股色股香

博客内容大多数收集于网上,如有版权之纠纷,敬请告知。

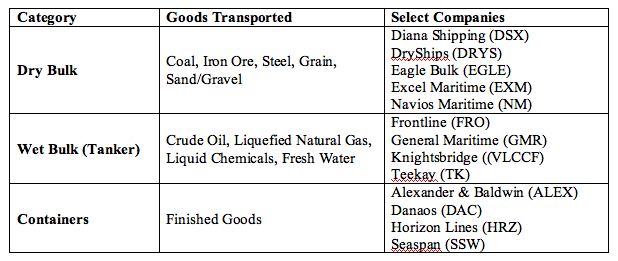

When selecting companies to invest in, one needs to be conscious of both demand and supply drivers. Demand drivers look at the availability and need for the cargo being transported while supply drivers look at the ability of ship builders to construct ships for commercial use.

The two primary drivers of demand are trade growth and trade patterns.

Trade Growth (Demand Driver)

- World GDP growth – the higher the level of economic activity the greater the demand for raw materials to trade

- Oil demand and supply – the higher the demand and supply of oil, the greater the need for tankers to transport

- Oil inventory levels – the amount of oil held in storage to meet future requirements has an impact on the demand for oil tankers in the future; seasonality often plays a critical role

- Steel production – Since iron ore and coal represent about 42% of global dry bulk trade, steel production is a significant factor in determining the demand for dry bulk carriers

Trade Pattern (Demand Driver)

- Refinery locations – varying levels of capacity and the sophistication of refineries’ processing capabilities affect the oil markets

- Sourcing – The distance between the place of origin and place of destination affects tonnage-mile demand for vessels

- Regional grain production – global grain trade depends on harvest of a particular year which, can significantly affect supply of cargo to transport

The two primary drivers of supply are ordering and scrapping

Ordering (Supply Driver)

- Ship building capacity – ship builders generally cannot cope with sudden increases in demand due to a time constraint to making ships; the current backlog of global shipyards reach out as far as the mid 2010’s

- Ship building prices – Lower prices can lead to increased orders thereby increasing the total tonnage available in the market

Scrapping (Supply Driver)

- Economic life – The higher the age of the fleet the higher the expected scrapping and lower the net fleet growth; the current average age of global shipping fleet is 19 years

- Regulations – Regulations on age and safety set by the International Maritime Organization and the EU can place restrictions on the particular kinds of vessels and fleets

Current Outlook Attractive

The demand for shipping capacity has been soaring for years thanks to places like China, India and the Middle East for their increasing needs and participation in global trade; this has pushed freight rates and operator profits up significantly. Luckily, supply of raw materials has kept in pace with demand, and thus has not constrained shipping activity. In addition, fuel costs are promoting a growing number of shippers to consider ocean versus other forms of transport.

A particularly attractive feature of shipping companies is that dividends are generally high and can range anywhere from 5-15% depending on the company; this can add significant bottom-line returns for your portfolio, even if the stock or market underperforms.

=======================================================================

台湾的Nobu Su在船运界的任何时期都会是位杰出人物。他看上去十分谦逊,而一位对手对他的描述是“酷爱冒险”。

作 为波动较大、相对新生的运费期货市场上一名熟练的玩家,Su还使自己的公司TMT成为一家油轮及干散货船的主要运营商。2002年父亲去世后他接管了 TMT,此后仅仅6年时间就取得了上述成就。TMT原名台湾海运公司(Taiwan Maritime Transportation),现在被重新命名为Today Makes Tomorrow。

“他前途远大,”一位船舶经纪人这样描述这位全球大船东。而在5年前,人们对他基本上还一无所知。

目前,大多数船运公司正变得越来越透明,运作与普通公司更为相近,在这个时代,现年49岁的Su更显得与众不同。

私有的TMT从未公布过财务数据。Su去年秋天才第一次接受媒体采访,他对TMT运营的船只数量也含糊其辞。

“数字总是在起起伏伏,大概在90至150艘之间,”他表示,“有记得有人说是130艘。”

不过,Su之所以成为国际船运界最具争议的人物,是TMT的船队和该公司买卖基于未来航运成本的金融产品行为之间的瓜葛。

该 公司许多竞争对手认为,TMT努力将船舶租赁费率向着其在远期运费协议(FFA)市场上高风险大额押注的方向推动,而该公司实物船舶的交易策略一定程度上 受到这种努力的左右。竞争对手声称,当TMT押注FFA价格下降时,往往会提供低于市场价格的租船费率。而当TMT押注FFA价格上涨时,又会撤离市场 ——从而降低运力,推高价格。

这种行为算不上不道德,但远远超出了大多数航运公司利用纸货市场来对冲市场风险的有限范围。

Su有意淡化TMT在纸货市场上的角色,只是表示它是“一个重要参与者”。然而,与该公司有关联的人士曾声称,TMT在全球FFA交易总量中占30%的份额。