bn block has been designed by Richard Rogers is being developed by brothers Christian and Nicholas Candy and is backed by the Sheikh himself from his personal fortune.

It will not be ready for another two years. Previous estimates for the price of the apartment ranged from £20m to £84m.

Two other penthouses have also been sold sources told The Times.

The previous most expensive flat sold in London was in a Chelsea development for £27m in 2005 also sold by the Candy brothers to a British financier.

At the time that was said to be the most expensive apartment in the world.

The price easily beats the price tag for what is marketed as Britain 's most expensive house – Updown Court in Windlesham, Surrey – which is on sale at £70million. - 2007 March 27 METRO

33% gains for prime London property

Analysts cite influx of foreign buyers for fastest price rise in almost 30 yearsPrime central London property prices are growing at their fastest in almost 30 years - and at three times the rate of the wider British market, figures show.

The value of the best properties in central London has risen by more than 33 per cent in the 12 months to end-April, according to estate agent Knight Frank's prime property index.

That is the fastest rate of growth since mid-1979 and means prices in central London are rising at three times the UK average.

A property worth just 100,000 pounds in 1976 would now be worth more than 4.1 million pounds, the index shows.

Knight Frank said demand had been supported by growing numbers of overseas buyers and money spent on property by City bankers.

Over the past year, Belgravia and Knightsbridge have seen the strongest market, with prices surging by more than 40 per cent.

Head of residential research Liam Bailey said: 'London's traditional spring market rush starts earlier and earlier every year. For the past two years, the season has opened in December rather than March, and has run on well into May.

'The early part of 2007 saw an incredibly active market, with price growth totalling nearly 11.9 per cent in the first quarter.'

He said, even after 18 months of strong price appreciation, the pace of growth was yet to slow and, if anything, had quickened.

In the six months to end-April, monthly price growth averaged 2.8 per cent, against 1.7 per cent in the same period last year.

'The strong performance of the top end of the market can be attributed, at least in part, to the continuing health of the City economy and the bonus season,' said Mr Bailey.

'However, it is our experience that, whilst there have been growing numbers of deals completed by City workers, it is the influx of overseas buyers - European, Russian, Indian and increasingly Middle Eastern - which is the key to the substantial price growth seen in many areas of central London,' Mr Bailey said.

Knight Frank data shows that the supply of available property fell by more than 50 per cent in the first quarter of 2007, compared to a 17 per cent rise last year.

Looking forward, Mr Bailey believed stock shortages would continue to buoy the market.

Higher transaction costs - stamp duty, in particular - mean people are moving less often, while the introduction of home information packs (HIPs) this summer is also likely to cause a drop in supply, he said.

The controversial packs - designed to make the home-buying process more efficient, cut the number of transactions that fall through and encourage homeowners to reduce energy consumption - are due to come into force in England and Wales on June 1, but have met fierce opposition.

HIPs are expected to cost sellers around 500 (S$1,520) and estate agents have been reporting a rush to complete deals ahead of their introduction.

The Knight Frank prime central London residential index charts the value of property at the top end of the market: flats and penthouses with an average value of 2.5 million and houses valued at close to 5 million. - Reuters 2007 May 24

- Prices of the most expensive homes in central London have soared by 5.6% in January and February alone, says Knight Frank, a top-end estate agency, making its predictions of a 12% year-on-year price rise in central London by the end of 2007 look already too low. It attributes the rise to a shortage of stock, especially in Belgravia, South Kensington and Chelsea, where there is continuing high demand from overseas buyers.

- Rents in central London are increasing at their highest rate on record, says Cluttons, a lettings agency. Rents have risen by 13.8% in the past 12 months, only the second time in 20 years that rental growth has entered double figures. The agency says that the steep rise is down to a shortage of good-quality properties to let, and many would-be buyers renting. The firm claims that landlords are also aggressively insisting that rents rise when properties are relet or tenants’ contracts are renewed.

London luxury-home prices rise at record pace

Luxury- home prices in London rose at a record monthly pace in March as Russians and Middle Eastern buyers competed for a smaller number of properties with financiers from the City of London, real estate broker Knight Frank LLC said.

The average price of the UK capital's most expensive houses and apartments increased by an average of 3.1 per cent last month from February, according to data compiled by Knight Frank. The annual increase was 32 per cent, the highest in 28 years.

'The continued strong performance can be explained by supply shortages and ongoing international demand now that City bonus money has been paid out,' said Liam Bailey, head of residential research at Knight Frank, in an interview.

The average price of a luxury house in Knight Frank's monthly index is now almost £5 million (S$15 million), with apartments costing £2.5 million. A typical house has appreciated by 100,000, or about four times the average annual UK wage, each month over the past year.

Prime residential property prices in the UK capital have now risen for 27 consecutive months. In the first quarter, house prices rose by 10 per cent and apartments by 7.5 per cent. Chelsea, favoured by bankers, and St John's Wood continue to perform well, said Mr Bailey.

Luxury-home prices in London are rising about three times as fast as UK house prices generally. Home prices rose 11.1 per cent in the three months to the end of March from the same period a year earlier, HBOS plc, Britain's largest mortgage lender, said on April 5.

The most expensive homes in London, or 'super prime' properties such as the Hyde Park luxury apartment complex project that is managed by Candy & Candy Ltd, are being pre-marketed with price tags of about £4,500 a square foot, according to newspaper reports.

In New York City, the most expensive apartments bordering Central Park sell for close to US$7,000 a square foot.

Sheikh Hamad bin Jassim bin Jaber al-Thani, the prime minister of Qatar, last month paid a record £100 million for the highest and biggest penthouse in the Candy & Candy Hyde Park development, according to the London-based Times.

Russians account for 21 per cent of all buyers paying at least £8 million for Londonhomes, said Mr Bailey. Middle Eastern buyers account for another 13 per cent. Britons buy 37 per cent of such properties, he said.

Roman Abramovich, Russia's richest man and owner of Chelsea Football Club, spent £49.3 million buying six properties in London between June 2005 and August 2006, according to the Daily Mail.

Other international business people including Lakshmi Mittal, chairman of the world's largest steel company, and brewing heiress Charlene de Carvalho-Heineken have bought property in London in recent years.

For houses worth more than £3 million, UK citizens account for 40 per cent of purchases. - 2007 April 12 Bloomberg

London prime homes surge at record pace

The price of prime London homes rose at the fastest pace in at least 31 years in January as wealthy European, Indian and Middle Eastern buyers competed for houses and apartments in Belgravia and Knightsbridge.

Prices of houses in central London valued at about £3 million (S$8.9 million) and apartments costing more than £1.5 million rose 3 per cent in January, real estate broker Knight Frank said yesterday. That's the biggest monthly gain since Knight Frank started its prime London property index in 1976. 'It's the bosses rather than highly paid bankers who are leading the way,' Liam Bailey, head of residential research at London-based Knight Frank, said. 'There is no doubt that the key to the price growth seen in Belgravia and Knightsbridge is international demand.'

International business people such as Lakshmi Mittal, chairman of the world's largest steel company; Roman Abramovich, Russia's richest man; and brewing heiress Charlene de Carvalho-Heineken have all bought property here in recent years.

Luxury house prices in Belgravia and Knightsbridge rose 38 per cent in the year to January, while apartments gained 36 per cent in value.

The number of people registered as looking to buy in the three prime districts in southwest London was 37 per cent higher in January than a year earlier while properties for sale hadn't risen so pushing up prices, said Knight Frank.

Sales in the two districts are regularly exceeding US$4,900 a square foot, said Mr Bailey. CB Richard Ellis Hamptons International Ltd said in September that London was the most expensive city in the world for prime real estate.

Prime Manhattan addresses on Fifth Ave, Park Ave and Madison Ave near Central Park cost about US$1,870 a square foot, the company said.

The 330,000 workers in London's main financial district may have earned a record £8.8 billion in bonuses last year according to the city's Centre for Economics and Business Research Ltd.

Prices for prime London properties rose by at least 2 per cent a month in 11 of the last 12 months. - Bloomberg 2007 February 14

London house prices surge on shortage

London house prices advanced in March as buyers snapped up properties at the fastest pace in almost three years, led by demand from wealthy foreigners and bankers.

London house prices advanced in March as buyers snapped up properties at the fastest pace in almost three years, led by demand from wealthy foreigners and bankers.

'London is the financial capital of the world, and we've just got more people looking than properties available,' said commercial director Miles Shipside in an interview. He sold part of his stake in Rightmove to fund his own house hunt in the city.

A shortage of properties for sale has driven up house prices even after the Bank of England raised the benchmark interest rate three times since the start of August. The average stock of unsold property per estate agent fell to 62.7 in February, the lowest since July 2004, the Royal Institute of Chartered Surveyors said in a report on March 13.

UK house prices rose 1.5 per cent on the month, the most in four months, and 12.2 per cent on the year, to an average of £228,183. Values increased from February in each of the nine regions measured by Rightmove in England, led by a 2.6 per cent gain in the North, while they fell by 0.3 per cent in Wales.

'The supply problem is extremely bad, especially at the top end,' said Gary French, chief surveyor at the Friend & Falcke agency in Belgravia, an area neighbouring Queen Elizabeth's London residence at Buckingham Palace. 'If people with money in Russia, or in the longer term China and India, start to see London as a safe haven, rightly or wrongly, then it will keep prices going right up. We're not affected by domestic interest rates.' Kensington and Chelsea, the district where film star Hugh Grant lives, led annual gains in London, rising 83 per cent from a year earlier to an average of £1,208,981.

The next biggest gain was in Westminster, at 50 per cent from a year earlier, followed by a 29 per cent increase in Hammersmith and Fulham.

Luxury-home prices in London rose at an annual rate of 31 per cent in February, the fastest pace since 1979, real-estate broker Knight Frank said on March 15.

Interest-rate increases in August, November and January may be discouraging some buyers.

The Royal Institution of Chartered Surveyors' index of house-price growth showed the smallest increase in nine months as the number of people registering to browse property dropped to a two-year low. - Bloomberg 20 March 2007

The world's most expensive flat has just been sold in London for £100 million according to reports

London flat goes for £100 million

Artist's impression of the One Hyde Park development: four blocks made of glass and red weathered steel The most expensive flat in London has been bought by the foreign minister of Qatar - the largest and most luxurious apartment in the One Hyde Park scheme.

For Sheikh Hamad it really is all about location, location, location - the £100 million penthouse is located opposite Harvey Nichols in Knightsbridge and has stunning views over Hyde Park.

It also comes equipped with some seriously high-end facitilities: 24-hour room service of a quality comparable to the Ritz Hotel, personal lifts from the underground car park equipped with eye-scanners, floor to ceiling fridges, panic rooms and bullet-proof windows and walls.

The development, designed by Richard Rogers Partnership for developers Candy & Candy, also features a special tunnel linking to the Mandarin Oriental Hotel.

When completed in 2010 it will comprise 86 flats spread across four blocks. Prices are expected to begin at around £4 million. The development's staggering prices are indicative of the extraordinary house price inflation that has gripped the city for many years now.

In Greater London the average flat costs £275,267, and the average detached house will set a homebuyer back by no less than £628,239. This represents an increase of 11.3 oer cent over 12 months, far outstripping wage inflation and tightening the screw on first-time buyers.

While the likes Sheikh Hamad can happily spend a tenth of a billion pounds on a single flat, the average London worker has to contend with prices that average more than half a million in several London boroughs.

In Kensington and Chelsea, the average price is £895,320, up by 18.9% annually, and even less well-to-do boroughs like Tower Hamlets and Hackney average close to £300,000 (up by 17.6% and 14% respectively)

If the situation continues, a further interest rate rise may be in the cards. However, in good news for those struggling with affordability, the latest Nationwide survey indicates that the three rate hikes introduced since last summer are beginning to take effect and house price inflation is slowing somewhat across the country. - May 2007

London flat goes for record £100m

If you're struggling to get your foot on the property ladder spare a though for a poor soul who is so far up it he needs an oxygen tank just to breath.

The world's most expensive flat has just been sold in London for £100 million according to reports.

Sheikh Hamad, the foreign minister of the Gulf State of Qatar, is behind the purchase of the penthouse home in the most exclusive block in the world -- One Hyde Park.

The apartment is one of 86 luxury flats being built on the edge of Hyde Park opposite Harvey Nichols in Knightsbridge.

The flats have 24-hour room service to the level of the Ritz, bullet-proof windows, eye scanners in lifts and spectacular views over Hyde Park and The Serpentine.

The site comes with underground parking for 115 vehicles and private lifts direct to each flat so residents don't have to accidentally bump into their neighbours.

Huge baths are hewn from wood, marble work surfaces, floor to ceiling fridges, panic rooms and former SAS security.

The £1.5bn block has been designed by Richard Rogers is being developed by brothers Christian and Nicholas Candy and is backed by the Sheikh himself from his personal fortune.

It will not be ready for another two years. Previous estimates for the price of the apartment ranged from £20m to £84m.

Two other penthouses have also been sold sources told The Times.

The previous most expensive flat sold in London was in a Chelsea development for £27m in 2005 also sold by the Candy brothers to a British financier.

At the time that was said to be the most expensive apartment in the world.

The price easily beats the price tag for what is marketed as Britain's most expensive house – Updown Court in Windlesham, Surrey – which is on sale at £70million. - METRO 27 March 2007

Hyde Park flats 'on sale for £84m'

Four flats overlooking Hyde Park are on sale for a rumoured £84 million each, the highest price ever asked for a British flat.

The flats are part of a development at One Hyde Park, designed by Richard Rogers Partnership. They will not be ready until 2010.

Sources said today that the four penthouse flats could feature bullet proof windows, specially purified air and even "panic rooms". The security system is believed to have been developed after consultation with the SAS.

A tunnel will link the flats to the Mandarin Oriental hotel, which will provide a concierge service for the development, which contains 86 flats with prices starting at £4 million.

The complex will also have a spa, squash court and private wine-tasting facility. According to the One Hyde Park website, the scheme is "a new residential scheme whose beauty, luxury and prestige will place it in a class of its own".

It is being managed by Candy & Candy, a development management company specialising in high end luxury flats. Nick and Christian Candy, the two brothers behind the company, hold the record for the current most expensive flat in London, which was in Chelsea and had a £27 million price tag.

Clients for the flats, some of which have already sold off-plan, are expected to include Arab princes and Russian oligarchs.

Flats at the development, on the site of the old 1950s office block Bowater House, are being sold for as much as £4,200 per square foot, a record for London. The four largest penthouses are 20,000 square foot each.

A spokesman for Candy & Candy, which is a notoriously secretive company, would not comment on the price tags or facilities of the flats today.

"The facilities are being worked on all the time by the team," she said. She added that the building "was designed to bring the Park across to Knightsbridge".

The Richard Rogers design features four blocks made of glass and red weathered steel. The record asking prices for the flats reflect the latest boom in the London property market, which has outperformed the rest of the British market this year.

Prices for homes in central London have risen by around 20 per cent this year.

Homes worth more than £5 million have outperformed even that. Figures from Haart estate agents, published yesterday, showed that demand in the capital remained strong even after the latest interest rate rise.

The average London house price increased by 0.5 per cent in January to £260,140 up from £258,568 in December, the group said.

January applicant numbers in Haart’s London branches were up 30 per cent on the same time last year, reaching record levels.

The agency predicts that house prices in the capital are predicted to rise by up to 8 per cent in 2007 as demand continues to outstrip supply and activity levels remain strong. - by Rosie Murray-West TELEGRAPH 8 February 2007

London prime homes surge at record pace

2007 Feb 14: The price of prime London homes rose at the fastest pace in at least 31 years in January as wealthy European, Indian and Middle Eastern buyers competed for houses and apartments in Belgravia and Knightsbridge.

Prices of houses in central London valued at about £3 million (S$8.9 million) and apartments costing more than £1.5 million rose 3 per cent in January, real estate broker Knight Frank said yesterday. That's the biggest monthly gain since Knight Frank started its prime London property index in 1976. 'It's the bosses rather than highly paid bankers who are leading the way,' Liam Bailey, head of residential research at London-based Knight Frank, said. 'There is no doubt that the key to the price growth seen in Belgravia and Knightsbridge is international demand.'

International business people such as Lakshmi Mittal, chairman of the world's largest steel company; Roman Abramovich, Russia's richest man; and brewing heiress Charlene de Carvalho-Heineken have all bought property here in recent years.

Luxury house prices in Belgravia and Knightsbridge rose 38 per cent in the year to January, while apartments gained 36 per cent in value.

The number of people registered as looking to buy in the three prime districts in southwest London was 37 per cent higher in January than a year earlier while properties for sale hadn't risen so pushing up prices, said Knight Frank.

Sales in the two districts are regularly exceeding US$4,900 a square foot, said Mr Bailey. CB Richard Ellis Hamptons International Ltd said in September that London was the most expensive city in the world for prime real estate.

Prime Manhattan addresses on Fifth Ave, Park Ave and Madison Ave near Central Park cost about US$1,870 a square foot, the company said.

The 330,000 workers in London's main financial district may have earned a record £8.8 billion in bonuses last year according to the city's Centre for Economics and Business Research Ltd.

Prices for prime London properties rose by at least 2 per cent a month in 11 of the last 12 months. - Bloomberg February 2007

Tiny London apartment on sale for £335,000

Location, location, location. Almost anywhere else, the tiny dilapidated studio wouldn't attract much more than mice. But this is London and the 77-square-foot former storage room — slightly bigger than a prison cell and without electricity — is going for £335,000.

The closet-sized space in the exclusive Knightsbridge neighborhood may be only "about the size of a ship's galley, said real estate agent Andrew Scott, who's handling the sale. "But it's permanently anchored to one of the wealthiest neighborhoods in the world."

At more than £4,340 a square foot, the mortgage buys a spot within walking distance of tony stores like Harrods and London's iconic Hyde Park.

Originally conceived as a maid's room, the apartment at 18 Cadogan Place hasn't been used for years and is littered with trash bags and crumbling paint.

A coffin-sized shower is en suite, and storage is provided by a shallow closet and 10-inch-deep shelves cut into the wall. Two hot plates and a small sink make up the kitchen. Two dirty windows allow light to filter into the basement room, and the fire escape could conceivably double as a shared patio.

With no electricity or heating, Scott said it would cost an additional £59,000 to make the room habitable.

"It is an investment," he said, as he stretched his arms the width of the room, laying his palms flat on opposite sides of the wall.

The sale of this dark, mildewy room illustrates the astronomical rise in property values across London, which in the past year has seen average residential property prices increase 22.4 percent, to about £703,000, according to figures released Monday by Rightmove, which tracks the British property market.

Prices in London's most desirable neighborhoods have grown even faster, with average house prices in the borough of Kensington and Chelsea — where Cadogan Place is located — rising 61.8 percent over the past year to a jaw-dropping £2.2 million.

Ultra high-end property prices in London are the most expensive in the world, with some recent sales hitting £5,900 per square foot — making the Cadogan Place studio a bargain by comparison, according to research published last year by CB Richard Ellis Group Inc.

Similar properties in New York can go for about £5,300 per square foot, while those in Hong Kong sell at around £3,950 per square foot.

Scott said he already had three offers on the property, which might go to auction. Size, he added, is in the "eye of the beholder."

"If you thought of this as the cabin on a boat, you'd say, 'It's pretty spacious,' " Scott said. - AP 2007 January 31

January hike in UK home prices hits 3-year high

House-price inflation in the United Kingdom reached the fastest pace in more than three years in January, led by London, as record bonuses for bankers blunted the effect of interest-rate increases, Hometrack Ltd said.

The cost of a home in England and Wales rose an annual 6 per cent, the biggest increase since July 2003, to an average £170,800 (S$514,665), according to a survey of 3,500 real-estate agents, the London-based property researcher said on Monday.

On the month, prices increased 0.4 per cent.

An £8.8 billion bonus round and a shortage of homes have kept house prices rising, even after three interest-rate increases by the Bank of England (BOE) to 5.25 per cent.

A basement in the London district of Chelsea the size of a snooker table was put up for sale last week for £170,000.

'It's London - and certain bits of London - that are making house prices appear so robust,' said Richard Donnell, Hometrack's director of research, in an interview.

'The markets that are seeing growth are the ones that are driven by bonus money. The people that are driving it are less sensitive to interest-rate increases.' he added.

Prices in the London area rose 0.8 per cent from December, Hometrack said.

In all other regions, gains were 0.3 per cent or less, apart from the East Midlands, where price growth stalled.

London, which accounts for 17 per cent of the United Kingdom's economy, will have price gains of 7 per cent this year, compared with 4 per cent for the country as a whole, Mr Donnell said.

'In London and the southeast we'll see a lack of supply keeping an upward pressure on prices,' he pointed out.

A basement room in London measuring six feet by 12 feet, which real-estate agents Lane Fox described as the smallest property to be offered for sale in the UK, has received three offers.

The flat is at 18 Cadogan Place in Chelsea, a West London district with the country's priciest homes, populated by film stars such as Hugh Grant.

BOE policy makers said at their Jan 10-11 meeting they considered whether the high price of assets, including houses, may fuel inflation.

They judged there was 'some risk' of that happening.

Investors are betting on the central bank raising the benchmark interest rate once more this quarter. The implied rate on the March contract was 5.73 on Jan 26 as of 3.15pm in London.

The contract settles to the three-month London interbank offered rate for the pound, which averaged about 15 basis points more than the bank's benchmark rate over the past decade. - Bloomberg 2007 January 30

London bankers buying life of luxury

About 4,200 bankers in the City will pocket bonuses of more than £1 million each

When you're a London banker with more than a million dollars in bonus money to burn, the yachts, James Bond cars and luxury homes are yours for the taking.

Britain's financial elite are prowling penthouses, visiting exclusive shops and considering the possibilities for spending the £17.3 billion (S$52.5 billion) bonus pot that a blazing hot market has earned them this year.

Sales of million-pound London houses and flats are already booming, and the bonus bonanza for merchant bankers and traders at global powerhouses like Merrill Lynch, Goldman Sachs and Lehman Brothers is expected to drive demand through the roof.

International real estate sales company Knight Frank said in a report available from its offices and entitled Rich City that the market for the type of London residences sought by bankers is expected to see the strongest growth in 2007.

'The super-prime market (US$4 million plus) is significantly out-performing the overall London market,' it said. 'This boom is forecast to continue into 2007, with year-end bonuses for London's financial elite estimated to increase.'

Housing in the capital is not the only sector soaking up chunks of big money from bankers in the square mile of London and its satellite enclave in Canary Wharf collectively known as 'The City'.

Shiny new Ferraris, Porsches, Aston Martins and other expensive cars piloted by well-heeled new owners have been roaring along the streets of London's financial districts every morning since bonus season began.

Pendragon, Plc - Europe's largest automotive retail group - said its prestige car division Stratstone has seen growing interest in Ferraris, Range Rovers and the Aston Martins made famous by James Bond over the December to March bonus season.

'The two hot cars at the moment are the Aston Martin V-8 and Range Rover Sport,' Pendragon chief executive Trevor Finn said on Friday.

Punters at the recent London Boat Show pored over the multi-million-pound yachts on display, checking out the hot-tubs, cabins and considering where best to keep the champagne cold on a sail around the sunny Mediterranean. 'To buy one of these boats is quite simple,' said Brian Peters, chairman of Peters-Opal, one of Europe's largest retailers of luxury motor yachts and sailing boats. 'You just write a cheque.'

Those sentiments may have been on the mind of Joel Plasco, the chief executive of London stockbroker Collins Stewart. His company sponsored the boat show and as he admired one of the biggest yachts at the show last week he looked thoughtful. 'I don't have a yacht,' he said.

Music and film lovers are also splashing out on high quality systems for home entertainment,

Sales staff at a shop for luxury electronic goods maker Bang & Olufsen said one customer spent 45,000 in a single visit on a 65-inch plasma-screen TV, state-of-the-art speakers and a few other big-ticket items. 'We are expecting great things,' said Bang & Olufsen sales consultant Richard Makings.

About 4,200 bankers in the City will pocket bonuses of more than £1 million each, according to an estimate from the Centre of Economics and Business Research.

A recent report published by Heartwood Wealth Management found that 46 per cent of City workers who anticipated receiving a bonus this year plan to spend it all.

Many high-end retailers have seen more window-shopping than frenzied purchasing. They reckon that visitors who don't buy just haven't seen the cash land in their accounts yet.

Tulsi Rao, a gemologist at fine jeweller David M Robinson, said she anticipates more customers like the one who bought a £34,000 watch from her more than a week ago. 'People are waiting for their payments for bonuses,' she said, 'are researching ... as soon as they get the cash they'll come in and buy.'

But one trader for a well-known US investment bank and out celebrating at a champagne bar with chums did sound a note of caution about the inevitable end to such a long boom. 'It may never happen again,' he said. 'So put it in the bank.' - Reuters 2007 January 22

The 'New' Rich in London

In the fantasy world of multimillion-pound property deals the Russians are the new Fifth Cavalry. This year, as the pool of takeover millionaires was drying up and big-hitting bankers started to disappear through their balance sheets, in rode the Russians with a fistful of newly converted dollars.It is not the first time they have appeared on the London property scene, but it is the first time they have paid such huge prices. The early post-glasnost pioneers bought unassuming flats and houses, typically for less than £500,000. In 2002 they have joined the big league.

The most spectacular Russian buy of the year was Stanley House, an elegant period property, just off the King’s Road in Chelsea. Its drawing room is decorated with a frieze of the Elgin Marbles, but the rest of the house is still in need of some finishing. That did not stop Hamptons from selling it for £10 million.

If that was the biggest buy, Boris Berezovsky was the biggest buyer. The Russian tycoon, who bankrolled Boris Yeltsin’s election campaign, bought one of the most impressive flats in Belgravia, kitted out to a James Bond specification, and also picked up a mansion in the Surrey stockbroker belt. Several multimillion-pound flats have gone to Russian buyers, who prefer modern, lateral space to tall, thin London townhouses. It is a Russian who tops the list of potential buyers for one of the country’s most expensive houses in Eaton Square.

There have been 15 sales at more than £8 million in London this year. One reason for the buoyancy is the return of the Middle East market. Arabs have been sellers, rather than buyers, of expensive properties in recent years, but 2002 marked a resurgence in spending.

It is mainly the third generation of oil-wealthy Middle Eastern families who have been in the market for UK homes. The most expensive private sale in the country this year, of a 13-bedroom house in Chesham Place, Belgravia, is believed to have gone to an Arab buyer.

Despite its size and its £19 million sales price, the property is a discreet, white stucco Belgravia house. That is entirely in keeping with the mood the current political climate demands. Another major Arab purchase this year was of a second-floor flat in Eaton Square, bought for £10 million from the Candy Brothers. This pair of young brothers has had phenomenal success in placing high-tech, high-gloss properties with buyers from the Middle East and Russia.

Some of the properties more traditionally associated with Arab purchasers have not been so successful. The two most expensive properties ever to come up for sale in the UK are a spectacular Eastern-style mansion, complete with prayer room, hairdressing salon and full Turkish bath in Kensington Palace Gardens, priced at £80 million, and an unfinished modern version of the same, near Windlesham in Surrey, priced at £70 million. No 18/19 KPG, as it is called in the trade, still awaits a buyer. Updown Court in Surrey, famous for its five swimming pools and not so famous for its road noise, was eventually sold by agents acting for the receivers at the rather undignified knock-down price of £13 million.

It has been a tough year in the regal neighbourhood of Kensington Palace Gardens, which is owned by the Crown Estate. Several embassies - most notably the Dutch - have moved elsewhere, and the properties they are leaving behind are struggling to find takers. The combination of high prices and short leases is proving increasingly unattractive in a world where freehold houses are becoming the norm.

One set of people who would be more than happy to stay in the ambassadorial road are Prince and Princess Michael of Kent. This year we learnt that they were paying £69-a-week rent for their five-bedroomed, grace and favour home in neighbouring Kensington Palace - the same as the rent paid by the average Bristol University student for digs in Clifton.

Celebrities from across the world have been helping the British property market boom, from Madonna in Wiltshire to Claudia Schiffer in Suffolk. (As a German, Schiffer is doing her bit for the market in Germany’s favourite second-home destination, Majorca, building a second property on a hill above her existing one.)

It was the celebrity belt of South Kensington that hit the headlines this year, when the singer George Michael put his house in Gilston Road up for sale for £8.25 million. For its size the house was the most expensive in the country, working out at just under £2,000 per square foot, a calculation which a judge ruled this week was the true measure of a property’s value.

Michael had owned the white stucco house for less than a year, having bought it in 2001 from the one-time media mogul Chris Evans for £7.25 million. Evans had bought it only a few months earlier for £6.7 million. In just over a year its value had supposedly risen by £1.55 million, or 22 per cent, keeping it roughly on a par with the Nationwide house price index. It has yet to find a buyer.

That is also the case with some of the most expensive houses up for sale in the country. Harewood House, a mansion on the edge of Windsor Great Park, near Ascot, with 12 bedroom suites, six reception rooms and a helicopter pad, came on the market this year at £27 million. It has been joined by an even larger neighbour, Fernhill Park, an Arab-owned mansion with 26 bedrooms and 11 cottages in 214 acres, priced at an eye-watering £48 million. Houses of this scale rarely sell quickly, unless they have that special rarity factor. The one property which definitely had that was Encombe in Dorset, set in a green bowl of 1,000 acres, with its own stretch of coastline. Charlie McVeigh III, European chairman of Schroder Salomon Smith Barney, snapped that up for £15 million. - Times 20 December 2002

Student numbers studyingat London’s universities have continued to grow and the supply of studentaccommodation in the capital remains tight

Drivers Jonas latest research highlights that 2,490 bedspaces have been completed in the last year across the capital. This is a product-type which our client could have interest. CONTACT US if you are seeking prospects to purchase your assets.

The research also uncovers that there are 4,078 bedspaces currently under construction with two thirds of these units expected to complete for the forthcoming academic year. That said, they believe we are still a long way from filling the supply gap.

We have seen a sharp increase in the number of schemes being submitted for planning, 13 of which have gained consent. However, for many it has been far from plain sailing with schemes struggling to get approval from local authorities as a result of tightening planning policy.

The latest data from the Higher Education Statistics Agency (HESA) shows that there are currently 267,800 full time students studying in London, a 5% increase on the total recorded for the previous academic year. International students have continued to have a strong presence with the total studying in London increasing by 9% over the last year, possibly driven by the weak value of sterling against the Euro and US Dollar making London even more attractive to overseas students.

This increase in students is forecast to continue and the University and Colleges Admissions Service (UCAS) is already reporting a 22% increase in applications for this year (2011/2012). There has also been a 63% increase in people over the age of 25 applying to universities.

This is likely to be a direct consequence of the economic downturn, with people choosing to retrain. - 2010 July DRUVERS JONAS DELOITTE