只有想不到,没有做不到

投资,股票,计算机(注:本文大部分来源于一位老师的博文,觉得有用,特此炒来与大家共赏,不喜欢的飘过)

What is the point of making predictions?

Peter Drucker — 'Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.

Anyone who has traded long enough knows that price action usually happens before an event. The old 'buy the rumor - sell the news' axiom.

Crude oil, the US Dollar, commodities, bonds, precious metals, gold miners... my perspective on all of them in 2015 were rather accurate. Just a lucky guess? Perhaps. Here are my 2016 predictions. Let's see how lucky I get this coming year.

(1) Bonds of all shapes and sizes will have a dramatic sell-off.

在2015年开始我看到了一个强劲反弹的债券市场,$ TLT的20年期国债有一个尖锐的举动直冲近$140,$ TLT此后回落至$120元。我想$ TLT可以在第一2016年上半年在$100附近。债券泡沫将最终破灭。我们会看到放气的垃圾债券泡沫。将蔓延至债券市场的其他部分,包括10年,这飘摇坐镇缺乏长期的支持。当它崩溃,将带来海量的卖点。在$ TLT20年期债图表已压缩和看起来蓄势大幅走低。

The 10 year bond looks on the brink with a support break likely to wet the sellers appetite.

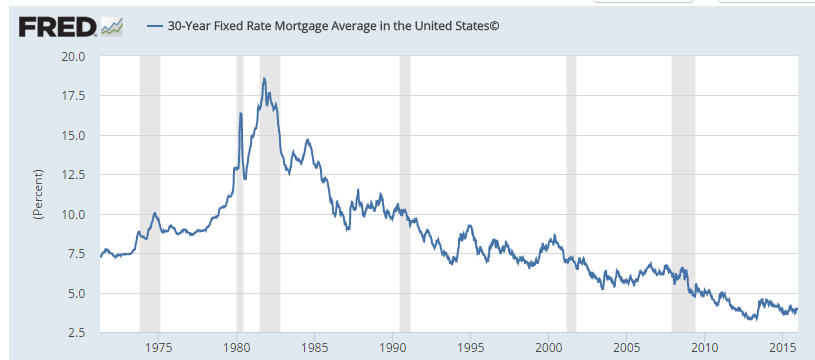

(2) Interest Rates Will Begin to Normalize in 2016 As Defaults Bring 'Raise the Risk'.

Bottom Line: It will cost more to borrow money in 2016.

美联储上调联邦基金利率0.25个基点,至2016年底,在可预见的未来, 我不认为他们会做的远不止于此。但是,这并不意味着处于历史低位的利率不会上升,在美国,美联储的零利率政策和量化宽松政策的方案一直保持利率在低水平。随着搁置两项政策,信贷趋于稳定的供应量,利率将开始恢复其自然风险定价状态 -- '正常化'。在这个中央计划的世界,新标准是利率尝试价格风险,而不是中央银行的承诺。

风险风险风险。更多的违约在整个能源行业里的风险是没有什么可以帮助的东西。波多黎各已经拖欠其部分债务。问题是,谁是下一个,以及金融市场如何避险?债务利率的定价应该在违约风险不会对美联储的零利率政策构成危险的时候实施。

人为的低利率使我们又回到另一个巨大的危机。企业已习惯异常低利率,在2016年企业会依靠额外债务,Corporations relying upon additional debt to make their current debt payments will go belly up in 2016. Countless loans handed out at the peak of the FED's 'easy money policies' will default。债务违约是通货紧缩。噗。这笔钱也没有了。

(3) The US Dollar Index will rally to a new 14 year high... and then some.

虽然美联储已下调其最大的利空美元的政策,其他央行依然准备并愿意提高自己。

As debt defaults become more prevalent amid higher interest rates and funding issues, the demand for the US Dollar increases at a time when supply is drying up.

After breaking into triple digits for the first time in 12 years in 2015, the US Dollar recent consolidation has set the stage for a massive rally in 2016.

(4) The historic bull market in stocks and housing that started in March 2009 will come to an end.

如果当前的市场是房子, 如果你在2007年买了一个破烂不堪的房子:油漆开裂,地板吱吱,壁板会被扭曲,屋顶瓦丢失,充满坑洞,一个生锈的信箱车道....you would just take out a giant home equity loan and fix the place up. If it was 2008 the home owner would just stop paying the home equity loan and talk nice to the mortgage company. If it was 2015, one of the best years for housing since the housing bubble, the homeowner would sell and buy something else. Mortgage rates have never been lower.

Which has helped fuel a 5% rise in home prices this year.

Low interest rates make that fixer upper with peeling paint and a crappy 1980's style green tiled bathroom cheaper to buy. That green tiled 80's bathroom doesn't look as nice when interest rates rise. Those buying a house in 2015 are going to be underwater in 2016.

and the stock market isn't going to like the higher costs of borrowing. A stronger US Dollar will make corporate exports more expensive. A stronger dollar will make Dollar denominated assets aka the US Stock market, more expensive to own.

The market will come back to test the August 2015 lows.

And when that happens I think there is a good chance they will not hold.

And when that happens I think there is a good chance they will not hold.

(5) The corporate share buyback bubble POPs -

有多少公司已回购自己的股票,通过发行债券在过去的几年里。 为什么?因为高管薪酬是基于股票。

The higher the stock price the higher their compensation AND corporations view stock buybacks as an efficient use of company capital, excess or otherwise attained. I wrote about it a year ago:

While corporate buybacks could be viewed as a sign that all is well... just think for a second what the opposite means. A company like $FCX recently suspended its dividend for the first time since.... drumroll.... 2008. Look where they decided to suspend the dividend ----- after the stock declined some 75%. .. not before. Corporations are not the smartest investors.

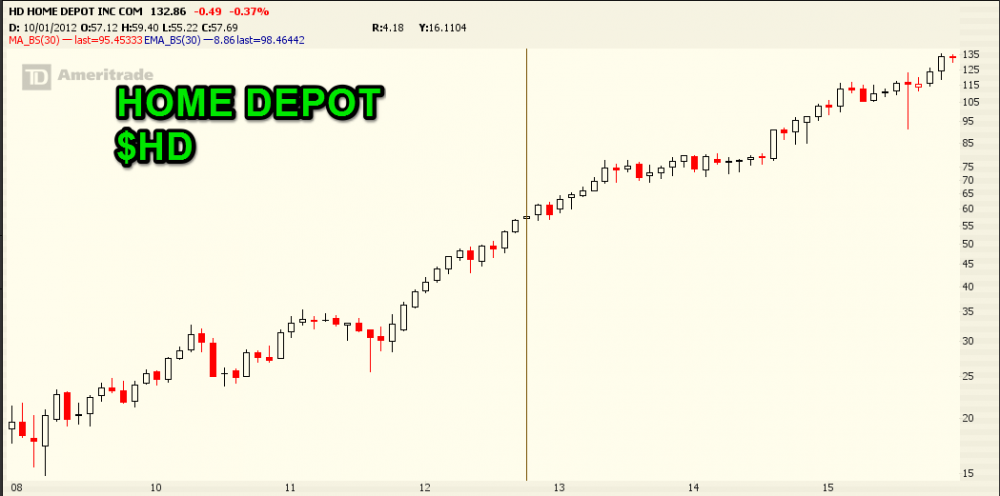

A company like Home Deport looks brilliant buying back its own stock when it keeps surging to record highs. If Home Depot continues to increase its share buyback scheme at some point it will own all of its stock..... but of course there will always be dilution from executive compensation... so we've got that going for us... which is nice....

At the lows during the financial crisis Home Depot was a $14 stock. It recently surged over $135 a share. You could argue the Home Depot share buyback machine is the smartest investor of our generation.

$14 to $135 in five years? Who is that masked investor? It's a bird, its a plane, noooo... why its the corporation itself. It will be tougher , if not impossible in 2016 for corporations to finance and continue their robust share buyback schemes. On top of that, the buybacks have masked dilution from executive compensation. The slow steady, relentless bid of yesterday year could easily turn into a nasty sell-off. The old stairs to the top and elevator to the basement.

This will take most of 2016 to materialize fully. But as the market is forward looking, the selling could start earlier rather than later. 'BUY' the time these buyback machines are put on pause the trade for downside will already be in full swing.

Conclusion:

Since the March lows in 2009 every Central Bank in the world has instituted untested, uncharted, and unprecedented policies. Here we are 6+ years later and we are going to start seeing the consequences of these policy's. Ultimately, no matter what the FED, ECB, Japanese, Chinese, Australians do the World is headed toward deflation. You are already seeing it via the commodity and crude oil collapse. While I mused previously that crude oil is 2015's landline telephone, the rout in prices has yet to hit a nadir. The commodity meltdown is even more telling. World Population is growing, yet demand is shrinking... prices will have to come down to meet demand. Yet Central Banks are trying to keep prices higher to avert another collapse and financial crisis. Perhaps they will succeed for another few years. Perhaps, just perhaps, all those crash callers will finally be right in 2016.