正文

她在$3-4鹅就开始关注,但是那是在OTC,所以没有买。 当时涡轮王也在推荐!现在鹅准备随时介入。

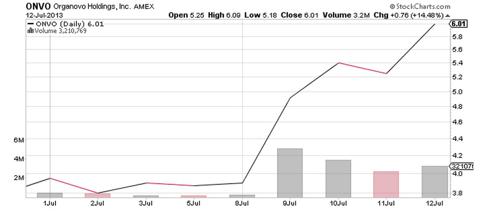

ONVO是3D 打印机用于医疗方面。7月9日正式成功加入NYSE,过去几天势头很猛,TRADING VOLUME大增祝大千儿88898 BUT YMYD! 赚了是你的,输了表怪我哈

ONVO是3D 打印机用于医疗方面。7月9日正式成功加入NYSE,过去几天势头很猛,TRADING VOLUME大增祝大千儿88898 BUT YMYD! 赚了是你的,输了表怪我哈

| Prices |

|---|

|

Uplisting To Expand Organovo's Valuation

Jul 16 2013, 5:17 | by D. Mero | about:ONVO

includes:DDD, SSYS

includes:DDD, SSYS

Organovo's (ONVO) investors were rewarded with a pleasant surprise on July 9th as the company announced that it had been approved to uplist on the NYSE MKT. Though its shares began trading on the New York Stock Exchange two days later, on July 11th, the reaction to the news was immediate. Since the release, shares of the 3D bioprinting company are up more than 50% on volume eight times the three month average. Overcoming the OTC stigma through the uplisting catalyst had been expected as it was mentioned on several occasions by CEO Keith Murphy who highlighted the milestone by ringing the opening NYSE bell on July 15th. This switch is a crucial event in Organovo's strives towards changing the shape of medical research.

What does the transfer mean for Organovo?

Listing its shares on the NYSE MKT, the premier US equity market for trading small growth companies, allows Organovo to see superior price discovery and liquidity while reducing trading volatility. This advancement would expose the company stock to retail and, more importantly, institutional investors who require the professed reputation of being listed on major national exchanges instead of the OTC markets. Many institutional investors and funds ("smart money") are restricted from taking positions in "speculative" OTC stocks due to their perceived risk profile. Upon NYSE MKT listing, this would be relieved, allowing greater inflow of "smart money" investments. As an influx of larger investors buy into the bioprinting craze, reputation and credibility follow suit which open the door to even more opportunities.

(click to enlarge)

Organovo got a taste of this endorsement, which spread like wildfire, during its first few days of trading on the NYSE MKT. Volume shot up way above average levels and price directly surged as a result. The institutional trading that was the driving force behind these large price swings also has the potential to surmount the psychological threshold affecting Organovo while trading on the OTC markets. With this uplisting, any remaining doubts that question the bioprinting technology or Organovo's partnerships are squashed as buyers continue to go long the 3D printing biotech.

A recent example that has undergone the same procedure as Organovo and reaping the benefits of a national exchange listing is Fibrocell Science (FCSC), a cell therapy company that focuses on the development of innovative products for aesthetic, medical and scientific applications. Prior to itsannouncement to submit listing application to the NYSE MKT from OTC on April 29th, 2013, FCSC averaged 13,000 shares of trading daily. Since then, the company has traded, on average, seven times the pre-uplist volume and seen a price increase of roughly 45%. Just a month after its transfer to NYSE MKT, Fibrocell was included in the Russell indexes, reflecting the advantages of being listed on a reputable exchange.

Like with Fibrocell, Organovo benefits from being listed on the NYSE MKT by inclusion in appropriate indexes. Due to their simplicity and diversification, index investing has grown in popularity as they are used by a wide range of investment managers and institutional investors for index funds and as benchmarks for investment strategies. Inclusion into a number of small cap indexes like the multiple Russell platforms and Wilshire Micro Cap Index would register new institutional holders in Organovo. ETFs and funds that track these indexes are required to allocate shares of newly included companies, such as ONVO, in their holdings when rebalancing their portfolios. The addition into appropriate indexes acts as future catalysts for ONVO investors. Both theWilshire Micro Cap and Russell Microcap annually rebalance their portfolios at the end of June. Although ONVO will not be included in the current year, it meets the criteria to be a 2014 addition.

Operationally, the uplisting is a fast track for ONVO as it will have greater options when choosing to raise additional capital to fund operations. Though the company is positioned with sufficient cash for the next year, being situated in development stages will undoubtedly require financing sometime in the future. The credibility and lower perceived risk associated with NYSE listed companies should grant Organovo greater bargaining power during negotiations on a financing deal with better terms, directly affecting shareholder value.

What does Organovo have to offer?

Organovo's NovoGen MMX Bioprinter technology places the company in a fascinating yet exclusive situation where it is exposed to two of the top-performing industries in the market; 3D printing and biotechnology. Investors in the company buy into the excitement of the 3D printing trend that is buzzing with hype, while also benefiting from advances in research that a biotech realizes. Due to this dual industry exposure, ONVO can be viewed as a more diversified investment given that the innovation of both fields will influence it. In other words, the exposure to different industries mitigates concentration risk while enhancing the company's potential alpha.

The bioprinting market has only one player: Organovo. The company currently faces no competition, therefore, making it the only play for investors interested in the bioprinting field. There are a growing number of 3D printing firms, such as 3D Systems (DDD) and Stratasys (SSYS), and ample biotechs, yet only one that combines the two industries. This novelty status can be utilized by Organovo to enforce a pricing premium simply through its supply and demand advantage. Additionally, the company employs protective patents as barriers to entry so that any incoming competitor must penetrate the market through ONVO directly. Being the lone name in this bioprinting market niche is beneficial for shareholders as it suggests ONVO will command a premium valuation to that of indirect competition like other biotechs or high technology companies.

Another company that demands the same valuation premium, due to its exclusiveness in its respective industry, is the leading electric car manufacturer Tesla Motors (TSLA). Tesla's novelty status has been the talk of Wall Street, in the last quarter, as its share price has surged 200%. To say the company is rolling with momentum is an understatement. Nonetheless, Tesla's stock offers investors the only pure play into the exponentially growing electric vehicle market. Although Tesla faces competition from conventional car makers like General Motors (GM) with their Volt and the Nissan Leaf, these established car makers have not received the same pricing premium as their purely electric counterpart. Possibly because they are not as concentrated on the EV trend. Therefore, by reason of its novelty status, Tesla's recent boom validates that being the only pure play in an emerging industry is deserving of a valuation premium.

Similar to Tesla, Organovo's lack of relevant competition in a potentially breakthrough industry justifies a valuation premium. Additionally, Organovo merits this pricing advantage as it represents the sole prospect for investors looking to capitalize on the budding industry of bioprinting. It can be argued that the same pricing premiums were placed on the only two 3D printing companies in 2012, as DDD and SSYS saw growths of 240% and 150%, respectively. However, the profits of the 3D printing industry have attracted new competition in 2013, such as ExOne (XONE), Arcam (AMAVF.OB) and many small start-ups that are looking to cut into the dominance of leaders DDD and SSYS. To date, 2013 has been another strong year for the two leaders in the industry, but their price movements have not shared the same traction as a year ago.

The increased competitive field of 3D printing brings up the possible prospect that Organovo may be on the acquisition block. The 3D printing leaders, DDD and SSYS, are looking to expand their stronghold on the market as profits will continue to lure rivalry. A month ago, Stratasys confirmed this byacquiring MakerBot. 3D Systems' acquisitive history supports this same notion that it may be interested in expanding into a similar, yet potentially lucrative field of bio-printing. Due to its exposure to the healthcare sector, an ONVO takeover by a larger pharmaceutical is always a possibility. Any interested acquirer would gain access to the NovoGen MMX Bioprinter for clinical trial testing without having to pay any future potential royalties. Of course, this is all speculation on my behalf. It just goes to show that Organovo has many options moving forward that add shareholder value.

Conclusion

Thus far, Organovo management has achieved all the goals they have laid out. This instills trust in shareholders for upcoming catalysts like the company's first commercialized product, a liver cell assay to be used for clinical drug testing. Organovo's recent uplisting will open the door to influential institutional investors, as the first few days of NYSE trading illustrated. The company's novelty status and lack of relevant competition will complement the influx of funds making it an attractive investment. These are exciting times for ONVO investors as word spreads on the breakthrough bioprinting technology.

Disclosure: I am long ONVO.PK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

评论

目前还没有任何评论

登录后才可评论.