正文

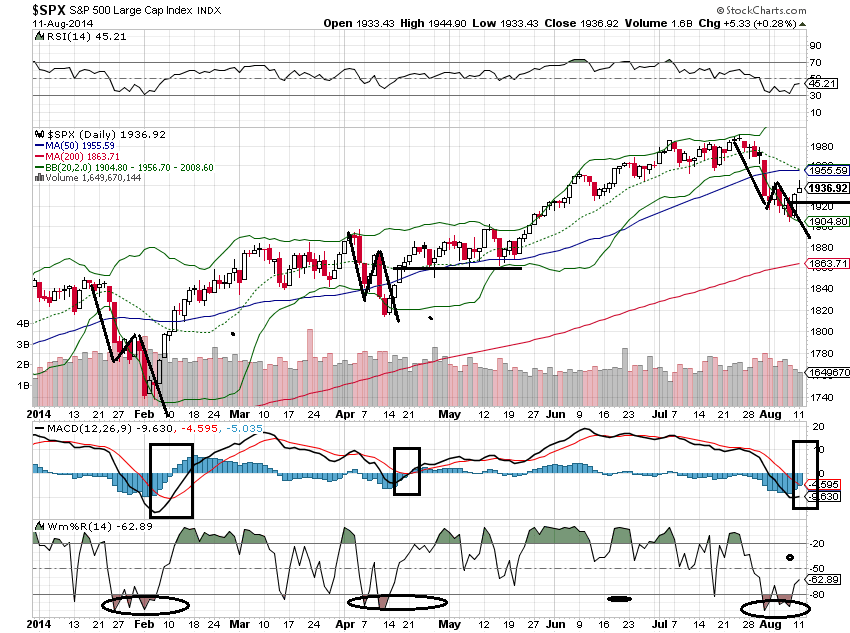

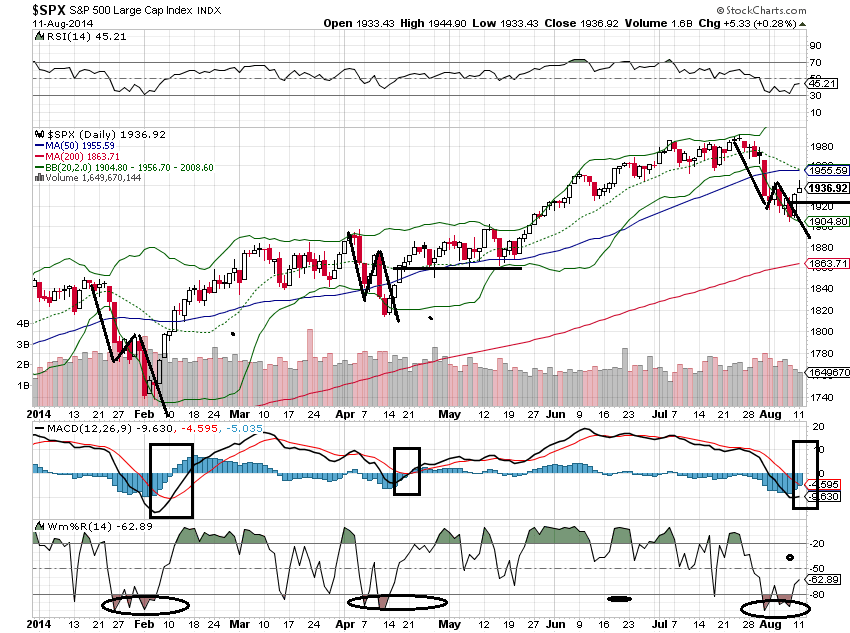

A-B-C pattern is a very common corrective pattern in a trend (either up or down). The size of A and C can be similar or C usually is greater than A. B is the counter movement in this corrective pattern (usually draw in-experienced traders jump in).

When W%M gets into oversold zone, you don't want to be a seller. When W%M gets into overbought zone, you don't want to chase the market (most of cases in a trending market). And big rally usually starts when MACD cross over zero (when that happens, market usually don't give you any chances to buy back positions. Why you don't want to a seller at oversold zone).

I think market will continue to be influenced by news. And we'd better not involved in news driven market on daily basis since the chance we get it right is very low. Stop watching futures is a good start. Data from US and China are not bad at the moment. Europe is the issue. In such case, flat and low volume market is likely in the remaining days of summer. In such low volume environment, playing SDS, TZA is fool's game. They won't give you the protection you need nor return to the downside. If you want to add protection, using puts when they are cheap enough.

When W%M gets into oversold zone, you don't want to be a seller. When W%M gets into overbought zone, you don't want to chase the market (most of cases in a trending market). And big rally usually starts when MACD cross over zero (when that happens, market usually don't give you any chances to buy back positions. Why you don't want to a seller at oversold zone).

I think market will continue to be influenced by news. And we'd better not involved in news driven market on daily basis since the chance we get it right is very low. Stop watching futures is a good start. Data from US and China are not bad at the moment. Europe is the issue. In such case, flat and low volume market is likely in the remaining days of summer. In such low volume environment, playing SDS, TZA is fool's game. They won't give you the protection you need nor return to the downside. If you want to add protection, using puts when they are cheap enough.

评论

目前还没有任何评论

登录后才可评论.