笨狼发牢骚

发发牢骚,解解闷,消消愁

癌症现状(上)

现代癌症研究、治疗的转折点:癌症基因的发现

The Discovery of the Human Oncogene

《万症之首属癌症》第三集

关于当今癌症研究的最新发展,下面三片极佳的介绍:

A conversation on the future of cancer research at Columbia University

2015.03

Curing Cancer: How Close are We?

2014.10

“儿童白血病治愈率达90%”,了不起的成就。

梅查理:希望之城癌症中心

具体癌症治疗方法不多(有提及),主要是癌症综合治疗的范例。

作为癌症治疗的最有希望的法子,说说免疫学。

说句外行话,举个例子说说为什么免疫学关键。开头说了,“基因突变的可能性,指数量级”,然而人体免疫系统也有指数量级,有应对的能力。如何利用人体自身强大的力量,是个关键。再举个大家高兴的例子。

说现代饮食很成问题,是真的,饮食搞好了,身体的免疫系统就知道谁是敌人,谁是朋友,更加有效力。

1996.10

Immunology Breakthrough Earns Nobel Prize

2013.12

Cancer Immunotherapy Named 2013 “Breakthrough of the Year”

Cancer Immunotherapy Named Science Magazine “Breakthrough of the Year”

美国科学杂志:Breakthrough of the Year 2013

文章。

治疗,新的治疗方法想法是:基因为指导,精确、针对性、局部、综合(环境、饮食、心理、高技术、治疗共用)。IBM(国际商用机器公司)最近将几乎所有癌症数据输入超级计算机里供医疗界使用,一个例子。

美国癌症协会列举的现在使用的治疗方式:

Surgery(手术)

Chemotherapy(化疗)

Radiation therapy(理疗)

Targeted Therapy(针对性治疗)

Immunotherapy(免疫疗法)

Hyperthermia(热疗)

Stem Cell Transplant (Peripheral Blood, Bone Marrow, and Cord Blood Transplants)(胎盘细胞移植)

那说了半天现在进步极快,是不是癌症基本有戏了?还没有。

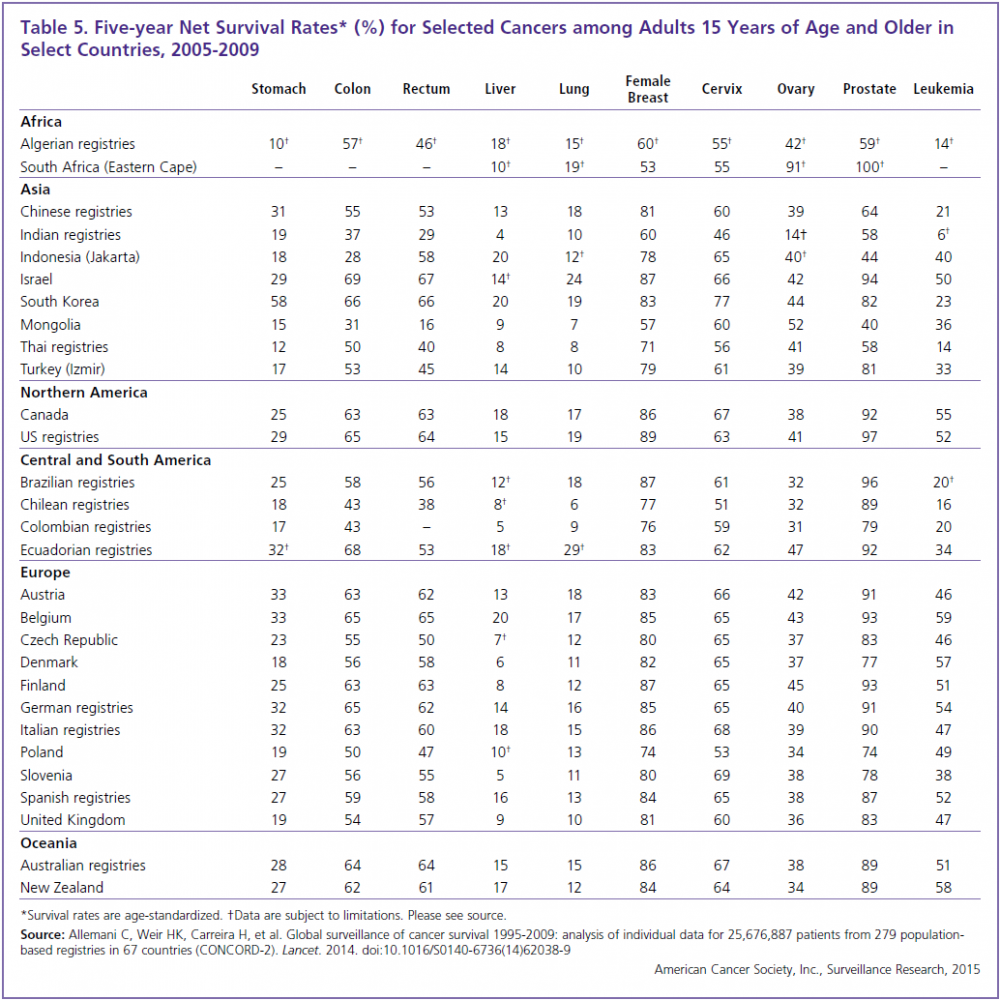

美国癌症协会数据

死亡率(2009)

(与世界卫生组织数据稍有区别)

5年前,死亡率还是高,肺癌肝癌很凶,所以烟酒就免了(别提什么红葡萄酒有益,一周一两杯,打住了)。

发病分布(2012)

中国肺癌肝癌发病率高,胃癌食道癌也厉害,中国饮食习惯真是问题。

预防、早期发现很关键。

美国国家卫生研究院(National Institutes of Health,简称NIH)所属美国国家癌症研究院(National Cancer Institutes)的数据(不好用)。

死亡率(所有人、所有癌症,不只是癌症病人的死亡率):

许多大家面临的困境,还在那。

美国大众电台

Stats Split On Progress Against Cancer

Why The War On Cancer Hasn't Been Won

Why Are Cancer Drugs So Expensive in the United States, and What Are the Solutions?

(这是文献,不是报道,只见到摘要)the average price of cancer drugs for about a year of therapy increased from $5000 to $10,000 before 2000 to more than $100,000 by 2012, while the average household income has decreased by about 8% in the past decade. Further, although 85% of cancer basic research is funded through taxpayers' money, Americans with cancer pay 50% to 100% more for the same patented drug than patients in other countries

(马约诊所相关文集)

2015.04.03

Why Are Cancer Drugs So Expensive in the U.S.?

2015.03.16

Oncologists reveal reasons for high cost of cancer drugs in U.S.

2015.03.28

5 Freakishly Expensive Cancer Drugs

No. 5: Xofigo, $12,657 monthly cost per patient(晚期前列腺癌)

No. 4: Cyramza, $13,256 monthly cost per patient(非小细胞肺癌、胃癌)

No. 3: Zykadia, $13,672 monthly cost per patient(ALK-positive NSCLC型肺癌)

No. 2: Lenvima, $13,945 monthly cost per patient(甲状腺癌)

No. 1: Blincyto, $64,260 monthly cost per patient(急性淋巴性白血病)

正在研制中的药和疗法,还没批,怎么办?

美国目前流行“死也要试”的运动,就是说命一条,没救了,豁出去了,不要厂家负责,吃了治了再说。这运动,以州立法通过允许为主,叫“Right to Try”。

“Right to Try” Experimental Prescription Drugs State Laws and Legislation for 2014 & 2015

别忘了把纪录片看完。

不过,我觉得,再过50年,癌症就会变得像感冒似的。不是希望,而是必然的结局。

中国呢?上面提到,有几种癌症在中国很猖狂,总的是,惨。

2014.12.16

最新数据:中国癌症5年生存率30.9%

2015.02.04

中国癌症现状调查:死亡人数占全球四分之一

2015.04.07

中国肿瘤癌情凶猛!

发病率与世界水平接近 但死亡率高于世界水平。中国为何遭遇“癌情”汹涌?

肿瘤防治专家认为,癌症死亡率居高不下,一个重要原因在于我国癌症发现较多处于中晚期。中国工程院院士、中国抗癌协会副理事长程书钧说,美国近些年来癌症的发病率有所下降,其5年生存率大约在60%至70%,而我国肿瘤患者5年生存率大约在30%左右。

中国抗癌协会科普宣传部部长、北京宣武医院胸外科主任支修益非常注重肺癌的健康知识宣传。他形象地比喻肺癌为被烟气、大气、油气、生气等“气”出来的病。

2014.11.20

中国癌症研究有引领潜力

对中国资料搜寻没什么法子,癌症研究的消息难找,此文三言两句,没内容。

2015.04.16

2015年中国生物免疫治疗公司排行榜分析

2015年国内生物研究公司进入免疫细胞治疗技术的排行榜如下:

NO.1:中源协和

NO.2中珠控股证券部

NO.3海欣股份

NO.4康恩贝

NO.5开能环保

NO.6香雪制药证券部

NO.7姚记扑克证券部

NO.8银丰生物

NO.9冠昊生物

NO.10双鹭药业

最后举个(美国媒体介绍的)中国了例子,一海归,奋斗了15年,出名堂了。

中国,缺的,需要的,就是这个。

2015.04.02

华尔街日报:A New Cancer Drug, Made in China

After 14 years, Shenzhen biotech’s medicine is one of the few locally developed from start to finish

HONG KONG—Xian-Ping Lu left his job as director of research at drug maker Galderma R&D in Princeton, N.J., to co-found a biotech company to develop new medicines in his native China.

It took more than 14 years but the bet could be paying off. In February, Shenzhen Chipscreen Biosciences’ first therapy, a medication for a rare type of lymph-node cancer, hit the market in China.

Xian-Ping Lu left his research job at a drug maker in the U.S. to co-found a biotech company in his native China

The willingness of veterans like Dr. Lu and others to leave multinational drug companies for Chinese startups reflects a growing optimism in the industry here. The goal, encouraged by the government, is to move the Chinese drug industry beyond generic medicines and drugs based on ones developed in the West.

Chipscreen’s drug, called chidamide, or Epidaza, was developed from start to finish in China. The medicine is the first of its kind approved for sale in China, and just the fourth in a new class globally. Dr. Lu estimates the research cost of chidamide was about $70 million, or about one-tenth what it would have cost to develop in the U.S.

“They are a good example of the potential for innovation in China,” said Angus Cole, director at Monitor Deloitte and pharmaceuticals and biotechnology lead in China.

China’s spending on pharmaceuticals is expected to top $107 billion in 2015, up from $26 billion in 2007, according to Deloitte China. It will become the world’s second-largest drug market, after the U.S., by 2020, according to an analysis published last year in the Journal of Pharmaceutical Policy and Practice.

China has on-the-ground infrastructure labs, a critical mass of leading scientists and interested investors, according to Franck Le Deu, head of consultancy McKinsey & Co.’s pharmaceuticals and medical-products practice in China. “There’re all the elements for the recipe for potential in China,” he said.

But there are obstacles to an industry where companies want big payoffs for a decade or more of work and tremendous costs it takes to develop a drug.

While the protection of intellectual property has improved, China’s cumbersome rules for drug approval and a government effort to cut health-care costs, particularly spending on drugs, could hurt the Chinese drug companies’ efforts, said Mr. Cole of Deloitte.

“Will you start to see success? Of course you will,” said Mr. Cole. However, “I’ve yet to see convincing or compelling evidence that it’s imminent.”

To date, many of the Chinese companies that are flourishing in the life sciences are contract research organizations that help carry out clinical trials, as well as providers of related services.

Some companies, like Shanghai-based Hua Medicine, are buying the rights to develop new compounds in China from multinational drug companies, what some experts consider more akin to an intermediate step to innovation.

Late last year, Hua Medicine completed an early-stage human clinical trial of a diabetes drug in China and in March filed an application to the Food and Drug Administration to develop it in the U.S. as well. The company has raised $45 million in venture funding to date.

Li Chen, who left an 18-year career at Roche Holding AG as head of research and development in China to help start Hua Medicine, said the company’s goal is to “create a game-changer of drug discovery.”

At Chipscreen Biosciences, Dr. Lu and his co-founders set up the company in 2001 in Shenzhen, a city that was quickly growing into a technology and research hub, just over the border from Hong Kong. They created a lab of 10 scientists to use a new analytic technique known as “chemical genomics” to examine the relationships between molecular structures of the existing and failed drugs, how they act on different targets in the body and what genes were being activated or repressed. Now they have more than 60 scientists.

By better predicting how chemicals would act on the body before entering human testing, they hoped they would be more likely get a drug to market.

“How can a small company compete with a multinational?” said Dr. Lu. “The only thing we can compete with is the scientific brain.”

The biggest challenges for the company have been financing and the Chinese regulatory system, said Dr. Lu. The company has raised a total of 300 million yuan ($48 million) over five rounds of venture funding, said Dr. Lu. Chipscreen also receives grant money from the Chinese government.

The company filed its application for approval of chidamide to the Chinese Food and Drug Administration, or CFDA, in early 2013. It had to wait nearly two years for approval, receiving the OK only in December.

Chidamide now is on the market in China for 26,500 yuan ($4,275) a month, a price far lower than patients in the U.S. pay for some of the newest cancer medicines but much more than the typical Chinese patient pays for drugs. Dr. Lu said the price reflects a balance between affordability for patients and return for shareholders. Some investors wanted to price the drug higher.

PBS是看到人家在放The Truth about Cancer就赶紧出来放一系列所谓正能量的癌症系列大力给大众洗脑。

癌症现状是:主流要维持谎言会越来越难。无能了这么多年,该是正视惨败的事实。

美国3亿2千万人口,中国大约14亿,相差4.5倍。

2014-15年,美国癌症新增加 超过150万,其中近58万死亡。

假设人口都一样的话,中国就是现在每年出现600万癌症新病人, 才仅仅和美国持平而已。

而中国的数字说:每年300万病例,220万死亡。死亡比例大约赶上了美国,依然比美国低。而新增加病例,则很少。

只能是大家没有定期诊断的意识,都是有了自我症状后才就医。这也能解释:死亡占诊断病例的比率很高的现实。

偶尔有几个痊愈的例子,统计上影响很小,属于可以忽略的尾数。

对没有保险的人士,浪费辛苦钱花不来! 能不能多活几年,碰运气。

基本上就是个钱断命绝的过程。