笨狼发牢骚

发发牢骚,解解闷,消消愁【注】美国《自然》杂志不会刊登不负责任的文章。

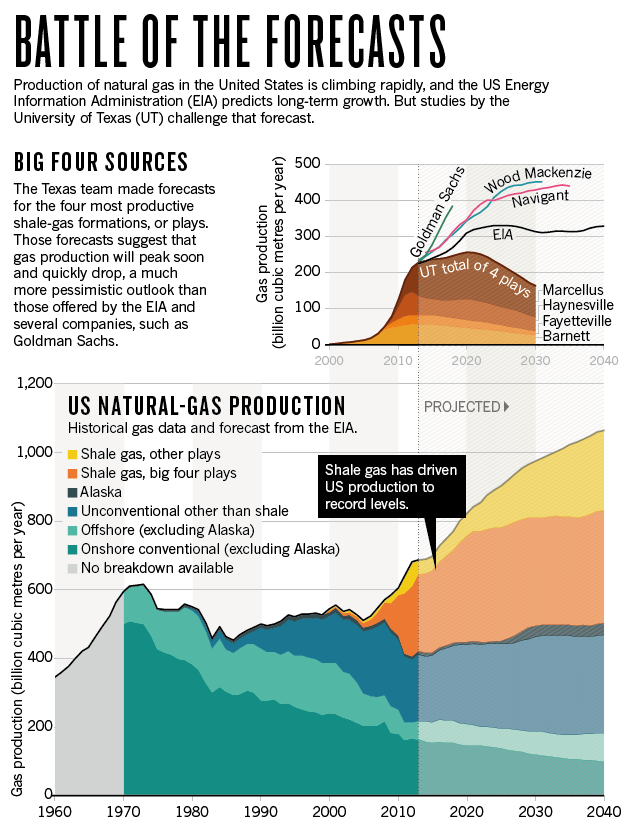

最新发表的研究对美国能源局就美国页岩天然气存储量表示怀疑。美国能源局现在的预测是“30年没问题”,奥巴马更是叫唤“百年存储量”,但德州大学奥斯丁分校的石油地质工程系却认定这是瞎猜。

据德州大学的分析,美国页岩油到2020年就会到顶,到2030年,产量就会减半。这还是乐观的了。

(A team of a dozen geoscientists, petroleum engineers and economists at the University of Texas at Austin has spent more than three years on a systematic set of studies of the major shale plays. That work is the “most authoritative” in this area so far, says Weijermars.)

美国页岩油工业是在这押了大注了,投资巨大,不知后果如何?

《自然》杂志专栏

Natural gas: The fracking fallacy

The United States is banking on decades of abundant natural gas to power its economic resurgence. That may be wishful thinking.

作者: Mason Inman

When US President Barack Obama talks about the future, he foresees a thriving US economy fuelled to a large degree by vast amounts of natural gas pouring from domestic wells. “We have a supply of natural gas that can last America nearly 100 years,” he declared in his 2012 State of the Union address.

Obama's statement reflects an optimism that has permeated the United States. It is all thanks to fracking — or hydraulic fracturing — which has made it possible to coax natural gas at a relatively low price out of the fine-grained rock known as shale. Around the country, terms such as 'shale revolution' and 'energy abundance' echo through corporate boardrooms.

Companies are betting big on forecasts of cheap, plentiful natural gas. Over the next 20 years, US industry and electricity producers are expected to invest hundreds of billions of dollars in new plants that rely on natural gas. And billions more dollars are pouring into the construction of export facilities that will enable the United States to ship liquefied natural gas to Europe, Asia and South America.

All of those investments are based on the expectation that US gas production will climb for decades, in line with the official forecasts by the US Energy Information Administration (EIA). As agency director Adam Sieminski put it last year: “For natural gas, the EIA has no doubt at all that production can continue to grow all the way out to 2040.”

But a careful examination of the assumptions behind such bullish forecasts suggests that they may be overly optimistic, in part because the government's predictions rely on coarse-grained studies of major shale formations, or plays. Now, researchers are analysing those formations in much greater detail and are issuing more-conservative forecasts. They calculate that such formations have relatively small 'sweet spots' where it will be profitable to extract gas.

The results are “bad news”, says Tad Patzek, head of the University of Texas at Austin's department of petroleum and geosystems engineering, and a member of the team that is conducting the in-depth analyses. With companies trying to extract shale gas as fast as possible and export significant quantities, he argues, “we're setting ourselves up for a major fiasco”.

That could have repercussions well beyond the United States. If US natural-gas production falls, plans to export large amounts overseas could fizzle. And nations hoping to tap their own shale formations may reconsider. “If it begins to look as if it's going to end in tears in the United States, that would certainly have an impact on the enthusiasm in different parts of the world,” says economist Paul Stevens of Chatham House, a London-based think tank.

Source: EIA/Univ. Texas/Goldman Sachs/Wood Mackenzie/Navigant

The idea that natural gas will be abundant is a sharp turnaround from more pessimistic outlooks that prevailed until about five years ago. Throughout the 1990s, US natural-gas production had been stuck on a plateau. With gas supplying one-quarter of US energy, there were widespread worries that supplies would shrink and the nation would become dependent on imports. The EIA, which collects energy data and provides a long-term outlook for US energy, projected as recently as 2008 that US natural-gas production would remain fairly flat for the following couple of decades.

Then the shale boom caught everyone by surprise. It relied on fracking technology that had been around for decades — but when gas prices were low, the technology was considered too costly to use on shale. In the 2000s, however, prices rose high enough to prompt more companies to frack shale formations. Combined with new techniques for drilling long horizontal wells, this pushed US natural-gas production to an all-time high, allowing the nation to regain a title it had previously held for decades: the world's top natural-gas producer.

Rich rocks

Much of the credit for that goes to the Marcellus shale formation, which stretches across West Virginia, Pennsylvania and New York. Beneath thickly forested rolling hills, companies have sunk more than 8,000 wells over several years, and are adding about 100 more every month. Each well extends down for about 2 kilometres before veering sideways and snaking for more than a kilometre through the shale. The Marcellus now supplies 385 million cubic metres of gas per day, more than enough to supply half of the gas currently burned in US power plants.

A substantial portion of the rest of the US gas supply comes from three other shale plays — the Barnett in Texas, the Fayetteville in Arkansas and the Haynesville, which straddles the Louisiana–Texas border. Together, these 'big four' plays boast more than 30,000 wells and are responsible for two-thirds of current US shale-gas production.

The EIA — like nearly all other forecasters — did not see the boom coming, and has consistently underestimated how much gas would come from shale. But as the boom unfolded, the agency substantially raised its long-term expectations for shale gas. In its Annual Energy Outlook 2014, the 'reference case' scenario — based on the expectation that natural-gas prices will gradually rise, but remain relatively low — shows US production growing until 2040, driven by large increases in shale gas.

The EIA has not published its projections for individual shale-gas plays, but has released them to Nature. In the latest reference-case forecast, production from the big four plays would continue rising quickly until 2020, then plateau for at least 20 years. Other shale-gas plays would keep the boom going until 2040 (see 'Battle of the forecasts').

Petroleum-industry analysts create their own shale-gas forecasts, which generally fall in the neighbourhood of the EIA assessment. “EIA's outlook is pretty close to the consensus,” says economist Guy Caruso of the Center for Strategic and International Studies in Washington DC, who is a former director of the agency. However, these consultancies rarely release the details behind their forecasts. That makes it difficult to assess and discuss their assumptions and methods, argues Ruud Weijermars, a geoscientist at Texas A&M University in College Station. Industry and consultancy studies are “entirely different from the peer-reviewed domain”, he says.

To provide rigorous and transparent forecasts of shale-gas production, a team of a dozen geoscientists, petroleum engineers and economists at the University of Texas at Austin has spent more than three years on a systematic set of studies of the major shale plays. The research was funded by a US$1.5-million grant from the Alfred P. Sloan Foundation in New York City, and has been appearing gradually in academic journals1, 2, 3, 4, 5 and conference presentations. That work is the “most authoritative” in this area so far, says Weijermars.

The main difference between the Texas and EIA forecasts may come down to how fine-grained each assessment is. The EIA breaks up each shale play by county, calculating an average well productivity for that area. But counties often cover more than 1,000 square kilometres, large enough to hold thousands of horizontal fracked wells. The Texas team, by contrast, splits each play into blocks of one square mile (2.6 square kilometres) — a resolution at least 20 times finer than the EIA's.

Resolution matters because each play has sweet spots that yield a lot of gas, and large areas where wells are less productive. Companies try to target the sweet spots first, so wells drilled in the future may be less productive than current ones. The EIA's model so far has assumed that future wells will be at least as productive as past wells in the same county. But this approach, Patzek argues, “leads to results that are way too optimistic”.

The high resolution of the Texas studies allows their model to distinguish the sweet spots from the marginal areas. As a result, says study co-leader Scott Tinker, a geoscientist at the University of Texas at Austin, “we've been able to say, better than in the past, what a future well would look like”.

The Texas and EIA studies also differ in how they estimate the total number of wells that could be economically drilled in each play. The EIA does not explicitly state that number, but its analysis seems to require more wells than the Texas assessment, which excludes areas where drilling would be difficult, such as under lakes or major cities. These features of the model were chosen to “mimic reality”, Tinker says, and were based on team members' long experience in the petroleum industry.

Alternative Futures

The lower forecasts from Texas mesh with a few independent studies that use simpler methods. Studies by Weijermars6, as well as Mark Kaiser7 of Louisiana State University in Baton Rouge and retired Geological Survey of Canada geologist David Hughes8, suggest that increasing production, as in the EIA's forecasts, would require a significant and sustained increase in drilling over the next 25 years, which may not be profitable.

Some industry insiders are impressed by the Texas assessment. Richard Nehring, an oil and gas analyst at Nehring Associates in Colorado Springs, Colorado, which operates a widely used database of oil and gas fields, says the team's approach is “how unconventional resource assessments should be done”.

“We're setting ourselves up for a major fiasco.”

Patzek says that the EIA's method amounts to “educated guesswork”. But he and others are reluctant to come down too hard. The EIA is doing “the best with the resources they have and the timelines they have”, says Patzek. Its 2014 budget — which covers data collection and forecasting for all types of energy — totalled just $117 million, about the cost of drilling a dozen wells in the Haynesville shale. The EIA is “good value for the money”, says Caruso. “I always felt we were underfunded. The EIA was being asked to do more and more, with less and less.”

Patzek acknowledges that forecasts of shale plays “are very, very difficult and uncertain”, in part because the technologies and approaches to drilling are rapidly evolving. In newer plays, companies are still working out the best spots to drill. And it is still unclear how tightly wells can be packed before they significantly interfere with each other.

Representatives of the EIA defend the agency's assessments and argue that they should not be compared with the Texas studies because they use different assumptions and include many scenarios. “Both modelling efforts are valuable, and in many respects feed each other,” says John Staub, leader of the EIA's team on oil and gas exploration and production analysis. “In fact, EIA has incorporated insights from the University of Texas team,” he says.

Yet in a working paper9 published online on 14 October, two EIA analysts acknowledge problems with the agency's methods so far. They argue that it would be better to draw upon high-resolution geological maps, and they point to those generated by the Texas team as an example of how such models could improve forecasts by delineating sweet spots. The paper carries a disclaimer that the authors' views are not necessarily those of the EIA — but the agency does plan to use a new approach along these lines when it assesses the Marcellus play for its 2015 annual report. (When Nature asked the authors of that paper for an on-the-record interview, they referred questions to Staub.)

Boom or bust

Members of the Texas team are still debating the implications of their own study. Tinker is relatively sanguine, arguing that the team's estimates are “conservative”, so actual production could turn out to be higher. The big four shale-gas plays, he says, will yield “a pretty robust contribution of natural gas to the country for the next few decades. It's bought quite a bit of time.”

Patzek argues that actual production could come out lower than the team's forecasts. He talks about it hitting a peak in the next decade or so — and after that, “there's going to be a pretty fast decline on the other side”, he says. “That's when there's going to be a rude awakening for the United States.” He expects that gas prices will rise steeply, and that the nation may end up building more gas-powered industrial plants and vehicles than it will be able to afford to run. “The bottom line is, no matter what happens and how it unfolds,” he says, “it cannot be good for the US economy.”

If forecasting is difficult for the United States, which can draw on data for tens of thousands of shale-gas wells, the uncertainty is much larger in countries with fewer wells. The EIA has commissioned estimates of world shale potential from Advanced Resources International (ARI), a consultancy in Washington DC, which concluded in 2013 that shale formations worldwide are likely to hold a total of 220 trillion cubic metres of recoverable natural gas10. At current consumption rates — with natural gas supplying one-quarter of global energy — that would provide a 65-year supply. However, the ARI report does not state a range of uncertainty on its estimates, nor how much gas might be economical to extract.

Such figures are “extremely dubious”, argues Stevens. “It's sort of people wetting fingers and waving them in the air.” He cites ARI's assessments of Poland, which is estimated to have the largest shale-gas resources in Europe. Between 2011 and 2013, the ARI reduced its estimate for Poland's most promising areas by one-third, saying that some test wells had yielded less than anticipated. Meanwhile, the Polish Geological Institute did its own study11, calculating that the same regions held less than one-tenth of the gas in ARI's initial estimate.

If gas supplies in the United States dry up faster than expected — or environmental opposition grows stronger — countries such as Poland will be less likely to have their own shale booms, say experts.

For the moment, however, optimism about shale gas reigns — especially in the United States. And that is what worries some energy experts. “There is a huge amount of uncertainty,” says Nehring. “The problem is, people say, 'Just give me a number'. Single numbers, even if they're wrong, are a lot more comforting.”

- Nature 516, 28–30 () doi:10.1038/516028a

《自然》杂志编辑评论

Nature | Editorial

The uncertain dash for gas

The United States and other countries have made huge investments in fracking, but forecasts of production may be vastly overestimated.

A decade ago, fracking was a misprint. Now, hydraulic fracturing is heralded as the future of energy supplies. Leading the way is the United States, which is tapping its rich shale deposits to produce more natural gas than at any other time in its history. The International Energy Agency projected in November that global production of shale gas would more than triple between 2012 and 2040, as countries such as China ramp up fracking of their own shale formations.

How much gas and oil is down there? Predictions about future shortages and abundances of various fuels are tricky, because although the geological presence of resources can be surveyed to some degree, how much would be profitable to extract is a moving target. Academic journals are filled with earnest projections about future energy dynamics, which usually turn out to be wildly inaccurate. Even worse, governments and companies wager billions of dollars on dubious bets. This matters because investment begets further investment. As the pipework and pumps go in, momentum builds. This is what economists call technology lock-in.

This week, Nature presents previously unpublished data suggesting that the lock-in of technology into shale-gas production may be a riskier bet than previously realized, at least in the United States. Nature has obtained detailed US Energy Information Administration (EIA) forecasts of production from the nation’s biggest shale-gas production sites. These forecasts matter because they feed into decisions on US energy policy made at the highest levels. Crucially, they are much higher than the best independent academic estimates.

The full story is contained in a News Feature on 【见上】. The conclusion is that the US government and much of the energy industry may be vastly overestimating how much natural gas the United States will produce in the coming decades.

“Nations have invested relatively little in tracking and assessing their natural resources.”

The EIA projects that production will rise by more than 50% over the next quarter of a century, and perhaps beyond, with shale formations supplying much of that increase. But such optimism contrasts with forecasts developed by a team of specialists at the University of Texas, which is analysing the geological conditions using data at much higher resolution than the EIA’s. The Texas team projects that gas production from four of the most productive formations will peak in the coming years and then quickly decline. If that pattern holds for other formations that the team has not yet analysed, it could mean much less natural gas in the United States’ future.

Like all energy forecasts, the lower projections from the Texas team could turn out to be inaccurate. Technological advances in the next few decades could open up more resources at lower costs, driving US production even higher than the EIA has predicted. But it is also possible that the Texas forecasts are too high, and that gas production will fall off even faster than the team suggests.

The one certainty here is that the United States and other nations have invested relatively little in tracking and assessing their natural resources. The EIA has a total budget of US$117 million, less than the value of one day’s gas production from the country’s shale formations. The agency’s budget has increased in recent years, but US natural-gas production has grown much more rapidly. There are now tens of thousands of wells tapping shale formations, and thousands more are started each year.

US federal and state governments have also failed to keep up with environmental concerns associated with fracking of shale formations for gas. For each well, drillers use tens of millions of litres of water, as well as untold amounts of chemical additives — and most states do not require them to report which compounds they use. Environmental groups have charged that fracking fluids can contaminate drinking water near wells, and emissions associated with drilling and production have caused air pollution. There have been few government or academic studies so far, but some research has found evidence of contamination associated with shale-gas production. Similar environmental problems plague fracking of shale deposits for oil, which has led to a sharp rise in US petroleum production in the past five years. And then there is the bigger picture: the extra greenhouse-gas emissions that come from new sources of fossil fuels.

Fracking has momentum. It will probably continue to grow to become an important part of the energy mix in many parts of the world. But for strategic, economic and environmental reasons, all involved should take a hard look at the numbers.