Hayward and Butler Comment on Speculation in Oil Markets

There are two new views today on who to blame (or who not to blame) for the recent run up in oil prices that has galvanized the country and the world, citizens across the globe prodding their lawmakers to take action, to do something - anything - to stop energy prices from rising.

In conjunction with the release of their Statistical Review of World Energy, BP (BP) chief executive Tony Hayward characterizes the blaming of speculators for pushing crude oil prices higher as "a myth".

He says it all comes down to supply and demand - too much demand and too little supply.

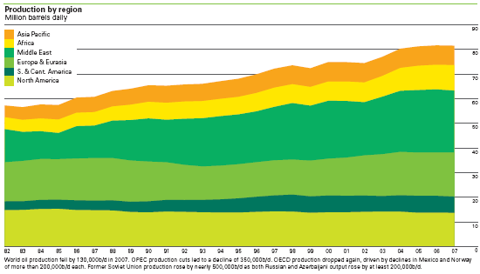

According to the annual review, total production fell by 130,000 barrels per day last year paced by production cuts of 350,000 barrels a day by OPEC. This was a decline of 0.1 percent, the first drop in production since 2002.

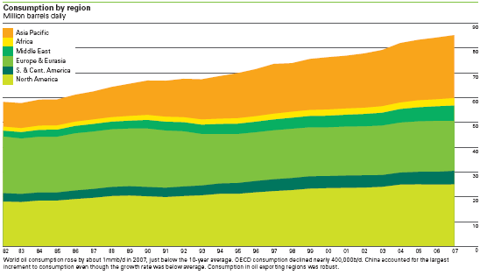

On the demand side, world-wide oil consumption grew by 1 million barrels a day in 2007, slightly below the 10-year average.

On the demand side, world-wide oil consumption grew by 1 million barrels a day in 2007, slightly below the 10-year average. Demand increased by 2.3 percent in the Asia-Pacific region with oil-exporting regions of the Middle East, South and Central America, and Africa accounting for two-thirds of the world’s overall demand growth.

Simply put, the world is consuming more oil than it can produce and when supply (production) exceeds demand (consumption), prices rise and will continue to rise until this imbalance is corrected by either increased production or demand destruction.

Simply put, the world is consuming more oil than it can produce and when supply (production) exceeds demand (consumption), prices rise and will continue to rise until this imbalance is corrected by either increased production or demand destruction. Don't let anybody tell you that the trillions of barrels of "proven" reserves around the world are going to do anything to affect the near-term price of oil unless those reserves can be pumped out of the ground and brought to market in a timely manner.

Correctly Identifying the "Right" Speculators

In his weekly commentary at Investment Rarities, long-time silver analyst Ted Butler weighs in on all the talk about "index speculators" driving the oil price higher. He seems to think that the recent fervor to stop the "speculators" in their tracks is well-founded, as long as the right group of speculators is identified.

But before the index funds are tarred and feathered and run out of town on a rail, let’s clear up a common misperception that it has been a sudden influx of index fund buying that has caused the recent dramatic increase in the price of crude oil. That is simply not true. The index funds are holding the same size, or smaller, long position in crude oil than they held 10 months ago, when crude oil was $70/barrel. Ditto for the large long speculators and smaller (unreported) traders on the NYMEX, according to CFTC data in the Commitment of Traders Report (COT). The data clearly shows that long traders on the NYMEX have not been buying aggressively and running up the price of crude. Well, if speculators are behind the recent sharp run-up in oil prices and the long-side traders haven‘t been buying, then who has been buying oil?

The answer is painfully obvious - the speculative shorts have been doing the buying. Public COT data proves this. The buying back of previously sold short futures contracts, primarily in the commercial category, account for the bulk of the buying over the past eight months or so, when oil was trading at $70.

There is always a short for every long position in every commodity futures contract. When enough longs panic and sell aggressively, prices plummet. When enough shorts panic and buy back their short positions aggressively, prices soar. Oil prices didn’t jump sharply because many new longs came into the market. They jumped because, at the margin, enough shorts panicked and bought back contracts they previously sold short, to prevent their losses from getting larger.

So while I agree that speculation caused oil prices to jump sharply, at least we should correctly identify which speculators did the buying. It was the shorts, not the longs. In fact, the data shows that the longs were selling. That’s not to say that oil prices won’t plunge in the future. They will, when enough longs panic and sell. To a large extent, this is the trading pattern of most markets.