笨狼发牢骚

发发牢骚,解解闷,消消愁前天说起日本央行是如何严惩国际日元炒家的?,提到实际上索罗斯并未做空人民币,只是看糟中国经济,自然觉得人民币会贬值。不过,做空人民币的自然大有人在,华尔街日报报道点出四人:Kyle Bass, Stanley Druckenmiller, David Tepper, and David Einhorn。Kyle Bass和David Einhorn都是做空美国次贷危机成名、发的,两人这几年对美国经济一直不报乐观态度,对多债务(如希腊)常有耸人听闻的言论,估计一直没赚钱来着;David Tepper则吃联储救市,做多美国股市发了大财;Stanley Druckenmiller是老资格,洗手多年,近年来常常警告美国经济已陷入死胡同。

Kyle Bass

David Einhorn

Stanley Druckenmiller

David Tepper

比起欧元日元对美元大肆贬值,人民币实在是为世界做了贡献:

贬这么一点点儿,算什么?但这个世界真残酷,大家是如狼似虎般的狠,一有点儿不妥,以前的全忘了。

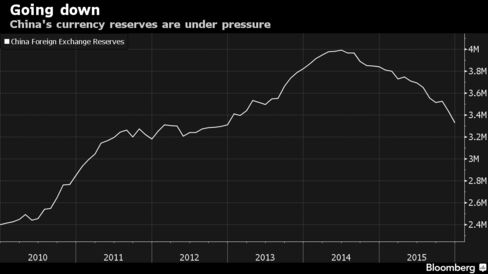

人民币会大幅贬值吗?贬值的主要理由是中国产品因货币过强而失去竞争力,比起日本欧洲,处境很难。没有出口,企业倒闭,就业成了问题,进而引起社会动荡。因为这个压力很大,去年中国外汇流失不少,彭博的报道:

《彭博》China's $1 Trillion Money Exodus Isn't About Capital Controls

中国外汇储备

如彭博所言,如果5%的人口担心,将每年允许的50000美元汇到国外,那中国外汇储备所剩下的3万3千亿救光了。那是自己人自杀,几个大鳄,不会成气候。

那人民币会真会大幅贬值吗?已经贬了6-7%(左右)了,出口企业翻不了身,也缓过一口气来了。中国出口企业缺乏竞争力,货币是一个因素,但不是主要的。大部分企业靠吃政府,吃惯了,产能过剩也反映到出口上,大家一拥而上,拼命贱卖,赚的就是政府的补贴,自相残杀是常事。这种情况,很多企业被淘汰时必然、应该的。但基于中国巨大的产量,这未必会影响出口全局。去年中国混的还可以,说要一千万个新职位,结果一千两百万个,算李克强的。所以,不必担心就业,要担心的是,银行往往因为政府鼓励、变相担保、多端要求给这类就业型企业贷款,不少企业目前处于低迷状态,债务过度,甚至连利息也难以担负:

2015.11.237.6万亿只为付利息,以债养债能维持多久?

一旦这些企业倒闭,银行的贷款怎么办,也许没辙得救银行。央行担心人民币的稳定性远高于对出口的救济。

人民币贬值的另一个因素是美国涨利息。去年年底美国联储开始首次涨利息,给人的感觉是过去的日子是一去不复返了。这给全世界资本巨大的心理压力,不但中国,几乎所有发展中国家都面临这个问题。心理压力很厉害,即使有头脑的人也往往不顾现实,不做分析,大家也是一哄而上,形成潮流,结果形势难以逆转。其实第一美国利息还是极低,美联储三番五次强调不会大幅加息,整个过程会慎重、缓慢。第二,美联储跟中国“央妈”没什么区别,整天担心股市动荡,(有钱人)亏钱了,大家一嚷嚷,联储就心软了,也心慌了,不会采取过多的行动。目前美国利率市场和美国经济学家的预测也是今年顶多会加两次息,而不是联储暗示的四次。第三,联储也担心美元过高会影响美观企业的竞争力,这跟中国央行的难题一样。停止上调利率而避免货币升值以暗地支持本国企业在世界上的竞争力,也算“操纵货币”,联储嘴里不提,但还是要做的。

我在日本央行是如何严惩国际日元炒家的?说起“人民币贬,不但影响中国和世界对人民币的信心,给人民币刚刚加入国际货币基金组织特别提款权(SDR)带来瑕痴,不利建立人民币国际贸易结算货币的地位,也导致中国外汇外流“,人民币作为中国贸易甚至世界贸易结算货币,对中国走向世界很关键,故此人民币也不能轻易贬值。这是一篇学术文章:

China’s ‘hidden’ current account deficit; invoicing decisions and liquidity effects on EMs

它提到一旦贬值,中国的亚洲交易国会要求以美元结算,进一步加剧贬值。

外流这么厉害,要管制外汇吗?连日本央行行长黑田东彥(Haruhiko Kuroda)都建议中国管制:

《彭博》2016.01.2 Kuroda Advises China to Impose Capital Controls to Defend Yuan

《彭博商业周刊中文版》2015.03.19 盘点中国富豪转移资金的9条密道

密道一:蚂蚁搬家

密道二:赌场洗钱

密道三:地下钱庄洗钱

密道四:银行“内存外贷”

密道五:换汇中介操作

密道六:虚开发票金额

密道七:虚假贸易“搭便车” 虚增进口价格外流资金

密道八:设虚假公司

密道九:海外并购“混出去”

政府正在采取的手段:

《彭博》

2016.01.27 Here's What China Is Doing to Tighten Noose on Capital Flows

2016.02.02 China Unleashes New Steps to Control Financial Risks, Outflows【参见:《一财网》离岸人民币流动性缩紧 做空人民币不容易】

China to Plan Looser Limits on Foreign Fund Outflows【注:这只是针对外资,不是国内资金外流】

《路透社》

2016.01.15

人民币会贬值多少?对冲基金将目光瞄向15%

2016.01.19

中国央行严控跨境人民币资金池业务 缓解资本外流压力

2016.01.27

中国试图让外界相信人民币将保持稳定 但投资者存疑

分析:人民币汇率能走稳多久?

《21世纪经济报道》2016.01.15

曝光不良资产腾挪术:银行采用多种方式逃避监管

《财新周刊》2015.11.30

不良贷款腾挪术

2016.012.03 外媒:人民币空头卷土重来 上个月曾被中国央行击退

有些情形抛售人民币也属迫不得已,比如中国有些企业在国外借钱,就是在国外发行债券。国外发行,自然是美元债券了。结果现在人民币贬值,还有进一步贬的可能性,企业们沉不住气了(彭博:China Has $23 Billion in Debt That Could Be Cut to Junk,中文翻译降级潮来临:230亿美元中企外债逼近垃圾级),据统计,

2015.12.30 外管局:截至9月末中国外债1.529万亿美元

广义政府债务余额为6665亿元人民币(等值1048亿美元),占7%;中央银行债务余额为2599亿元人民币(等值409亿美元),占3%;银行债务余额为44758亿元人民币(等值7035亿美元),占46%;其他部门债务余额为30239亿元人民币(等值4754亿美元),占31%;直接投资:公司间贷款债务余额为13057亿元人民币(等值2052亿美元),占13%

德国商业银行中国经济学家周浩早些在

2015.08.15 理性判断中国外债风险

说“2015年第一季度末时,中国的外债存量较2014年相比下降了3%,存量规模为8,700亿美元左右”。不论如何,美元外债得回赎,那就得用美元还给债主,就得用人民币买美元,结果跟抛售人民币抢购美元无异,给人民币增加了一个压力。

据此,我相信人民币不会大幅贬值,也不会比目前掉多少。华尔街的人说“押人民币大跌(就像赌钱)的(赌)注,已经下了“,中国政府怎么说都没用。当然了,不过,中国政府顶着,人民币不(大)掉,他们能不能赚钱,就说不准了。

《华尔街日报》【中文翻译】

Currency War: U.S. Hedge Funds Mount New Attacks on China’s Yuan

Bets against the yuan by hedge funds come at a time of enormous sensitivity for Chinese leaders

By Juliet Chung and Carolyn Cui

Jan. 31, 2016

Some of the biggest names in the hedge-fund industry are piling up bets against China’s currency, setting up a showdown between Wall Street and the leaders of the world’s second-largest economy.

Kyle Bass’s Hayman Capital Management has sold off the bulk of its investments in stocks, commodities and bonds so it can focus on shorting Asian currencies, including the yuan and the Hong Kong dollar.

It is the biggest concentrated wager that the Dallas-based firm has made since its profitable bet years ago against the U.S. housing market. About 85% of Hayman Capital’s portfolio is now invested in trades that are expected to pay off if the yuan and Hong Kong dollar depreciate over the next three years—a bet with billions of dollars on the line, including borrowed money.

“When you talk about orders of magnitude, this is much larger than the subprime crisis,” said Mr. Bass, who believes the yuan could fall as much as 40% in that period.

Billionaire trader Stanley Druckenmiller and hedge-fund manager David Tepper have staked out positions of their own against the currency, also known as the renminbi, according to people familiar with the matter. David Einhorn’s Greenlight Capital Inc. holds options on the yuan depreciating.

The funds’ bets come at a time of enormous sensitivity for China’s leaders. The government is struggling on multiple fronts to manage a soft landing for the economy, deal with a heavily indebted banking system and navigate the transition to consumer-led growth.

Expectations for a weaker yuan have led to an exodus of capital by Chinese residents and foreign investors. Though it still boasts the largest holding of foreign reserves at $3.3 trillion, China has experienced huge outflows in recent months. Hedge funds are gambling that China will let its currency weaken further in a bid to halt a flood of money leaving the country and jump-start economic growth.

The effort is a lot riskier, though, than taking on a currency whose value is set by the market. China’s state-run economy gives the government a number of levers to pull and tremendous resources at its disposal. Earlier this year, state institutions bought up so much yuan in the Hong Kong market where foreigners place most of their bets that overnight borrowing costs shot up to 66%, making it difficult to finance short positions and sending the yuan up sharply.

The situation grew more tense after billionaire investor George Soros predicted at the World Economic Forum gathering in Davos, Switzerland, recently that “a hard landing is practically unavoidable” for China’s economy. He said he is betting against commodity-producing countries and Asian currencies as a result.

George Soros, of Soros Fund Management, at the World Economic Forum in Davos, Switzerland, recently. He said he is betting against Asian currencies. ENLARGE

George Soros, of Soros Fund Management, at the World Economic Forum in Davos, Switzerland, recently. He said he is betting against Asian currencies. Photo: Bloomberg News

Days later, a commentary appeared in China’s state-run Xinhua News Agency warning that “radical speculators” trying to short sell, or bet against, the Chinese currency would “suffer huge losses” as the Chinese monetary authority takes “effective measures to stabilize the value of the yuan.”

A spokesman for Soros Fund Management, Mr. Soros’s family office, declined to comment on the firm’s currency positions.

The show of force has scared off some fund managers from adding to their wagers. Some traders have scaled back or even exited from their short bets, saying they have little appetite to go up against the Chinese government. Some say they are looking with new interest at shorting the currencies of other Asian countries that they expect would fall if the yuan keeps depreciating.

The standoff harks back to big battles such as Soros’s bet against the British pound a quarter-century ago. In 1997, Malaysia’s prime minister blamed Mr. Soros for a run on the ringgit during the Asian financial crisis. Mr. Druckenmiller, then chief investment officer for Soros Fund Management, said at the time that while the main Soros hedge fund had earlier shorted the ringgit, it bought the currency during the crisis, cushioning its fall.

Hayman Capital began betting against the yuan last year after studying China’s banking system and being stunned at its rapid expansion of debt. The firm’s analysis suggested that past-due loans, which currently stand at about 2% of the total, would rise sharply and eventually require an injection by the central government of trillions of dollars of yuan to recapitalize the banks. An expansion of the Chinese central bank’s balance sheet would lead its currency to weaken, just as the dollar depreciated when the Federal Reserve bailed out U.S. banks during the financial crisis.

Broader market bets against the yuan began growing last August, when the People’s Bank of China unexpectedly devalued the currency by 2% against the U.S. dollar. The move fueled speculation that Beijing eventually would have to decouple the yuan from the strengthening dollar and follow other countries to weaken its currency as a way to buoy growth.

Mr. Druckenmiller, who now invests his own wealth, and one of his former protégés, Zach Schreiber, who runs the roughly $10 billion hedge-fund firm PointState Capital LP, also have had sizable shorts against the renminbi since last year, people familiar with the matter said.

The wager helped PointState gain about 15% last year, said a person familiar with the firm, and has contributed to gains of more than 5% through mid-January.

Traders who remain bearish now are shorting China’s currency in several ways, say people familiar with the trades. Some are betting that the gap between the currency’s onshore exchange rate and more market-sensitive offshore rate will diverge further. Early in January, the spread hit a record of 0.1367 before government intervention narrowed it sharply.

Two days before China devalued its currency last August, William Ackman’s Pershing Square Capital Management LP began to put on a “large notional short position in the Chinese yuan through the purchase of puts and put spreads” to hedge against “unanticipated weakness in the Chinese economy,” according to Mr. Ackman’s annual investor letter, disclosed this past week.

But, demonstrating how difficult it can be to profit from such bets, Mr. Ackman said in the letter the wager had generated only a modest profit for Pershing Square and had been insufficient to offset the firm’s larger losses, as China continued to defend the exchange rate.

Mr. Ackman wrote that he continued to hold the position because of its importance as a hedge.

Other firms that have profited from shorting China’s currency include the $2 billion Scoggin Capital Management and Carlyle Group LP’s Emerging Sovereign Group, according to people familiar with the matter.

For 2016, ESG’s short-China fund, Nexus, was up more than 20% partway through January, according to people familiar with the fund, thanks in part to a large short position against the yuan. Much of Nexus’s position is made up of options, one of the people said.

It was unclear how much exposure Greenlight and Mr. Tepper’s Appaloosa Management LP have, though Mr. Tepper was outspoken last year in calling the yuan overvalued.

Since August, China has been imposing various rules to stabilize the exchange rate and stem the outflows, including a 20% reserve requirement applied to onshore yuan-derivative trades. That move makes it more expensive for funds to keep shorting the currency through swaps.

Chinese officials have indicated they aren’t seeking to devalue the yuan in order to gain advantage over their trading partners, citing the need to avoid a damaging spiral of competitive devaluations as others follow suit. The country still has room to stimulate its economy through fiscal policies, economists say.