美股大盘综合信息报导

永远敬畏市场:试用K线技术分析探寻美股大盘走势Always trade what you see, instead of what you think!

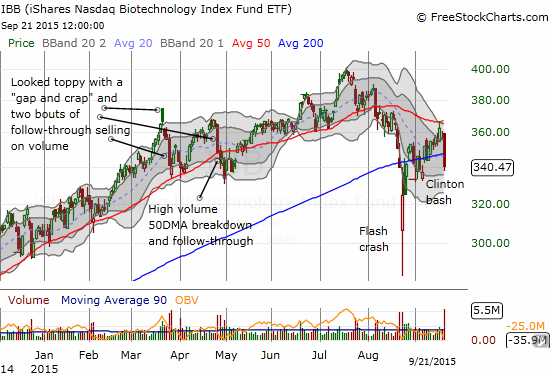

Hillary Clinton Takes Down the iShares Nasdaq Biochnology: Buy the News?

"...

Missing from the article was a specific quantification of the scale of the problem, the cost to the health care system, and/or an estimate of excess profits made by the industry. The article was mainly focused on specific cases of egregious price hikes and a fascinating examination of the background of Martin Shkreli, the founder and chief executive of Turing. Ironically, the article also note that two members of Congress wrote a letter in August to Valeant Pharmaceuticals (VRX) to investigate sharp price hikes on two recently acquired heart medications. One of those Congressmen, independent Vermont Senator Bernie Sanders, is fiercely competing with Clinton for nomination from the Democratic party for President. Is it possible that Clinton is moving quickly to prevent Sanders from getting all the credit for going after evil drug companies?

None of these gaps and intricacies matter for now as sellers seek to get out first and ask questions later. If I traded this special situation, I would stand ready to buy as soon as Clinton announced/released her plan (hopefully her plan at least fills in some of the gaps left by the article). The buy the news strategy gets more tempting the deeper the selling going into Clinton’s announcement.

Certainly, risks to IBB have increased some unknown amount and perhaps IBB deserves to lose some of its premium. However, given the main business model of IBB-constituent companies is NOT price gouging, Clinton’s sabre-rattling could very well end up tangential to IBB’s prospects.

Moreover, there are multiple layers of uncertainty ahead: Clinton wins the Democratic nomination (maybe a Sanders nomination has the same impact for drug companies, but theoretically the market already got a chance to panic about the odds of a Sanders victory), Clinton wins the Presidency, Clinton gets Congress to pass a related bill, said bill survives a battery of legal challenges. In other words, there are many, many years between now and the time that we could even have a hope of knowing whether any kind of related regulation descends upon IBB. The present value of this uncertainty is probably just about zero. Thus, buying IBB on a bet that Clinton-related losses will eventually reverse seems like a good risk/reward bet.

Note also the past resiliency of IBB to past selling. From a technical perspective, IBB SHOULD have topped out already. Monday’s high-volume selling (September 21, 2015) confirmed the 50-day moving average (DMA) as resistance and cracked the even more important 200DMA. The current close is just the third lowest close since the flash crash. In other words, the technical stakes are VERY high here…

Be careful out there! "

Web source: http://drduru.com/onetwentytwo/2015/09/21/hillary-clinton-takes-down-ibb/

密切关注!!!