It will be argued in this article that Sinopec should see significant reserves growth over the next 1 to 5 years, more than doubling current reserves, due to reserve additions in both domestic (Chinese) and international areas. Sinopec as covered in an earlier article has a substantial exploration and production division with proven reserves under SEC reporting guidelines of approximately 3.77 Billion Barrels of oil equivalent (86% oil) - compared on a reserve basis to Conoco Phillips (COP) (at 6.85 Bn BOE (42% oil) ex affiliates -- mainly Lukoil) and Chevron (CVX) (7.85 Bn BOE, excluding affiliates). Expected growth in Sinopec's reserves and production, based on Sinopec's statements concerning oil and gas development activities, should make Sinopec approximately equivalent to both Conoco Philips and Chevron on a reserves basis over the next five years.

Potential Reserve Additions Within China:

Domestically, Sinopec has two very promising areas within China for reserve growth: Sinopec's Puguang Gas field in Sichuan (the second largest known gas field in China) and the Tahe Oil Field in Xinjiang. Both have high estimated reserves (over 1 billion barrels of oil equivalent) and are in production or close to production currently, but have not been consolidated on Sinopec's reserves statement.

Puguang Gas Field:

The giant Puguang gas field, with between 300-400 bcm of recoverable reserves (approximately 2-3 billion barrels of oil equivalent) is expected to come online at the end of 2008, at which time the pipeline to Shanghai will be completed. The reserves have not been consolidated in Sinopec's 2007 Annual report filed with the SEC due to the fact that only proven and producing oil and natural gas reserves can be consolidated according to SEC guidelines. Initial production per year is expected at 4 bcm per year (approximately 68,000 barrels per day of oil equivalent) and increase to a final production figure of 8 bcm (136,000 barrels per day oil equivalent) by 2010 by Rigzone. This is estimated to add approximately 15% to Sinopec's 2007 production of approximately 900,000 barrels per day of oil equivalent by 2010.

Tahe Oil Field:

In the far West, in the Chinese province of Xingang the Sinopec's Tahe field, located in the Tarim Basin, was up and producing an estimated 100,000 barrels per day at the end of 2007 according to Sinopec's 2007 annual report, although the Tahe field has not been consolidated in Sinopec's 2007 annual report. There are no direct references of Tahe or Tarim on Sinopec's 2007 reserves statement and the production has not been included in the oil production in the 2007 Annual Report. The overall field is estimated at 1 billion tons of oil equivalent (approximately 7.4 Bn barrels of oil). What is ambiguous in reports concerning Tahe is whether or not this number refers to recoverable oil or oil in place. It is more likely that the oil reserve number refers to total oil in place since Chinese reports typically indicate total oil reserves, as is the case with the recent oil and gas discoveries in Bohai Bay. At a recoverable percentage of 35% for Tahe of total oil, the reserves booked would be 2.6Bn barrels. The author cannot find additional information concerning final production rates, but at an estimate 200,000 bpd in 2010, this would add 22% to Sinopec's 2007 production of 900,000 barrels per day of oil equivalent production. Chart 1 below shows the TarimBasin in Xinjiang, where the Tahe Oil Field is located, in comparison with the other oil and gas fields in China. (Note that this chart was completed in 1999, before the Puguang Gas Field was discovered, so this field is not indicated below):

Chart 1: China's Oil Fields, Including the Tarim Basin in Xinjiang:

Source: FromtheWilderness

It should be noted that there has been some criticism of Xinjiang's oil potential in the past by analysts. Chinese officials had, throughout the 1990's and early 2000's, made optimistic claims about the region's oil and gas potential. They even claimed that Xinjiang could potentially overtake production from China's eastern Daqing and Bohai Bay areas. (Daqing is one of the four largest oil fields in the world, owned and operated by PetroChina.) Some analysts have poked holes in this argument about Xinjiang's oil potential. It is likely, according to Beijing based petroleum geologists, that there is not one single giant field in Xinjiang but rather a series of medium sized fields. The oil is more viscous (closer to heavy oil), thus the depths needed to drill are several kilometers deep. However, this does not mean that Xinjiang should be taken to the opposite extreme, that there no little or no economically recoverable oil in the region, as has been done in certain publications. The achievement of initial production of 100,000 barrels per day from the Tahe Oil field in 2007 shows that the Tarim basin has significant potential, if not as high as China's eastern coast.

Overall, from domestic areas Puguang and Tahe, Sinopec can expect to book an additional 4.5Bn to 5.5Bn barrels by the end of the 2009 to 2010l. This compares to an existing reserve base of 3.77Bn barrels at 2007, and add an additional 200,000 - 300,000 barrels per day of oil equivalent production, taking Sinopec over 1 million barrels of oil per day by 2010. This is a very high production number for a firm selling at around $US80Billion in market capitalization.

Potential Reserve Additions Internationally:

Internationally, Sinopec has three main areas which have high potential; Angola, Iran and Venezuela, and two areas of good potential: Russia and Africa. The larger areas of reserve potential, Angola, Iran and Venezuela, will be discussed below.

Angola:

Angola is one of the world's hottest areas for oil investment, with projected daily production by 2010 of 2.6 M bpd by Rigzone. Angola is projected to overtake Nigeria after 2010 in terms of oil production. Sinopec Group, the parent of Sinopec Corp (SNP), has a 37.5% interest in Angola's offshore Greater Plutonio field, which was up an running in 2007 with production of 240,000 barrels per day. (Sinopec's proportional interest of 90,000 bpd.) This production number had not been consolidated into the publicly held Sinopec Corp at the end of 2007, although Sinopec Group has indicated that overseas properties will be transferred to the publicly listed subsidiary. (See this article for details.) Total reserves of this field are estimated at 750M barrels, which translates to a productive field life of 8-9 years at current production rates.

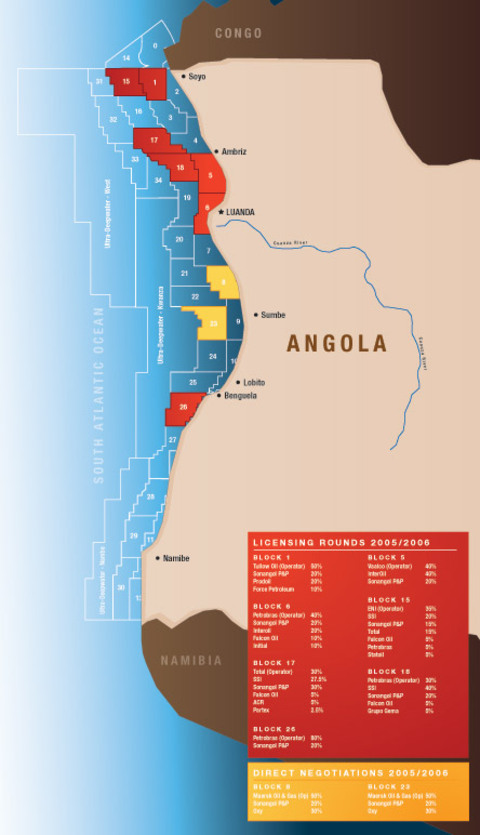

Sinopec also owns equity shares in other offshore oil fields, ranging from 20% to 40%, in offshore Angola Blocks 17, 18, and 15, which, as reported by the University of Alberta, contain a total of 3.2 Billion Barrels of oil. Production dates are expected within the next 5 years, with initial production undisclosed. Overall, Sinopec's Angola oil fields can potentially add approximately 1 billion barrels to reserves when the oil fields are developed, in the 2010 time frame.

Chart 2 shows the relative distribution of Blocks in offshore Angola. It is noted that the majority of blocks have not been awarded as of 2007, when this map was constructed. Sinopec, having won positions in three blocks, is strongly positioned over the long term for future block bidding in Angola.

Chart 2: Map of Blocks in Offshore Angola:

Source: SubseaIQ

It should be noted that there is some resentment of Sinopec by certain international oil majors over Angola. This is due to the fact that Sinopec bid very high rates for the rights to participate in Angola's oil fields. The amount Sinopec paid was approximately 10x higher than Exxon Mobil's (XON) bids for the same fields. Critics have stated that Sinopec "will pay any price to participate in international oil" and that Sinopec could not possibly develop Angola's oil fields profitably due to the high prices paid for the fields. However, the respected consultancy Woods McKenzie has stated that Sinopec's international activities should be profitable at current prices, despite the high acquisition prices paid. Further, with the current very high oil prices, it is more likely that Sinopec's Angolan operations will be profitable.

Iran:

One of Sinopec's most promising international ventures is Iran, particularly Iran's Yadavaran oil field, which has an estimated 3 billion barrels of recoverable oil in place and is currently undeveloped. Sinopec has signed agreements to develop this oil field in early 2008. The reserve numbers will likely not be able to be consolidated on Sinopec's reserve statements, however, due to the fact that under Iranian law foreign firms are not allowed to own Iranian properties of oil and gas. However, Iranian law does provide a guaranteed return of between 10-20% per annum to oil firms on production, with essentially no risk, as there are no exploration costs. The details of Sinopec's deal with Iran are currently opaque, but it has been rumored that Iran has intended to provide good terms for Sinopec in order to attract interest by international majors in undeveloped oil fields going forward. Terms are rumored to be 15% with a 4 year payback period, according to the Oil and Gas Journal, (Yadavaran Buyback Contract Signals Better Iranian Terms, Oil and Gas Journal, Jan 14, 2008) which is considerably better than other deals in Iran in recent years. Overall, the Iranian Yadavaran oil deal should boast profitability at Sinopec for several years going forward.

Venezuela:

Sinopec, along with PetroChina, has moved into Venezuela on a large scale after Exxon Mobil, Conoco Philips, and many other Western oil majors were expelled of the country in 2007 without significant compensation. Venezuela has publicly stated that its massive Orinoco oil heavy oil belt, with comparable recoverable oil reserves to those of Saudi Arabia, will be developed mainly by Venezuela's national oil company PDVSA with a large contribution from Sinopec and PetroChina, as reported by YaleGlobal. Sinopec has taken a 32% interest in certain regions of Venezuela's Orinoco's heavy oil belt, with 60% owned by PDVSA (Venezuela's national oil company). Current production is estimated by Schlumberger of Venezuela's total oil sands territory at 600,000 barrels per day. Venezuela would like to increase this number to at least 2 million by 2020.

As the reserve numbers are very large in Venezuela's heavy oil belt, it's more informative to look at potential production numbers. Venezuela has indicated that it wants to increase combined production with Chinese, both Sinopec and PetroChina, to 200,000 bpd by 2010 and 400,000 bpd by 2011, with further increases thereafter (Venezuela-China Team Sets Orinoco Target, Platt's Oilgram News, August 25, 2006). Assuming 50% of the Chinese production goes to Sinopec, at 32% equity ownership, this translates to 64,000 barrels per day by 2011.

Overall, Venezuela is a growing source of petroleum production for Sinopec over the long term. There is some doubt that Sinopec will receive a high margin on oil operations in Venezuela, as Hugo Chavez has stated, during the expulsion of Exxon and other western majors in 2006, "The days of private enterprise in oil in Venezuela are over." The operations should add some value to Sinopec.

Chart 3: Potential Reserve and Production Additions to Sinopec over the Next 1 to 5 Years:

Notes:

* Under Iranian law, the Yadavaran Oil field will not be able to be consolidated as reserves, and potential production numbers of this field have not been disclosed as of 5/08.

**Venezuelan heavy oil production can go much higher than 100,000 bpd proportional interest to Sinopec, but a 100,000 bpd number is used here to indicate potential taxation/expropriation issues.

Potential Reserves are presented as a mean number for estimates of resource size. Potential production numbers are estimated in peak production years based on preliminary data from reports and articles cited above.

***”Probability of Achieving Production” is the author’s assessment of attainability of indicated future production rates on a scale from “Low” to “Very High.”

Conclusion:

Sinopec has several areas both domestically and internationally that show high promise for substantial reserve additions going forward. In particular, Sinopec's domestic Puguang and Tahe gas and oil fields are almost certainly going to add substantially to reserves in the next 1 to 3 years. Internationally, Angolan production is currently up and running, with potential for further production and reserve addition increases. Iran and Venezuela also show high promise for Sinopec profitability.

Note that this article did not discuss potential problems with the Shengli oil field after 2010. Many analysts believe Sinopec's main oilfield Shengli, which is decades old, could decline after 2010. Also, other divisions within Sinopec, namely Sinopec's refining division, was not discussed in this article, but was addressed in an earlier article. Finally, cost projections were not discussed, in that Sinopec's potential may exist, but profitability of these potential oil fields was not discussed.