笨狼发牢骚

发发牢骚,解解闷,消消愁

希腊属于西方发达经济体的一员,实是奇闻。说起腐败,希腊在世界上是佼佼者,没中国那么疯狂,但程度上一点儿也不必中国差。而且希腊腐败,那是自下而上的,全国全民参与(民众不交税,但要福利)。多年来,希腊完全靠借钱过日子。金融危机后,债主们(主要是欧洲的)缓下来,要希腊还债,勒紧裤带,全面砍杀。

当时(五年前),不少人觉得此招不行,但没有什么其它办法,也就上马了。问题是希腊整个烂烂的,没人愿意吃苦,而德国为主的债主们为了让自己出的钱还得有人还,也就想方设法维持现状,撑着。老实说,当时不这么做,不少欧洲银行得倒闭。

我对(古)希腊文明顶礼膜拜,常言道,希腊文明是西方文明(也就是世界文明了,西方基本把世界征服了)的鼻祖和基础,不过罗马灭了希腊后,像埃及一般,世界就没希腊什么事儿了。希腊人民也没法子,全球化了,竞争不过别人,变成第三世界,干脆赖着。

希腊腐败如何,经济状况如何,说得多了,不重复了,就列一些图表。

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| Public Revenue (% of GDP) | 41 | 43.6 | 45.2 | 47 | 46.9 | 45.9 | 44.8 | TBA |

| Public Expenditure (% of GDP) | 52.1 | 53.7 | 53.8 | 59.2 | 48.5 | 45.9 | 43.5 | TBA |

| Budget Balance (% of GDP) | -11.1 | -10.1 | -8.6 | -12.2 | -1.6 | -0.1 | 1.3 | TBA |

| Real GDP Growth (%) | -5.4 | -8.9 | -6.6 | -3.9 | 0.6 | 2.9 | 3.7 | 3.5 |

| Public Debt (billion euros) | 330 | 356 | 305 | 319 | 317 | 316 | 309 | 304 |

| Nominal GDP (billion euros) | 226 | 207 | 194 | 182 | 181 | 187 | 196 | 207 |

| Debt-to-GDP ratio | 226 | 208 | 194 | 182 | 181 | 187 |

(此表来自雾灵十二少的博文)

现在希腊意识到没路可走了,老实说欧洲的三寡头(Troika,指欧委、欧行、国际货币基金组织三方的钦差大臣)法子也走投无路了(享惯富了,打也没用),希腊属于“暴民造反”了,来个真民主。新政府上任,说以撕毁“一切不平等条约”,以前借的钱,重新谈。这整个是借钱赖账,欧洲当然觉得规矩不能改,没门儿,非还不可。

希腊跑到德国讲道理,这么说的:

“德国百姓,辛苦了,你们欠了钱给我们,花了,谢过了。

我们穷,也懒,又想过好日子,没法子,只能借钱。本来借不到的,嘿,你们的银行还真借给我们,熟话说不花白不花,我们自然吃了喝了。现在要还,我们是勒紧裤带,就是还不出来,没法子。我们不好,不应当借钱过日子。不过你们也错了,责任还挺大的,因为你能明知我们还不起,还借给我们,说实在的,这是活该,钱是要不回来了。

这样吧,咱两谈谈,说说条件,也别指望我全还了。你松松口,让我缓过劲来,倒是总要还你点儿的。不然,一锅端。”

希腊说的有没有道理呢?有。在欧洲经济疲弱之际,德国经济蒸蒸日上,其中一个巨大的原因是贸易顺差,欧洲其他国家没钱,只能从德国借。德国借了,自然有风险,不过德国企业置之不顾,觉得国家、欧联撑着,确实属于不服责任,欠钱的不还,德国企业、银行应当承担。所以希腊说的经济上也有道理。但是,就道义、信誉来说,双方都属不服责任(不好听,无赖)。

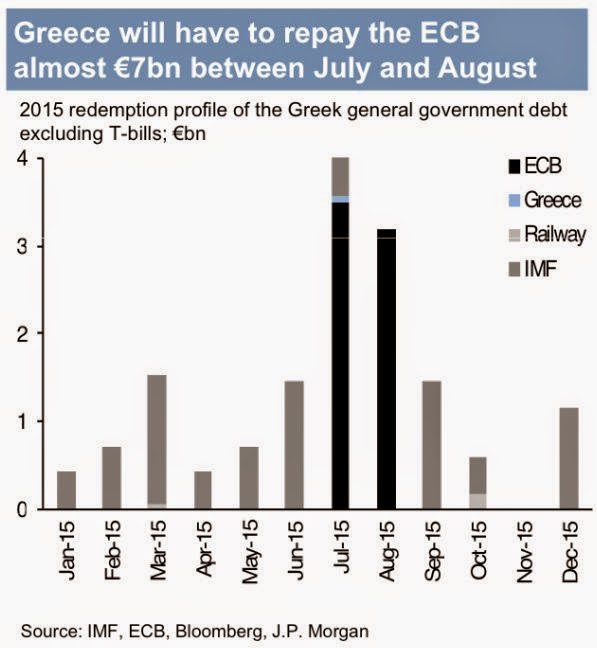

希腊债务偿还时间表:

如果希腊撒手,各国的损失是多少呢?

比较比较。

中国:赤裸裸、原始的腐败

希腊:制度下无耻的腐败

德国:制度下“合理”的资本主义贪婪掠夺,“合法的”腐败

希腊还真够赖的,希腊百姓既要撕毁“一切不平等条约”,但也要留在欧盟、欧元区,继续享受“发达国家的地位”。

那德国,也没什么好的说:

就是说,给希腊的援助对“救济”银行去了。

这一摊子,够欧洲理的了。目前,双方都没有让步的意思,因为谁先退一步,马上被动。

慢慢看戏。

【后记】

2015年02月12日

(凤凰)李克强总理致电邀请 希腊总理将出访中国寻求投资

(观察者网)外媒称希腊新总理已接受访华邀请 将会见李克强

(大公网)中俄向希腊伸橄榄枝 中国在意港口投资勿生变

2015.01.31法新社

Greece's Piraeus port U-turn will not hurt China investment: analysts

2014.11.20华尔街日报

Chinese Transform Greek Port, Winning Over Critics

Cosco-Built Container Terminal in Piraeus Marks Public-Relations Victory for Beijing

PIRAEUS, Greece—When state-controlled China Overseas Shipping Group Co. arrived here five years ago, it was met with a month-and-a-half-long dockworkers’ strike and a banner along the waterfront: “Cosco Go Home.”

Today, a new Cosco-built container terminal supports 1,000 jobs, silencing most union unrest. After pumping in a billion dollars and promising another half billion, it has also transformed the port, just outside of Athens, into one of the biggest and fastest-growing in the Mediterranean.

The investment now ranks as one of the most successful Greek privatizations in recent decades. It also has delivered a rare public-relations victory for Beijing. Critics have accused China-backed firms of overpaying for a number of big resource plays in the developed world—from oil fields in Canada to mines in Australia—and then bungling their management.

Industry watchers say Cosco probably overpaid in its Greek gambit, too. But its transformation of the Piraeus container terminal is being hailed an operational success so far, for both the company and the port.

Cosco, founded in 1961 amid China’s Great Famine, bet big on Greece after a decade of minority investments in a handful of foreign ports—in Singapore, Suez and Antwerp. Its investment in Piraeus has helped catapult the company into the major leagues of global port operators, alongside the APM Terminals unit of Danish shipping giant A.P. Moeller-Maersk A/S and Dubai-based DP World.

The investment has also been a boon to Piraeus, a struggling port scarred by decades of industrial decline and the country’s protracted debt crisis. The port’s proximity to Athens makes it the busiest passenger harbor in Europe, a leading cruise-ship terminal in the Mediterranean, and unofficial home port to the biggest merchant fleet in the world.

“We are successful in Piraeus,” said Fu Cheng Qiu, chief executive of Cosco’s Piraeus subsidiary. Things didn’t look promising back in 2009, when Cosco first arrived, he said: “There was the financial crisis; we had no business.”

After a few years of talks between Greek and Chinese officials, Beijing committed to making Greece a hub for Chinese exports. In 2008, Cosco put in a €490 million ($620 million) bid for a 30-year concession. Some industry and government officials familiar with the deal said the offer was about five times the market value of the concession.

Cosco has since tried to revisit the terms of the deal. The concession has been extended to 35 years, and the current government recently consented to an agreement that would allow Cosco to expand its operations. It has granted it the rights to build a third wharf at the container terminal, without going through a competitive tender.

In October 2009, when Cosco took control of the container terminal, Greece’s militant dockworkers union, emboldened by the incoming socialist government that would win elections a few days later—launched a six-week-long strike that crippled the port.

The strike left some 4,500 containers stranded at the terminal for weeks, and dented Greece’s already wobbling economy.

The Greek government, Cosco and the Piraeus Port Authority agreed to a deal that helped restore labor peace on the docks. Cosco was allowed to operate its part of the container terminal unfettered by the union wage scales. Most of Cosco’s workers are now hired through a third-party, nonunionized employment agency.

They earn around €1,200 a month, a better-than-average wage in Greece, but roughly a third of what unionized dockworkers earned five years ago, and less than what workers still earn at the rival PPA-controlled wharf abutting the Cosco docks.

The new jobs have helped reduce labor unrest. But some powerful opponents still complain about the deal.

“They have created a workers’ ghetto,” said Panagiotis Lafazanis, a senior member of Parliament with the main opposition, radical-left Syriza party.

Meanwhile, Cosco has further plans to expand—moves that the company expects will boost volumes to more than six million containers by 2016. Cosco has installed 11 new loading cranes that will put its Piraeus operations roughly on equal footing with capacity at Rotterdam, Antwerp and Hamburg, Europe’s three busiest container ports.

“They are excellent at long-term planning,” said Athanasios Christopoulos, secretary-general of ports and investment policy at Greece’s shipping ministry.