Equivalent Credit Ratings | ||||

| Credit Risk | Moody's* | Standard & Poor's** | Fitch IBCA** | Duff & Phelps** |

| INVESTMENT GRADE | ||||

| Highest quality | Aaa | AAA | AAA | AAA |

| High quality (very strong) | Aa | AA | AA | AA |

| Upper medium grade (strong) | A | A | A | A |

| Medium grade | Baa | BBB | BBB | BBB |

| NOT INVESTMENT GRADE | ||||

| Lower medium grade (somewhat speculative) | Ba | BB | BB | BB |

| Low grade (speculative) | B | B | B | B |

| Poor quality (may default) | Caa | CCC | CCC | CCC |

| Most speculative | Ca | CC | CC | CC |

| No interest being paid or bankruptcy petition filed | C | C | C | C |

| In default | C | D | D | D |

* The ratings from Aa to Ca by Moody's may be modified by the addition of a 1, 2 or 3 to show relative standing within the category.3. Bond average default rate within one year, by Moody's

**The ratings from AA to CC by Standard & Poor's, Fitch IBCA and Duff & Phelps may be modified by the addition of a plus or minus sign to show relative standing within the category. Moody's Rating Average Default Rate Within One Year of Rating Definition Notes Aaa Highest Rating Available Investment grade bonds. Aa Very High Quality A High Quality Baa Minimum Investment Grade Ba Low grade Junk Bonds B Very speculative Caa Substantial Risk Ca Very poor quality C Imminent default

2. Bond average default rate within one year, by Moody's

According to a Moody’s analysis of bonds from 1983 to 2007, about 0.2% of bonds worldwide with an Aaa rating defaulted within 10 years. That compares with 0.5% of those ranked Aa2 and 1.7% of all investment-grade debt. Almost 32% of high-yield bonds defaulted within a decade, the analysis showed.

(1970-2001)0.00% 0.02% 0.01% 0.15% 1.21% 6.53% 24.73%

or in default

3. Credit spreads not far off their highest since the Great Depression, by Moody's

4. Equity earnings yield/Baa spread at historical low, meanings investment grade credits looking most attractive vs. equity since 1930s

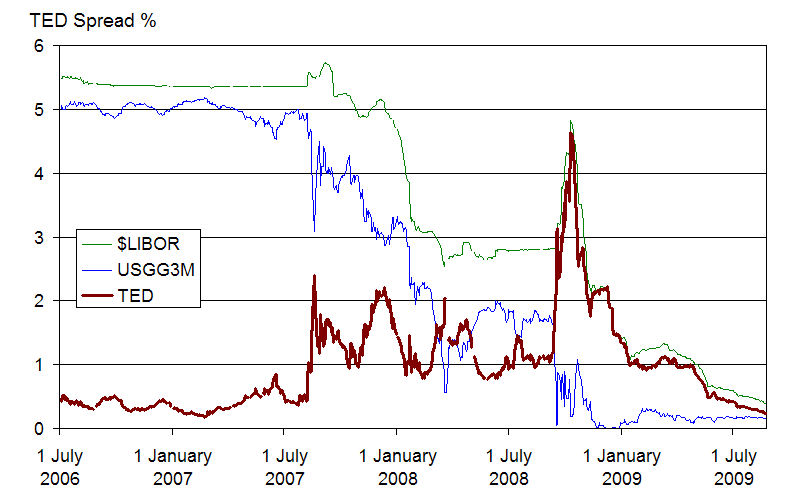

5. Difference between 3 month Libor and Treasury bill yields at highest level

6. Difference between 3 month Libor and Treasury bill

Currently the number of non-financial AAA companies in the U.S. dwindled to 6 from more than 60 in the early 1980s, according to S&P. Among them are Automatic Data Processing, Exxon Mobil, GE, Johnson & Johnson, Microsoft and Pfizer. But GE is on the brink of being downgraded, which means its debt service cost could be significantly higher.