2005 (1235)

2006 (492)

2007 (191)

2008 (735)

2009 (1102)

2010 (315)

2011 (256)

2012 (203)

Bonds have outperformed stocks in the past decade, and over significant periods over the past 200 years.

Index Universe published an excellent article by Bob Arnott on bonds performance versus stocks performance. We recommend reading it. From the article:

Most observers, whether bond skeptics or advocates, would be shocked to learn that the 40-year excess return for stocks, relative to holding and rolling ordinary 20-year Treasury bonds, is not even zero.

Arnott’s article reviews corporate bonds versus stocks from 1801 through now (about 208 years). He cites and graphs bonds outperforming over 62% of the time — not randomly, but in cycles. He identified 129 years of bond outperformance (68 years from 1803-1971; 20 years from 1929-1949; and 41 years from 1968-2009 YTD).

For these reasons, as well as the aging demographic of Baby Boomers who control a large portion of household assets, we think that bonds will assume a larger role in portfolios than previously.

That said, if the unprecedented government spending ongoing now creates high levels of inflation as some predict, bonds will suffer. Bonds may or may not be a great place to be going forward, particularly Treasuries, once a reduced fear factor allows people to assume more credit risk, or when China and other major buyers lower bids to obtain the rates they feel they need for the long-term.

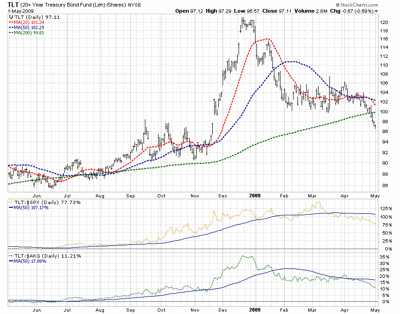

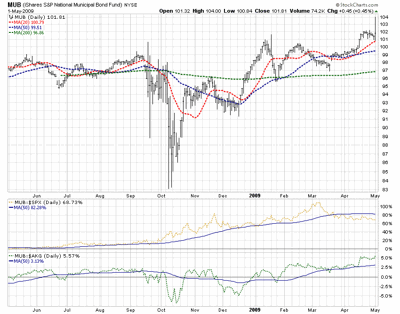

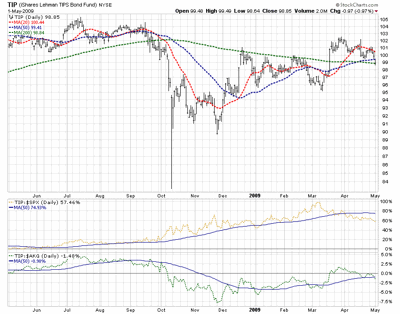

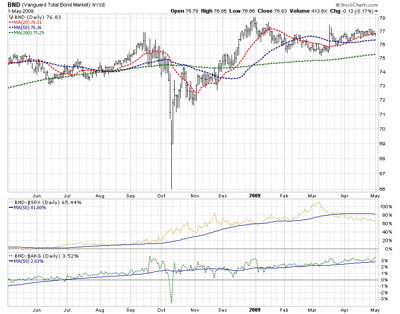

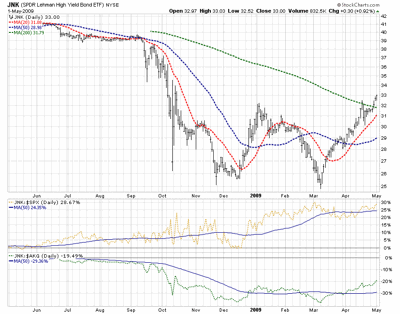

Treasuries are bearish and have a signficant impact on aggregate bonds as well. Muni's are going well, probably in anticipation of Federal bailout of states and in anticipation of tax hikes. Junk is bullish.

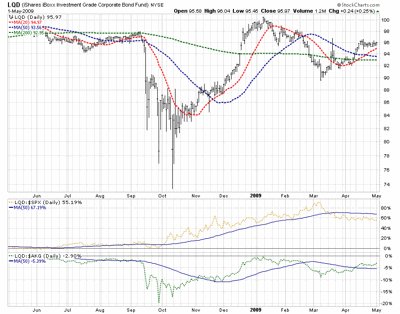

click images to enlarge

Whether stocks would suffer too would depend on how much inflation and its impact on the overall economy. Stocks like some inflation, and dislike massive inflation.