2005 (1235)

2006 (492)

2007 (191)

2008 (735)

2009 (1102)

2010 (315)

2011 (256)

2012 (203)

Respect the Bear, Beware the Bull by Cam Hui

The market action of this equity advance screams bear market rally, but I believe that traders need to respect the momentum inherent in this upswing.

Bear market rally!

I have characterized this move as a bear market rally before and I remain convinced that this advance does not represent the start of a new bull. There are many reasons for this.

- In late April, Mish writing at his Global Economic Analysis blog outlined a number of technical indicators that suggest caution in the face of this advance.

- Insiders are selling like crazy (see story here).

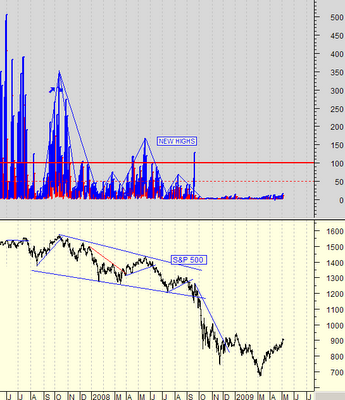

- Market internals remain weak. Marty Chenard at his site Stocktiming.com, indicated that the number of new highs is surprisingly low considering the magnitude of this rally:

New Highs vs. S&P 500

- Mark Hulbert’s newsletter writer sentiment indicators also show that sentiment has gotten bullish much too quickly – a contrarian bearish sign.

Don’t get gored by the bull

Nevertheless, it is important not to get overly enthusiastic on the bearish side.

Positive price action in the face of bad news is a bullish sign. Consider the whopping 17% advance by Bank of America’s (BAC) common shares as news broke that it may need an additional $34b in capital.

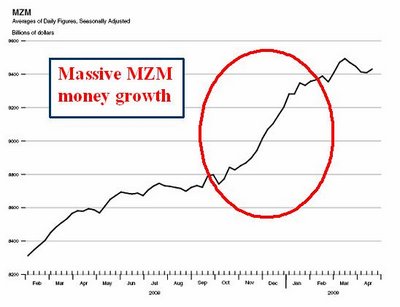

There is a lot of fiscal and monetary stimulus that has gone to lift this market. Michael Feroli, a senior economist at JPMorgan Chase, recently cautioned that:

It was a 2.2% uptick in consumer spending that prevented economic troubles in the U.S. from getting worse in the first quarter of this year. However, the consumer economy's apparent strength is misleading because it was fueled by lower taxes and transfer payments from the government.

His conclusions are correct in the longer run but incorrect in the short term. The chart below shows the increase in MZM in 4Q 2008. All that stimulus has to go somewhere…and it’s showing up now.

Todd Harrison of Minyanville sums up my sentiment best:

We must remember that a cornered animal has little to lose. The Federal Reserve and Treasury Department have thrown a lot at this market and seem intent on inventing mechanisms, printing currency and further diluting the definition of free-market capitalism. I learned the hard way in 2003 to respect those agendas, and it's a lesson I carry with me to this day.

What happens next?

Now that prevailing sentiment has moved from “Armageddon is around the corner” to “green shoots”, the next turning point will likely occur when the fast money ponders the question of what happens next, now that we seem to have stabilized.

Traders who are long should maintain tight stops, as this market could roll over any time. Traders who are in cash should probably stay in cash and not chase this market.